.jpg?downsize=773:435)

Kirloskar Industries Ltd.'s shares fell over 4%, following the release of its third-quarter earnings for the financial year 2025. The company's net profit saw a significant decline.

The company reported a net profit of Rs 24 crore for the quarter ended Dec. 31, 2024, a sharp decline of 52.4%, compared to Rs 50.5 crore in the same period last year. Despite this, the company's revenue increased by 3.9%, reaching Rs 1,614 crore from Rs 1,554 crore year-on-year. However, the Ebitda also fell by 24.5% to Rs 172 crore, down from Rs 228 crore. The Ebitda margin contracted to 10.7% from 14.8% in the previous year.

Kirloskar Industries Ltd. is an Indian conglomerate with diversified interests across various sectors, including manufacturing, engineering, and real estate. The company was established over a century ago.

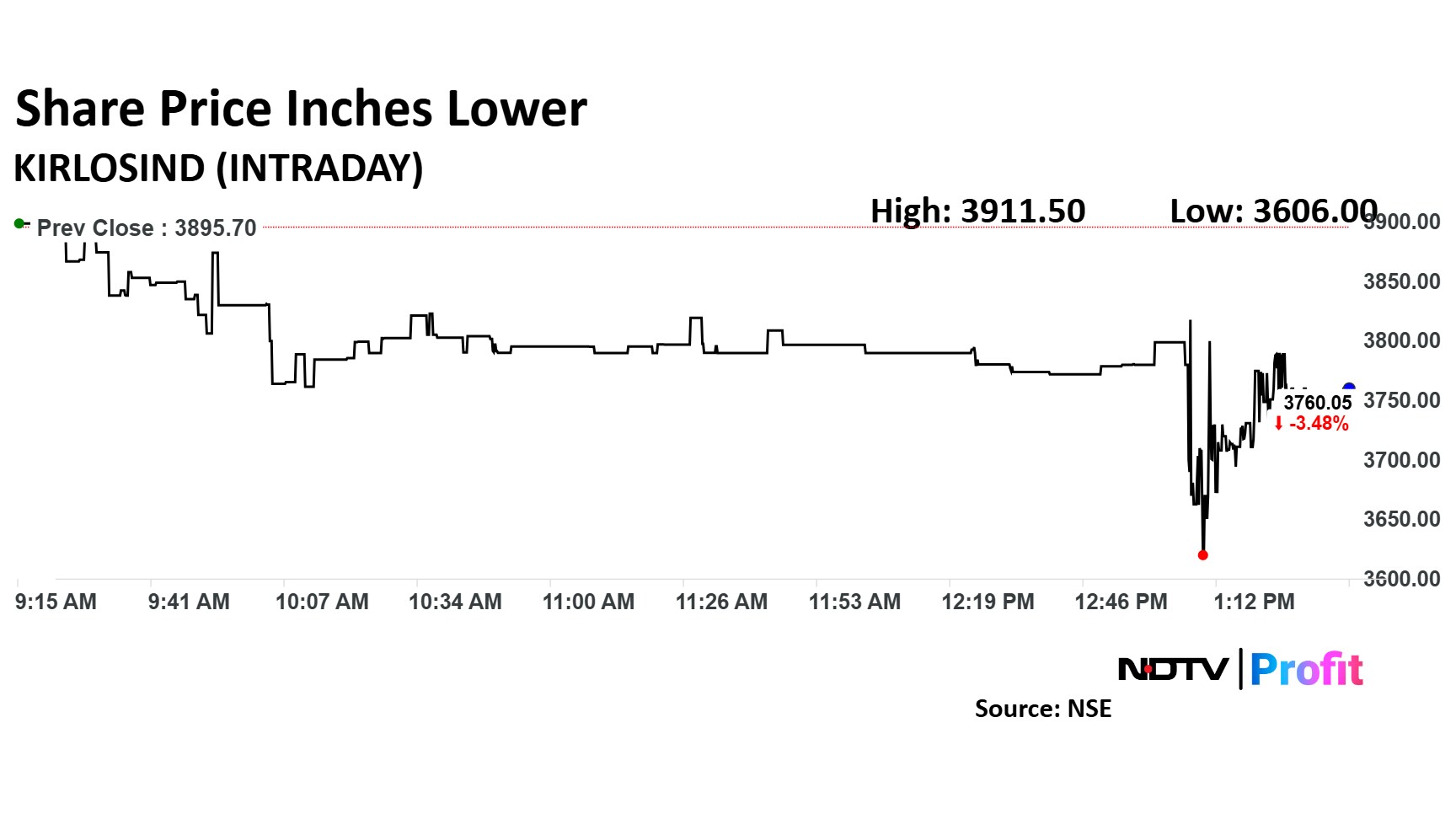

Kirloskar Industries Share Price

Shares of Kirloskar Industries fell as much as 4.37% to Rs 500 apiece. They pared losses to trade 0.98% lower at Rs 515.35 apiece, as of 1:34 p.m. This compares to a 0.99% advance in the NSE Nifty 50.

The stock has declined 12.55% in the last 12 months. Total traded volume so far in the day stood at 2.0 times its 30-day average. The relative strength index was at 28.

All three analysts tracking the company maintain a 'buy' rating on the stock, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 30.05%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.