Acme Solar Result Highlights (Consolidated, YoY)

Revenue rises 65% to Rs 511 crore versus Rs 310 crore.

Ebitda up 68.5% to Rs 458 crore versus Rs 272 crore.

Net Profit at Rs 131 crore versus Rs 1.4 crore.

Margin at 89.6% Vs 87.8%.

J&K Bank Result Highlights (Standalone, YoY)

Total income up 10.4% to Rs 3,518.57 crore versus Rs 3,188.48 crore.

Net Profit up 16.7% to Rs 484.84 crore versus Rs 415.49 crore.

Net interest income rises 7% to Rs 1,465.83 crore versus Rs 1,369.22 crore.

Gross NPA ratio at 3.50% versus 3.37%, up 13 basis points quarter-on-quarter.

Net NPA ratio at 0.82% versus 0.79%, up three basis points quarter-on-quarter.

SAIL Result Highlights (Consolidated, QoQ)

Revenue down 11.6% to Rs 25,921.76 crore versus Rs 29,316.14 crore.

Net Profit down 40% to Rs 744.58 crore versus Rs 1,251.00 crore.

Ebitda down 21% to Rs 2,768.66 crore versus Rs 3,483.87 crore.

Margin at 10.7% versus 11.9%.

Orient Cements Result Highlights (YoY)

Revenue up 24.4% to Rs 866.48 crore versus Rs 696.27 crore.

Net Profit up 459% to Rs 205.37 crore versus Rs 36.71 crore.

Ebitda up 90% to Rs 182.61 crore versus Rs 95.99 crore.

Margin at 21.1% versus 13.8%.

RPG Life Science Result Highlights (Consolidated, YoY)

Net Profit falls 2% to Rs 26.3 crore versus Rs 26.8 crore.

Revenue rises 2.1% to Rs 169 crore versus Rs 165 crore.

Ebitda drops 9.2% to Rs 35.5 crore versus Rs 39.1 crore.

Margin at 21% versus 23.6%.

Petronet LNG Result Highlights (QoQ)

Revenue down 3.5% to Rs 11,879.86 crore versus Rs 12,315.75 crore.

Net Profit down 21% to Rs 850.58 crore versus Rs 1,070.18 crore.

Ebitda down 23% to Rs 1,159.72 crore versus Rs 1,512.92 crore.

Margin at 9.8% versus 12.3%.

Prataap Snacks Result Highlights (Consolidated, YoY)

Revenue down 2.5% to Rs 411.00 crore versus Rs 421.44 crore.

Net Profit down 93% to Rs 0.69 crore versus Rs 9.44 crore.

Ebitda down 40% to Rs 18.01 crore versus Rs 30.03 crore.

Margin at 4.4% versus 7.1%.

MD Debadatta Chand

Prioritising cash management businesses and government-linked MSME schemes.

Targeting corporates with strong cash flows.

Tamilnad Mercantile Bank Result Highlights (Standalone, YoY)

Total income up 6.8% to Rs 1,617.47 crore versus Rs 1,514.87 crore.

Net Profit up 6.1% to Rs 304.89 crore versus Rs 287.29 crore.

Net interest income rises 2% to Rs 579.55 crore versus Rs 566.56 crore.

Gross NPA ratio at 1.22% versus 1.25%, down three basis points quarter-on-quarter.

Net NPA ratio at 0.33% versus 0.36%, down three basis points quarter-on-quarter.

Sobha Result Highlights (Consolidated, YoY)

Revenue up 33.0% to Rs 851.93 crore versus Rs 640.40 crore.

Net Profit up 125% to Rs 13.62 crore versus Rs 6.06 crore.

Ebitda down 57% to Rs 23.81 crore versus Rs 55.92 crore.

Margin at 2.8% versus 8.7%.

Gujarat Mineral Development Corporation Result Highlights (Consolidated, QoQ)

Revenue down 6.8% to Rs 732.60 crore versus Rs 786.28 crore.

Net Profit down 28% to Rs 163.77 crore versus Rs 226.22 crore.

Ebitda down 13% to Rs 169.24 crore versus Rs 193.56 crore.

Margin at 23.1% versus 24.6%.

Tata Chemical Result Highlights (Consolidated, YoY)

Revenue down 1.8% to Rs 3,719 crore versus Rs 3,789 crore.

Net Profit up 68% to Rs 252 crore versus Rs 150 crore.

Ebitda up 13% to Rs 649 crore versus Rs 574 crore.

Margin at 17.5% versus 15.1

SBI Cards Result Highlights (YoY)

Net Profit falls 6.5% to Rs 556 crore versus Rs 594 crore.

Net Interest Income rises 14% to Rs 1,680 crore versus Rs 1,476 crore.

CFO Sridhar Inumella

Personal loans grew 19.5% year-on-year in quarter ended June.

Growth in personal loans moderated this quarter.

Source: Con Call

Poonawalla Fincorp Result Highlights (Standalone, YoY)

Net Profit falls 78.5% to Rs 62.6 crore versus Rs 292 crore.

Net Interest Income rises 11% to Rs 639 crore versus Rs 576 crore.

Increases borrowing limit to Rs 75,000 crore from Rs 50,000 crore.

Approves raising funds worth Rs 1,500 crore via equity.

Aadhar Housing Result Highlights (Standalone, YoY)

Net Interest Income rises 21.6% to Rs 428 crore versus Rs 352 crore.

Net Profit up 18.6% to Rs 237 crore versus Rs 200 crore.

Bank Of Baroda Result Highlights (Standalone, YoY)

Total income up 11.4% to Rs 35,766.02 crore versus Rs 32,115.95 crore.

Net Profit up 1.9% to Rs 4,541.36 crore versus Rs 4,458.15 crore.

Net interest income falls 1% to Rs 11,434.78 crore versus Rs 11,600.1 crore.

Gross NPA ratio at 2.28% versus 2.26%, up 2 basis points quarter-on-quarter.

Net NPA ratio at 0.60% versus 0.58%, up 2 basis points quarter-on-quarter.

Schaeffler India Q1 Earnings Highlight (Consolidated, YoY)

Net Profit rises 17% to Rs 287 crore versus Rs 245 crore.

Revenue rises 11.7% to Rs 2,353 crore versus Rs 2,107 crore.

Ebitda rises 14.3% to Rs 430 crore versus Rs 376 crore.

Margin at 18.3% versus 17.9%.

Sterlite Technologies Q1 Earnings Highlight (Consolidated, QoQ)

Revenue down 3.1% to Rs 1,019.00 crore versus Rs 1,052.00 crore.

Net Profit up 100% to Rs 10.00 crore versus Rs 5.00 crore.

Ebitda up 6% to Rs 132.00 crore versus Rs 125.00 crore.

Margin at 13.0% versus 11.9%.

Laurus Labs Q1 Earnings Highlight (Consolidated, YoY)

Revenue rises 31.4% to Rs 1,570 crore versus Rs 1,195 crore.

Ebitda at Rs 382 crore versus Rs 171 crore.

Margin at 24.3% versus 14.3%.

Net profit at Rs 163 crore versus Rs 12.5 crore.

Cyient Q1 Earnings (Consolidated, QoQ)

Revenue down 10.3% to Rs 1,712 crore versus Rs 1,910 crore.

EBIT down 31% to Rs 163 crore versus Rs 235 crore.

Margin at 9.5% versus 12.3%.

Net Profit down 10% to Rs 154 crore versus Rs 171 crore.

Hexaware Technologies Q2 CY2025 Highlights

Revenue up 1.65% at Rs 3260 crore versus Rs 3207 crore.

Ebit down 27.54% at Rs 328.5 crore versus Rs 453.4 crore.

Ebit margin down 406 bps at 10.07% versus 14.13%.

Net profit up 16.1% at Rs 379.9 crore versus Rs 327.2 crore.

Q1 Result Highlights (Consolidated, YoY)

Revenue down 83% at Rs 32 crore versus Rs 188 crore.

EBITDA loss of Rs 55 crore versus EBITDA Loss of Rs 41.5 crore.

Net Profit at Rs 51.2 crore versus Rs 12.7 crore.

Q1 Result Highlights (QoQ)

Revenue up 1.3% at Rs 434 crore versus RS 428 crore

EBITDA up 1.2% at Rs 31.8 crore versus Rs 31.4 crore

Margin Flat At 7.3%

Net Profit up 0.8% at Rs 19.9 crore versus Rs 19.7 crore

Q1 Result Highlights, (Consolidated YoY)

Revenue up 11.5% to Rs 93.19 crore versus Rs 83.57 crore

Net Profit up 0.1% to Rs 14.87 crore versus Rs 14.85 crore

EBITDA down 9% at Rs 22 crore versus Rs 24.1 crore

Margin at 23.6% versus 28.9%

Q1 Results Highlights (Consolidated, YoY)

Revenue down 0.3% at Rs 703 crore versus Rs 706 crore

EBITDA down 2.4% at Rs 130 crore versus Rs 133 crore

Margin At 18.5% versus 18.9%

Net Profit up 1.4% at Rs 94.5 crore versus Rs 93.2 crore

Q1 Results Highlights (Consolidated, YoY)

Revenue down 13.4% at Rs 14,812 crore versus Rs 17,094 crore

Ebitda down 85.1% at Rs 98.6 crore versus Rs 663 crore

Margin at 0.7% versus 3.9%

Net Loss of Rs 40.1 crore versus profit of Rs 357 crore

Q1 Results Highlights (YoY)

Net Profit up 22.4% at Rs 17.5 crore versus Rs 14.3 crore

Revenue up 2% at Rs 769 crore versus Rs 55 crore

EBITDA up 15% at Rs 46 crore versus Rs 40 crore

Margin at 6% versus 5.3%

Q1 Results Key Highlights (Consolidated, YoY)

Net Profit at Rs 10.5 crore versus loss of Rs 13.5 crore

Revenue down 12.2% at Rs 319 crore versus Rs 364 crore

Ebitda up 36% at Rs 57 crore versus Rs 41.9 crore

Margin at 18% versus 11.5%

Shriram Finance Result Highlights (Standalone, YoY)

Total income up 20.1% to Rs 11,541.76 crore versus Rs 9,609.71 crore.

Net Profit up 8.8% to Rs 2,155.73 crore versus Rs 1,980.59 crore.

Net interest income rises 10% to Rs 5772.46 crore versus Rs 5233.9 crore.

Gross NPA ratio at 4.53% versus 4.55%, down 2 basis points quarter-on-quarter.

Net NPA ratio at 2.57% versus 2.64%, down 7 basis points quarter-on-quarter.

HFCL Q1 Results Highlights (Consolidated YoY)

Revenue down 24.8% at Rs 871 crore versus Rs 1,158 crore

Ebitda down 83.8% at Rs 28.4 crore versus Rs 175 crore

Margin At 3.3% versus 15.1%

Net Loss of Rs 32.2 crore versus profit of Rs 111 crore

To Raise up to Rs 700 crore via equity

Intellect Design Q1 Highlights (Consolidated QoQ)

Revenue down 3.34% at Rs 701.68 crore versus Rs 725.9 crore

EBIT down 47.34% at Rs 95.19 crore versus Rs 180.78 crore

Margin down 1133 bps at 13.56% vs 24.9%

Net profit down 30.17% at Rs 94.48 crore versus Rs 135.31 crore

Cipla Q1 Highlights (Consolidated YoY)

Revenue up 3.9% to Rs 6,957 crore versus Rs 6,693.00 crore

Net Profit up 10% to Rs 1,292 crore versus Rs 1,176.00 crore

Ebitda up 3.6% to Rs 1,777.05 crore versus Rs 1,714.95 crore

Margin at 25.5% versus 25.6%

Steel Authority of India will report first quarter earnings for FY26 shortly. The street expects the firm to post a profit of Rs 1,076 crore, while its total income is likely to be at Rs 25,791 crore. Its Ebitda is expected at Rs 2,763 crore, while margin is seen at 10.7%.

Cipla Ltd. will also be reporting its results for the quarter on Friday.

The company is likely to report a net profit of Rs 1,211 crore and revenue of Rs 7,057 crore for the first quarter, according to the estimates.

Its Ebitda is expected at Rs 1,728 crore, while margin is seen at 24.5%.

Shriram Finance Ltd. will report Q1 FY26 results shortly. The street expects the company to report a net profit of Rs 2,152 crore and total income of Rs 6,301 crore.

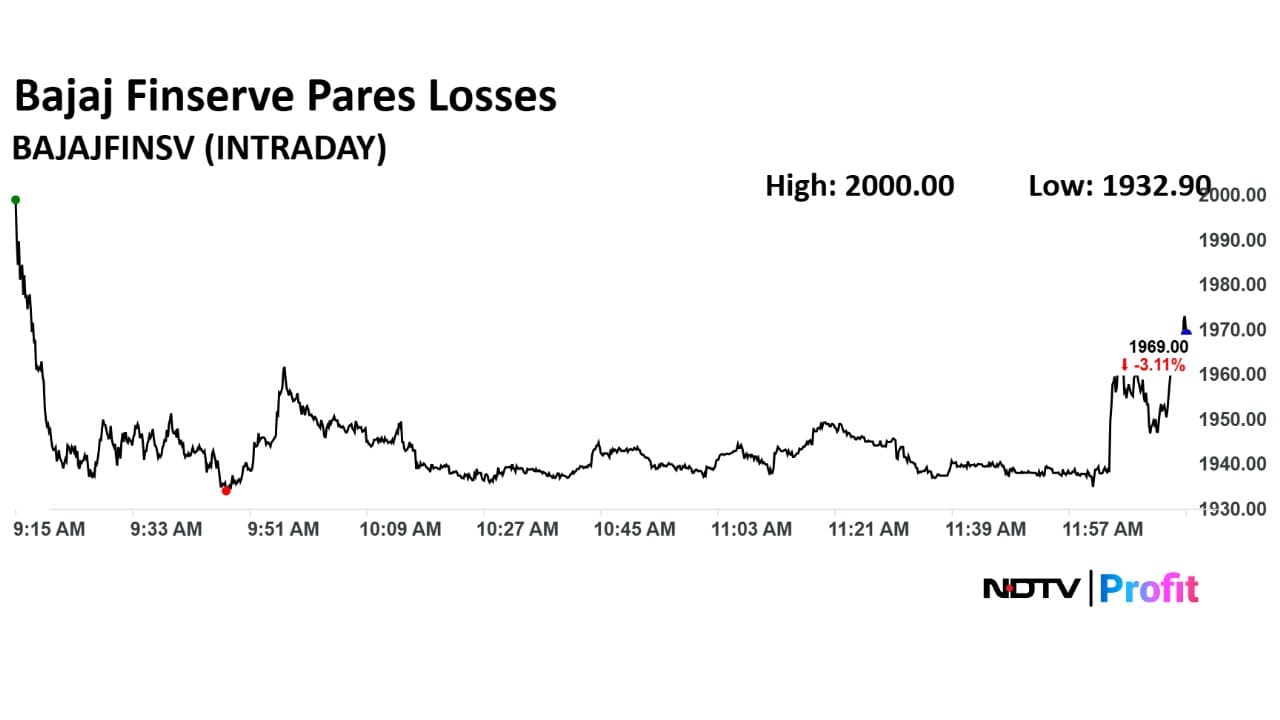

Bajaj Finserv Earnings Highlights (Consolidated, YOY)

Net Profit up 30.5% at Rs 2,789 crore versus Rs 2,138 crore

Total Income up 12.6% at Rs 35,439 crore versus Rs 31,479 crore

86 companies are set to announce their June quarter (Q1 FY26) financial results on July 25.

The leading players scheduled to declare Q1 results on Friday include Jammu and Kashmir Bank, Shriram Finance, Bank of Baroda, Cipla, Steel Authority of India Ltd., and SBI Cards, among others.

These results will carry the business performance of the companies for the April to June 2025 period.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.