Bharti Airtel's March quarter earnings prompted cautious optimism from both Morgan Stanley and Citi, with both brokerages noting a mix of steady India operations, seasonal softness, and rising capex. The stock remains a 'buy' for Citi and carries a modest upside view from Morgan Stanley.

Morgan Stanley noted a "slight beat" on Ebitda in Airtel's India business, driven by better-than-expected performance in the Airtel business segment. The brokerage maintained an unchanged view on earnings, but flagged a modest upside to its 12-month EPS outlook.

Citi labelled Airtel's final quarter as "expectedly soft", compared to recent quarters, primarily due to seasonality—two fewer days in the quarter—and flat average revenue per user, which already reflected the full benefit of the third quarter tariff hikes. Still, the firm maintained a 'buy' rating with a target price of Rs 1,920.

Net subscriber additions came in at 5 million, with 4G and 5G subscribers growing 6.6 million, observed the brokerage. Citi noted strong margin performance, with incremental Ebitda margins at 85%.

Citi is awaiting management's commentary on capex trends, free cash flow utilisation, and the status of Bharti's request for equity conversion of AGR dues.

Both brokerages are aligned in seeing long-term structural strength in Airtel's business, though short-term concerns around seasonal softness and capex spend keep sentiment cautiously optimistic.

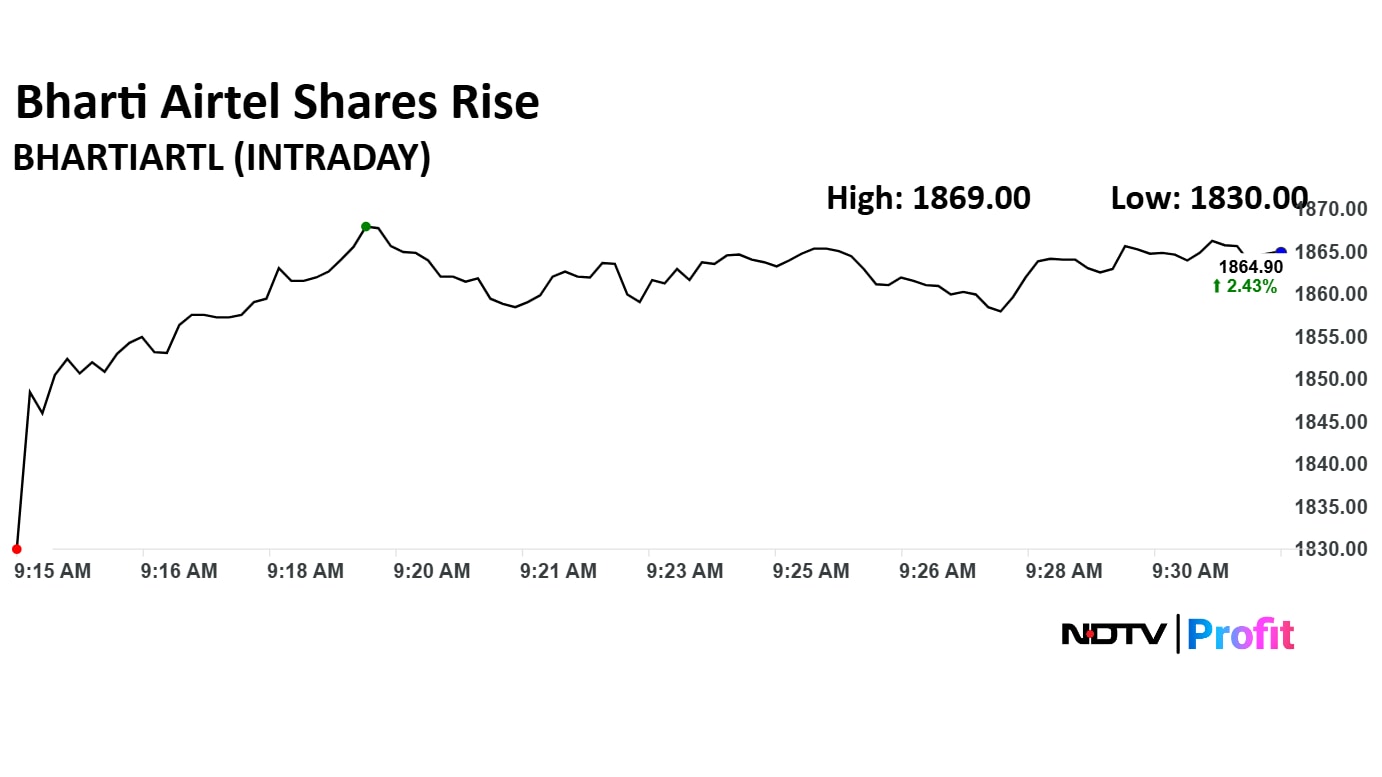

Bharti Airtel Share Price Today

The scrip rose as much as 2.32% to Rs 1,862.80 apiece. It pared gains to trade 2.41% higher at Rs 1,864.40 apiece, as of 09:33 a.m. This compares to a 0.51% advance in the NSE Nifty 50.

It has risen 17.35% on a year-to-date basis. The relative strength index was at 45.18.

Out of 34 analysts tracking the company, 29 maintain a 'buy' rating, three recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 2.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.