Samvardhana Motherson International Ltd.'s share price continued its upward trajectory, rising by 4.32% on Friday after a 3.35% rally on Thursday, following the announcement of its fourth quarter results and the approval of bonus shares.

The company reported a 6% increase in revenue, reaching Rs 29,317 crore, compared to Rs 27,666 crore in the same quarter last year.

Ebitda saw a slight decline of 1.6% year-on-year to Rs 2,643 crore in the January-March period, compared to Rs 2,686 crore. The Ebitda margin contracted to 9% from 9.7%.

However, net profit surged by 19.6%, reaching Rs 1,051 crore compared to Rs 879 crore in the previous year.

In addition to the strong financial performance, the board of Samvardhana Motherson International approved the issuance of bonus shares in the ratio of 1:2.

This means that shareholders will receive one additional share for every two shares they hold, which is expected to enhance shareholder value and attract more investors.

The board also approved the issuance of non-convertible debentures worth Rs 8,500 crore on a private placement basis.

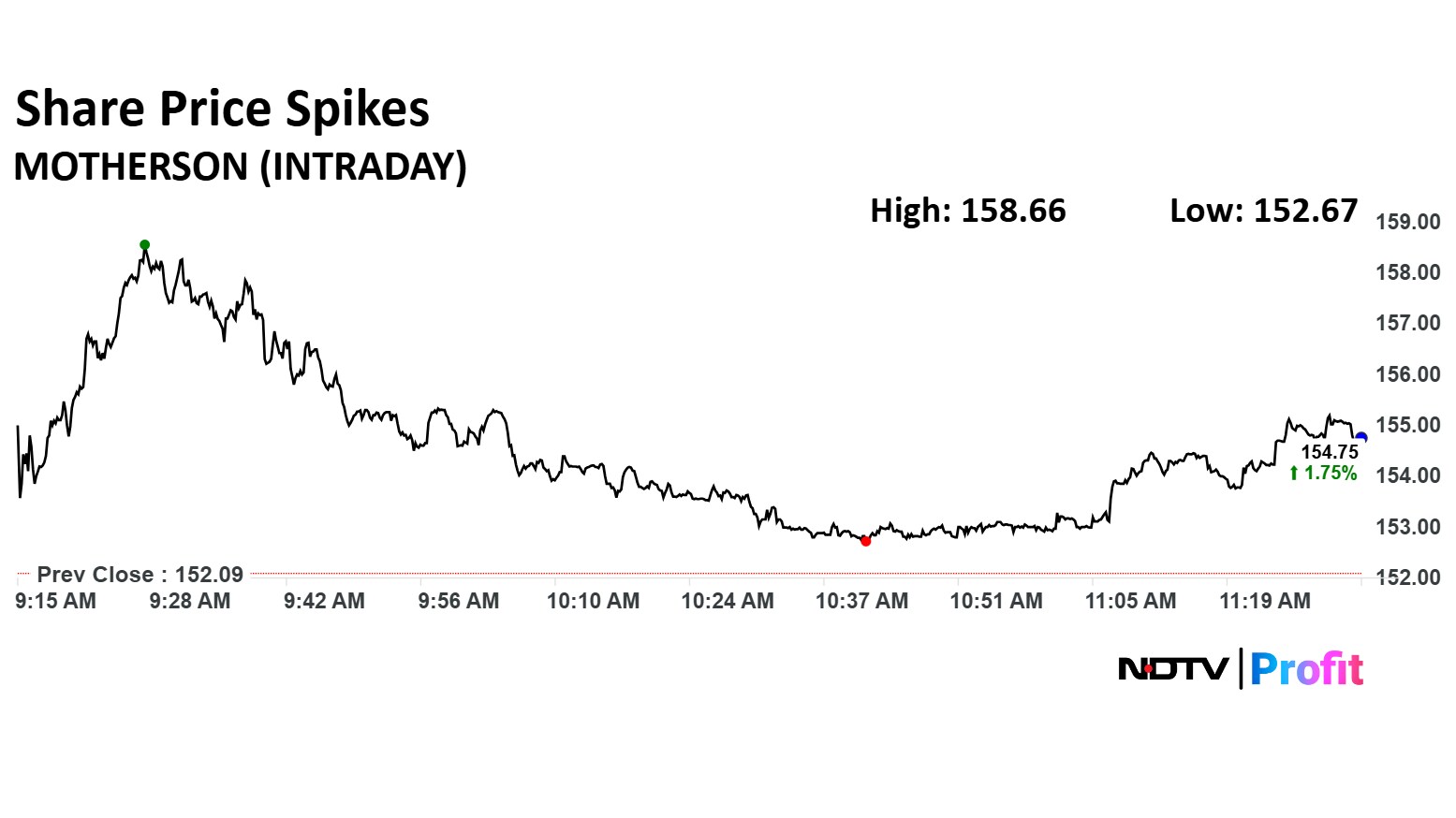

Samvardhana Motherson Share Price

The scrip rose as much as 4.32% to Rs 158.66 apiece. It pared gains to trade 1.97% higher at Rs 155.08 apiece, as of 11:31 a.m. This compares to a 0.20% decline in the NSE Nifty 50.

It has risen 2.23% in the last 12 months. Total traded volume so far in the day stood at 5.5 times its 30-day average. The relative strength index was at 69.

Out of 26 analysts tracking the company, 21 maintain a 'buy' rating, two recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.