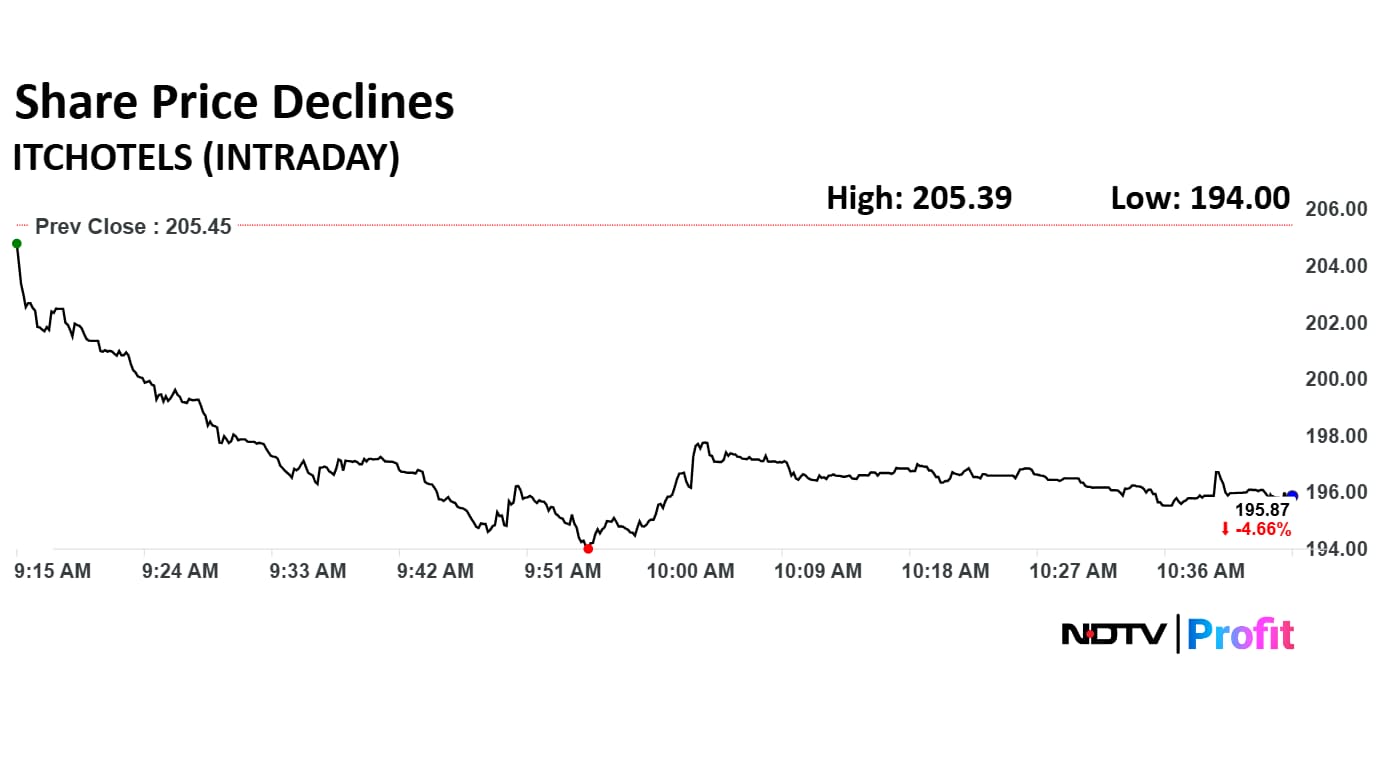

ITC Hotels Ltd.'s share price declined 5.57% on Tuesday to trade lower at Rs 194 apiece.

This comes despite the company securing a fresh 'Buy' from ICICI Securities and bullish nod from Macquarie on the hotel space.

Macquarie remains optimistic about India's hotel sector, highlighting that a 12% valuation correction since August has created an attractive entry point for investors. Recent checks indicate that hotels have returned to double-digit revenue growth in Q3FY26, signaling a strong recovery in demand.

The brokerage expects this growth to be sustainable, supported by robust GDP expansion, GST reforms, seasonal strength, a low base effect, and an influx of renovated and new rooms. Within the sector, Macquarie's preferred picks are Lemon Tree Hotels, ITC Hotels, and Chalet Hotels.

ITC Hotels Ltd. reported a robust 74.3% year-on-year rise in its net profit for the second quarter of fiscal 2026. The company's bottom-line for the September quarter stood at Rs 133 crore, compared to Rs 76.2 crore in the year-ago period.

Revenue rose 7.9% to Rs 839 crore from Rs 778 crore in the same quarter last year. Earnings before interest, taxes, depreciation and amortisation grew 15.8% to Rs 246 crore from Rs 212 crore. The Ebitda margin stood at 29.3% as against 27.3% in the year-ago period.

The scrip fell as much as 5.57% to Rs 194 apiece. It pared losses to trade 4.64% lower at Rs 196 apiece, as of 10:43 a.m. This compares to a 0.55% decline in the NSE Nifty 50 Index.

It has risen over 8% year to date. Total traded volume so far in the day stood at 1.71 times its 30-day average. The relative strength index was at 37.47.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.