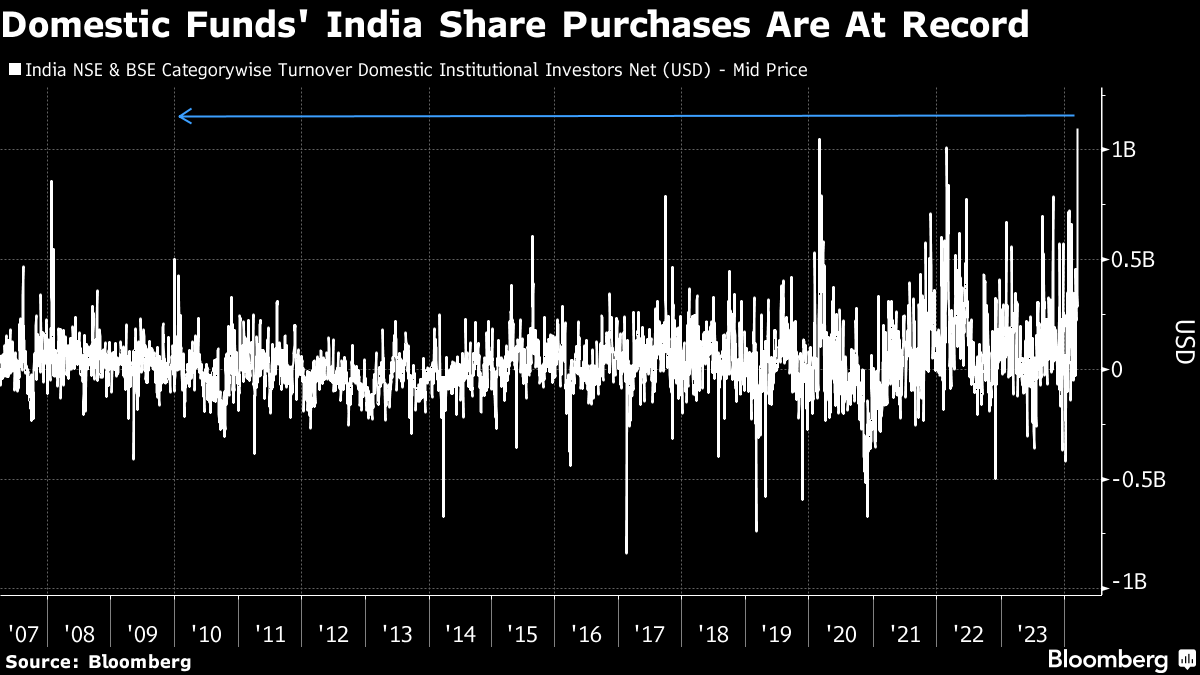

(Bloomberg) -- India's financial institutions made record single-day purchases of local shares Wednesday, taking advantage of the sharp selloff in the nation's small- and medium-sized companies.

Investors including mutual funds, banks and insurers bought a net $1.1 billion of shares, according to data compiled by Bloomberg. Foreigners sold a net of $555 million of stocks, provisional data show.

Shares rebounded Thursday, with a gauge of smaller companies jumping as much as 2.9% in the best performance since December 2022. The index is still hovering in correction territory, after retreating about 10% from its February peak.

The selloff has erased more than $80 billion off the small-cap gauge's value in two weeks through Wednesday amid concerns raised by the securities regulator about stretched valuations in the segment.

The measure had rallied about 75% from March 2023 through February, boosted by India's strong economic growth and corporate earnings.

--With assistance from Chiranjivi Chakraborty.

(Updates throughout.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.