Shares of Easy Trip Planners Ltd., the parent company of online travel aggregator EaseMyTrip, fell by as much as 10% on Tuesday after 28.2 lakh shares (2.4% of equity) changed hands in 28 block trades on the NSE, according to a Bloomberg report.

The buyers and sellers are not immediately known. The fall has caused the shares to drop to their lowest level since Nov. 22.

Earlier, media reports indicated that the company's co-founder Nishant Pitti, who is also one of the three promoters, announced plans to sell his remaining 14% stake in the company for Rs 780 crore via block deals. In September, Pitti had already divested a 14% stake for Rs 920 crore through open market transactions.

EaseMyTrip is the app operated by Easy Trip Planners, which was founded in 2008 by Nishant Pitti, Rikant Pitti, and Prashant Pitti. In October, the company's board approved the issuance of bonus shares in a 1:1 ratio. In November, it also launched EMT Desk, an all-in-one platform aimed at transforming corporate travel.

Easy Trip Planners Share Price Today

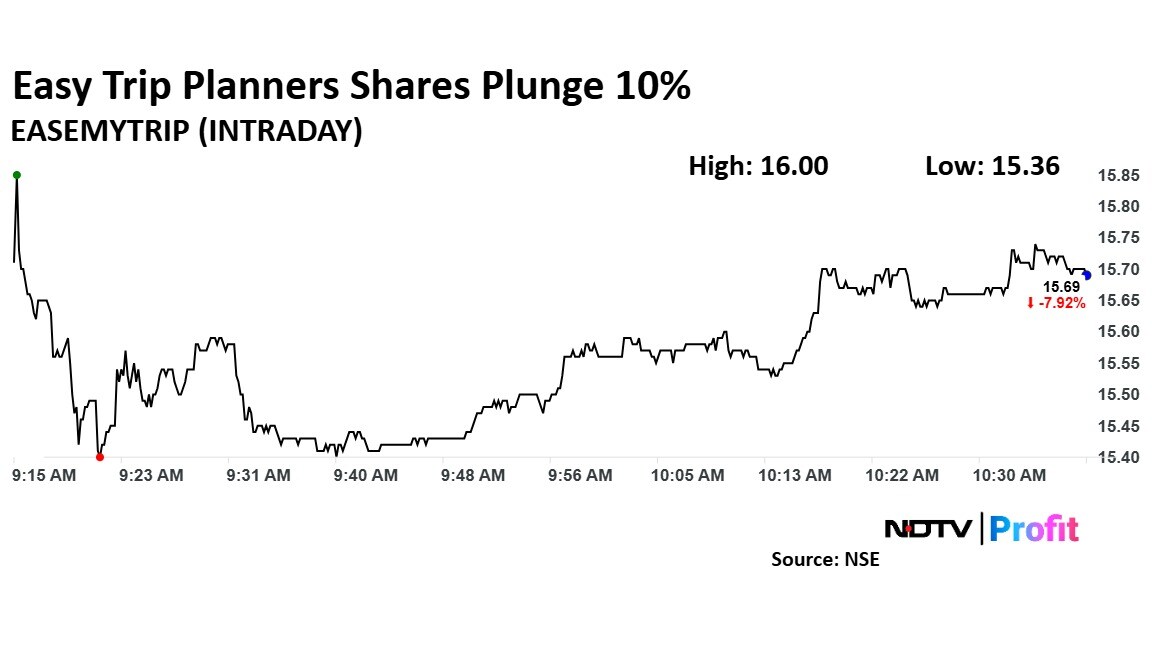

The travel company's stock fell as much as 9.86% during the day to Rs 15.36 apiece on the NSE. It was trading 7.92% lower at Rs 15.69 apiece, compared to a 0.47% decline in the benchmark Nifty 50 as of 10:38 a.m.

It has fallen 22.70% in the last 12 months and 22.08% on a year-to-date basis. The total traded volume so far in the day stood at 12 times its 30-day average. The relative strength index was at 42.26.

The one analyst tracking the stock has a 'sell' rating on it, according to Bloomberg data. The 12-month analyst target price on the stock is Rs 21, implying a downside of 22.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.