Major Indian equity indices extended their gains to a fifth straight session on Wednesday. The Nifty 50 index advanced 0.2 percent to close at 8,927. Its futures added 3 percent in open interest across all series with traders taking higher number of long positions.

Nifty rollovers stood at 54 percent, a notch higher than its previous 3-month average of 52 percent indicating traders were more willing to carry their positions forward into the next series.

The Nifty Bank index remained flat but saw further accumulation of 5.8 percent in its futures open interest across all series. Foreign institutional investors (FII) sold index futures worth Rs 272 crore on a net basis.

The India Volatility Index (VIX) gained 1.3 percent to close at 13.7 indicating expansion in option premiums.

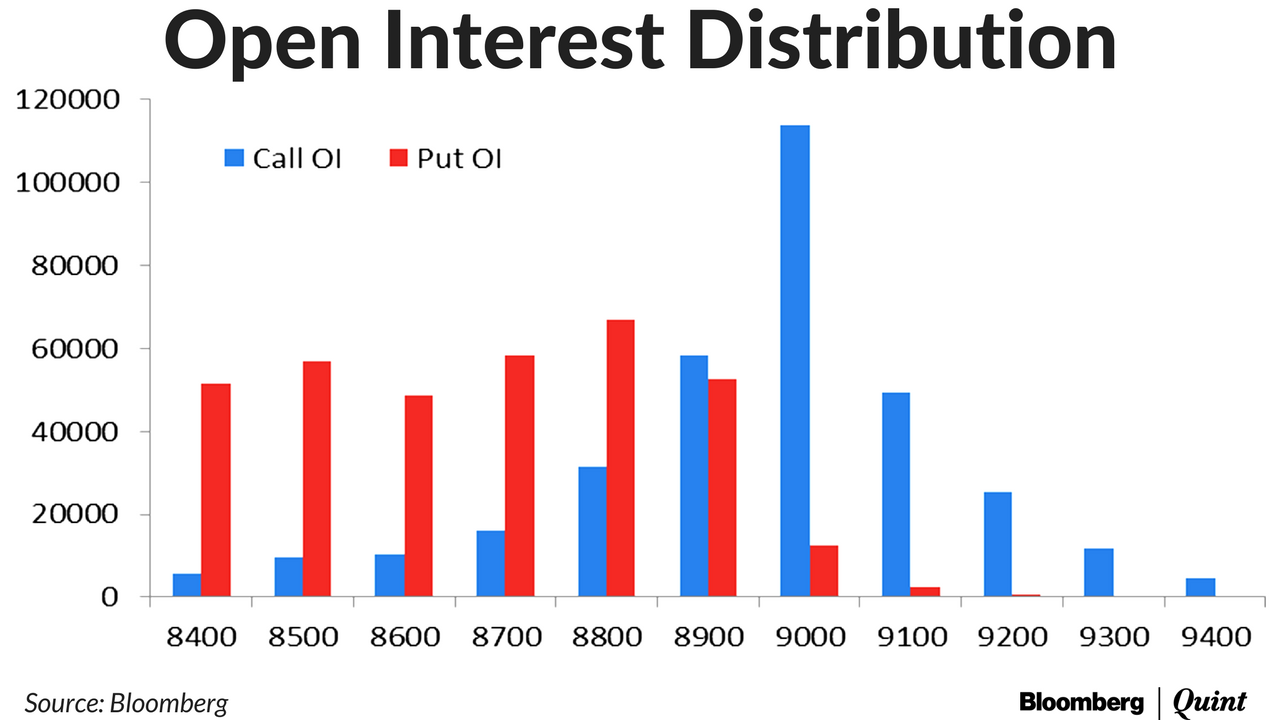

Maximum open interest remained with 9,000 call and 8,800 put. There was substantial addition of open interest in the 9,000 call, which indicates further writing. This may be also interpreted as 9,000 will be stiff resistance for the Nifty to scale.

FIIs bought 2,377 index call contracts and unwound 3,644 index put contracts on a net basis.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.