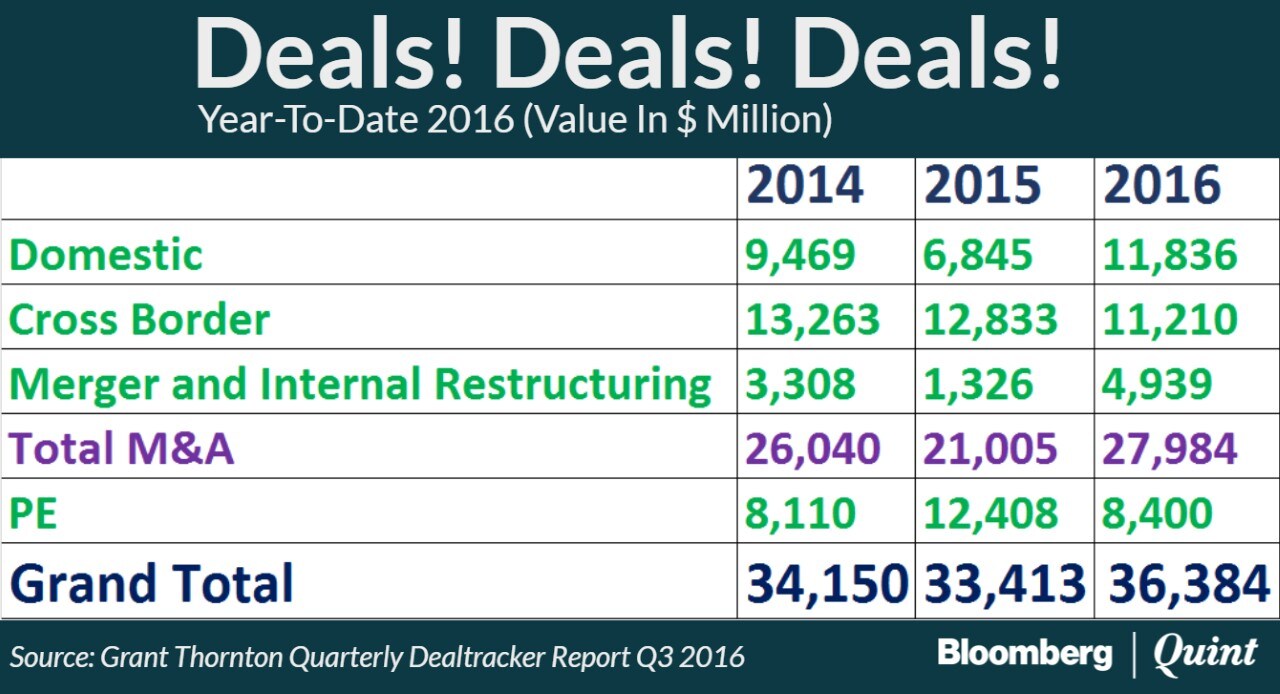

Corporate India's shopping spree continues unabated as overall deal activity so far this year climbed to $36.3 billion across 1,134 deals – the highest since 2011 – according to global audit, tax and assurance firm Grant Thornton.

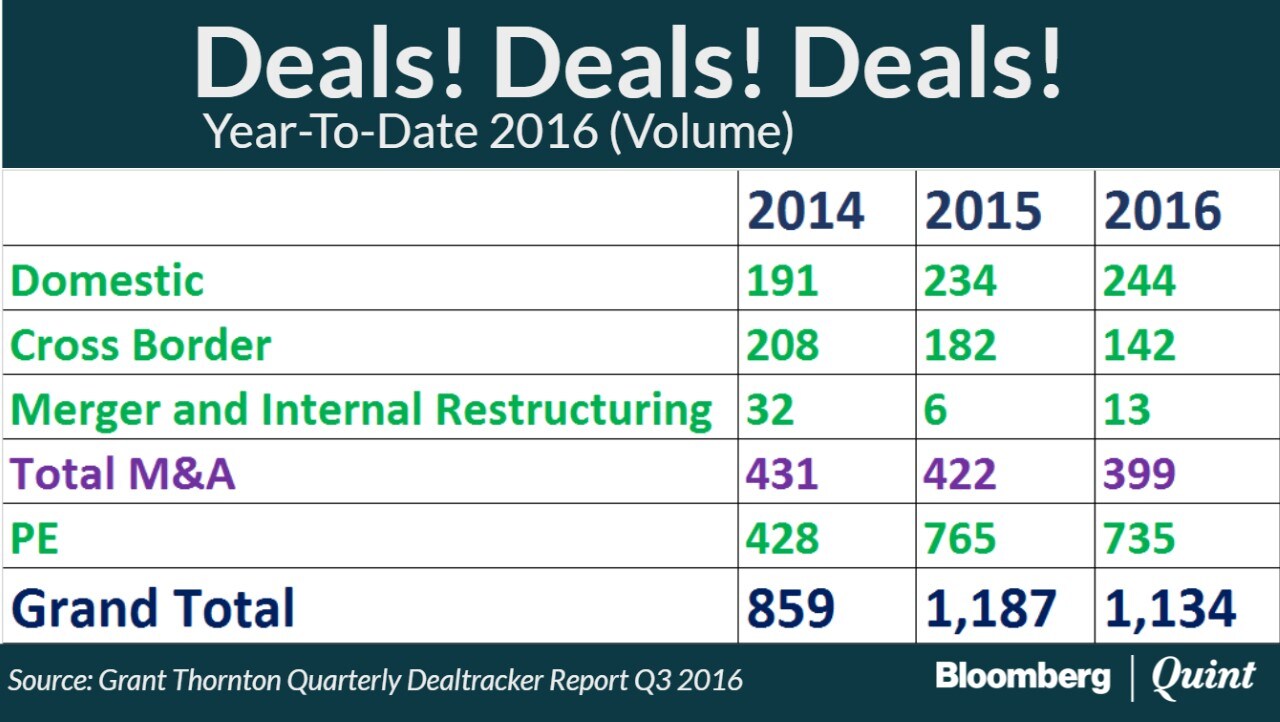

The total deal value, including mergers and acquisitions (M&A) as well as private equity (PE) transactions, grew 10 percent growth on a year-on-year basis. The number of deals fell 5 percent in the same period.

Despite a weak global deal making environment, the year recorded seven deals in the billion-dollar club and 44 deals valued over $100 million, together contributing around 75 percent of the total deal values.

For the July-September quarter alone, the overall deal value rose 19 percent on a yearly basis to $14.7 billion, the highest in the last eight quarters. M&A deals in the quarter saw 77 percent increase in the deal value while private equity deals declined 53 percent.

Mergers & Acquisitions Drive Deal Activity

Merger and acquisition (M&A) deals worth $12.17 billion were announced in the quarter, taking the year-to-date tally to a three-year high of $28 billion, said Grant Thornton's deal tracker report.

The report added that the rebound was primarily driven by 73 percent increase in the value of domestic deals, including two mega mergers in telecom and banking, but the value cross border deals remained at almost the same level as last year.

In terms of sector spread, the overall deal activity was driven by BFSI (Banking, Financial services and Insurance), energy, pharma and telecom that collectively contributed over $20 billion.

One of the largest transactions in 2016 was in the telecom space – the $3.6 billion merger of Reliance Telecommunications and Aircel. Other large acquisitions like the Ultratech-Jaiprakashcement acquisition and Nirma – Lafarge cement acquisition also boosted M&A deal values this year.

Private Equity Deals Remain Muted

Private equity investments however continued to witness a steady decline with 32 percent year-on-year decline in deal value so far this year. 735 deals were reported in the first three quarters of 2016 compared to 765 deals worth $12.4 billion in the same period last year.

Around $4.4 billion of private equity deals came from startups, information technology and and IT-enabled services, and BFSI. Startups contributed to 51 percent to investment values, led by instant messaging application Hike Ltd. raising $175 million in its Series D funding from investors including Tencent Holdings, Foxconn, Tiger Global, Bharti Enterprises and Softbank Holdings.

Positive Outlook

The deal outlook remains bullish for the months ahead, Grant Thornton said.

Deal outlook for the year is expected to be positive supported by robust growth in domestic M&A activity and deleveraging initiatives by Indian corporates and increasing consolidation in sectors such as telecom, manufacturing etc.Harish HV, Partner, Grant Thornton India

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.