- The BSE Sensex ended negative eight times in 15 Modi government budget presentations

- Sensex fell 1.88% and Nifty dropped 1.96% after STT hike on derivatives was announced

- STT on futures raised to 0.05% from 0.02%, triggering market sell-off and negative sentiment

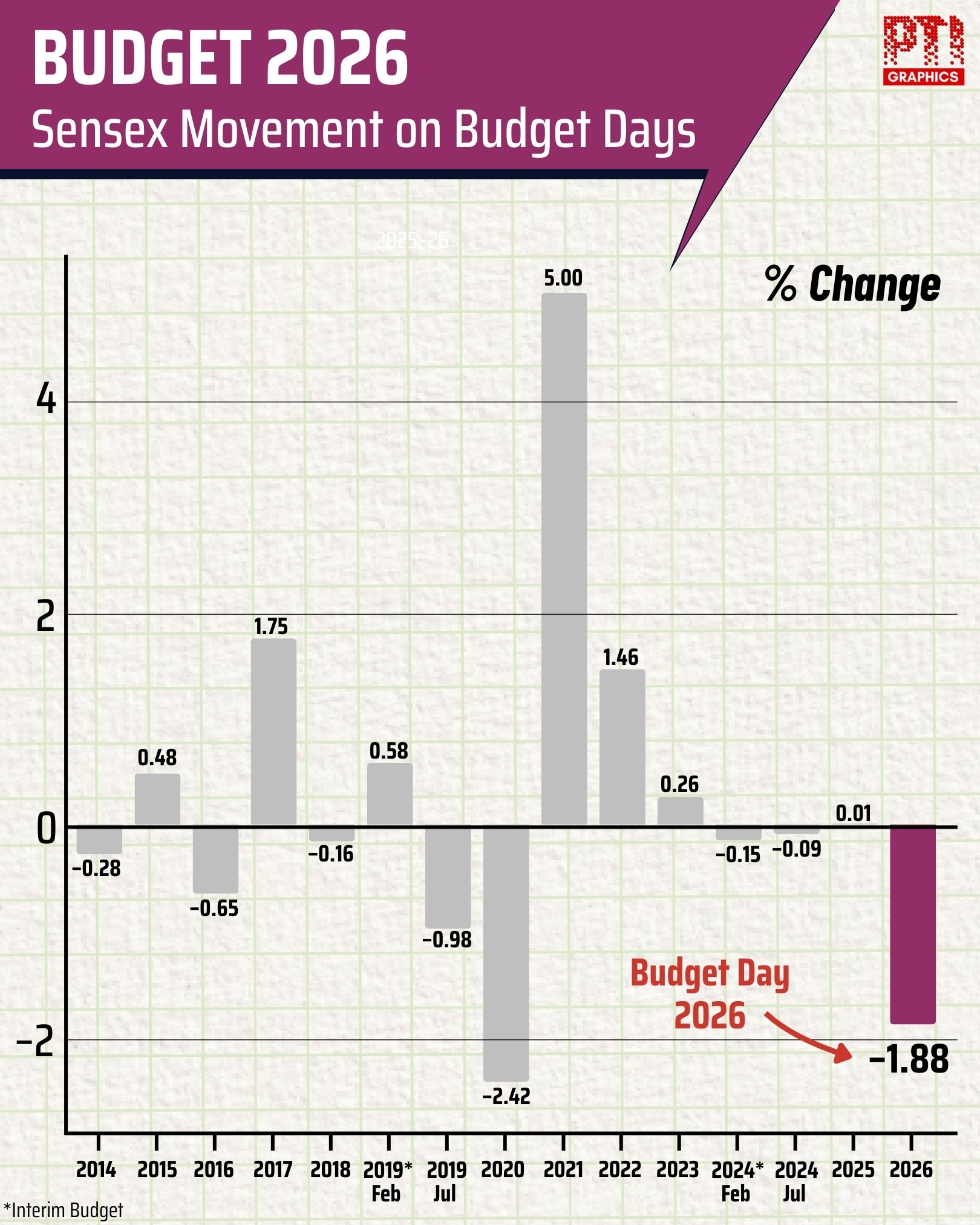

In the 15 Union Budget presentation days of the Narendra Modi government since it came to power in 2014, the BSE benchmark Sensex has ended in negative territory eight times.

The NDA government, led by Prime Minister Narendra Modi, has so far presented 15 budgets, including two interim budgets ahead of the general elections in 2019 and 2024.

Benchmark equity indices Sensex and Nifty tumbled nearly 2 per cent on Sunday after Finance Minister Nirmala Sitharaman on Sunday proposed an increase in the Securities Transaction Tax (STT) on derivatives.

Reversing early gains, the 30-share BSE Sensex tumbled 2,370.36 points, or 2.88 per cent, to slide below the 80,000-mark at 79,899.42 in afternoon trade as Sitharaman said the STT on futures contracts would be raised to 0.05 per cent from 0.02 per cent.

The benchmark finally ended at 80,722.94, down 1,546.84 points, or 1.88 per cent.

The 50-share NSE Nifty tanked 495.20 points, or 1.96 per cent, to settle at 24,825.45. During the day, it tumbled 748.9 points or 2.95 per cent to 24,571.75.

"The Budget supports sectors affected by global trade tariffs and focuses on emerging areas of development, including data centres, GCC, semiconductors, biopharma, rare earth elements, and manufacturing. Additionally, it extends support to traditional sectors like textiles, aquaculture, and MSMEs, which have been impacted by global protectionist trade policies.

"Despite these measures, the market's reaction has been negative, primarily due to low expectations, limited outlays and the negative bias created by the increased STT for futures, triggering a knee-jerk response," Vinod Nair, Head of Research, Geojt Investments Ltd, said.

STT hike on Futures dampen stock market sentiment; Sensex crashes nearly 2%.

Photo Credit: PTI

Last year on the Budget day, the 30-share BSE benchmark gauge eked out a marginal gain of 5.39 points, or 0.01 per cent, to settle at 77,505.96.

On July 23, 2024, the BSE benchmark ended lower by 73.04 points, or 0.09 per cent, at 80,429.04. On the interim Budget presentation on February 1 that year, the BSE Sensex ended lower by 106.81 points, or 0.14 per cent, at 71,645.30.

In 2023, on the Budget day, the bellwether index ended at 59,708.08, up 158.18 points, or 0.26 per cent.

In 2022, the Sensex jumped 848.4 points, or 1.46 per cent, at 58,862.57, while in 2021, it rallied 2,314.84 points, or 5 per cent, to 48,600.61 after the Budget announcements.

On February 1, 2020, the 30-share BSE benchmark ended 987.96 points, or 2.42 per cent, lower.

In the prior year, it clocked a gain of 212.74 points, or 0.58 per cent, on February 1, while on July 5, the index ended lower by 394.67 points, or 0.98 per cent.

In 2018, the barometer ended lower by 58.36 points, or 0.16 per cent, while in the previous year, it climbed 485.68 points, or 1.75 per cent.

The Budget presentation date was in 2017 changed to February 1 to allow the government to complete the Parliamentary approval process by March-end and allow implementation of the Budget from the start of the fiscal year on April 1.

Presenting the Budget on February 28 meant that the implementation could not start before May/June after accounting for 2-3 months of the parliamentary approval process. The Sensex went lower by 152.3 points, or 0.65 per cent, in 2016 Budget day.

In 2015, the 30-share BSE benchmark went up 141.38 points, or 0.48 per cent, while on July 10, 2014, it declined 72.06 points, or 0.28 per cent.

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)

Comprehensive Budget 2026 coverage, LIVE TV analysis, Stock Market and Industry reactions, Income Tax changes and Latest News on NDTV Profit.