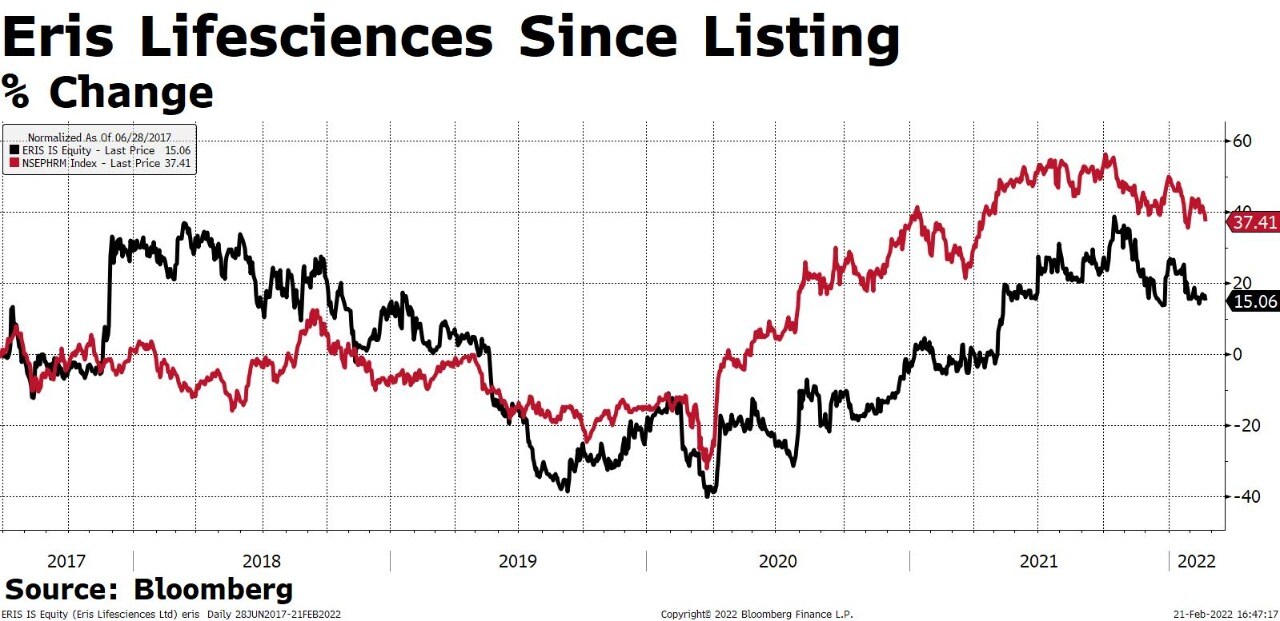

Shares of Eris Lifesciences Ltd. have surged more than 80% since the pandemic lows. Yet, the surge masks modest returns since its listing five years ago.

The company is immune to the twin banes Indian drugmakers have struggled to overcome in the U.S., their largest market: pricing pressure and regulatory scrutiny. Eris, a maker of formulations or finished drugs, is the only listed Indian pharma company that solely caters to the domestic market with no overseas exposure. A reason behind its better margins over peers.

Yet, it has lagged the pharma benchmark when some of the Indian drugmakers have seen stellar rebounds from the troughs of the pandemic. That's because of a slowdown in its core business growth even prior to the coronavirus outbreak. Analysts expect that to change as global infections of Covid-19 wane.

India-focus allows Eris to avoid pricing pressure in the American market. Pharma companies with exposure to regulated markets like the U.S., Europe and Australia face a strict overview of facilities and high product-filing expenses, worsening their margins. And there's an additional risk of adverse regulatory action hurting supply and exports.

Eris has had superior profitability than large Indian drugmakers, with an operating margin above 35%. The company maintained the record in the third quarter ended December when pharma manufacturing costs rose.

The company has also fared better on margins than drugmakers like Ipca Laboratories Ltd. and Alkem Laboratories Ltd. that generate more than half of their sales from the domestic market.

Within India too, Eris scores better. Around 8% of the company's domestic portfolio comes under the pricing caps, according to a report by BOB Capital Markets Ltd. It's 17% for the overall Indian pharmaceutical market.

That gives the company room to increase prices by up to 10% every year under Indian rules. By comparison, prices of products under the Drug Price Control Order cannot rise more than the wholesale inflation, which has trended below 5% on an average historically.

Overcoming Covid Hit, Cost Spike

Eris largely makes drugs for chronic or long-term ailments like diabetes, and sub-chronic conditions that require treatment for intermediate duration.

It gets as little as 8% of its sales from acute or short-term illnesses like cough and cold, according to its investor presentation.

The company maintained a steady margin even as sales of the chronic and sub-chronic segments slowed during the pandemic, when demand for acute therapies drove pharma growth.

The slowdown in the chronic market was partly because of panic buying and stocking out of fear of unavailability last year, Krishnakumar Vaidyanathan, executive director and chief operating officer at Eris, told BloombergQuint.

The drugmaker maintained stable margins even as raw material prices spiked. The company reported an operating margin of 38.9% and 36.6% in the second and third quarters, respectively.

It identified the top 25 important raw materials and—in anticipation of a price hike—stocked adequate quantities early on, Vaidyanathan said. Of these, only five saw a meaningful price rise and Eris was able to contain the impact, he said.

The company's sales mix improved as sales of its high-margin drugs rose during the quarter, according to Krishnakumar. That also helped it report better margins, he said, without giving details of products.

Eris mostly relies on market representatives to build long-standing relationships with doctors for sale and marketing of its products. Their productivity (or sales per representative) improved 11% year-on-year in the nine months through December.

Tax Advantage

The company's facility for oral solids like tablets and capsules in Guwahati enjoys income tax exemption till financial year 2024, and GST subsidies till financial year 2025, reducing the company's tax burden.

Around 74% of the products sold in FY21, and 81% sold in the nine months ended December were manufactured at the Guwahati unit.

Eris plans to commission a new facility in Gujarat by the end of FY23 to manufacture sterile injectables and oral liquids or syrups and suspensions, along with tablets and capsules.

The facility is aimed at mitigating the risks of a single-location operation, the company said. It will house research and development laboratories for formulation, analytical and microbiology. The first phase would entail a capital expenditure of Rs 130 crore, of which Rs 100 crore will be spent in FY22, it said.

The new facility is located in a special economic zone and will be eligible for a tax incidence of less than 10%, said Param Desai, a pharma analyst at Prabhudas Lilladher.

Expanding Portfolio

Eris eyes both organic growth and acquisitions.

Krishnakumar said the company is looking at acquisition targets in their therapy areas of interest with gross margins of 70-75%. "Since our standalone Ebitda margin is north of 40%, we have the ability to chase growth by sacrificing margins potentially to the tune of 200-300 basis points."

Eris has already acquired companies or drug portfolios in the past two years. That includes the buyout of Strides Shasun Ltd.'s branded business, anti-diabetes drug Zomelis from Novartis International AG. It also tied up with MJ Biopharm Pvt. Ltd. for injectable insulin to expand its diabetes portfolio.

Growth Bump

Eris shares have rebounded from the lows of March 2020 when India announced a nationwide lockdown to contain the first Covid-19 wave. Still, the stock was tumbling even prior to the pandemic and has returned 14% since its 2017 listing.

Eris has been nimble in adding product opportunities in high-growth markets and which it can scale multifold, Vishal Manchanda, pharma analyst at Nirmal Bang, told BloombergQuint. "But unfortunately drag in their base portfolio products like glimepiride (diabetes) and telmisartan (hypertension) are not allowing them to translate the new launches into company level growth."

Meaning, the company growth has been lagging since its listing due to a slowdown in some of its core product categories, Manchanda said, "As the base portfolio stabilises and the new launches gain critical mass, we should potentially see company level growth accelerating."

The immediate boost is likely to come from post-pandemic normalising.

Covid-related anomalies should correct in the coming years, said Param Desai of Prabhudas Lilladher, referring to the spike in demand for acute therapies during the pandemic.

Krishnakumar, too, expects a revival in the cardio-metabolic market from Q2 FY23 with a 15% growth.

Even during the pandemic, revenue rose 23% from 2019 to 2021 despite a small acute portfolio.

The stock doesn't have a single "sell" rating. Of the nine analysts tracking Eris Lifesciences, seven maintain "buy" and two suggest "hold", according to Bloomberg. The average of 12-month price targets implies a potential upside of 27.3%.

Key Risks

Ebitda margin contraction: Any slowdown in revenue could impact the company's operating leverage and affect margins, noted Desai.

Competition: While the company's new launches may be attractive from a growth perspective, the market is extremely competitive, noted Nirmal Bang's Manchanda. Hence, the company may need to invest more upfront to outpace competition.

Marketing workforce related issues: Eris' strength lies in its marketing workforce that has long-standing relationships with doctors. Inability to use this workforce efficiently or losing this workforce to competitors could also impact performance.

Market slowdown: There was a slowdown in the prescriptions during Covid-19 period. Any such event could adversely impact the business in the future, observed Prabhudas Lilladher's Desai.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.