State Bank of India share price resumed gains on Monday after a blip on Friday as analysts remained optimistic over steady performance during the three months ended June and stable asset quality.

The country's largest lender's first-quarter profit beat estimates. The bank's core performance was broadly in line with expectations, with net interest income growing less than 1% quarter on quarter. A sharp 55% year-on-year jump in other income aided operating profit, which beat street estimates by 11%.

Provisioning was in line with analysts' forecasts, while profitability received a boost from other income. This quarter was marked by steady core performance, a sharp boost from treasury gains, and a largely stable asset quality.

While most brokerages remain bullish, Macquarie stands out with an 'Underperform' call. The street expects near-term NIM pressures. Strong loan growth, healthy deposit momentum, and improving credit demand will likely support performance in the second half of FY26.

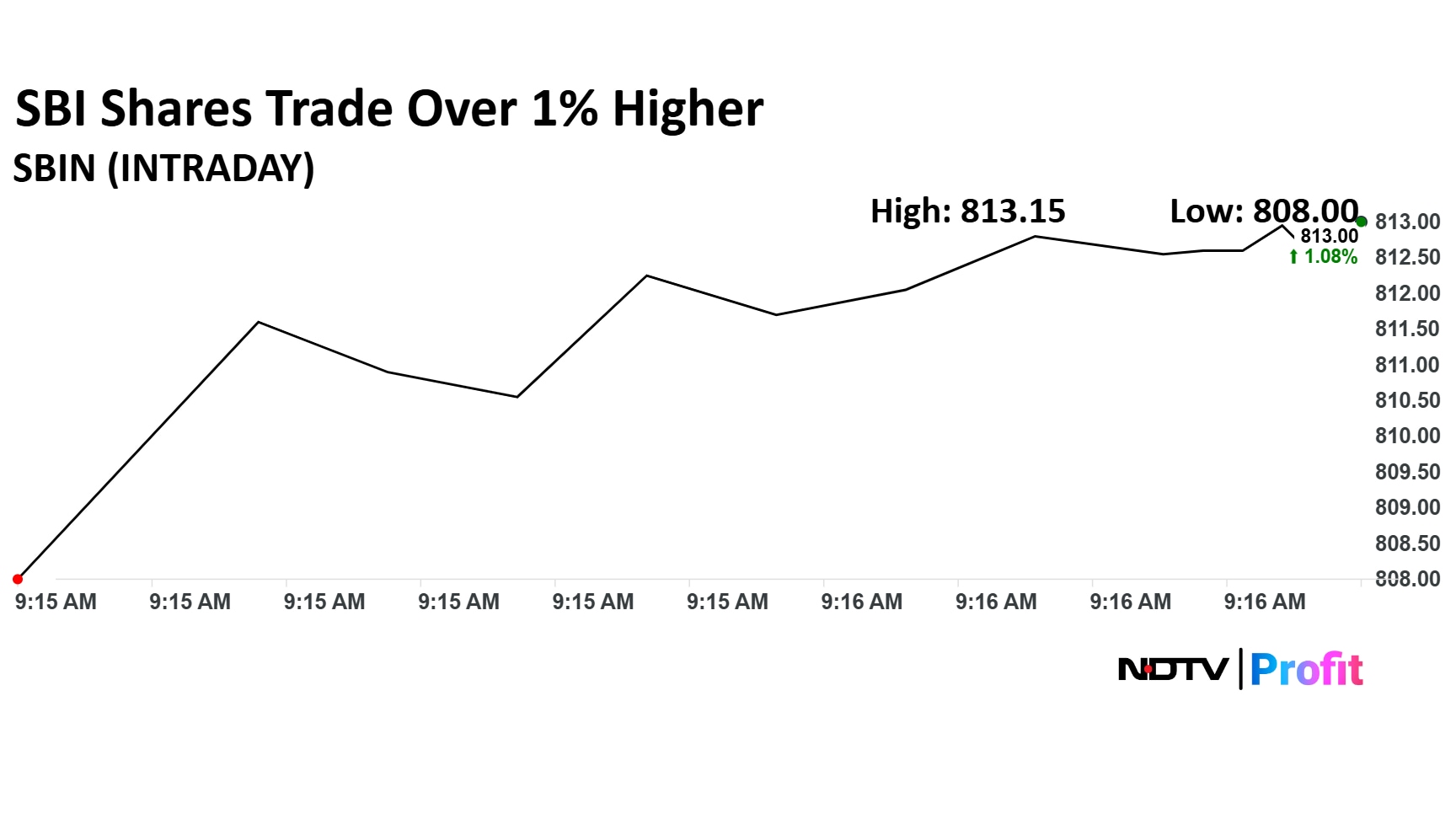

SBI Share Price

SBI stock rose as much as 1.22% during trade so far to Rs 813 apiece on the NSE. It was trading 1% higher at Rs 812.3 apiece, compared to a 0.12% advance in the benchmark Nifty 50 as of 9:18 a.m.

It had declined 1% in the last 12 months and 2.67% on a year-to-date basis. The relative strength index was at 37.

Forty-one out of the 50 analysts tracking the company have a 'buy' rating on the stock, eight recommend a 'hold', and one suggests a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 941.6, implying an upside of 17%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.