(Bloomberg) -- India's stocks, bonds and currency are among the most attractive plays across emerging markets, thanks to a vibrant economy and policies that shield the country from global markets, according to Goldman Sachs Group Inc.

Strong earnings growth is supporting the share market, while the country's inclusion in international indexes, stronger government finances, and slowing inflation favor fixed income, analysts led by Kamakshya Trivedi, Danny Suwanapruti and Sunil Koul wrote in a note. Ample foreign exchange reserves mean the rupee is a top choice for carry, they said.

“We still think that relatively low volatility and sensitivity to external markets, and a relatively high yield makes local fixed income in India an attractive long from a total return standpoint,” the analysts said. “Come for the resilience, stay for the upside.”

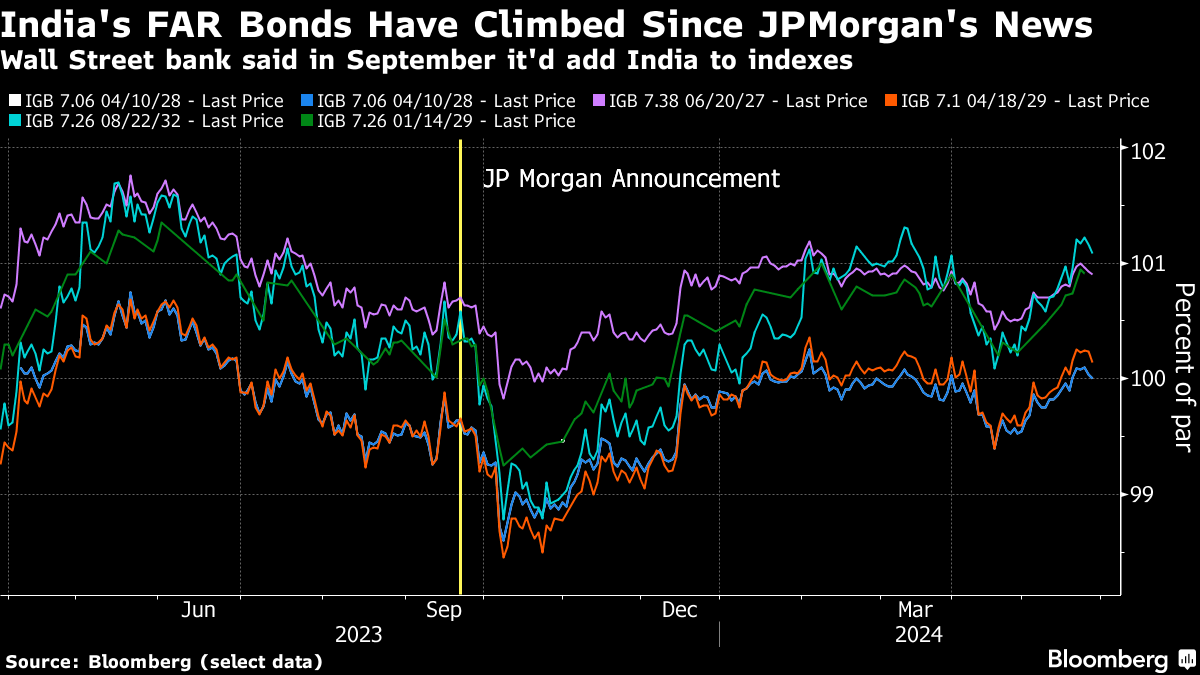

Two landmark events are shaping India at the moment. Prime Minister Narendra Modi is seeking a third term in office in elections ending in the coming days. The nation's sovereign bonds are also due to join JPMorgan Chase & Co.'s flagship emerging market bond gauge in late June, which is expected to attract as much as $40 billion of overseas capital to the country that has long sought to shield itself from hot money flows.

While the voting will matter for financial markets in the short-term, “ultimately Indian asset returns are more likely to be driven by the strength of domestic macro fundamentals,” Goldman analysts said.

(Updates to add analyst names in second paragraph)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.