Shares of Trent Ltd. revised the lower circuit limit to fall almost 18% to hit a near one-year low, after hitting 10% lower circuit limit on Monday at market open. This happened following bearish commentary from analysts after the company's fourth-quarter business update and a larger market selloff.

Goldman Sachs cut its target price for Trent to Rs 6,760 from Rs 7,500, citing weaker than expected sales growth. Morgan Stanley also noted that Trent's fourth-quarter top-line growth fell short of expectations.

Trent reported a 28% year-on-year increase in sales growth for the fourth quarter, a slowdown from the 37% growth seen in the previous quarter. The company's standalone gross revenue for the quarter stood at Rs 4,334 crore, which was below Morgan Stanley's estimate of 35% net revenue growth.

For fiscal 2025, Trent's gross standalone revenue growth was 39% year-on-year, slightly underperforming the brokerage's forecast of 42%. According to Goldman Sachs, Trent's sales typically decline in the fourth quarter due to seasonal factors, but this year's 9.7% quarter-on-quarter decline was steeper than usual. This suggests either a weakness in demand or aggressive discounting to clear inventory.

The moderation in sales growth was likely driven by a further slowdown in like-for-like sales, which had already shown signs of deceleration in the third quarter. Analysts are concerned that this trend may continue, impacting Trent's future performance.

Despite the disappointing sales figures, analysts remain cautiously optimistic about Trent's long-term prospects, citing the company's strong store expansion strategy and potential benefits from recent income tax cuts.

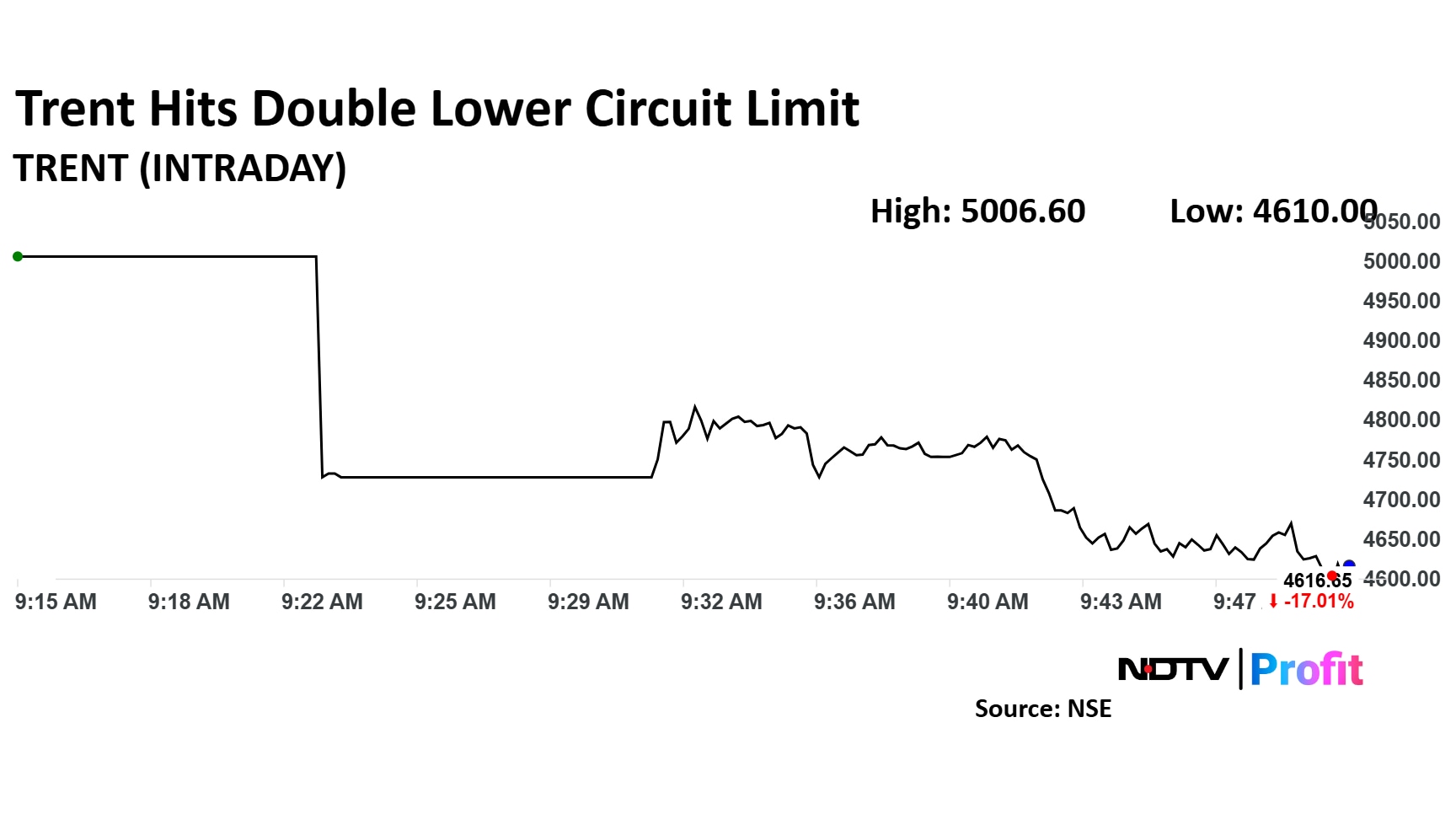

Trent Share Price

The scrip fell as much as 17.83% to Rs 4,570 apiece. It pared losses to trade 17.69% lower at Rs 4,578.95 apiece, as of 09:57a.m. This compares to a 3.96% decline in the NSE Nifty 50.

It has risen 16.46% in the last 12 months. Total traded volume so far in the day stood at 12 times its 30-day average. The relative strength index was at 33.

Out of 24 analysts tracking the company, 17 maintain a 'buy' rating, three recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 34%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.