Hero MotoCorp Ltd.'s share price rose over 2% after the company reported robust third-quarter earnings, prompting various brokerages to weigh in on the company's performance and future prospects. The company's financial results have led to mixed reactions from analysts.

Jefferies has maintained a “Buy” rating on Hero MotoCorp with a target price (TP) of Rs 5,075. The brokerage highlighted an Ebitda beat in the third quarter, with Ebitda and PAT growing 8-12% year-on-year, exceeding estimates by 7-12% due to higher-than-expected average selling prices and gross margins. Ebitda per vehicle rose slightly by 1% quarter-on-quarter to a new high.

Citi has also maintained a “Buy” rating but has cut the target price to Rs 5,400 from Rs 6,300. The brokerage noted that Hero's third-quarter results were ahead of estimates, driven by steady margins and a positive outlook for rural demand. Citi believes recent tax rate changes could further aid industry demand. However, it cautioned that the competitive landscape remains challenging, and Hero's market share could continue to be under pressure.

Hero MotoCorp reported a standalone net profit of Rs 1,203 crore for the three months ended December 31, 2024, marking a 12.1% year-on-year increase. Revenue rose by 5% to Rs 10,211 crore, slightly below analysts' estimate of Rs 10,235 crore. Ebitda increased by 8.4% to Rs 1,476 crore, surpassing the estimated Rs 1,162 crore. The Ebitda margin improved by 50 basis points to 14.5%, compared to the estimated 14.2%. Additionally, the company declared a dividend of Rs 100 per share.

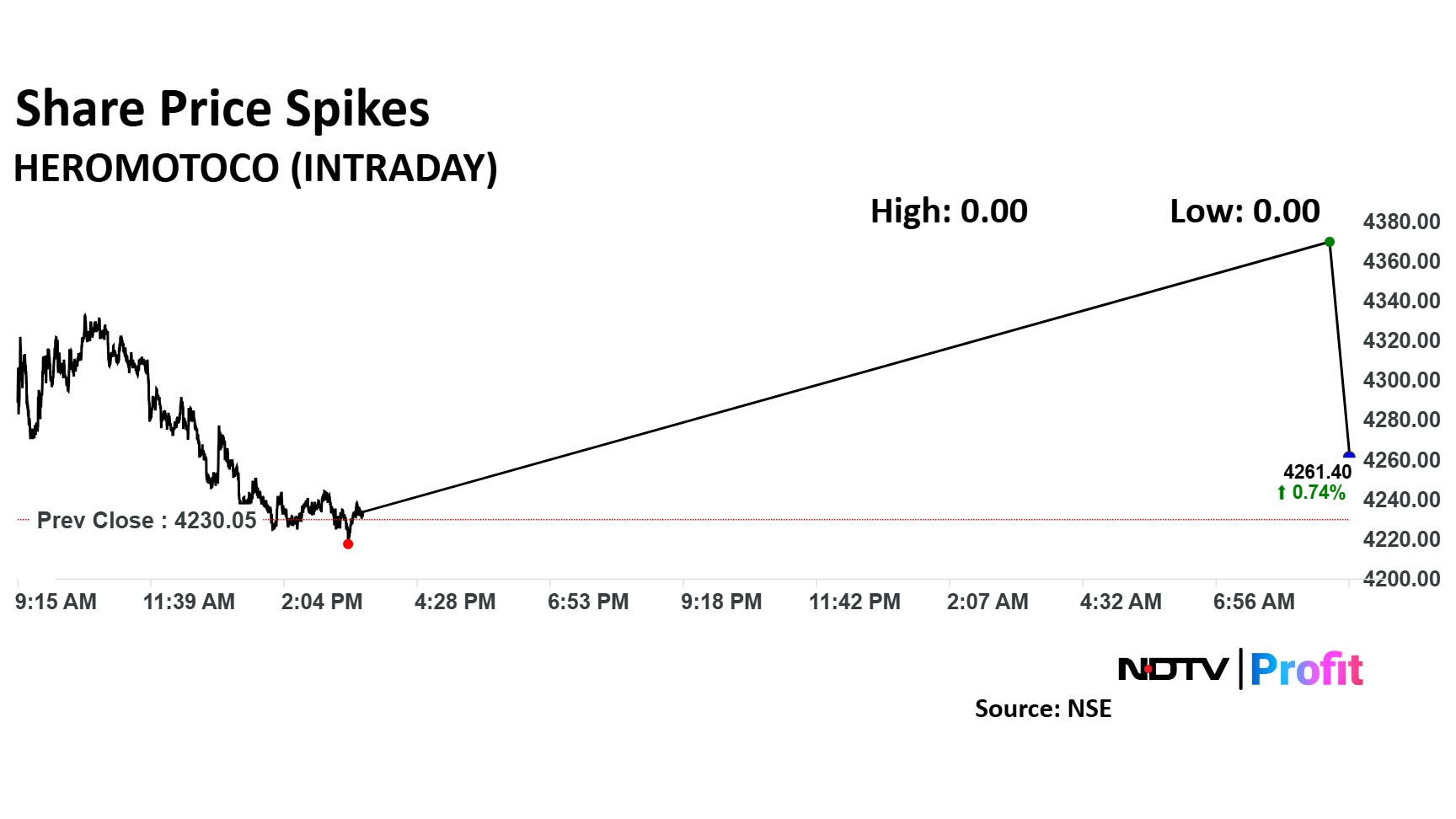

The scrip rose as much as 2.13% to Rs 4,319.95 apiece. It pared gains to trade 0.82% higher at Rs 4,264.90 apiece, as of 09:17 a.m. This compares to a flat NSE Nifty 50 index.

It has fallen 11% in the last 12 months. The relative strength index was at 55.

Out of 42 analysts tracking the company, 27 maintain a 'buy' rating, nine recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 20.1%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.