Tata Consumer Products Ltd.'s shares surged over 8% on Wednesday following an upgrade from Goldman Sachs.

The brokerage raised its rating on Tata Consumer from 'neutral' to 'buy', and increased the target price to Rs 1,200 from Rs 1,040 per share. This upgrade is based on several positive factors that are expected to drive the company's growth in the coming years.

Goldman Sachs' analysis points to an upcoming earnings inflection for Tata Consumer, predicting strong EPS growth over fiscals 2025-2027.

The brokerage emphasised the company's strategic focus on innovation and expanding distribution channels, which are anticipated to significantly scale up its growth. Additionally, the salt segment is identified as a medium-term market share gain and premiumisation play, contributing to the company's overall growth trajectory.

Investors reacted positively to Goldman Sachs' upgrade, reflecting confidence in Tata Consumer's strategic direction and growth potential.

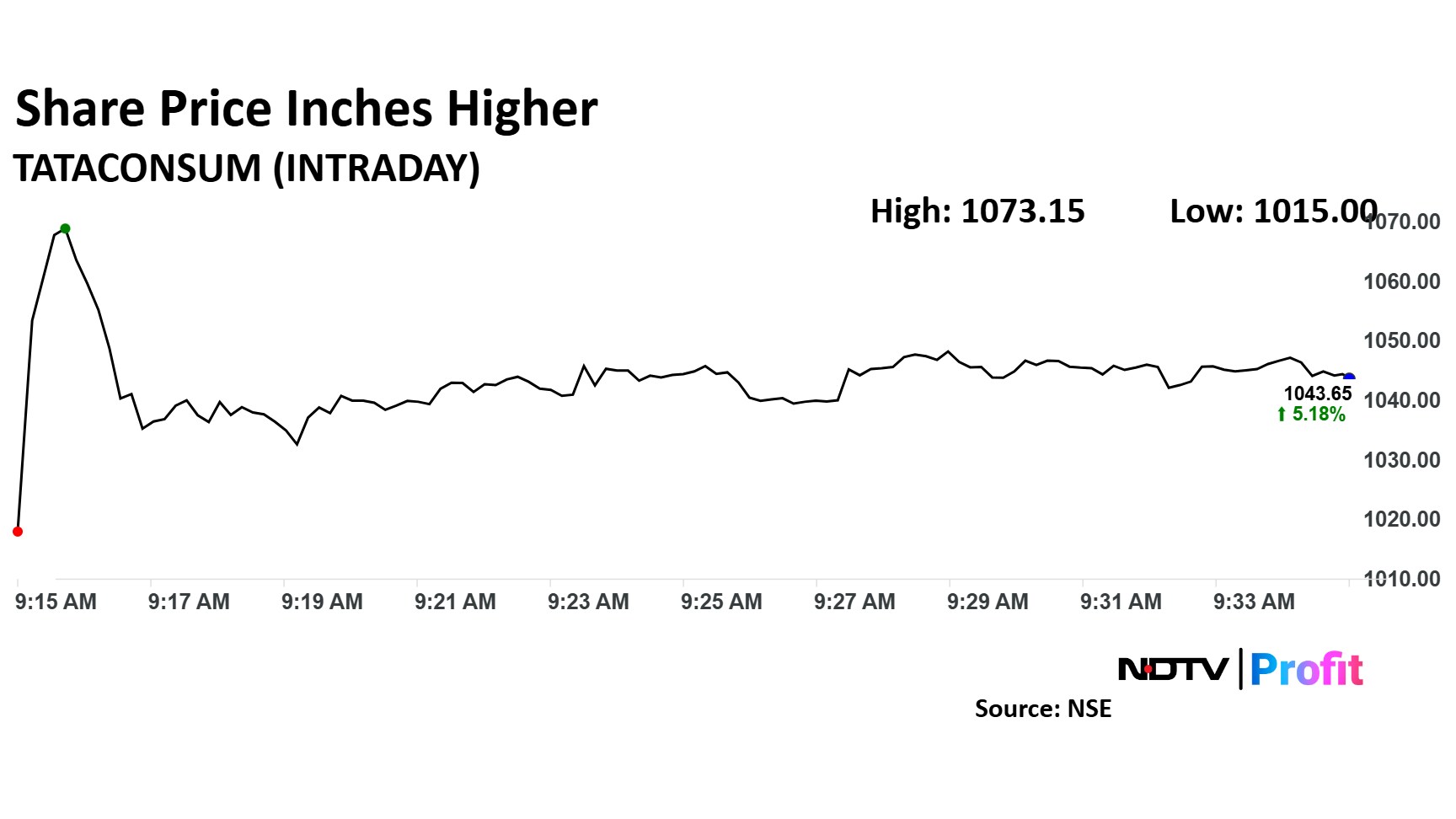

Tata Consumer Products Share Price

Shares of Tata Consumer rose as much as 8.15% to Rs 1,073.15 apiece. It pared gains to trade 5.46% higher at Rs 1,046 apiece, as of 09:31 a.m. This compares to a 0.41% advance in the NSE Nifty 50.

The stock has fallen 6.34% in the last 12 months. Total traded volume so far in the day stood at 1.02 times its 30-day average. The relative strength index was at 70.

Out of 30 analysts tracking the company, 25 maintain a 'buy' rating, four recommend a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 9.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.