Marico Ltd.‘s share price rose over 5% on Monday after the company posted an 8% rise in fourth-quarter profit, broadly in line with analysts' expectations.

The FMCG firm's net profit stood at Rs 343 crore in the three months ended March, up from Rs 318 crore a year earlier, according to its stock exchange filing post market hours on Friday. That compared with the Rs 336.7 crore consensus estimate of analysts tracked by Bloomberg.

Marico recommended a final dividend of Rs 7 per share for the financial year 2024–25. The record date has been set as Aug. 1, and the dividend will be paid on or before Sept. 7, subject to shareholder approval at the company's annual general meeting.

Following the results, brokerages including Jefferies, Goldman Sachs and Macquarie raised their target prices on the stock, highlighting the resilience of Marico's core business and continued traction in new growth segments.

Brokerage Commentary

Jefferies noted that India volume growth was encouraging despite a muted macroeconomic backdrop, while international business performance also held up well. However, the brokerage flagged some pressure on margins owing to compressed gross margins and elevated advertising and promotional spends. Still, it maintained a constructive outlook, citing confidence in both core and new portfolios.

Goldman Sachs said Marico delivered a strong quarter, led by growth in newer businesses even as core volume growth remained soft. It emphasised that strong execution in new categories more than offset the weakness in legacy brands and sees high visibility of double-digit revenue growth in fiscal 2026. Margins are likely to see a gradual recovery later in the year, it said.

Macquarie said the fourth quarter is in-line and conditions were supportive for flagship brand Parachute, helped by stable copra costs and recent price hikes. While smaller brands were impacted by supply chain challenges, the brokerage noted a continued recovery in value-added hair oils and increased confidence in the foods and digital-first segments. It raised its earnings per share forecast and target price on the back of stable Ebitda performance and optimistic management commentary.

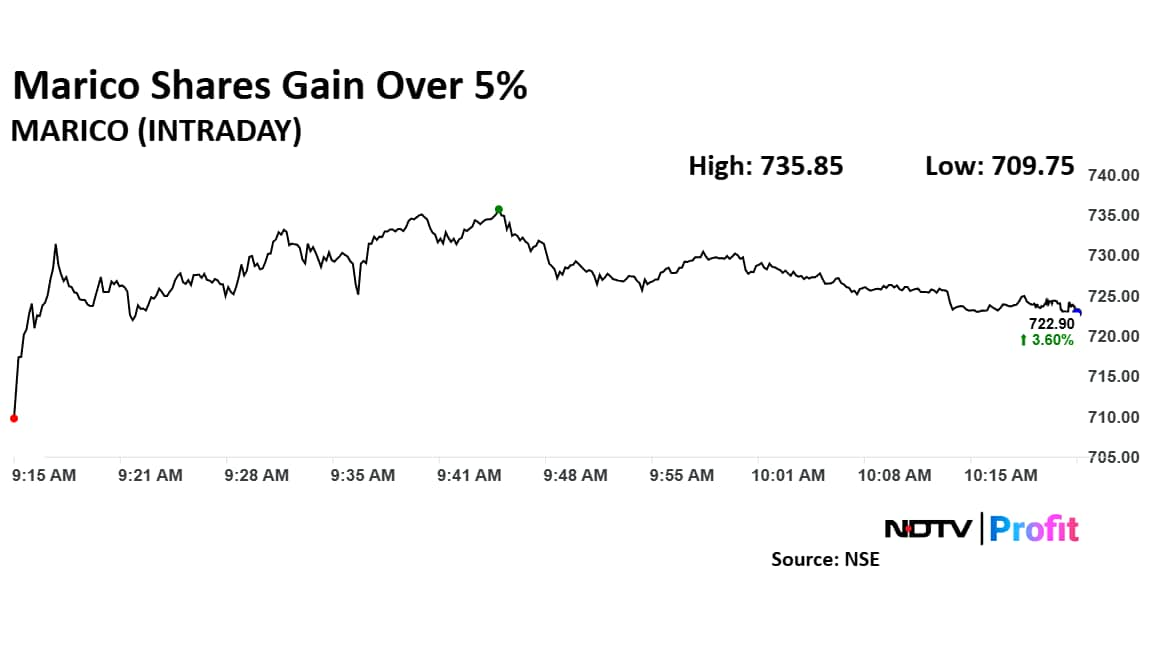

Marico Share Price Today

Marico stock rose as much as 5.46% during the day to Rs 735.85 apiece on the NSE. It was trading 3.75% higher at Rs 723.9 apiece, compared to a 0.58% advance in the benchmark Nifty 50 as of 10:18 a.m.

It has risen 40.07% in the last 12 months and 13.20% on a year-to-date basis. The total traded volume so far in the day stood at 7.2 times its 30-day average. The relative strength index was at 58.33.

Thirty one out of the 42 analysts tracking Marico have a 'buy' rating on the stock, eight recommend a 'hold' and three suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 754.72, implying an upside of 3.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.