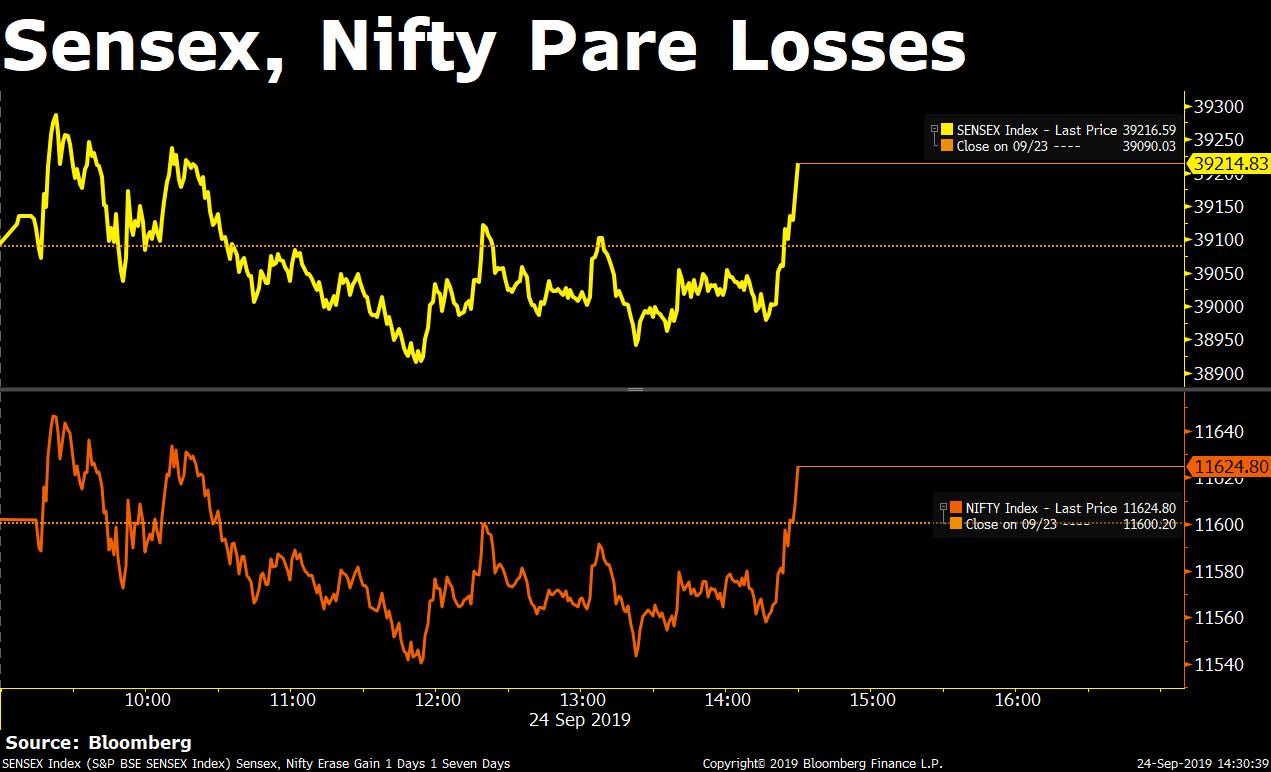

Indian equity benchmarks halted a two-day rally, led by the declines in financial companies.

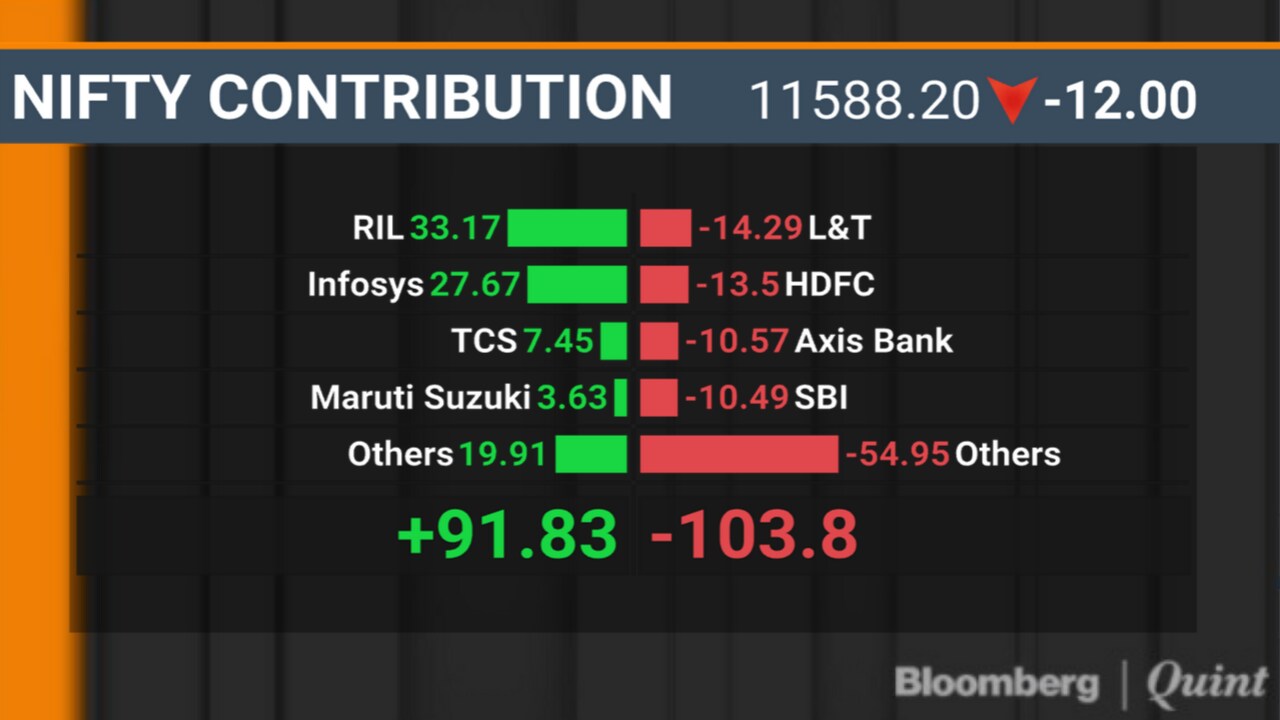

The S&P BSE Sensex and the NSE Nifty 50 ended little changed at 39,097 and 11,588.20 respectively. The broader markets represented by the NSE Nifty 500 Index ended 0.12 percent lower.

Indian equity markets are expected to touch new highs before the bi-monthly monetary policy due in October.

That’s according to Avendus Capital Alternate Strategies’ Andrew Holland. “We're not near the highs yet, but we will quickly get there,” he told BloombergQuint in an interaction.

“The market is expecting more positive news on personal tax front and capital gains tax and will try to hit new highs within next couple of weeks,” Holland added.

The market breadth was tilted in favour of sellers. About 955 stocks declined and 813 shares advanced on National Stock Exchange.

Seven out of 11 sectoral gauges compiled by NSE ended lower, led by the NSE Nifty PSU Bank Index’s 2.3 percent fall. On the flipside, the NSE Nifty IT Index was the top sectoral gainer, up 1.9 percent.

Indian equity benchmarks halted a two-day rally, led by the declines in financial companies.

The S&P BSE Sensex and the NSE Nifty 50 ended little changed at 39,097 and 11,588.20 respectively. The broader markets represented by the NSE Nifty 500 Index ended 0.12 percent lower.

Indian equity markets are expected to touch new highs before the bi-monthly monetary policy due in October.

That’s according to Avendus Capital Alternate Strategies’ Andrew Holland. “We're not near the highs yet, but we will quickly get there,” he told BloombergQuint in an interaction.

“The market is expecting more positive news on personal tax front and capital gains tax and will try to hit new highs within next couple of weeks,” Holland added.

The market breadth was tilted in favour of sellers. About 955 stocks declined and 813 shares advanced on National Stock Exchange.

Seven out of 11 sectoral gauges compiled by NSE ended lower, led by the NSE Nifty PSU Bank Index’s 2.3 percent fall. On the flipside, the NSE Nifty IT Index was the top sectoral gainer, up 1.9 percent.

Mahindra Logistics

Zee Entertainment

Banco Products

HBL Power Systems

The yield on the 10-year note rose three basis points to 6.77 percent.

Bond traders are awaiting the government’s second half borrowing plan amid concern that the $20 billion tax break may weigh on the fiscal deficit.

Investors will also watch if the borrowing calendar includes an overseas sale of bonds after the government said it will refrain from extra borrowing. The 10-year yield is seen trading between 6.70-6.80 percent in the day.

The yield on the 10-year note rose three basis points to 6.77 percent.

Bond traders are awaiting the government’s second half borrowing plan amid concern that the $20 billion tax break may weigh on the fiscal deficit.

Investors will also watch if the borrowing calendar includes an overseas sale of bonds after the government said it will refrain from extra borrowing. The 10-year yield is seen trading between 6.70-6.80 percent in the day.

The Indian rupee reserved gains against the U.S. dollar. The home currency traded little changed at 70.94 against the greenback.

The Indian rupee reserved gains against the U.S. dollar. The home currency traded little changed at 70.94 against the greenback.

Indian equity benchmarks are headed for a volatile close.

The S&P BSE Sensex and the NSE Nifty 50 traded little changed at 39,135 and 11,602 as of 3 p.m. after fluctuating between gains and losses. The broader markets represented by the NSE Nifty 500 Index also traded little changed.

BASF India

Dish TV

Marico

JBM Auto

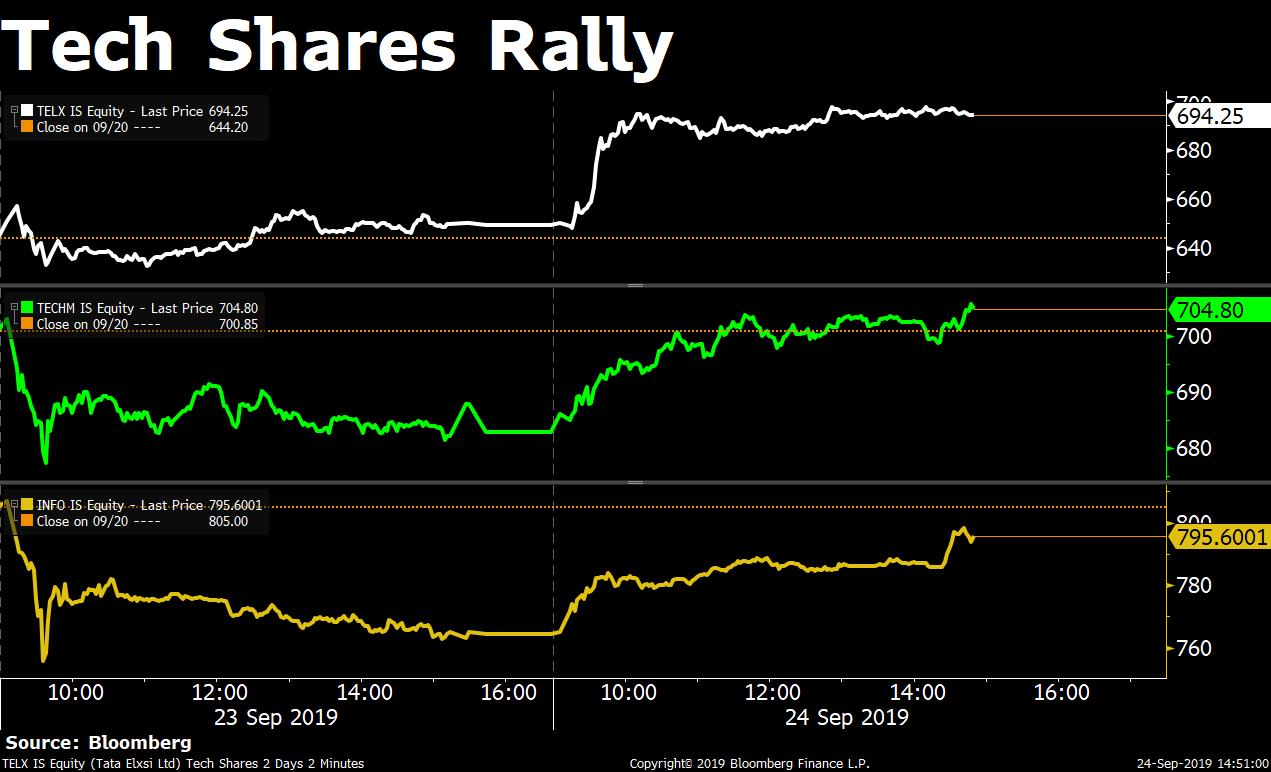

Shares of the information technology companies rallied in today’s trade, led by Tata Elxsi’s 7 percent advance.

Shares of Infosys, which was the top performer on Sensex and Nifty rose over 4 percent, while shares of Tech Mahindra advanced over 3 percent.

Shares of the information technology companies rallied in today’s trade, led by Tata Elxsi’s 7 percent advance.

Shares of Infosys, which was the top performer on Sensex and Nifty rose over 4 percent, while shares of Tech Mahindra advanced over 3 percent.

Shares of ITD Cementation India fell as much as 19.9 percent, the most since October 2017, to Rs 48.20.

The stock extended declines for the second consecutive trading session. Trading volume was almost 14 times its 20-day average, according to Bloomberg data. The Relative Strength Index was below 30, indicating that the stock may be overbought.

BloombergQuint spoke to ITD Cementation’s Chief Financial Officer Prasad Pathwardhan on Kolkata Metro incident. Here are the key highlights from the conversation:

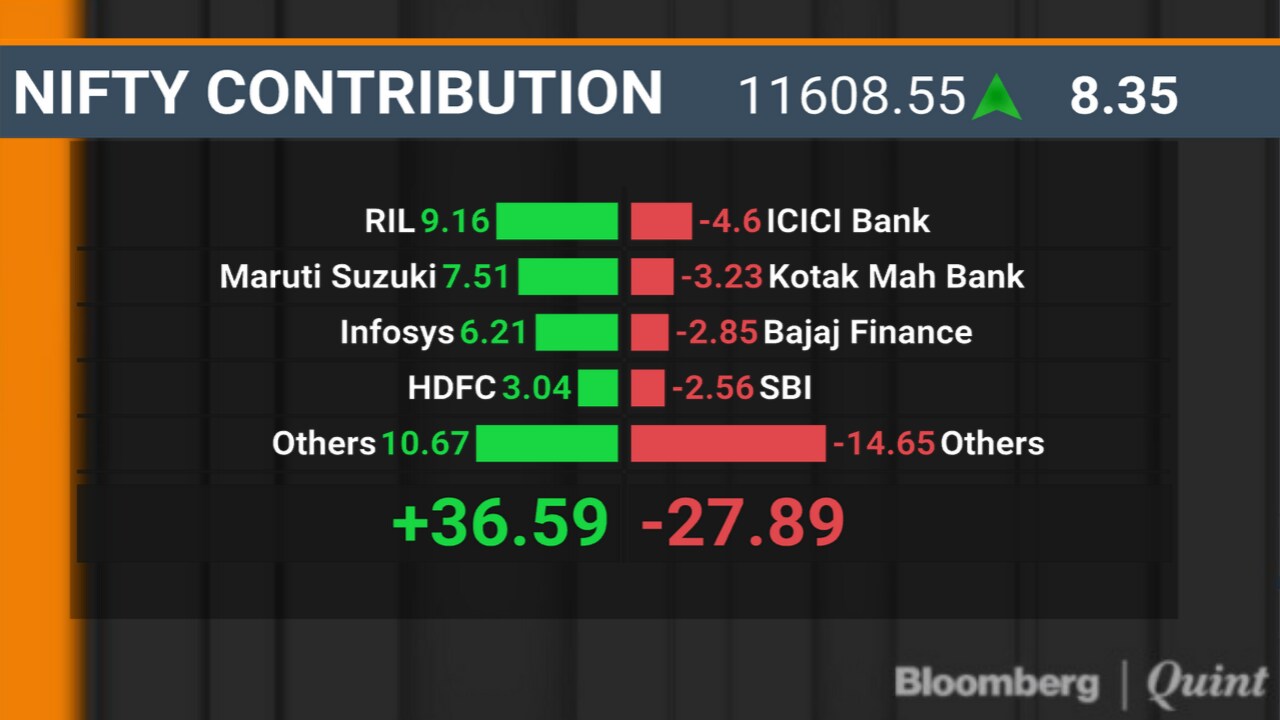

Indian equity benchmarks pared losses, led by the gains in Reliance Industries Ltd. and Infosys Ltd.

The S&P BSE Sensex rose 0.24 percent to 39,179 as of 2:30 p.m. and the NSE Nifty 50 rose 0.15 percent to 11,616. The broader markets represented by the NSE Nifty 500 Index rose 0.1 percent.

The market breadth, however, was tilted in favour of sellers. About 997 stocks declined and 743 shares advanced on National Stock Exchange.

Indian equity benchmarks pared losses, led by the gains in Reliance Industries Ltd. and Infosys Ltd.

The S&P BSE Sensex rose 0.24 percent to 39,179 as of 2:30 p.m. and the NSE Nifty 50 rose 0.15 percent to 11,616. The broader markets represented by the NSE Nifty 500 Index rose 0.1 percent.

The market breadth, however, was tilted in favour of sellers. About 997 stocks declined and 743 shares advanced on National Stock Exchange.

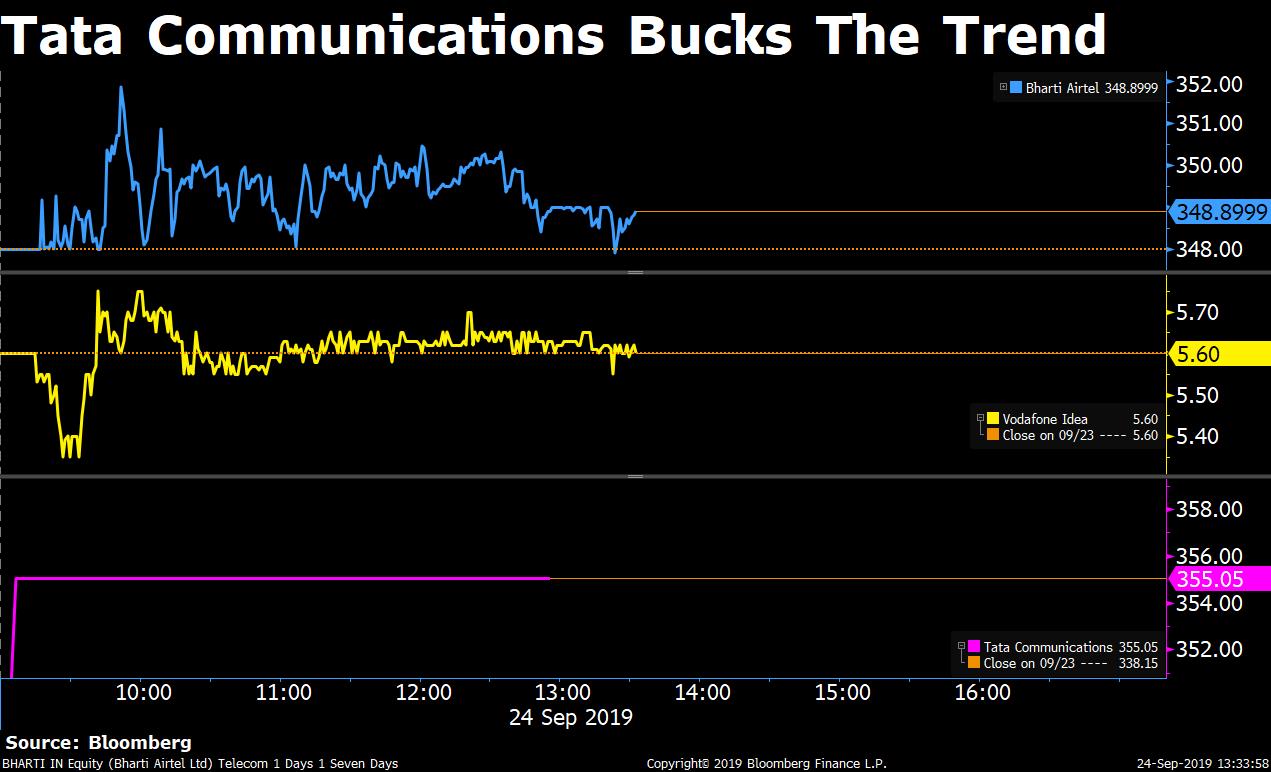

Shares of the telecom operators struggle to hold gains.

Bharti Airtel, which rose over 1.2 percent intraday fluctuated between gains and losses to trade little changed at Rs 347.90, while shares of Vodafone Idea, which rose as much as 2.68 percent traded flat at Rs 5.60.

Besides, shares of Tata Communications were locked in upper circuit of 5 percent for the sixth consecutive trading session at Rs 355.05. The stock is set for its best monthly gains in 14 years.

Shares of the telecom operators struggle to hold gains.

Bharti Airtel, which rose over 1.2 percent intraday fluctuated between gains and losses to trade little changed at Rs 347.90, while shares of Vodafone Idea, which rose as much as 2.68 percent traded flat at Rs 5.60.

Besides, shares of Tata Communications were locked in upper circuit of 5 percent for the sixth consecutive trading session at Rs 355.05. The stock is set for its best monthly gains in 14 years.

Indian equity benchmarks traded flat in the afternoon trade after a two-day rally fueled by corporate tax cuts.

The S&P BSE Sensex traded flat at 39,077.23 and the NSE Nifty 50 fell 0.13 percent to 11,585.15 as of 1:10 pm. The broader markets represented by the NSE Nifty 500 Index fell 0.21 percent.

The market breadth was in favour of sellers. Around 974 stocks declined while 737 stocks advanced on National Stock Exchange.

Motilal Oswal Financial Services has upgraded the earnings growth estimate for Nifty companies to 25 percent for the current financial year on account of government’s corporate tax cut boosts.

“The fiscal stimulus resets corporate earnings growth and also helps in the building of risk capital in balance sheets,” said Rajat Rajgarhia, managing director & CEO (Institutional Equities), MOFSL to BloombergQuint. “The bigger impact is how this profitability will flow back into the system— either in the form of lower prices, higher investments or dividends— to stimulate the economic activity,” he added.

Lemon Tree Hotels

Coromandel International

BASF India

Thomas Cook

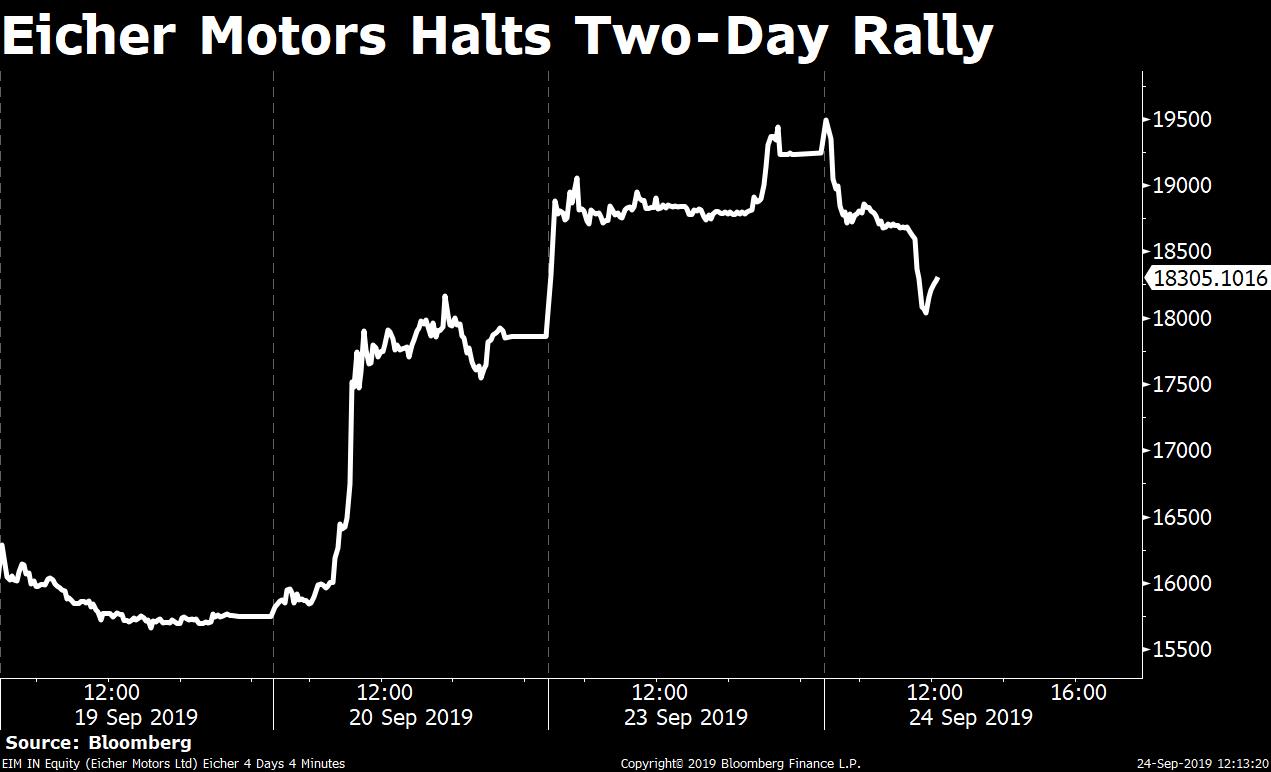

Shares of Eicher Motors fell as much as 6.7 percent, the most in over four months, to Rs 17,955. The stock was the worst performer on Nifty.

The scrip advanced nearly 24 percent in the past two trading sessions. Eicher Motors traded at 24 times its estimated earnings per share for the coming year, according to Bloomberg data.

Shares of Eicher Motors fell as much as 6.7 percent, the most in over four months, to Rs 17,955. The stock was the worst performer on Nifty.

The scrip advanced nearly 24 percent in the past two trading sessions. Eicher Motors traded at 24 times its estimated earnings per share for the coming year, according to Bloomberg data.

Source: SAT Proceedings

About 11 lakh shares of Dish TV changed hands in a large trade, Bloomberg data showed. Buyers and sellers were not known immediately.

Indian equity markets are expected to touch new highs before the bi-monthly monetary policy due in October.

That’s according to Avendus Capital Alternate Strategies’ Andrew Holland. “We're not near the highs yet, but we will quickly get there,” he told BloombergQuint in an interaction.

“The market is expecting more positive news on personal tax front and capital gains tax and will try to hit new highs within next couple of weeks,” Holland added.

Eight out of 11 sectoral gauges compiled by NSE traded lower, led by the NSE Nifty media Index’s 1.4 percent decline. On the flipside, the NSE Nifty IT Index was the top sectoral gainer, up 1.56 percent.

Indian equity benchmarks continued to fluctuate between gains and losses to trade little changed.

The S&P BSE Sensex fell 0.08 percent to 39,054 as of 11:10 a.m. and the NSE Nifty 50 fell 0.19 percent to 11,577. The broader markets represented by the NSE Nifty 500 Index fell 0.2 percent.

Nifty’s 11,500 put option contract was among the most active Nifty option contracts on National Stock Exchange.

Premium on the contract, which is set to expire on Thursday, jumped 1.02 percent to Rs 53.50. Over 9.73 lakh shares were added to the open interest which stood at over 35.85 lakh shares.

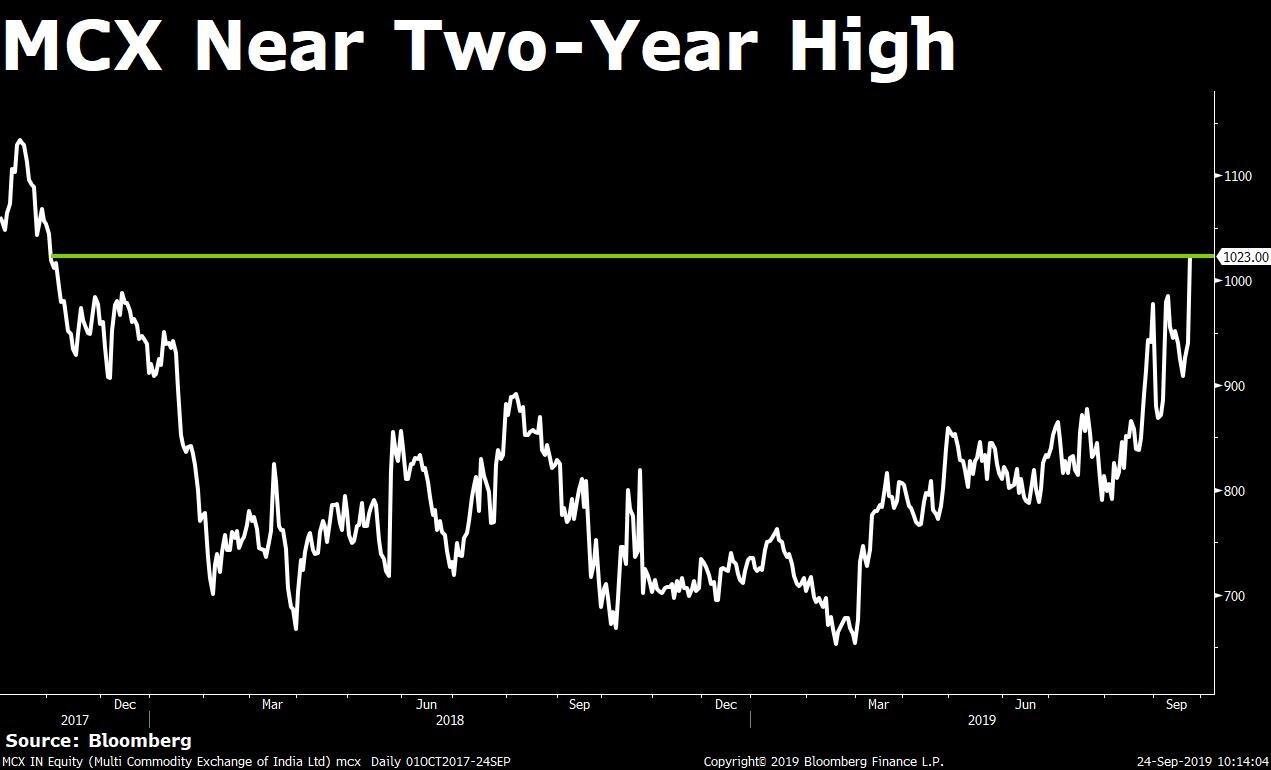

Shares of Multi Commodity Exchange of India Ltd. could reach Rs 1,260 in the next 12 months.

That’s according to international research firm Morgan Stanley. It is the highest price target on the company so far, among the analysts tracked by Bloomberg. The price target implies a potential upside of 36 percent from yesterday’s close.

The brokerage firm upgraded the stock to ‘Overweight’ from ‘Equal-weight’, it said in a research report. “We see a strong structural multiyear business uptrend at MCX. Also, strong cyclical tailwinds to trading volumes could hasten the structural upside and should also be an added incentive to build positions in the stock now,” it said.

Morgan Stanley forecasts its EPS to grow at a compounded annual growth rate of 20 percent over FY19-22 and 19 percent for FY19-24. “We expect the one-year forward price-to-earnings multiple to re-rate from 24 times to 28 times in the next one year and to the long-term mean of 33 times in the subsequent two years,” it added.

Besides, Morgan Stanley added MCX to its focus list, along with Indian Hotels Company Ltd. The stocks will be replacing Dabur Ltd. and Sun Pharmaceutical Industries Ltd., according to a separate note.

Shares of MCX rose as much as 9.4 percent, the most in over two weeks to Rs 1,028, its highest in nearly two years.

Shares of Multi Commodity Exchange of India Ltd. could reach Rs 1,260 in the next 12 months.

That’s according to international research firm Morgan Stanley. It is the highest price target on the company so far, among the analysts tracked by Bloomberg. The price target implies a potential upside of 36 percent from yesterday’s close.

The brokerage firm upgraded the stock to ‘Overweight’ from ‘Equal-weight’, it said in a research report. “We see a strong structural multiyear business uptrend at MCX. Also, strong cyclical tailwinds to trading volumes could hasten the structural upside and should also be an added incentive to build positions in the stock now,” it said.

Morgan Stanley forecasts its EPS to grow at a compounded annual growth rate of 20 percent over FY19-22 and 19 percent for FY19-24. “We expect the one-year forward price-to-earnings multiple to re-rate from 24 times to 28 times in the next one year and to the long-term mean of 33 times in the subsequent two years,” it added.

Besides, Morgan Stanley added MCX to its focus list, along with Indian Hotels Company Ltd. The stocks will be replacing Dabur Ltd. and Sun Pharmaceutical Industries Ltd., according to a separate note.

Shares of MCX rose as much as 9.4 percent, the most in over two weeks to Rs 1,028, its highest in nearly two years.

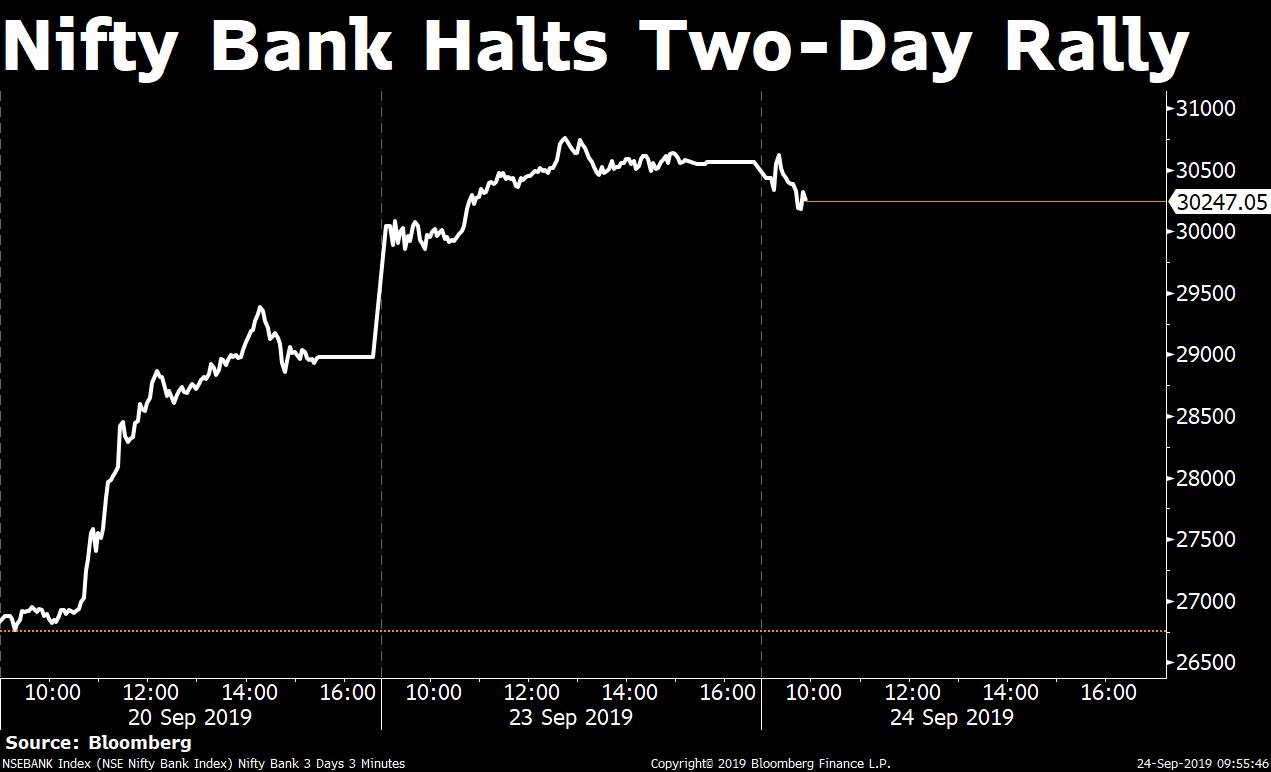

The NSE Nifty Bank Index halted a two-day rally and fell as much as 1.4 percent. The declines in the 12-share gauge was led by RBL Bank Ltd. and Yes Bank Ltd.

The NSE Nifty Bank Index halted a two-day rally and fell as much as 1.4 percent. The declines in the 12-share gauge was led by RBL Bank Ltd. and Yes Bank Ltd.

Shares of Aurobindo Pharma fell as much as 4.6 percent, the most since Aug. 1, to Rs 588.90.

Market regulator Securities and Exchange Board of India imposed Rs 22 crore fine on the pharmaceutical company, its promoter PV Ramprasad Reddy and other connected entities for violating insider trading norms.

The stock traded at 12 times its estimated earnings per share for the coming year, according to Bloomberg data.

Shares of Thomas Cook extended declines for the second consecutive trading session. The stock fell as much as 10.8 percent to Rs 136.20.

The company clarified that it has not received any intimation from the Ministry of Corporate Affairs and has no existing relationship with Aarush Forex on the news of suspicious transaction made by the company.

Trading volume was almost 40 times its 20-day average, Bloomberg data showed. The stock declined 39.7 percent so far this year and dropped 40.7 percent in the past 12 months.

Shares of Maruti Suzuki extended gains for the third consecutive trading session. The stock rose as much as 4 percent to trade above 7,000 for the first time since May 27.

The stock advanced 16 percent in the past five days and returned 14 percent in the past 30 days, Bloomberg data showed. The scrip traded at 30 times its estimated earnings per share for the coming year.

Shares of Maruti Suzuki extended gains for the third consecutive trading session. The stock rose as much as 4 percent to trade above 7,000 for the first time since May 27.

The stock advanced 16 percent in the past five days and returned 14 percent in the past 30 days, Bloomberg data showed. The scrip traded at 30 times its estimated earnings per share for the coming year.

Shares of Lemon Tree Hotels rose as much as 17.2 percent, the most since Jan. 29, 2019, to Rs 69.95.

About 5.52 crore shares or 7 percent equity of the company changed hands in a large trade, Bloomberg data showed. Buyers and sellers were not known immediately.

Of the shares traded, 1 percent were at the ask price and 97 percent were at the bid, according to Bloomberg data.

Indian equity benchmarks fluctuated between gains and losses in the opening trade.

The S&P BSE Sensex traded 0.17 percent higher at 39,166 as of 9:18 a.m. and the NSE Nifty 50 traded 0.12 percent higher at 11,616. The broader markets represented by the NSE Nifty 500 Index traded 0.15 percent higher.

The market breadth was tilted in favour of sellers. About 718 stocks declined and 683 shares declined on National Stock Exchange.

Seven out of 11 sectoral gauges compiled by NSE traded lower, led by the NSE Nifty Media Index’s 0.56 percent fall. On the flipside, the NSE Nifty IT Index was the top sectoral gainer, up 0.53 percent.

Indian equity benchmarks fluctuated between gains and losses in the opening trade.

The S&P BSE Sensex traded 0.17 percent higher at 39,166 as of 9:18 a.m. and the NSE Nifty 50 traded 0.12 percent higher at 11,616. The broader markets represented by the NSE Nifty 500 Index traded 0.15 percent higher.

The market breadth was tilted in favour of sellers. About 718 stocks declined and 683 shares declined on National Stock Exchange.

Seven out of 11 sectoral gauges compiled by NSE traded lower, led by the NSE Nifty Media Index’s 0.56 percent fall. On the flipside, the NSE Nifty IT Index was the top sectoral gainer, up 0.53 percent.

The Indian rupee opened higher against the U.S. dollar. The home currency appreciated as much as 0.29 percent to 70.72 against the greenback.

Most Asian markets are trading in the green while the local tax break should help keep the risk appetite strong. The pair may stay in the range of 70.40-71.20 a dollar.

The Indian rupee opened higher against the U.S. dollar. The home currency appreciated as much as 0.29 percent to 70.72 against the greenback.

Most Asian markets are trading in the green while the local tax break should help keep the risk appetite strong. The pair may stay in the range of 70.40-71.20 a dollar.

Indian equity benchmarks are set for a tepid start.

The S&P BSE Sensex rose 0.27 percent or 104 points to 39,194 during the pre-market trade and the NSE Nifty 50 rose 0.36 percent to 11,641.

Get your daily fix of global markets here.

Good Morning!

The Singapore-traded SGX Nifty, an early indicator of NSE Nifty 50 Index’s performance in India, rose 0.6 percent to 11,672 as of 8:30 a.m.

Stocks in Asia were mixed on Tuesday as investors weighed hopes for upcoming high-level U.S.-China trade talks against mixed global economic data.

Japan outperformed as it returned from a holiday on Monday. Shares in Hong Kong, China, Korea and Australia were little changed. S&P 500 futures climbed.

Short on time? Well, then listen to this podcast for a quick summary of All You Need To Know before the opening bell.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.