The imposition of anti-dumping duty on Chinese truck and bus radial tyres for five years is likely to result a 200-300 basis point earnings before interest, taxes, depreciation and amortisation margin expansion for major tyre companies. This will be credit positive for certain India Ratings-rated domestic manufactures.

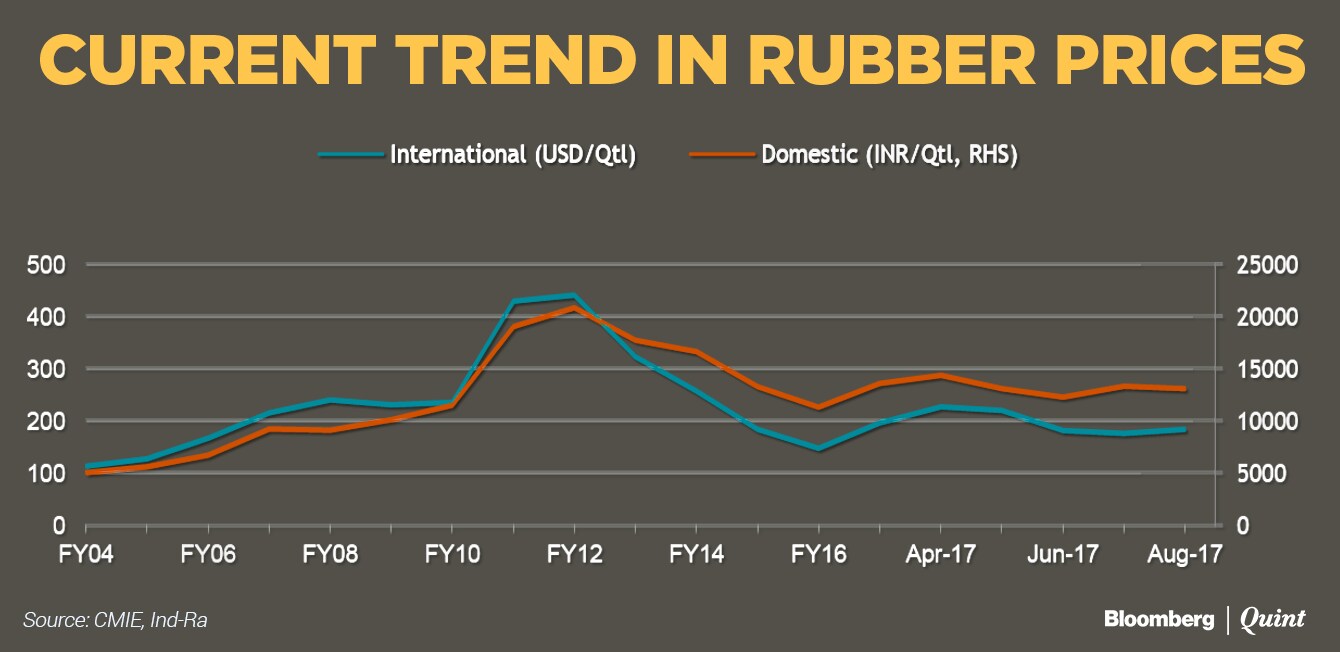

The profitability of tyre companies has been declining due to increased rubber prices and pressure from imported Chinese tyres in the truck and bus radial segment. The recent decline in domestic rubber prices (down 20 percent from February 2017 levels) along with the imposition of anti-dumping duty is likely to provide relief to these companies.

Credit Positive

Among rated issuers, JK Tyres & Industries Ltd. and Apollo Tyres Ltd. are the market leaders in the segment and have expanded capacities in this segment on the anticipation of demand. Both the companies are likely to see an improvement in profitability as a result of anti-dumping duty along with higher utilisation of domestic capacities.

Our expectation of a slowdown in the domestic medium and heavy commercial vehicle segment in FY18 has played out; in the first five months of the current financial year, sales were down 13.60 percent year-on-year, leading to lower revenues from sales to original equipment manufacturers. However, the replacement demand will persist. Hence, we expect tyre manufactures to increase prices in the range of 5-6 percent gradually in the truck and bus radial segment due to the imposition of anti-dumping duty.

Chinese tyres are available at a discount of 20-25 percent to the tyres from Indian tyre manufacturers. The anti-dumping duty is likely to increase the prices of Chinese radial tyres by 10-15 percent.

Assuming that domestic manufacturers increase prices by 50 percent commensurate with the duty on Chinese tyres, on a consolidated basis, the EBITDA margin for these tyre companies could see an improvement in the range of 2-3 percent.

We believe JK Tyres & Industries benefits more among the other rated issuers due to its larger presence in the truck and bus radial segment (around 31 percent of the market share) followed by Apollo Tyres and Ceat Ltd.

India Ratings and Research, a wholly owned subsidiary of Fitch Group, is a SEBI and RBI accredited credit rating agency operating in the Indian credit market.

This article has been published in arrangement with India Ratings.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.