The shares of KFin Technologies Ltd. fell nearly 7% on Tuesday due to multiple large trades.

On Tuesday morning, shares worth Rs 1,885.10 crore changed hands in multiple large trade orders. On the NSE, in eight trades, shares worth Rs 1,860.37 crore changed hands, while on the BSE, shares worth Rs 24.73 crore changed hands.

While the buyers and the sellers of the deals were not known, NDTV Profit on Monday reported that KFin Technologies Ltd.'s promoter is likely to sell approximately a 6.9% stake through a block deal.

Foreign promoter General Atlantic Singapore Fund Pte. Ltd. is to sell up to 1.18 crore shares, or a 6.9% stake worth Rs 1,210 crore, according to sources. The floor price is to be around Rs 1,025 per share, an 8.3% discount to CMP, as per sources.

The lock-in period is to be around 90 days lock-in by sellers. IIFL is the sole banker for this deal, they said.

General Atlantic Singapore Fund Pte. and its arm General Atlantic Singapore KFT Pte. Ltd. currently hold approximately 32.91% stake in the company. With General Atlantic Singapore Fund Pte. Ltd., holding a 31.98% stake.

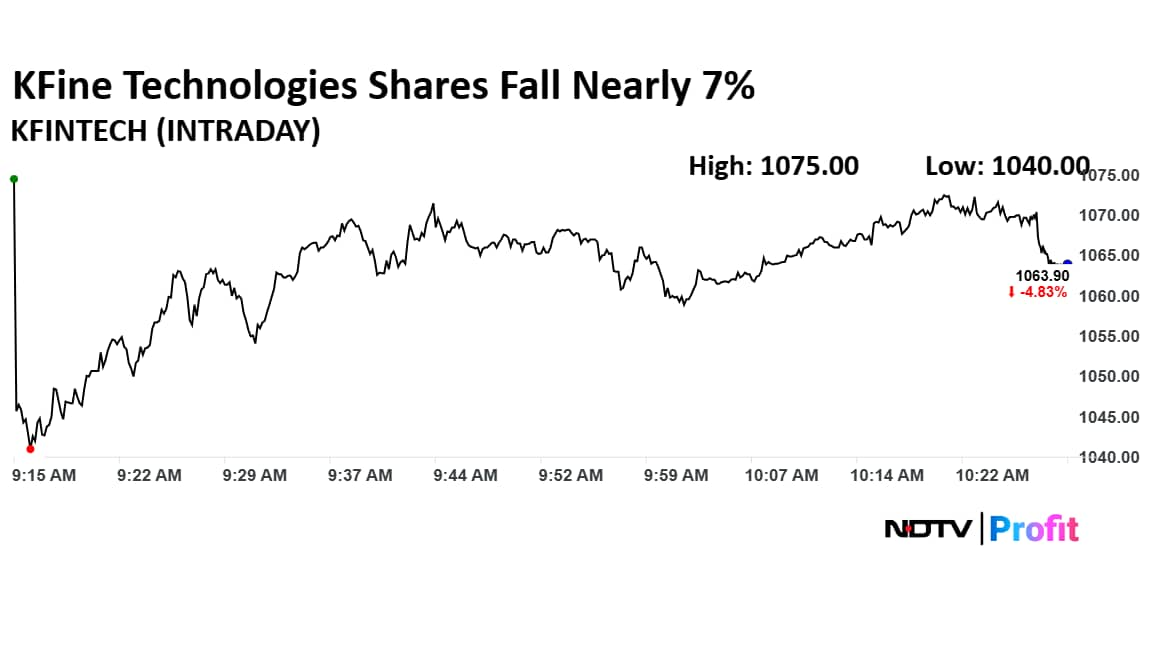

KFin Technologies Share Price Falls

The shares of KFin Technologies fell as much as 6.79% to Rs 1,040 apiece, the lowest level since May 9. It pared losses to trade 4.73% lower at Rs 1,065 apiece, as of 10:27 a.m. This compares to a 0.83% decline in the NSE Nifty 50 Index.

It has risen 42.49% in the last 12 months and fallen 30.43% year-to-date. Total traded volume so far in the day stood at 32 times its 30-day average. The relative strength index was at 42.90.

Out of 16 analysts tracking the company, 10 maintain a 'buy' rating, two recommend a 'hold,' and four suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 19.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.