Thanks so much for following the blog today!

Do keep up with the latest results posted by big names like Divi's Labs and Amber Enterprises tomorrow as well.

Galaxy Surfactants Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 23% at Rs 1,145 crore versus Rs 929 crore (Bloomberg estimate: Rs 1048 crore)

Ebitda up 25% at Rs 127 crore versus Rs 102 crore (Bloomberg estimate: Rs 106.5 crore)

Margin at 11.1% versus 10.9% (Bloomberg estimate: 10.2%)

Net Profit down 2% at Rs 75.9 crore versus Rs 77.5 crore (Bloomberg estimate: Rs 66.3 crore)

EIH Associated Q4 FY25 Results Highlights (YoY)

Revenue up 5.7% at Rs 140 crore versus Rs 132.4 crore

EBITDA up 21% at Rs 60.6 crore versus Rs 50 crore

Margin at 43.3% versus 37.7%

Net Profit up 26% at Rs 46.3 crore versus Rs 36.8 crore

Shipping Corp board recommended a final dividend of Rs 6.59 per share for FY25.

Shipping Corp Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue down 6.2% at Rs 1,325 crore versus Rs 1,412.5 crore

Ebitda down 10.4% at Rs 364.6 crore versus Rs 407.1 crore

Margin at 27.5% versus 28.8%

Net Profit down 40% at Rs 185 crore versus Rs 307 crore

Kalpataru Projects Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 18% at Rs 7,067 crore versus Rs 5,971 crore

Ebitda up 19% at Rs 538 crore versus Rs 452 crore

Margin flat at 7.6%

Net profit up 37% at Rs 225.4 crore versus Rs 164.4 crore

IOL Chemicals Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 4.7% at Rs 528 crore versus Rs 504 crore

Ebitda up 27% at Rs 63 crore versus Rs 49.5 crore

Margin at 11.9% versus 9.8%

Net profit up 14% at Rs 31.4 crore versus Rs 27.6 crore

Ratnamani Metals Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 15% at Rs 1,715 crore versus Rs 1,496 crore

Ebitda up 23% at Rs 302 crore versus Rs 246 crore

Margin at 17.6% versus 16.4%

Net Profit up 7.8% at Rs 207 crore versus Rs 192 crore

Repco Home Finance board approved plans to raise up to Rs 1,500 crore via non-convertible debtentures in one or more tranches.

Repco Home Finance Q4 FY25 Results Highlights (YoY)

Total Income up 9.5% at Rs 435 crore versus Rs 397 crore

Net profit up 6.3% at Rs 115 crore versus Rs 108.1 crore

The board recommended a final dividend of Rs 4 per share for FY25.

India Glycols Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue down 6.8% at Rs 863 crore versus Rs 926 crore

Ebida up 39% at Rs 146 crore versus Rs 105 crore

Margin at 16.9% versus 11.3%

Net Profit up 52% at Rs 64 crore versus Rs 42 crore

CreditAccess Grameen board approved plans to raise up to Rs 2,000 crore via non-convertible debtentures in one or more tranches.

It also appointed Ganesh Narayanan as MD and CEO effective June 26.

CreditAccess Grameen Q4 FY25 Results Highlights (Standalone, YoY)

Total Income down 3.5% at Rs 1,408 crore versus Rs 1,459 crore

Net Profit down 88% at Rs 47 crore versus Rs 397 crore

Net interest income of Rs 876 crore

Net interest margin of 12.7%

Gross NPA: 4.76%

Net NPA: 1.73%

Heritage Foods Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 10.3% at Rs 1,048 crore versus Rs 950.5 crore

Ebitda up 14% at Rs 79.8 crore versus Rs 70.1 crore

Margin at 7.6% versus 7.4%

Net profit down 5.7% at Rs 38.1 crore versus Rs 40.4 crore.

The board recommended a final dividend of Rs 2.5 per share for FY25.

Delhivery Q4 Highlights (Consolidated, YoY)

Revenue up 5.6% to Rs 2,191.56 crore versus Rs 2,075.53 crore. (Bloomberg estimate: Rs 2,272 crore)

Ebitda up significantly to Rs 119.06 crore versus Rs 45.87 crore (Bloomberg estimate: Rs 76.6 crore).

Margin at 5.4% versus 2.2% (Bloomberg estimate: 3.4%).

Net profit of Rs 72.55 crore versus a net loss of Rs 68.46 crore (Bloomberg estimate: Rs 29 crore).

After posting fourth quarter results, the board of the company is set to pay a dividend of Rs 15.8 per share.

Source: Exchange filing

Gujarat Alkalies Q4 Highlights (Consolidated, YoY)

Revenue up 7.4% to Rs 1,075.5 crore versus Rs 1,002 crore.

Ebitda up significantly to Rs 114 crore versus Rs 28.8 crore.

Margin at 10.6% versus 2.8%.

Net profit of Rs 8.8 crore versus a net loss of Rs 46.2 crore.

Hyundai plans to introduce eight new products over the next two fiscal years, focusing on a balance between volume, market share, and profitability. The company is strategically allocating its capital expenditure, with 40% dedicated to the Talegaon plant and 25% towards developing new products, driving growth and expansion.

Texmaco Rail Segment Revenue (Consolidated, YoY)

Freight Car Division: Rs 1,078.6 crore, up 22%

Infra - Rail & Green Energy: Rs 130.3 crore, down 21%

Infra-electrical: Rs 137.4 crore, UP 47%

Texmaco Rail Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 17.6% to Rs 1,346 crore versus Rs 1,144.6 crore

EBITDA up 15.7% to Rs 97.2 crore versus Rs 84 crore

Margin at 7.2% versus 7.3%

Net Profit down 11.7% to Rs 40 crore versus Rs 45.3 crore

Hyundai Motor India is set to invest Rs 7,000 crore in FY26, while aiming to maintain double-digit operating margins. However, the new Talegaon plant is expected to initially weigh on profitability. Despite this, the company is poised for growth and expansion, with plans to leverage its investments for future success.

Hyundai is focusing on premiumization to drive its business growth in India. The company plans to introduce hybrid powertrains in the country before FY30. Hyundai India is set to host its first investor day in September 2025, highlighting its strategic plans.

The company is at a pivotal stage in its Indian operations and will start production at its Talegaon plant in Q3 FY26. Hyundai aims to deepen localization initiatives in India during FY26 and make the country its largest export hub globally. Additionally, the company expects RBI rate cuts and tax relief to support car demand in FY26.

(Source: Media call)

13% of Hyundai cars sold in India have a CNG powertrai

Hyundai has achieved 82% localisation in FY25

Domestic sales fell 4.2% YoY to 1,53,550 in Q4 FY25

Exports rose 14.1% YoY to 38,100 units in Q4 FY25

Domestic sales fell 2.6% to 5,98,666 units in FY25

Exports rose 0.1% YoY 1,63,386 units in FY25

Premiumisation aiding ASPs meaningfully

Sterlite Technologies Q4 Highlights (Consolidated, YoY)

Revenue up 24.8% at Rs 1,052 crore versus Rs 843 crore.

EBITDA at Rs 125 crore versus Rs 31 crore.

Margin at 11.9% versus 3.7%.

Net loss of Rs 40 crore versus loss of Rs 22 crore.

Sammaan Capital Q4 Highlights (Consolidated, YoY)

Net profit up 1.4% at Rs 324 crore versus Rs 319 crore.

Total income down 5.5% at Rs 2,132 crore versus Rs 2,255 crore.

Hyundai Motor India Q4 Highlights (Standalone, YoY)

Revenue up 2.5% at Rs 17,562 crore versus Rs 17,132 crore (Estimate: Rs 17,351 crore).

EBITDA up 0.6% at Rs 2,489 crore versus Rs 2,474 crore (Estimate: Rs 2,102 crore).

Margin at 14.2% versus 14.4% (Estimate: 12.1%).

Net Profit down 4% at Rs 1,583 crore versus Rs 1,649 crore (Estimate: Rs 1,332 crore).

To pay final dividend of Rs 21 per share.

Jubilant Pharmova Q4 Highlights (Consolidated, YoY)

Revenue up 9.7% at Rs 1,929 crore versus Rs 1,759 crore.

EBITDA up 27.3% at Rs 345 crore versus Rs 271 crore.

Margin at 17.9% versus 15.4%.

Net Profit at Rs 154 crore versus loss of Rs 58.6 crore.

To pay final dividend of Rs 5 per share.

Bharat Heavy Electricals Q4 Highlights (Consolidated, YoY)

Revenue up 8.9% at Rs 8,993 crore versus Rs 8,260 crore (Estimate: Rs 11,575 crore).

EBITDA up 14.3% at Rs 832 crore versus Rs 728 crore (Estimate: Rs 1,153 crore).

Margin at 9.2% versus 8.8% (Estimate: 10%).

Net Profit up 3% at Rs 504 crore versus Rs 490 crore (Estimate: Rs 738 crore).

Emami Q4 Highlights (Consolidated, YoY)

Revenue up 8% at Rs 963 crore versus Rs 891 crore (Estimate: Rs 944 crore).

Net Profit up 9% at Rs 162 crore versus Rs 149 crore (Estimate: Rs 170.7 crore).

EBITDA up 4% at Rs 219 crore versus Rs 211 crore.

Margin at 22.8% versus 23.7%.

Nucleus Software Exports Q4 Highlights (Consolidated, QoQ)

Revenue up 11.3% at Rs 229 crore versus Rs 206 crore.

EBIT at Rs 71.1 crore versus Rs 29.6 crore.

Margin at 31% versus 14.4%.

Net Profit up 85.2% at Rs 64.8 crore versus Rs 34.9 crore.

Shares of the company rose as much as 12.02% to Rs 193.50 apiece on Friday ahead of their financial results declaration.

Shares of the company rose as much as 12.02% to Rs 193.50 apiece on Friday ahead of their financial results declaration.

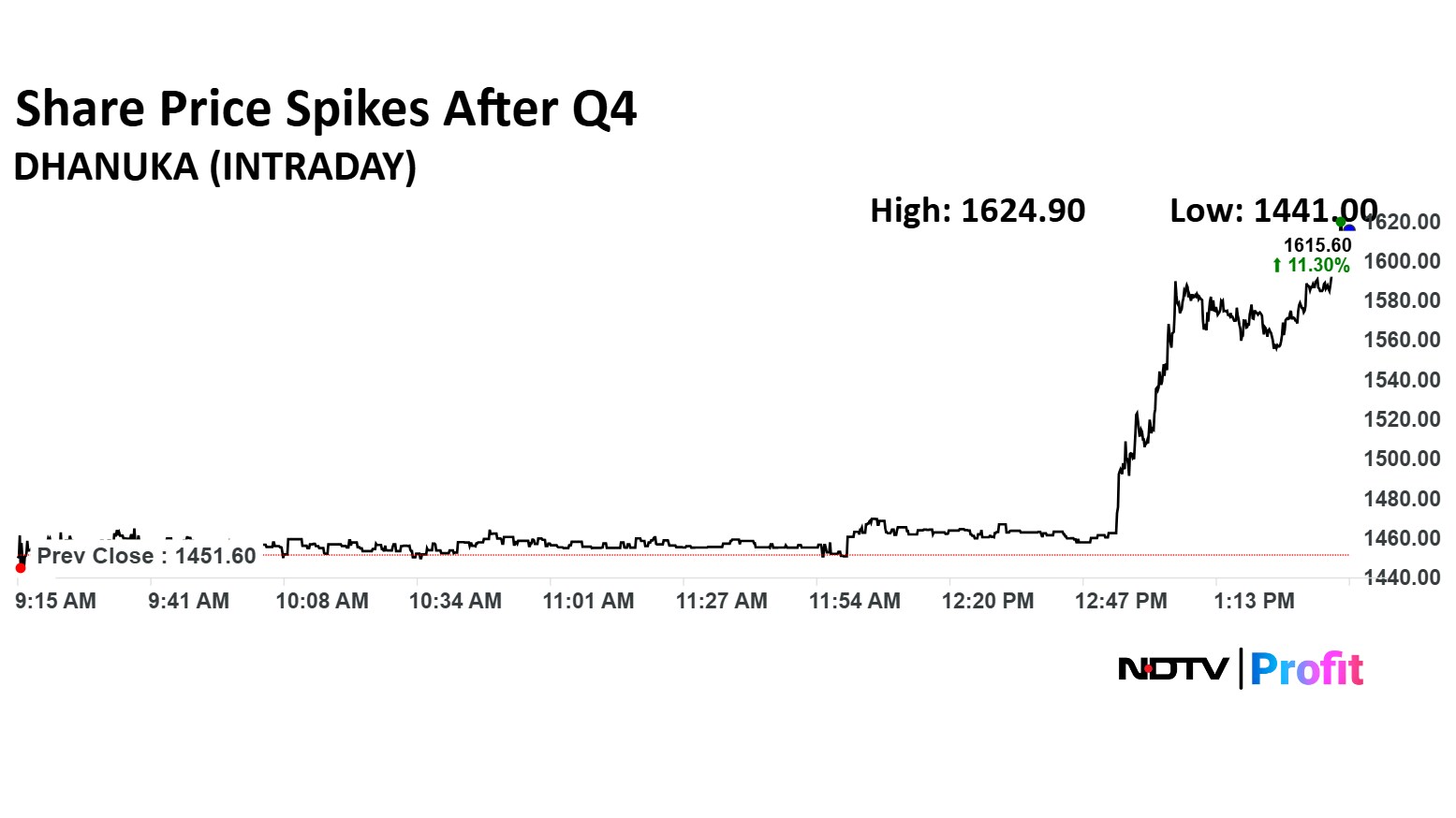

Dhanuka Agritech share price surged nearly 12% on Friday after company posted strong Q4 results where net profit jumped 28% at Rs 75.5 crore versus Rs 59 crore.

Dhanuka Agritech share price surged nearly 12% on Friday after company posted strong Q4 results where net profit jumped 28% at Rs 75.5 crore versus Rs 59 crore.

Delhivery's revenue is expected to be Rs 2,272 crore, with an Ebitda of Rs 76.6 crore and a margin of 3.4%, culminating in a net profit of Rs 29 crore, as per consensus analysts' estimates that are compiled by Bloomberg.

Dhanuka Agritech Q4 Highlight (Consolidated, YoY

Revenue up 20% at Rs 442 crore versus Rs 368 crore

EBITDA up 37% at Rs 110 crore versus Rs 80.1 crore

Margin at 24.8% versus 21.7%

Net Profit up 28% at Rs 75.5 crore versus Rs 59 crore

To pay final dividend of `2/share

Public sector firm Bharat Heavy Electricals is projected to report a revenue of Rs 11,575 crore, an Ebitda of Rs 1,153 crore, leading to a margin of 10% and a net profit of Rs 738 crore, as per consensus analysts' estimates that are compiled by Bloomberg.

As per Bloomberg's estimates, for the fourth quarter Hyundai Motor India is expected to report a revenue of Rs 17,351 crore with an Ebitda of Rs 2,102 crore, resulting in a margin of 12.1% and a net profit of Rs 1,332 crore.

Eureka Forbes Q4 Highlight (Consolidated, YoY)

Revenue up 10.7% at Rs 613 crore versus Rs 554 crore.

EBITDA up 28.7% at Rs 86.9 crore versus Rs 67.6 crore.

Margin at 14.2% versus 12.2%.

Net Profit at Rs 49.5 crore versus Rs 21.4 crore.

Board Appoints Rakesh Moza as chief sales officer effective May 19.

As many as 105 companies, including Hyundai Motor India Ltd., Shipping Corp. of India, Delhivery Ltd., and Reliance Infrastructure Ltd. are set to announce their fourth quarter earnings on Friday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.