Goldman Sachs suggested 12 stocks that are likely to reap benefits of the government's production-linked schemes.

Electronic manufacturing services and components sector will be direct beneficiaries, the brokerage said in a Jan. 3 note.

According to Goldman Sachs, automakers will likely see the cannibalisation of internal combustion engines' revenue by electric vehicles for many participants, and new "green" businesses may be small contributors for conglomerates like Reliance Industries Ltd. and Adani Group in the initial years.

"With semiconductors still nascent in India, there is no direct domestic play at this stage, although we expect large Indian companies to participate in collaboration with global technology partners."

Direct Beneficiaries Of PLI

Goldman Sachs expects the PLI scheme to drive incremental revenues and capital expenditure for five companies as participants along with seven covered companies being 'key enablers.'

Reliance Industries, Dixon Technologies Ltd., Mahindra & Mahindra Ltd., Amber Enterprises Ltd. and TVS Motor Ltd. are likely to see rise in incremental revenue.

Dixon Technologies is expected to witness the biggest rise in incremental revenue of nearly 34%, followed by Amber Industries with 20.6%, according to the note.

Reliance Industries, TVS Motor and Mahindra & Mahindra will benefit from Energy Transition PLI. "We see RIL as India's largest greenabler with their New Energy capex ratio one of the highest amongst large energy peers with an aggressive target to reach net zero emissions by 2035," it said.

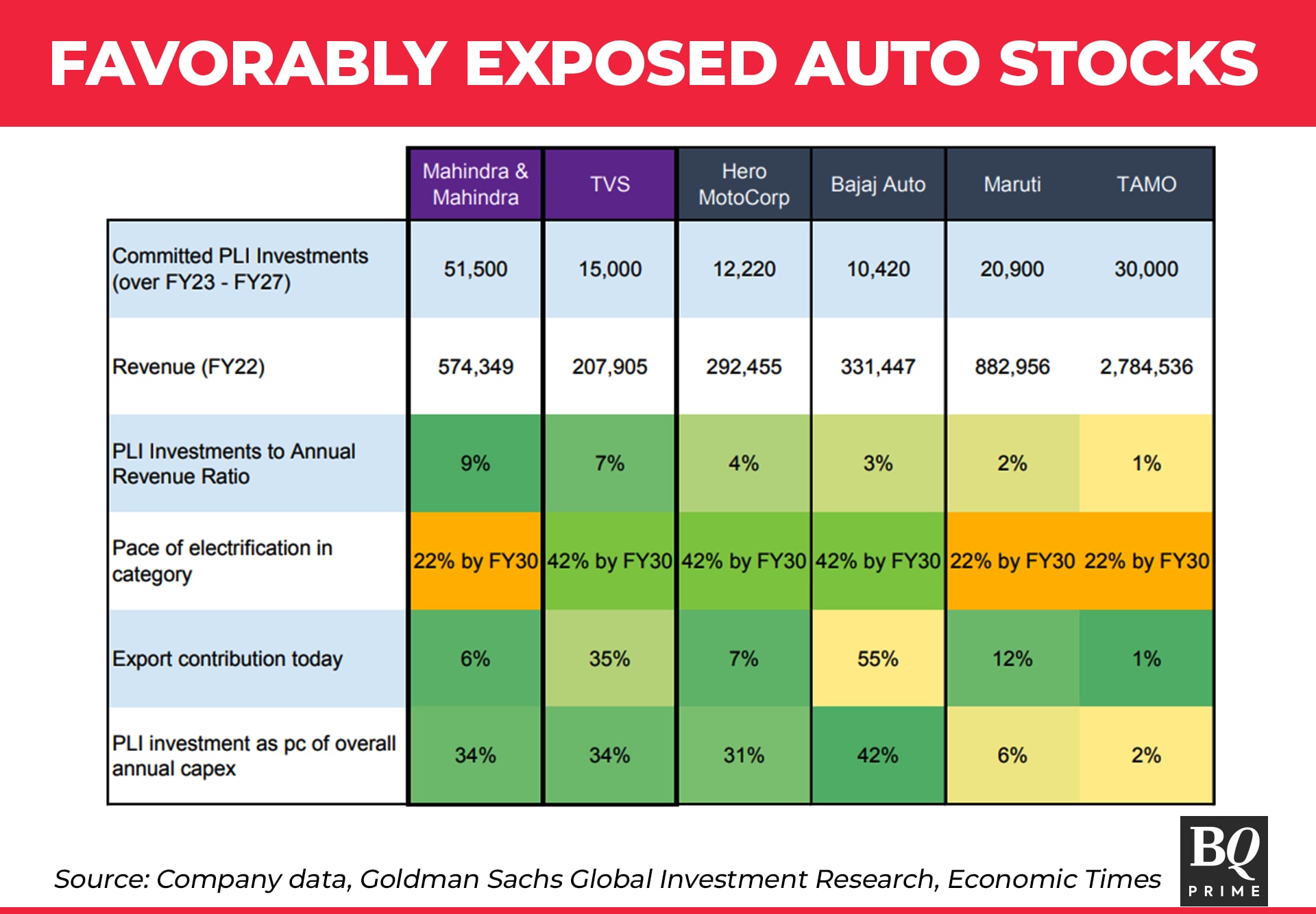

Meanwhile, Mahindra & Mahindra has made the largest investment commitment among Indian original equipment manufacturers towards PLI schemes. The company is expected to invest Rs 5,200 crore between FY23 and FY27.

This amount is roughly 9% of the company's annual topline (FY22) vs the 2% committed by Maruti's partner Suzuki Motor Gujarat and 1% by Tata Motors, Goldman Sachs noted.

With TVS' presence in 40 exports markets, compared to 80 markets for Bajaj Auto, the brokerage said there is still scope for the company to expand further in export markets, and accordingly expect PLI scheme investments to "offer superior opportunity to support incremental sales from export".

Enablers

Goldman Sachs suggests four enablers in the logistics and engineering, procurement and construction industry and three in banking.

L&T is "well positioned" to benefit from sustained momentum in government funded domestic infrastructure projects, order inflow from the Middle East, pick-up in private capex aided by the government's push on manufacturing, and potential sale/financing of non-core power, road, and metro projects.

With the first leg of PLI focused towards electronics, the brokerage expects that transportation of electronics components will accelerate, and Air Express may be a beneficiary. Blue Dart Express is likely to reap these benefits.

"We are 'Buy' rated on Blue Dart with shares trading at a discount (on EV/Sales) to companies with exposure to e-commerce growth, despite its superior margin profile," it added.

Container Corp. will accelerate from 7% to 12.5%, assuming full implementation of PLI-related schemes and the mid-point of growth seen by Chinese ports during 2003-2015, the brokerage said.

Moreover, the largest port company, Adani Ports and Special Economic Zone Ltd., is likely to get a boost from "pick-up in manufacturing activity, as it'll lead to higher imports of components and energy (via coal, oil, gas), and higher exports of finished goods."

Banks including State Bank of India, ICICI Bank Ltd. and HDFC Bank Ltd. will be able to capitalise the PLI opportunity aided by credit needs of larger companies in capital intensive sectors such as semiconductors, automobiles & auto components, advanced chemistry cell battery and specialty steel.

Disclaimer: Adani Enterprises is in the process of acquiring a 49% stake in Quintillion Business Media Ltd., the owner of BQ Prime.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.