.jpg?downsize=773:435)

The shares of KEC International Ltd. rose over 6% on Monday after the company received new orders worth Rs 1,267 crore across its businesses.

The civil construction company's transmission and distribution business secured 800 kV HVDC and 765 kV transmission line orders from Power Grid Corp., according to an exchange filing on Saturday. The transmission and distribution segment also received an order for supply of towers, hardware and poles in America.

KEC International's cable business won an order for supply of various types of cables and conductors in India and overseas.

"These wins have further strengthened our T&D order book in India," said Vimal Kejriwal, managing director and chief executive officer at KEC International. He also added that the company's year-to-date order intake stands at over Rs 23,300 crore, a growth of 35% from last year.

KEC Q3 Performance

KEC International reported a 34% year-on-year rise in net profit at Rs 130 crore for the quarter ended December, compared to Rs 97 crore in the same quarter of the previous fiscal. Revenue increased 6.8% year-on-year for the three months ended December, reaching Rs 5,349 crore.

Operating income, or earnings before interest, taxes, depreciation, and amortisation, rose 22% year-on-year to Rs 374.5 crore. The Ebitda margin expanded to 7% from 6.1% in the same period the previous year.

KEC International Share Price

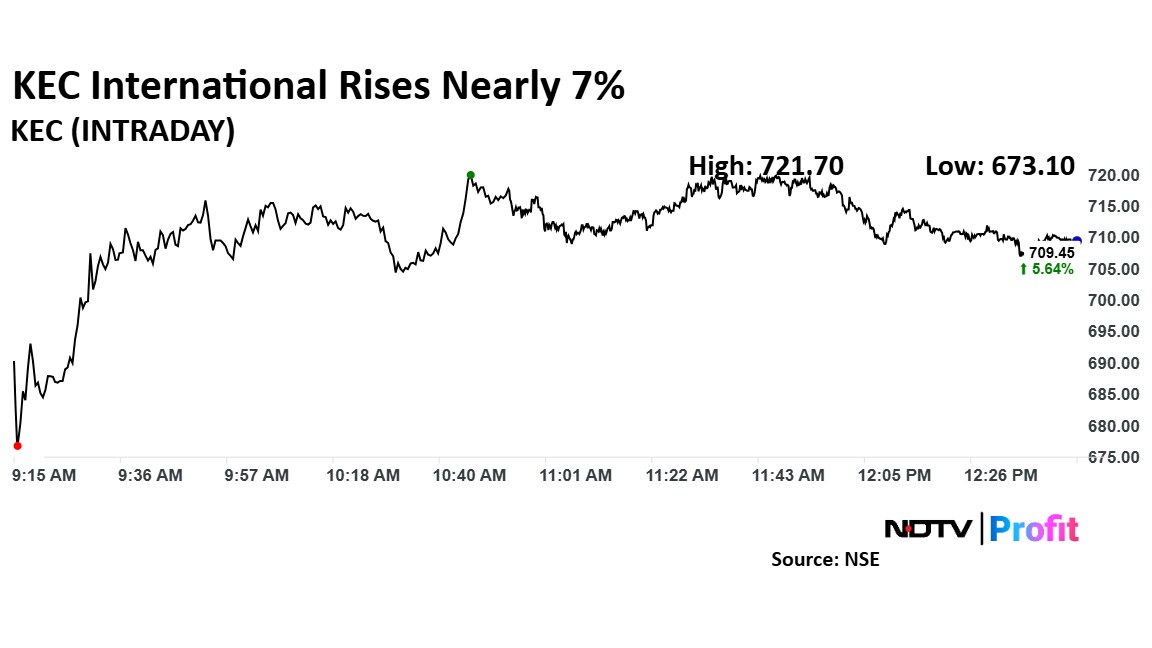

The shares of KEC International rose as much as 6.83% to Rs 717.50 apiece, the highest level since March 12. It pared gains to trade 5.12% higher at Rs 706 apiece, as of 12:43 p.m. This compares to a 0.29% advance in the NSE Nifty 50 Index.

It has risen 5.02% in the last 12 months and fallen 40.89% year-to-date. Total traded volume so far in the day stood at 13 times its 30-day average. The relative strength index was at 43. above 70 overbought or below 30 is over sold

Out of 25 analysts tracking the company, 19 maintain a 'buy' rating, four recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 31.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.