(25).jpeg?downsize=773:435)

Shares of IT major Wipro Ltd. saw a drop of 2.17% on Monday as investors adjusted their positions ahead of the last trading day before the company's ex-dividend date. Wipro has declared an interim dividend of Rs 6 per share, with the record date for determining eligible shareholders set for Tuesday, January 28, 2025. The ex-dividend date, which falls tomorrow, marks the point at which the stock begins trading without the entitlement to dividends.

To qualify for the dividend, investors must hold the stock before the ex-date. After January 28, Wipro's shares will no longer carry the entitlement for the dividend, and only those on the company's shareholder list as of the record date will receive the payout.

Wipro's financial results for the quarter ended December 31, 2024, showed a mixed but generally positive performance. The company reported a slight revenue increase of 0.1%, reaching Rs 22,319 crore, slightly exceeding analysts' estimates of Rs 22,218 crore.

Wipro's net profit rose by 4% quarter-on-quarter to Rs 3,354 crore, beating market expectations of Rs 3,057.4 crore. In terms of profitability, the company's earnings before interest and taxes grew by 5%, reaching Rs 3,863 crore, surpassing the consensus estimate of Rs 3,628 crore. Additionally, Wipro's operating margin improved to 17.3%, exceeding the forecasted 16.33%.

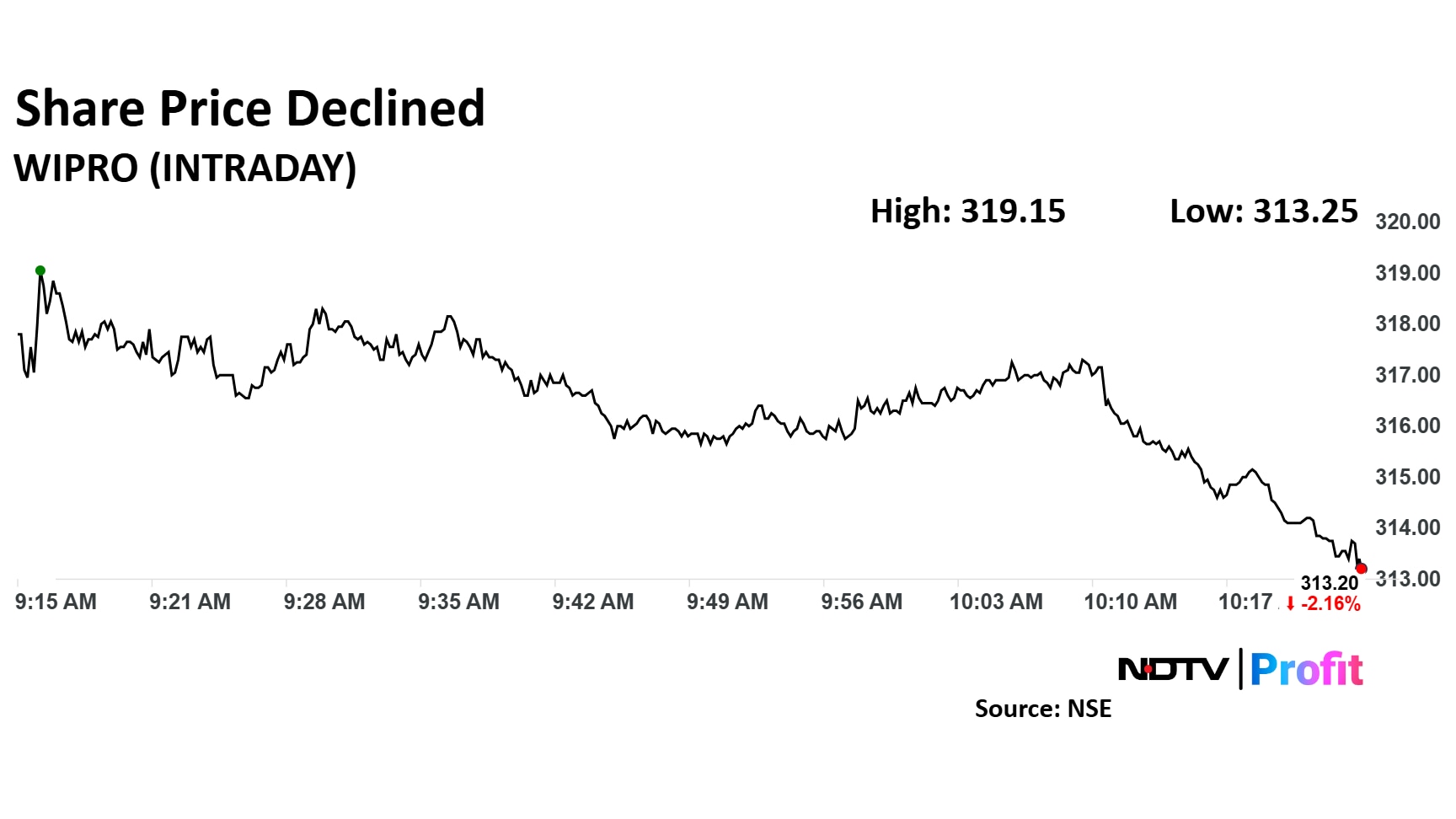

The scrip fell as much as 2.17% to Rs 313.15 apiece. It pared losses to trade 2.16% lower at Rs 313.20 apiece, as of 10:18 a.m. This compares to a 0.80 decline in the NSE Nifty 50 Index.

It has risen 33.02% in the last 12 months. Total traded volume so far in the day stood at 0.25 times its 30-day average. The relative strength index was at 60.

Out of 45 analysts tracking the company, 12 maintain a 'buy' rating, 14 recommend a 'hold,' and 19 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 7.4%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.