Shares of CreditAccess Grameen Ltd. fell over 18% on Monday to hit a 34-month-low after it cut its guidance for the full financial year the second time. In addition, Nomura has cut the target price to Rs 800.

However, volumes rose to 12 times the 30-day average in the first half an hour of trade.

CreditAccess Grameen Cuts Guidance

This year, the microfinance institution expects loan growth of 7% to 8%, which is lower than the earlier 8% to 12% guidance given by the company in October 2024, according to the company's investor presentation. In May 2024, the company had given a guidance of 23% to 24%.

This financial year, the company expects credit costs in the range of 6.7% to 6.9%. The guidance is above the 4.5% to 5% given by the company in October 2024. In comparison, the company had given a guidance of 2.2% and 2.4% in the beginning of this fiscal.

Return on assets is expected to be in the range of 2.3% to 2.4% from the earlier 3% to 3.5%. The guidance at the start of the fiscal was given at 5.4% to 5.5%. The return on equity has fallen to 9.5% to 10% from the earlier given guidance of 12% to 14%.

CreditAccess Grameen Q3 Performance

For the quarter ending December 2024, CreditAccess Grameen reported a loss of Rs 99.5 crore against a profit of Rs 353 crore reported in the same quarter last year. On the other hand, total income rose 6.7% to Rs 1,382 crore from Rs 1,295 crore reported in the same quarter in the previous fiscal.

Net interest income for the December quarter rose 7.4% year-on-year to Rs 861.7 crore, the company said in a press release. The pre-provision operating profit also grew 3.5% to Rs 622.9 crore.

Nomura Cuts Target Price For CreditAccess Grameen

Nomura has lowered its target price for CreditAccess Grameen to Rs 800 from Rs 850 earlier. The company reported its first-ever quarterly loss due to higher credit costs, driven by challenging conditions in the microfinance sector, the brokerage pointed. Delinquency trends are proving difficult to reverse, with key stress points in Karnataka and Tamil Nadu, leading to accelerated write-offs.

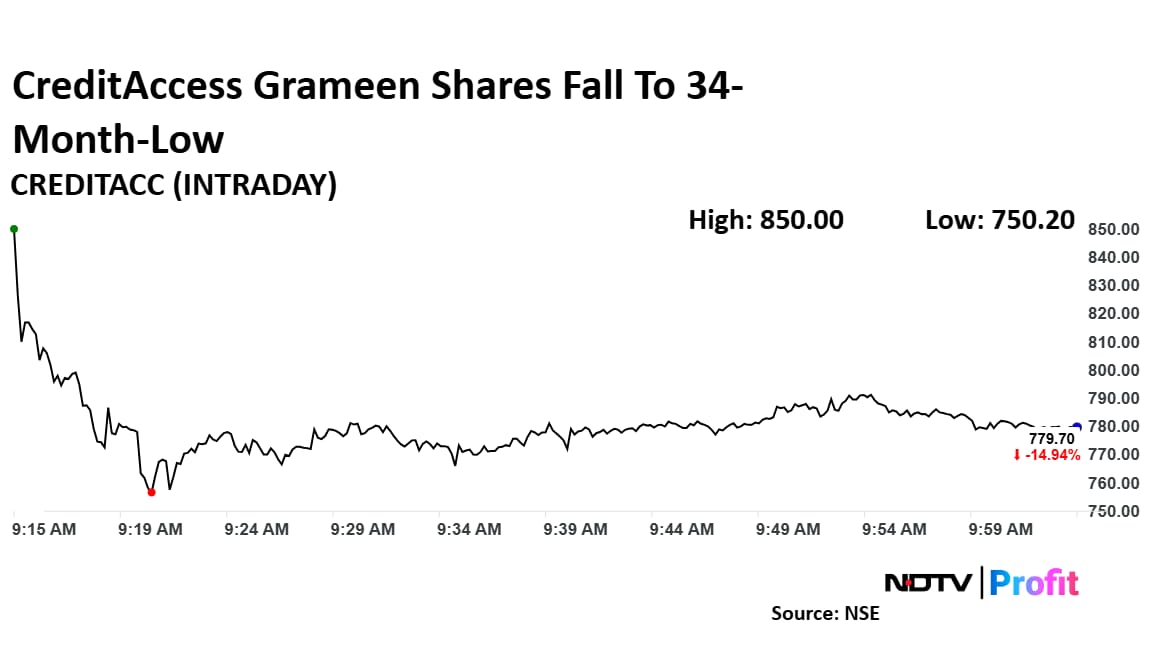

CreditAccess Grameen Shares Fall To 34-Month Low

Shares of CreditAccess Garmeen fell as much as 18.15% to Rs 750.20 apiece, the lowest level since March 15, 2022. It pared losses to trade 14.14% lower at Rs 787 apiece, as of 9:55 a.m. This compares to a 0.54% decline in the NSE Nifty 50 Index.

It has fallen 49.50% in the last 12 months. Total traded volume so far in the day stood at 12 times its 30-day average. The relative strength index was at 37.

Out of 19 analysts tracking the company, 13 maintain a 'buy' rating, four recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 33.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.