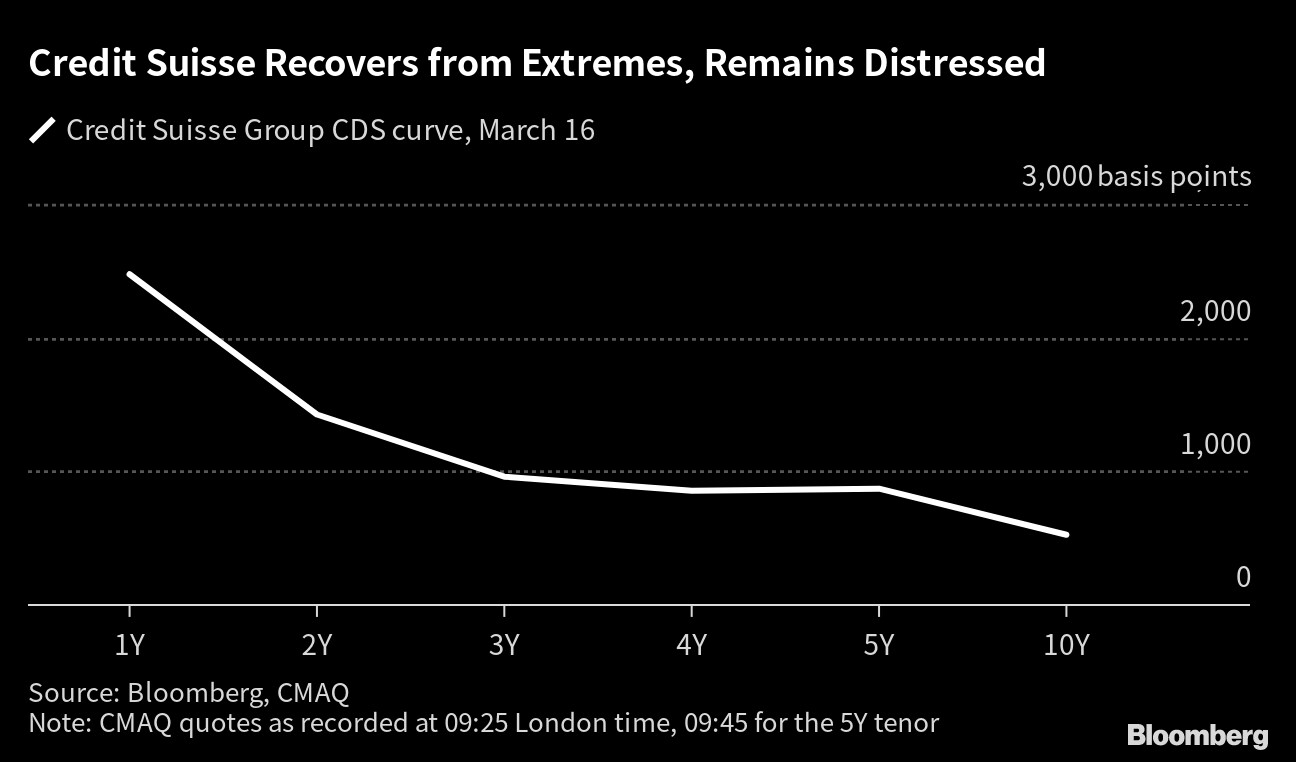

(Bloomberg) -- The cost of insuring the bonds of Credit Suisse Group AG against default dropped, though they remained in distressed territory, after the lender said it would tap Switzerland's central bank for fresh liquidity.

Bid-ask spreads narrowed, with traders quoting prices from 10.5 to 17.5 points upfront for one-year senior credit default swaps on Thursday morning, according to people who saw the quotes.

Those offers are substantially below Wednesday's pricing when the range was at one stage 20 to 30 points upfront, the people said, asking not to be identified because the numbers aren't public. The last recorded quote on pricing source CMAQ was about 2,720 basis points at 10:40 a.m. London time.

The bank didn't immediately reply to a request for comment.

The support from the Swiss National Bank brought some temporary relief to risk gauges for the broader European banking sector. A Bloomberg index tracking the cost of insuring European senior bank bonds recorded its biggest drop in almost three years, before retracing most of its tightening. Another index tracking credit default swaps tied to European subordinated banking debt also moved similarly.

Worries about Credit Suisse's financial health exploded into a full-blown crisis on Wednesday after the bank's biggest shareholder said it wouldn't boost its stake in the bank for regulatory reasons. That triggered a huge spike in the credit derivatives linked to the bank as trading counterparties rushed to protect themselves against a possible default.

The bank's bonds and shares also plunged, leading the Swiss National Bank to pledge to provide emergency financing if needed. The lender can borrow as much as 50 billion Swiss francs ($54 billion) from the central bank liquidity facility.

On Thursday, following the news, Credit Suisse Group's bonds initially rose, although they were still far from paring this week's losses. The 7.75% notes due in 2029 jumped as much as 10 points to 81 cents on the euro before reversing all their gains, falling to around 70, according to CBBT data compiled by Bloomberg at 11:26 a.m. London time. They were trading around 98 as of last Friday.

Bond Buyback

It's since offered to buy back as much as 3 billion francs of dollar- and euro-denominated debt. Securities issued by the bank gained in response.

Spreads of more than 1,000 basis points in one-year senior bank CDS is an extremely rare phenomenon and regarded as a sign of distress. Major Greek banks traded at similar levels during the country's debt crisis and economic slump.

For five-year senior credit default swaps, quoted prices were in the range of 21 to 26 points upfront on Thursday, the people said.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.