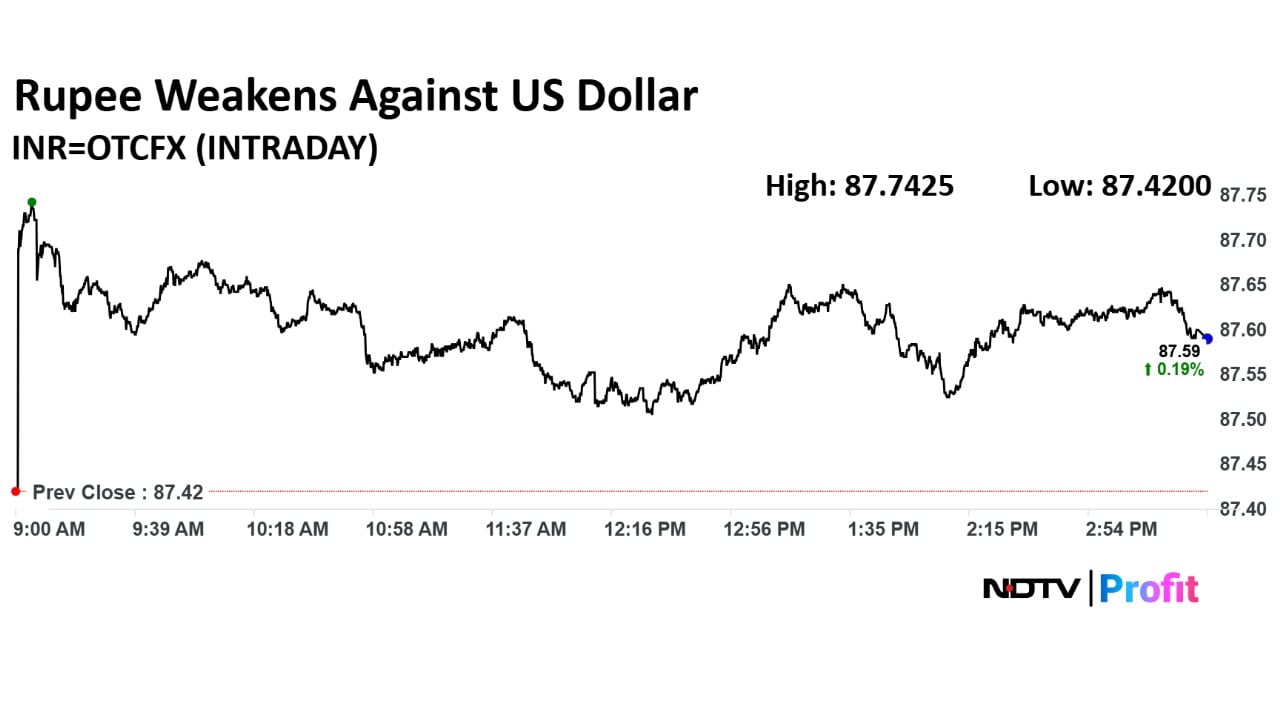

Rupee closed 17 paise weaker at 87.60 against US Dollar.

Rupee loses 2.15% in value against US dollar in July

Rupee posts third consecutive month of decline

July 2025 was rupee's worst month since September 2022

Source: Cogencis

Rupee closed 17 paise weaker at 87.60 against US Dollar.

Rupee loses 2.15% in value against US dollar in July

Rupee posts third consecutive month of decline

July 2025 was rupee's worst month since September 2022

Source: Cogencis

Key Highlights

Benchmarks end lower after gaining for the last two sessions.

Benchmarks Indices slightly Outperformed Broader Market Indices.

Nifty fell 200 points from the day’s high.

Nifty faces volatile trading day on Monthly expiry.

38 out of 50 stocks decline in Trade.

Nifty Midcap fell nearly 1% for the day, drag by Indus Towers and IPCA Labs.

Nifty Smallcap 250 fell 1% for the day, drag by Apar Industries and Aarti Industries.

All sectoral indices loses in trade barring Nifty FMCG and Media.

Key Highlights

Benchmarks end lower after gaining for the last two sessions.

Benchmarks Indices slightly Outperformed Broader Market Indices.

Nifty fell 200 points from the day’s high.

Nifty faces volatile trading day on Monthly expiry.

38 out of 50 stocks decline in Trade.

Nifty Midcap fell nearly 1% for the day, drag by Indus Towers and IPCA Labs.

Nifty Smallcap 250 fell 1% for the day, drag by Apar Industries and Aarti Industries.

All sectoral indices loses in trade barring Nifty FMCG and Media.

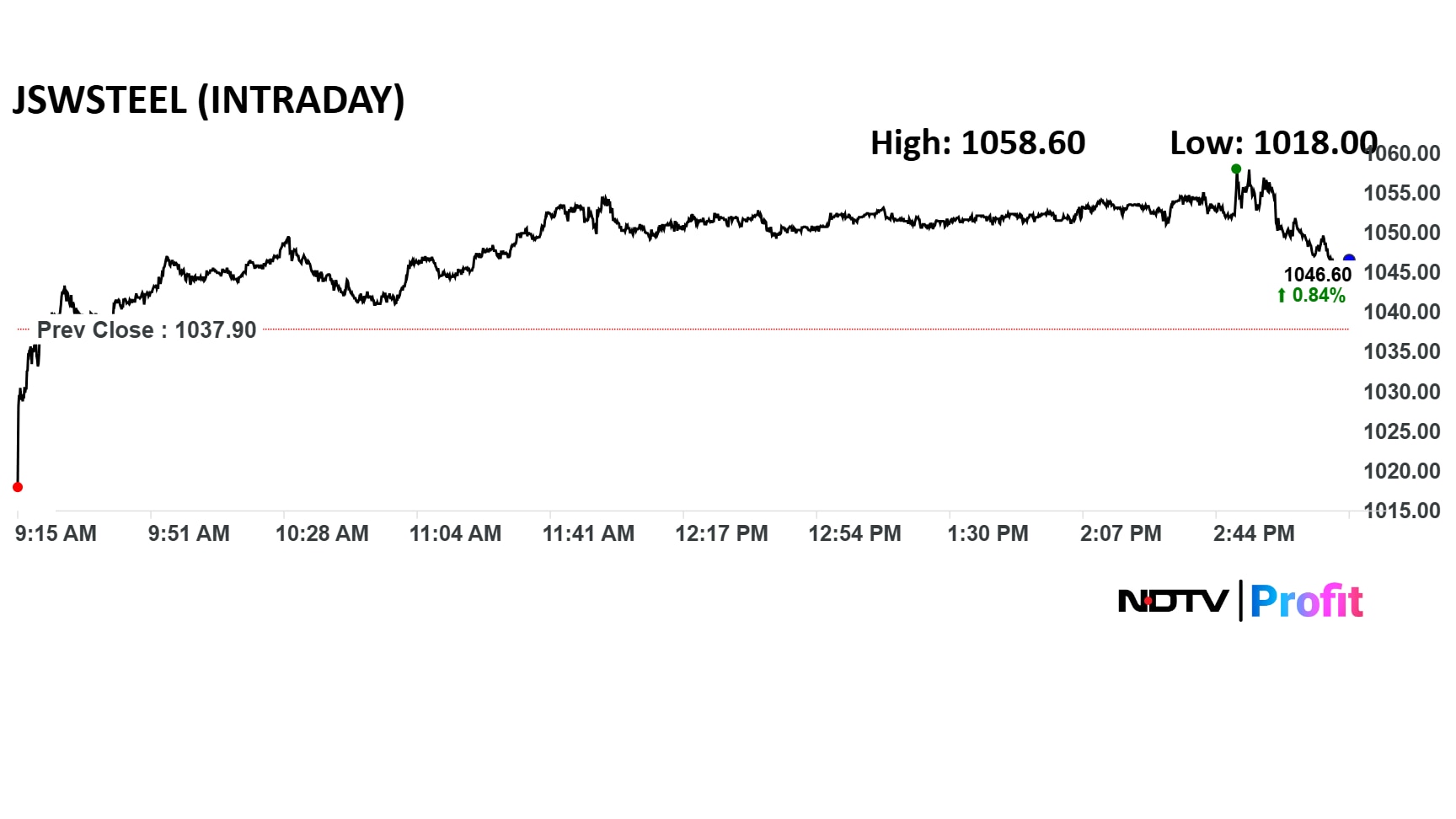

Supreme Court has withdrawn its May 2 decision to reject the liquidation of Bhushan Power and Steel and the acquisition scheme of JSW Steel.

The top court has admitted review petition by JSW Steel to hear the matter on Aug. 7.

Maruti Suzuki Ltd. reported a modest rise in standalone net profit in the first quarter of fiscal 2026, which beat street expectations on the back of higher other income.

Non-core income was Rs 1,823 during the quarter, compared to Rs 975 crore.

Maruti Suzuki Q1 Highlights (Standalone, YoY)

Revenue up 8.1% to Rs 38,414 crore versus Rs 35,531 crore. (Bloomberg estimate: Rs 36,371 crore)

Net Profit up 2% to Rs 3,712 crore versus Rs 3,6450 crore. (Estimate: Rs 3,075.8 crore)

Ebitda down 11% to Rs 3,995 crore versus Rs 4,502 crore (Estimate: Rs 3,798.5 crore)

Margin at 10.4% versus 12.7% (Estimate: 10.4%).

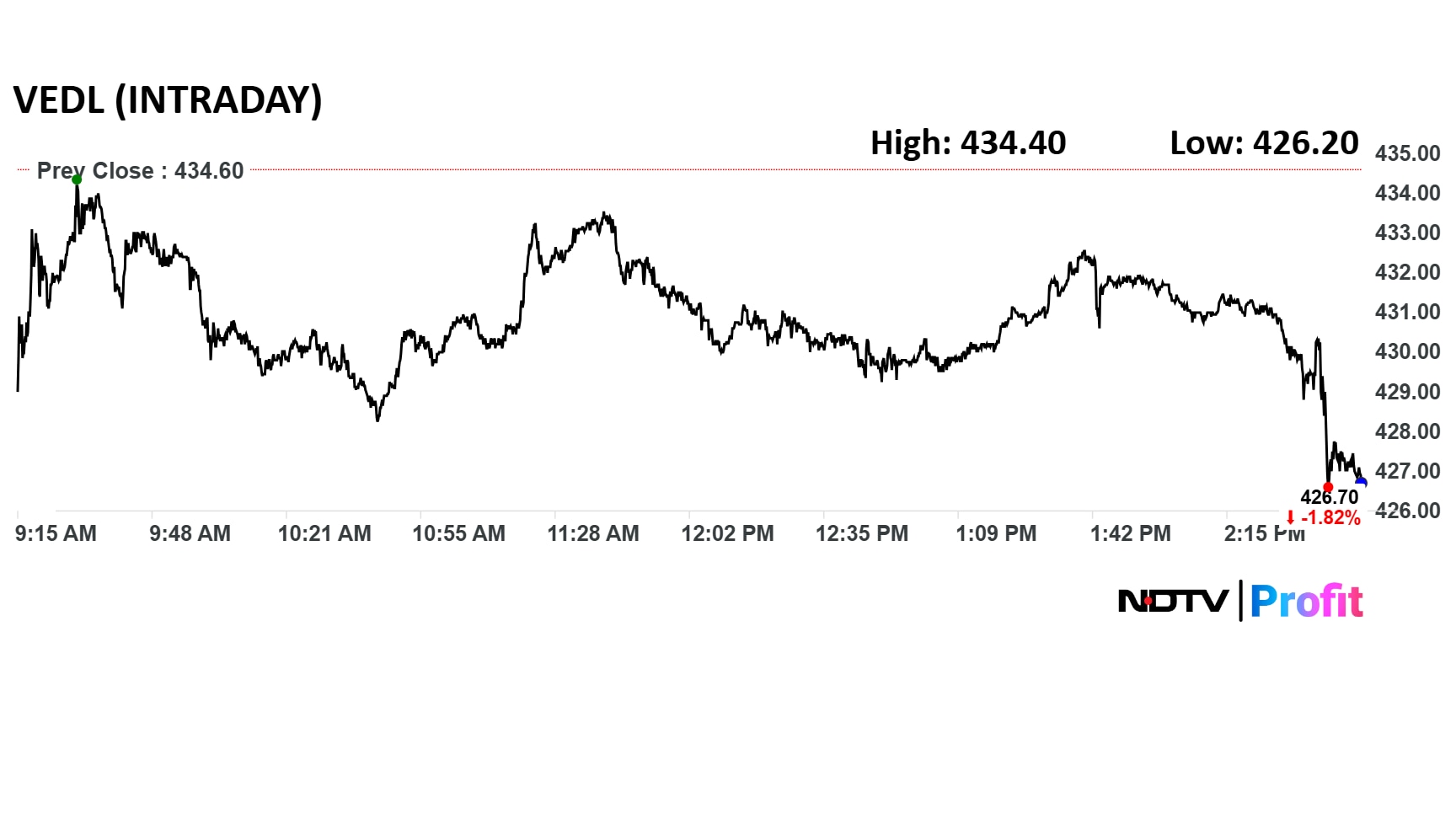

Vedanta Q1 Highlights (Consolidated, QoQ)

Revenue down 6.5% at Rs 37,824 crore versus Rs 40,455 crore.

Ebitda down 13.5% at Rs 9,918 crore versus Rs 11,466 crore.

Margin at 26.2% versus 28.3%.

Net Profit down 8.6% at Rs 3,185 crore versus Rs 3,483 crore.

Vedanta Q1 Highlights (Consolidated, QoQ)

Revenue down 6.5% at Rs 37,824 crore versus Rs 40,455 crore.

Ebitda down 13.5% at Rs 9,918 crore versus Rs 11,466 crore.

Margin at 26.2% versus 28.3%.

Net Profit down 8.6% at Rs 3,185 crore versus Rs 3,483 crore.

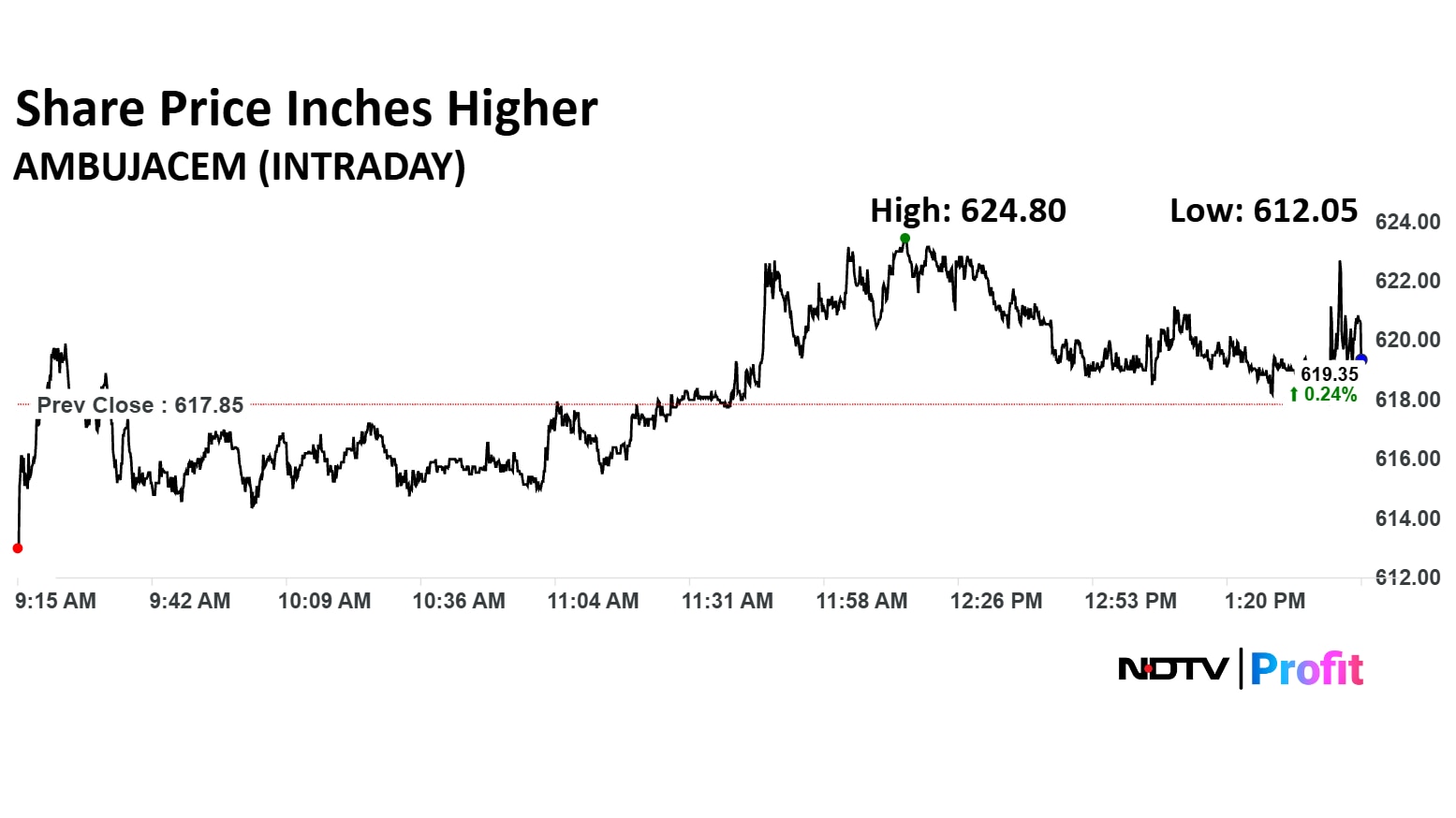

Ambuja Cements Q1 Highlights (YoY)

Revenue up 21.7% at Rs 5,521 crore versus Rs 4,538 crore.

Ebitda up 38.9% at Rs 878 crore versus Rs 632 crore.

Margin at 15.9% versus 13.9%.

Net Profit up 50.8% at Rs 855 crore versus Rs 567 crore.

Sun Pharma Q1 Highlights (Consolidated, YoY)

Revenue up 9.5% at Rs 13,851 crore versus Rs 12,653 crore.

Ebitda up 11.3% at Rs 4,073 crore versus Rs 3,658 crore.

Margin at 29.4% versus 28.9%.

Net Profit down 19.6% at Rs 2,279 crore versus Rs 2,836 crore.

There was an exceptional loss in the quarter of Rs 818 crore.

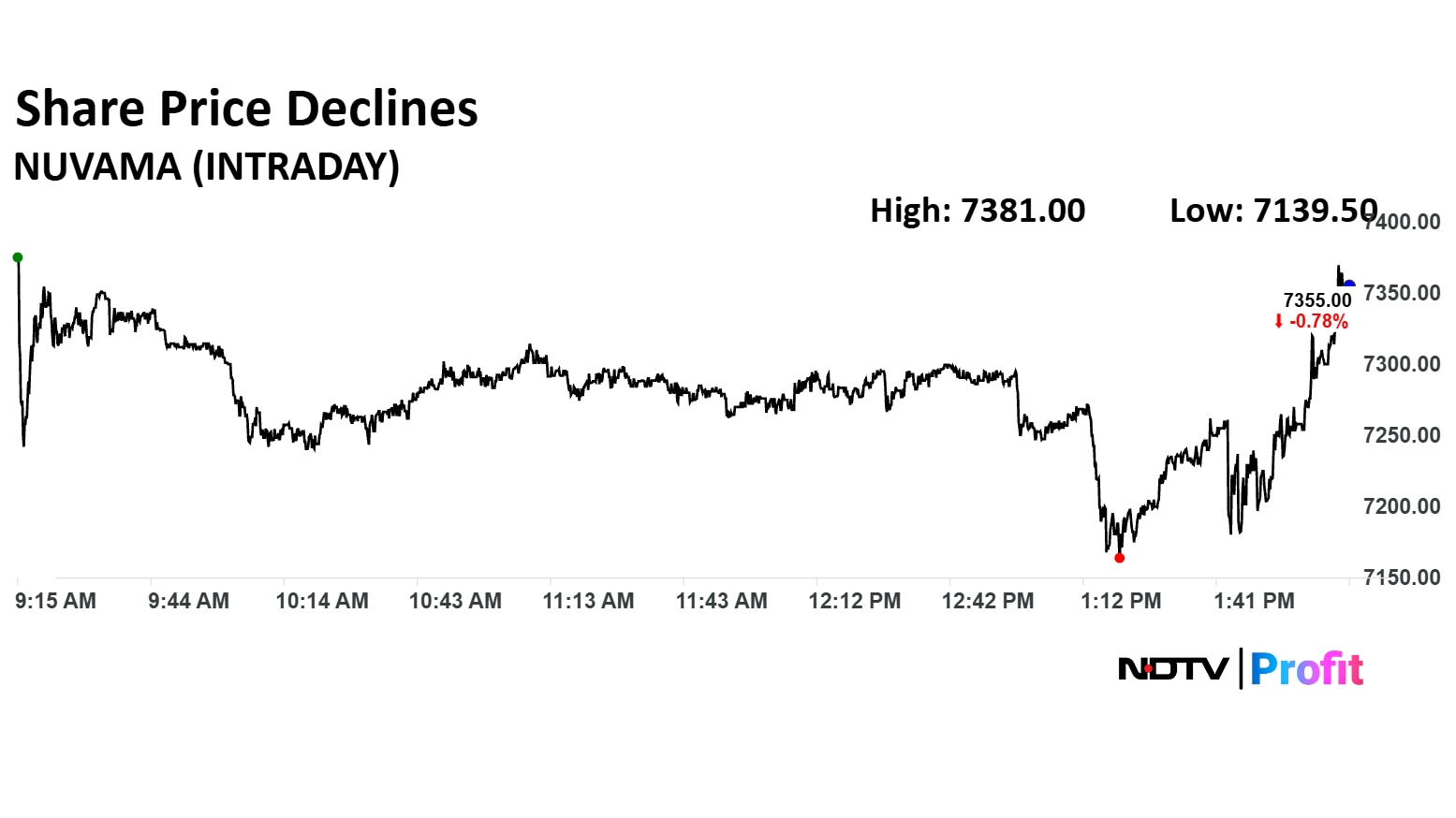

Nuvama Wealth Management Ltd.'s share price declined 3.68% on Thursday as the IT Department conducted searches at multiple locations of the company.

Nuvama Wealth Management Ltd.'s share price declined 3.68% on Thursday as the IT Department conducted searches at multiple locations of the company.

Ambuja Cement share price spiked post the company reporting their first quarter earnings. The company's net profit rose 50.8% in first quarter results.

Ambuja Cement share price spiked post the company reporting their first quarter earnings. The company's net profit rose 50.8% in first quarter results.

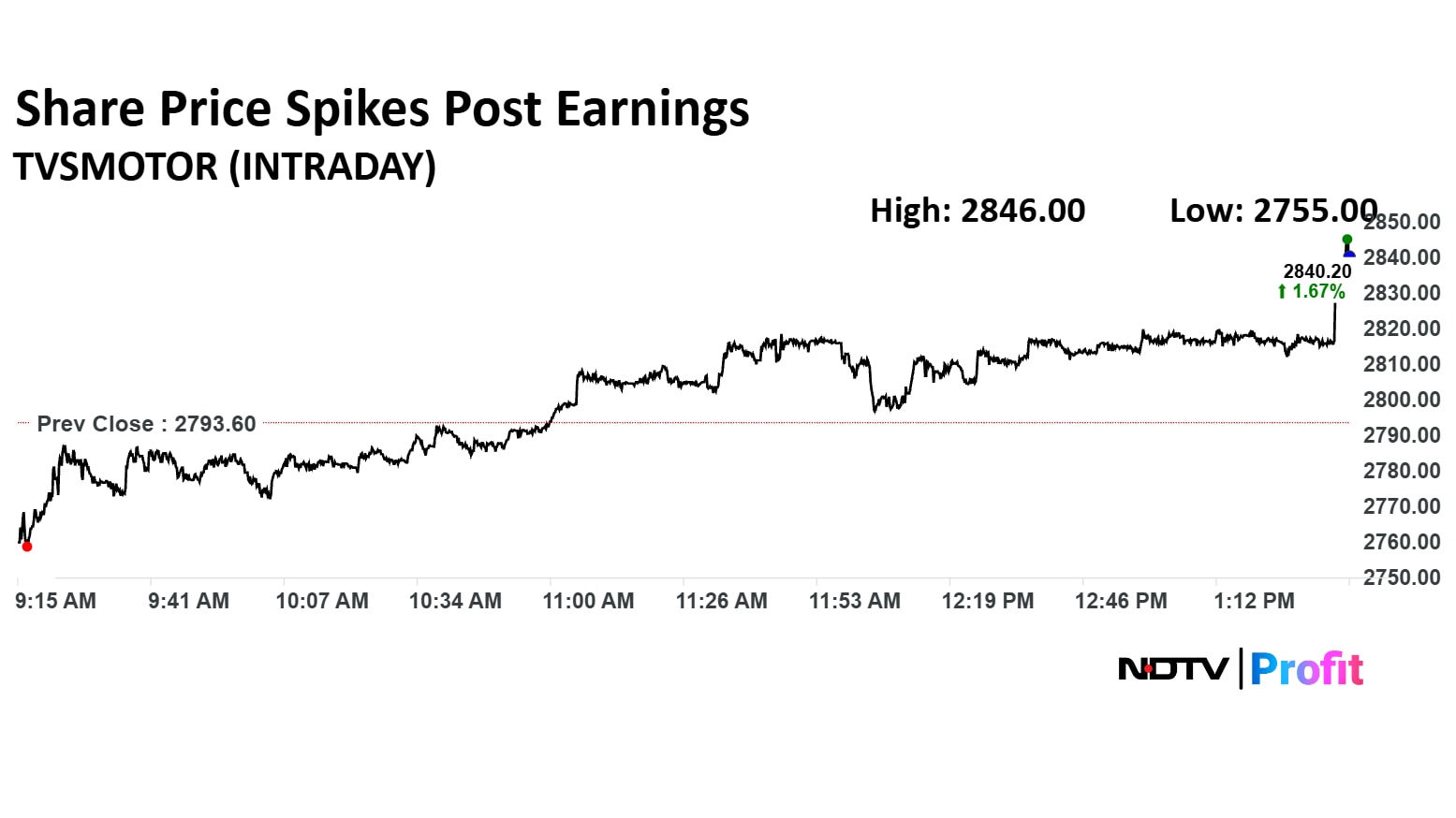

TVS Motors share price spiked past 1.8% after the company reported its first quarter earnings for financial year 2026. Net Profit for the company rose 34.85%.

TVS Motors share price spiked past 1.8% after the company reported its first quarter earnings for financial year 2026. Net Profit for the company rose 34.85%.

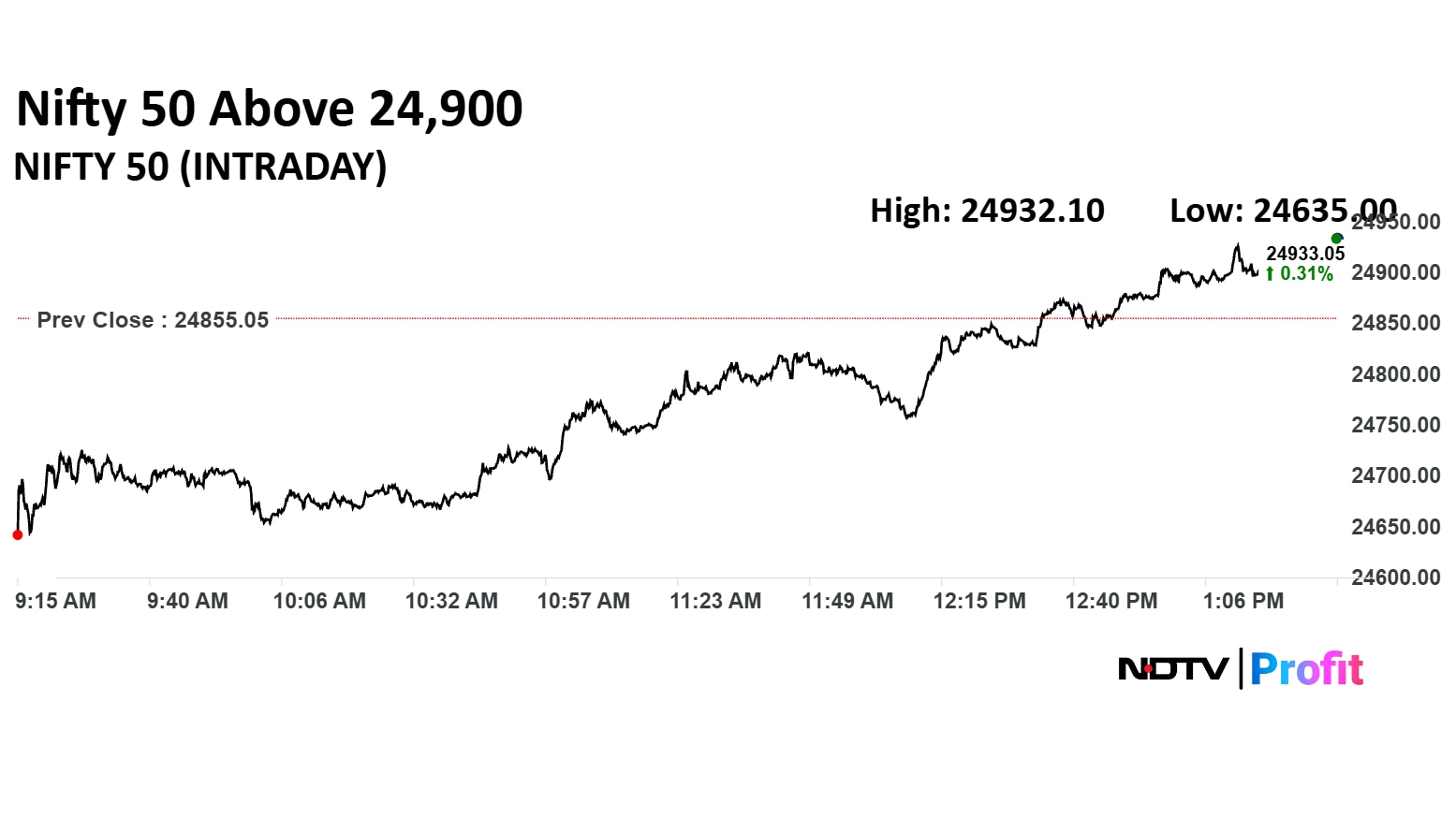

Benchmark Nifty 50 crosses 24,900 mark to hit 24,932 at intraday as it recovered the early trade losses. The market appeared spooked at opening bells following Trump's 25% tariff announcement on India but later recovered losses and held steady.

Benchmark Nifty 50 crosses 24,900 mark to hit 24,932 at intraday as it recovered the early trade losses. The market appeared spooked at opening bells following Trump's 25% tariff announcement on India but later recovered losses and held steady.

The NSE Nifty 50 recovered from the session's low of 24,635 to trade as high as 24,928. That's a jump of 293 points.

The BSE Sensex jumped 1,000 points from the day's low to 81,986.

The NSE Nifty 50 recovered from the session's low of 24,635 to trade as high as 24,928. That's a jump of 293 points.

The BSE Sensex jumped 1,000 points from the day's low to 81,986.

The Sri Lotus IPO has been subscribed 5.89 times as of 12:24 p.m. on Thursday.

Qualified Institutions: 5.39 times

Non-Institutional Buyers: 7.76 times.

Retail Investors: 5.39 times

Portion reserved for employees: 4.57 times.

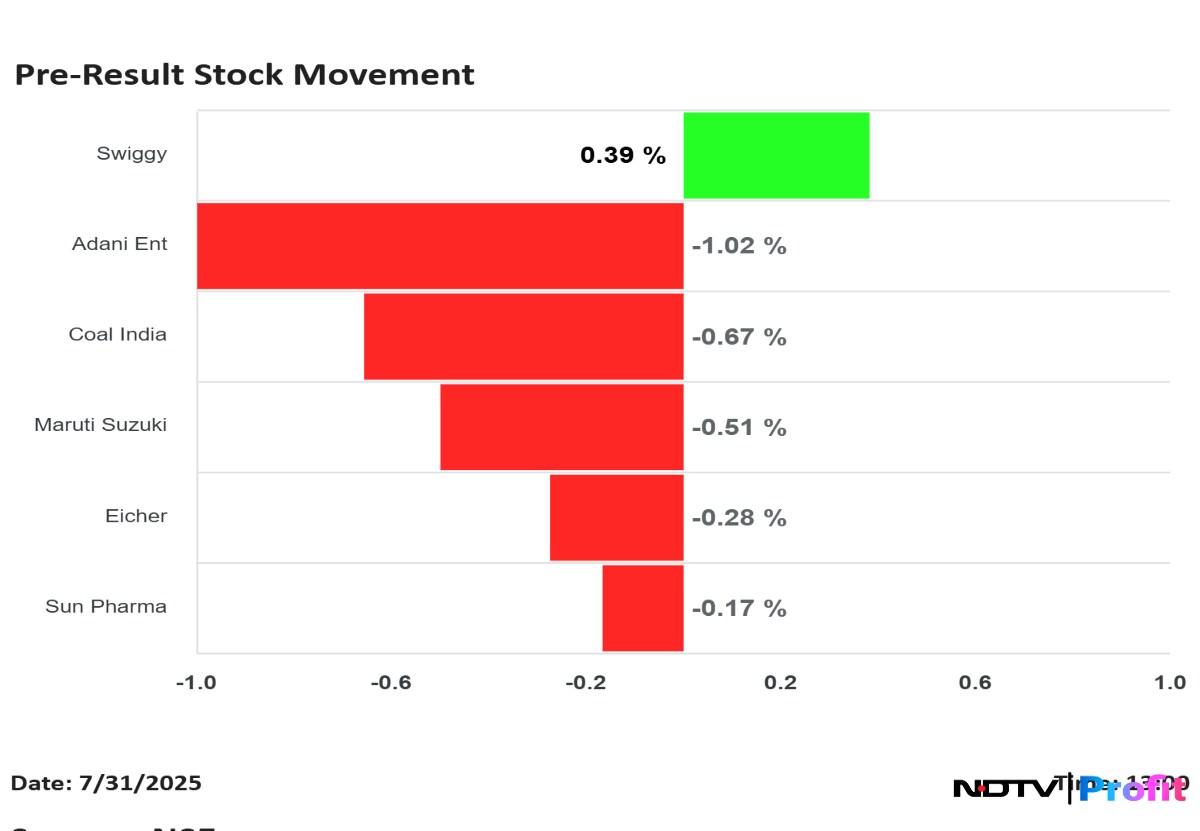

Coal India, Maruti Suzuki, Adani Enterprises, Eicher Motors and Sun Pharma shares are down ahead of their Q1 results. Swiggy is up.

Coal India, Maruti Suzuki, Adani Enterprises, Eicher Motors and Sun Pharma shares are down ahead of their Q1 results. Swiggy is up.

After nearly a percentage point decline at market open, both Nifty and Sensex clawed back to trade in green past noon.

Key Points:

Nifty recovers 230 points from day's low, trades in green.

Market pare early losses, HUL, ICICI Bank lead recovery in Nifty.

Nifty advance-decline ratio even split, 24 advance, 24 decline with 2 unchanged.

Sectoral indices trade mixed; Bank, Defence, FMCG trade in green.

Nifty FMCG top sectoral gainer; HUL, Godrej Consumer lead gains.

Nifty and Sensex staged a notable comeback just past noon. The indices nearly gave up their losses to trade flat.

Nifty and Sensex staged a notable comeback just past noon. The indices nearly gave up their losses to trade flat.

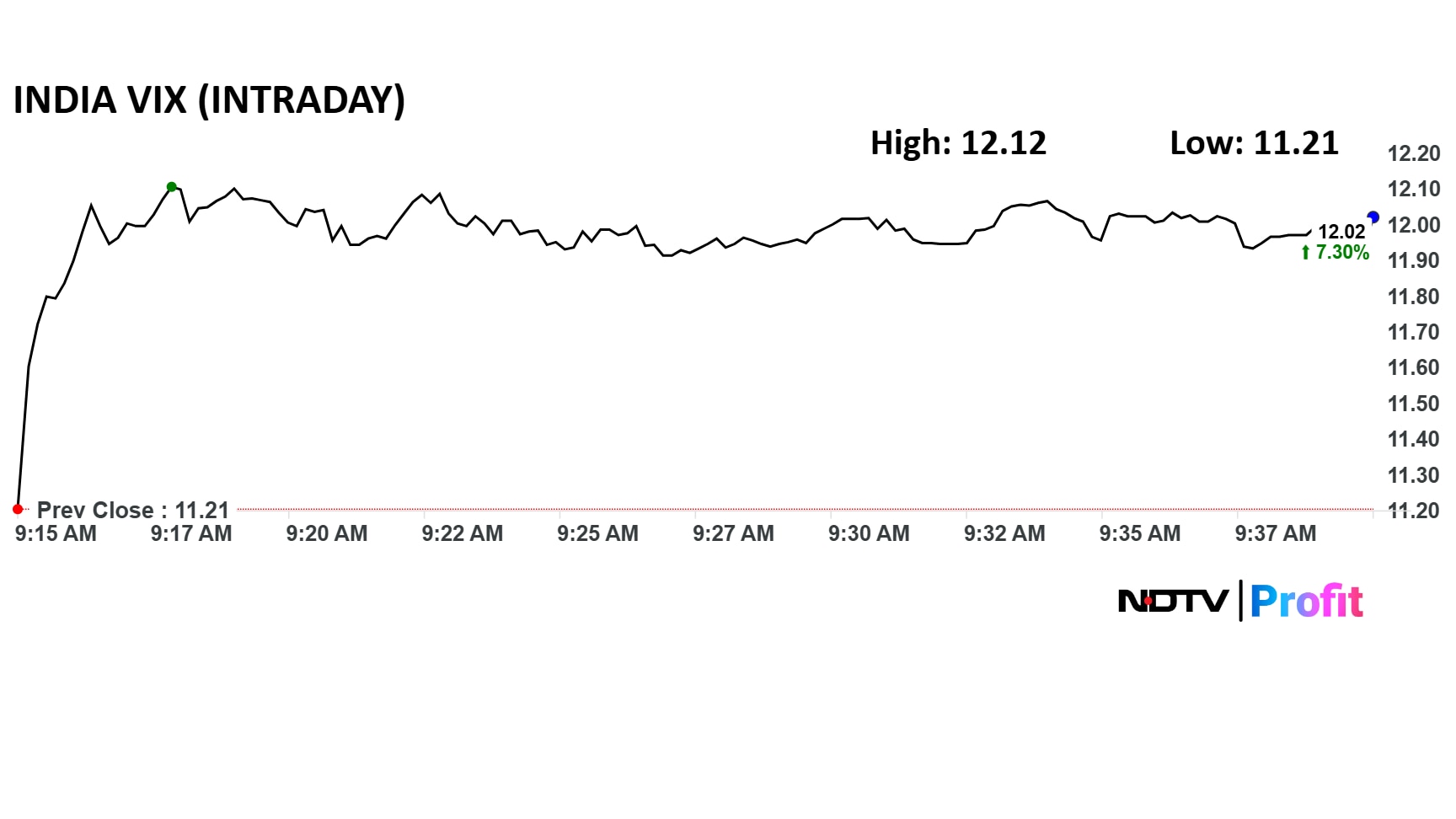

Nifty down 0.3% at 24781

Sensex down 0.3% at 81,226

Nifty Bank down 0.35%

Nifty IT down 0.6%

India VIX up 5.5%

RIL, Bharti Airtel, HDFC Bank top draggers

Nifty Midcap 150 down 0.9%

Nifty Smallcap 250 down 0.6%

Nifty down 0.3% at 24781

Sensex down 0.3% at 81,226

Nifty Bank down 0.35%

Nifty IT down 0.6%

India VIX up 5.5%

RIL, Bharti Airtel, HDFC Bank top draggers

Nifty Midcap 150 down 0.9%

Nifty Smallcap 250 down 0.6%

The NSDL IPO has been subscribed 2.8 times as of 11:40 am. on Thursday.

Qualified Institutions: 1.07 times.

Non-Institutional Buyers: 4.98 times.

Retail Investors: 2.77 times.

Portion reserved for employees: 5 times.

The grey market premium for NSDL IPO was Rs 131, as of 11:00 a.m. on July 31, according to InvestorGain. That implies a potential listing at around Rs 931 per share, marking a premium of 16%.

The Ministry of Petroleum and Natural Gas is currently assessing the potential impact of U.S. President Donald Trump’s newly announced 25% tariff on Indian exports. The announcement also states that an additional penalty will be imposed due to India's crude oil imports from Russia. Senior government officials told NDTV Profit that the ministry is awaiting formal executive directives on specific measures.

The US tariff announcement, made late Wednesday, has raised concerns across India’s energy sector, particularly as Russian crude now accounts for nearly 35–40% of India’s total oil imports. India’s energy bill could see a sharp spike if Russian supply is disrupted, a senior official said, adding that refiners may be forced to turn to alternative sources such as the U.S. and Brazil.

India has diversified its crude basket in recent years, but the scale of Russian imports, up nearly tenfold since 2021, makes any abrupt shift both costly and complex. Sources to NDTV Profit also raised concerns over tariff-driven disruptions which may push up global crude prices.

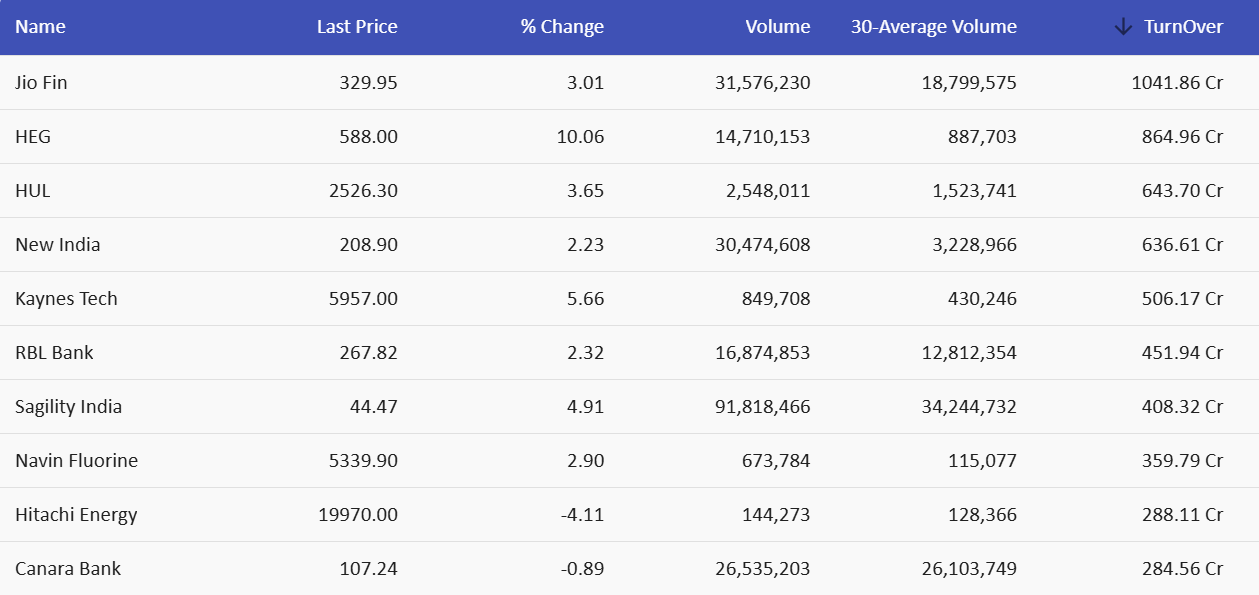

Jio Financial Services, HEG, Hindustan Unilever, New India Assurance, Kaynes Tech, RBL Bank, Sagility India, Navin Flourine, Hitachi Energy and Canara Bank are the most traded equities in terms of total turnover as of 11:00 a.m. on Thursday.

Jio Financial Services, HEG, Hindustan Unilever, New India Assurance, Kaynes Tech, RBL Bank, Sagility India, Navin Flourine, Hitachi Energy and Canara Bank are the most traded equities in terms of total turnover as of 11:00 a.m. on Thursday.

India's textile sector is currently a key focus for investors, with the nation standing as the world's fourth-largest textile exporter. A significant portion, 28%, of India's textile exports are directed to the United States, while over half of India's textile and apparel imports consist of US cotton.

Several Indian textile companies demonstrate substantial exposure to the US market. Welspun Living has 65% exposure, Indo Count's exposure stands at 70%, and Himatsingka Seide leads with 83%. Other notable companies include Gokaldas at 77%, Alok Industries at 45%, Trident at 38%, Arvind at 35%, and KPR Mills at 21%.

GMR Power and Urban Infra share price declined 5.28% to Rs 108 apiece, the lowest level since June 27. The company has reported a loss of Rs 7.8 crore versus profit of Rs 1,225 crore.

Computer Age Management Services Ltd. fell 5.26% to Rs 3,685.4 apiece, the lowest level since May 15. The stock declined because it has reported 4.38% on the quarter fall in net profit.

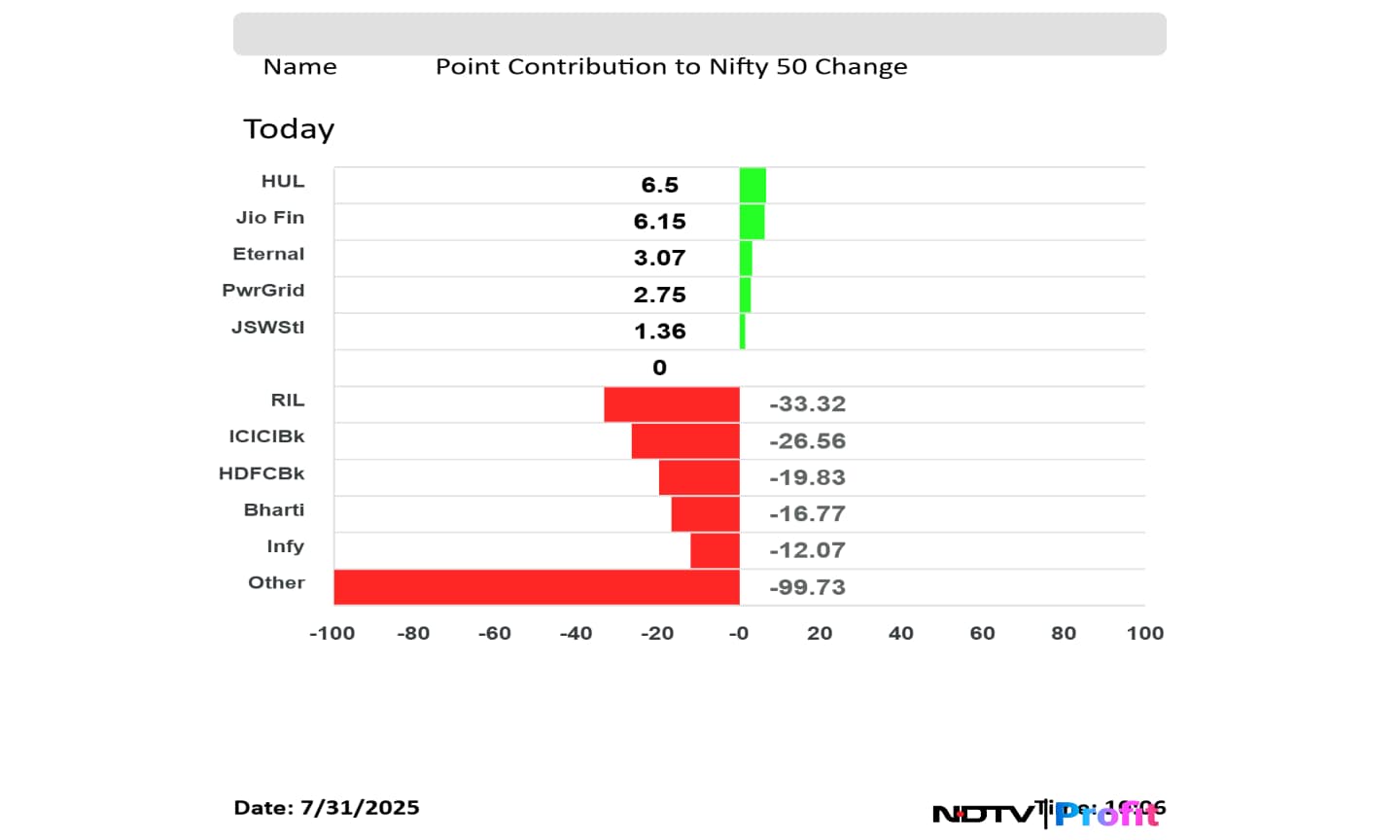

Shares of financial companies, oil and gas, information technology and telecom are the top draggers on the Nifty as of 10:40 a.m.

RIL, ICICI Bank and HDFC Bank are weighing.

Shares of financial companies, oil and gas, information technology and telecom are the top draggers on the Nifty as of 10:40 a.m.

RIL, ICICI Bank and HDFC Bank are weighing.

Jayesh Mehta, vice chairman and CEO of DSP Finance told NDTV Profit that the Reserve Bank of India may intervene in the currency market to manage volatility but not as aggreesively.

"Technically, we haven’t seen that much of a fall in rupee as we had expected. We have continuous selling by FPIs and that's also not helping rupee. RBI will also intervene but I think it will be softly. I don't expect aggressive intervention by the RBI to help the rupee. We may see another 50-70 paisa movement on the downside if these tensions continue. Not sure at what level will RBI will step in heavily," he said.

The rupee has fallen 31 paise intraday to 87.73 against the dollar.

Reliance Industries, ICICI Bank, HDFC Bank and Bharti Airtel are the top drags on the 50-stock Nifty.

Reliance Industries, ICICI Bank, HDFC Bank and Bharti Airtel are the top drags on the 50-stock Nifty.

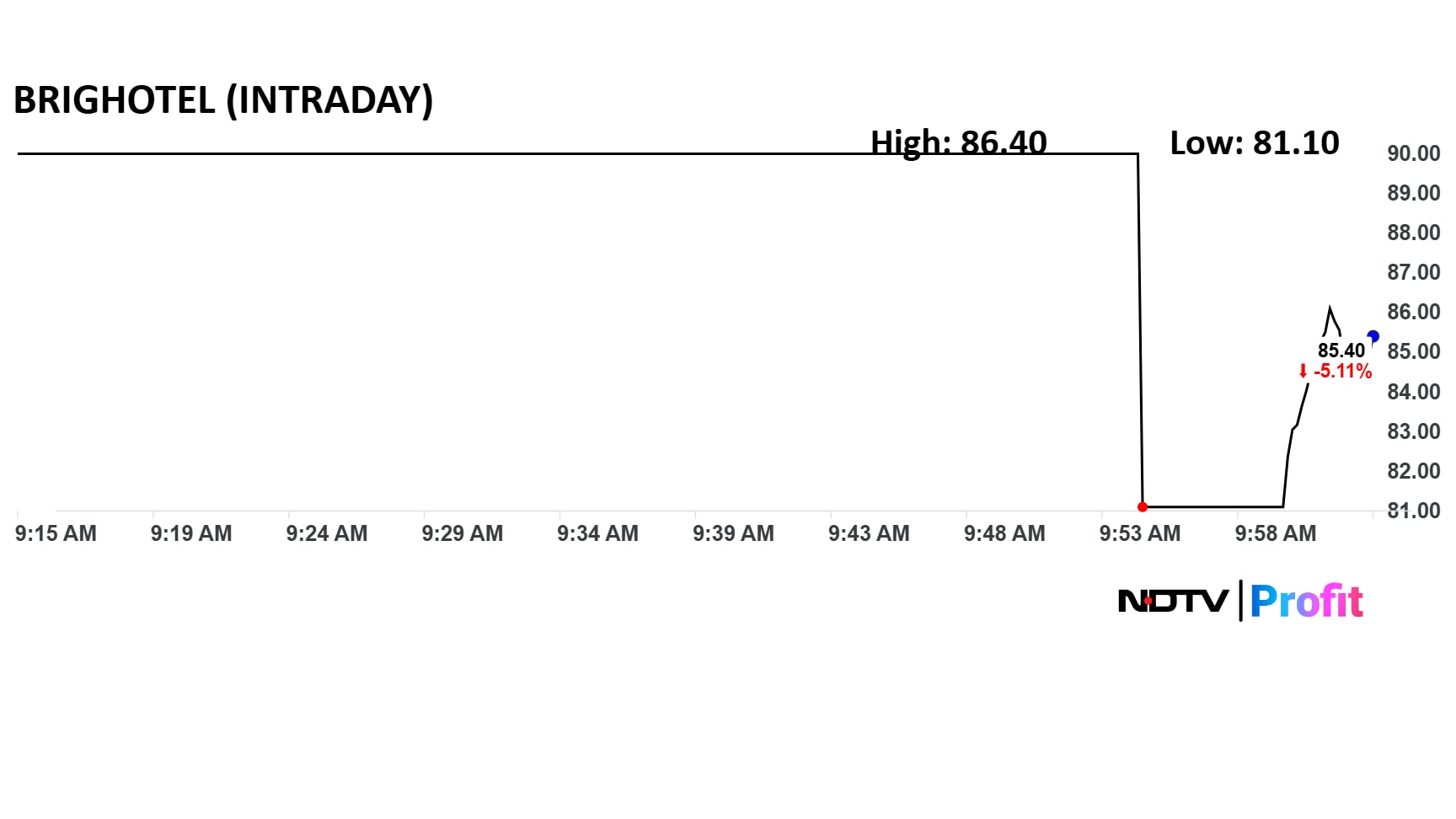

Brigade Hotel Ventures shares listed at a nearly 10% discount to its IPO price on the stock exchanges.

The scrip opened at Rs 81.1 on the NSE and Rs 82 on the BSE. The issue price was Rs 90.

Brigade Hotel Ventures shares listed at a nearly 10% discount to its IPO price on the stock exchanges.

The scrip opened at Rs 81.1 on the NSE and Rs 82 on the BSE. The issue price was Rs 90.

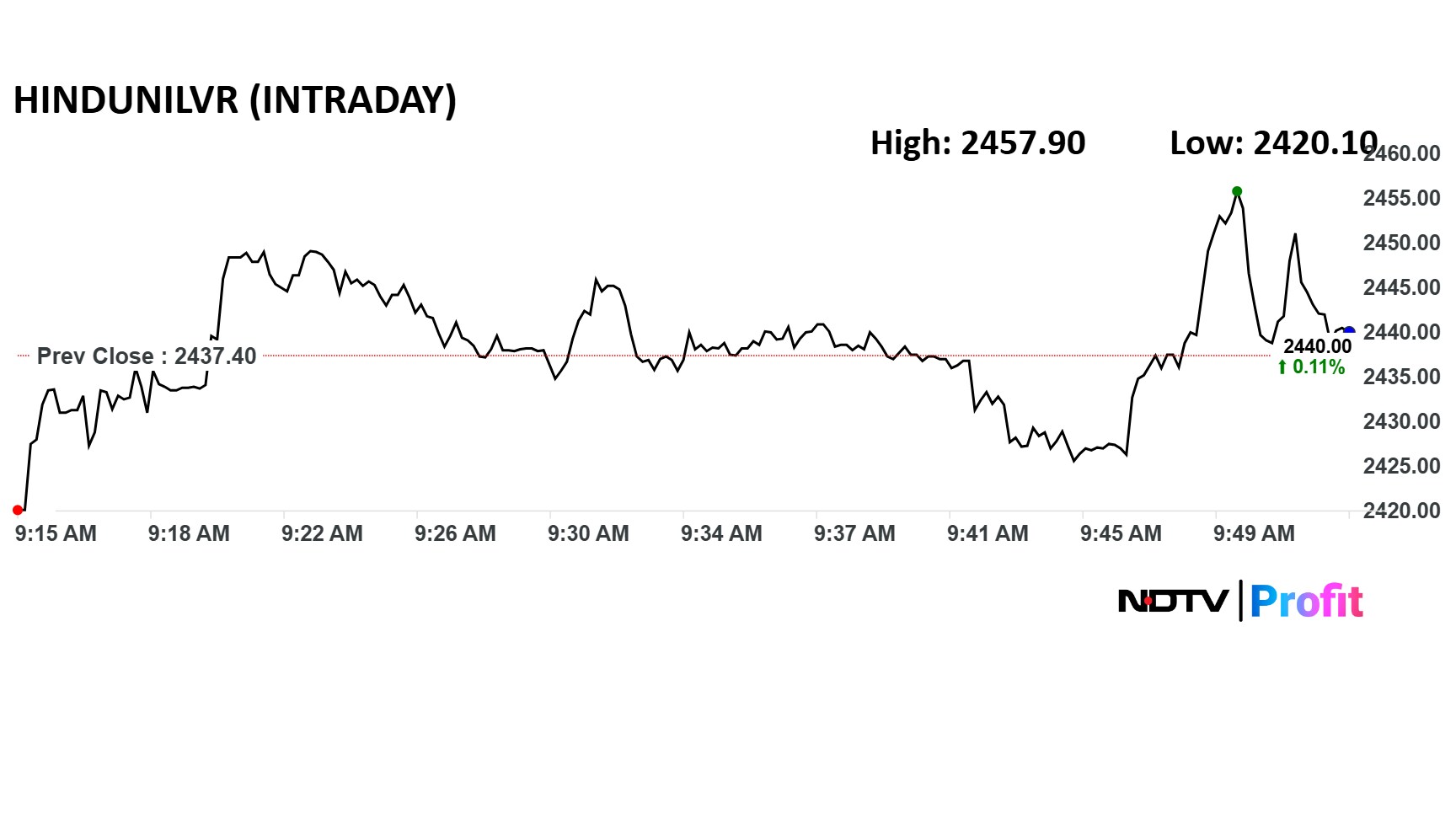

Home Care Revenue at Rs 5,783 crore versus Rs 5,675 crore

Personal Care Revenue at Rs 2,541 crore versus Rs 2,385 crore

Beauty & Wellbeing Revenue at Rs 3,349 crore versus Rs 3,199 crore

Foods Revenue at Rs 4,016 crore versus Rs 3,850 crore

Hindustan Unilever Q1 FY26 (Standalone, YoY)

Net profit up 7.6% Rs 2,732 crore versus Rs 2,538 crore (Estimate: Rs 2,583 crore)

Revenue up 4% 15,931 crore versus Rs 15,339 crore (Estimate: Rs 15,962 crore)

Ebitda down 1.3% at Rs 3,558 crore versus Rs 3,606 crore (Estimate: Rs 3,618 crore)

Margin 22.3% versus 23.5% (Estimate at 24.1%)

Consolidated YoY

Revenue up 5.13% at Rs 16,514 crore vs Rs 15,707 crore

Ebitda down 0.7% at Rs 3,718 crore vs Rs 3,744 crore

Margin at 22.51% vs 23.83%

Net profit up 5.59% at Rs 2,756 crore vs Rs 2,610 crore

Volatility increased in the Indian stock markets during early trade on Thursday. the India VIX surged 8% soon after market open and stayed higher as of 9:40 a.m.

Volatility increased in the Indian stock markets during early trade on Thursday. the India VIX surged 8% soon after market open and stayed higher as of 9:40 a.m.

US President Donald Trump on Thursday again took aim at India and Russia. He has slapped a 25% import tariff on India and announced additional penalties for India's oil and defence purchases from Moscow.

In a post on Truth Social, he said:

"I don’t care what India does with Russia. They can take their dead economies down together, for all I care. We have done very little business with India, their Tariffs are too high, among the highest in the World. Likewise, Russia and the USA do almost no business together. Let’s keep it that way, and tell Medvedev, the failed former President of Russia, who thinks he’s still President, to watch his words. He’s entering very dangerous territory!"

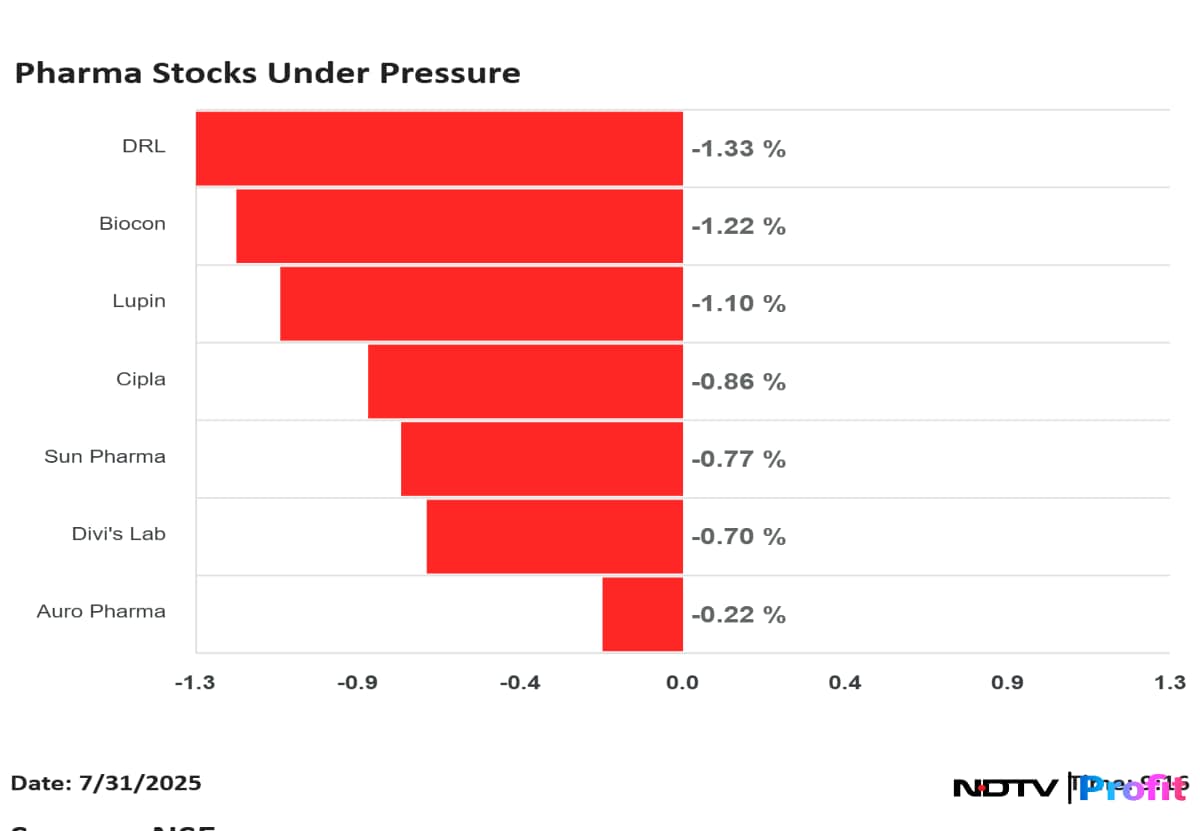

Shares of Indian pharmaceutical companies came under pressure on Thursday after Trump announced a 25% tariff on Indian exports to the United States. While the pharma sector remains exempt for now, in an earlier post, Trump indicated via a post on Truth Social that duties on drug exports are likely to be introduced soon.

Nifty Pharma dropped 1.51% intraday as it underperformed the benchmark Nifty 50, which dropped 0.86% intraday.

Major players such as Sun Pharma, Dr. Reddy’s Laboratories, Cipla, Divi’s Laboratories, Aurobindo Pharma, Lupin, and Biocon faced market volatility.

Shares of Indian pharmaceutical companies came under pressure on Thursday after Trump announced a 25% tariff on Indian exports to the United States. While the pharma sector remains exempt for now, in an earlier post, Trump indicated via a post on Truth Social that duties on drug exports are likely to be introduced soon.

Nifty Pharma dropped 1.51% intraday as it underperformed the benchmark Nifty 50, which dropped 0.86% intraday.

Major players such as Sun Pharma, Dr. Reddy’s Laboratories, Cipla, Divi’s Laboratories, Aurobindo Pharma, Lupin, and Biocon faced market volatility.

Shares of Oil and Natural Gas Corporation (ONGC) and Oil India declined on Thursday, in line with broader market sentiment which turned cautious following U.S. President Donald Trump’s announcement of a steep 25% tariff on Indian exports.

The tariff package, unveiled late Wednesday, also includes unspecified penalties for countries importing oil and other commodities from Russia, a move that could have implications for India’s energy trade. In the same light, major listed entities like ONGC and Oil India saw immediate disruption.

Oil India declined 1.45% at intraday and ONGC declined 0.83% at intraday.

All sectoral indices trade in red

47 of Nifty 50 stocks decline in trade on open

Financials drag Nifty by 50 points

Nifty Oil & Gas worst performing sectoral index

1934 stocks on NSE trade in red, but only 23 hit lower circuit

All sectoral indices trade in red

47 of Nifty 50 stocks decline in trade on open

Financials drag Nifty by 50 points

Nifty Oil & Gas worst performing sectoral index

1934 stocks on NSE trade in red, but only 23 hit lower circuit

At pre-open session, the Nifty fell to 24,111, a drop of over 1%. Sensex dipped below 78,600.

The 10-year bond yield opened 2 basis points higher at 6.39%

It closed at 6.37% on Wednesday

Source: Cogencis

Rupee opened 26 paise weaker at 87.69 against US Dollar.

It's the lowest level since Feb 10.

It closed at 87.43 a dollar on Wednesday.

The dollar index is flat globally.

Source: Cogencis

The GIFT Nifty futures contracts are down 0.6% at 24,707.

Shares of Maruti Suzuki India Ltd., Marico Ltd., Eicher Motors Ltd., Bharat Heavy Electricals Ltd., Varun Beverages Ltd. and 49 other companies will be of interest on Thursday, as it marks the last session for investors to buy shares to qualify for receiving the dividend before the stock goes ex/record-date.

Under India's T+1 settlement cycle, shares purchased on the record date itself will not qualify for the dividend payment. Hence, if the record date of a dividend stock is Aug. 1, then shares must be purchased by July 31.

At an aggregate level, India's goods exports to the US are 2.2% of GDP

This implies a less severe direct impact of tariff-related developments

Further, nuances will emerge at the sector level on the basis of the tariff differential with other economies and exposure to the US

Remain watchful of the developments from the next round of negotiations

The second order impact of the tariffs through weaker corporate confidence and deferred capex cycle, which in our view is likely to be more pronounced

Textiles make up comprise close to half of India's overall exports, while the share of pharma products is 40%

India’s goods exports to the US may be hurt, but it is small as a share of GDP

Some loss in exports to the US could be offset by redirecting exports to other nations

Recent INR weakness, if it sustains, could also work to limit the tariff impact

Bigger implication of the US tariffs could be the shrinking of US trade deficit, especially amid weaker USD and higher rates

This shall impart a deflationary impulse to the global economy, hurting trade, growth and earnings everywhere

This will keep markets volatile as FII flows could soften – key market movers now

See more global monetary easing is likely down the line

Final tariffs for some ASEAN countries have now come through, at lower than the 25% for India

India has stood its ground in not agreeing to lowering tariffs for agri-products

India can gain if the tariffs on China remain substantial

If most of the adverse effects eventuate, the worst case impact would be 30 bps to GDP growth

Greater immediate macro impact depends on whether FII outflows & INR depreciation accelerate

Negative: Auto, Renewables (higher tariffs relative to competition)

Neutral for now: EMS, Cap goods, Steel/ aluminium, Oil & Gas, Pharma

Mixed: Chemicals, Textiles (dependent on final tariff rate for Bangladesh)

Gold prices rebounded in Asia session after data showed that US economic activity rebounded in the second quarter. US's inflation adjusted GDP grew 3% on the year during April–June from a 0.5% shrink in the previous quarter, as Bloomberg reported.

Gold futures were trading 0.23% down at $3,344 as of 7:43 a.m.

Oil prices declined in Asia session as concerns rose after US President Donald Trump threatened to impose penalty on India for Russian oil purchase.

The October future contract of Brent crude was trading 0.07% down at $72.42 a barrel as of 7:38 a.m.

The Hang Seng and CSI 300 fell sharply on Thursday as manufacturing activity slowed more than expected in China. The official Manufacturing Purchasing Index for July came at 49.3 against expectation of 49.7.

The Hang Seng and CSI 300 were trading 1.52% and 1.28% respectively as of 7:34 a.m.

The Nasdaq 100 and S&P 500 futures rose sharply in Asia session as earnings from megacap technology firms boosted sentiments. Further, the dollar index steadied after the US Federal Reserve kept the interest rate steady.

The Nasdaq 100 and S&P 500 futures were trading 1.24% and 0.86% higher, respectively as of 7:28 a.m.

The GIFT Nifty was trading 0.04% or 11 points higher at 24,666 as of 6:34 a.m., which implied a positive open for the NSE Nifty 50.

Traders will monitor share prices of Indraprastha Gas Ltd., Tata Steel Ltd., Kaynes Technology India Ltd., and oil refineries and marketing stocks due to overnight news flow and first-quarter earnings.

India's benchmark equity indices ended higher for a second consecutive session on Wednesday as better-than-expected earnings pulled up heavyweight Larsen & Toubro Ltd. to help offset decline in Tata Motors Ltd. and Reliance Industries Ltd.

The NSE Nifty 50 settled 140 points or 0.14% higher at 24,855, managing to hold above the support level of 24,750. The BSE Sensex added 144 points or 0.18% to close at 81,481.86.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.