Bajaj Housing Finance Ltd.'s share price continued its fall for a fourth-session on Friday to close at its lowest since listing as investors look forward to its results.

Bloomberg estimates its net profit to be at Rs 551.1 crore and interest income is expected to be Rs 2,482.5 crore.

In its operational update for the quarter released earlier this month, the NBFC had said its assets under management stood at around Rs 1.08 lakh crore as of Dec. 31, 2024, higher by 26% as against the year-ago period.

Bajaj Housing Finance's loan assets stood at Rs 95,550 crore at the end of the December quarter, the company said. This marked a climb of 30.5% as against Rs 73,197 crore as of Dec. 31, 2023.

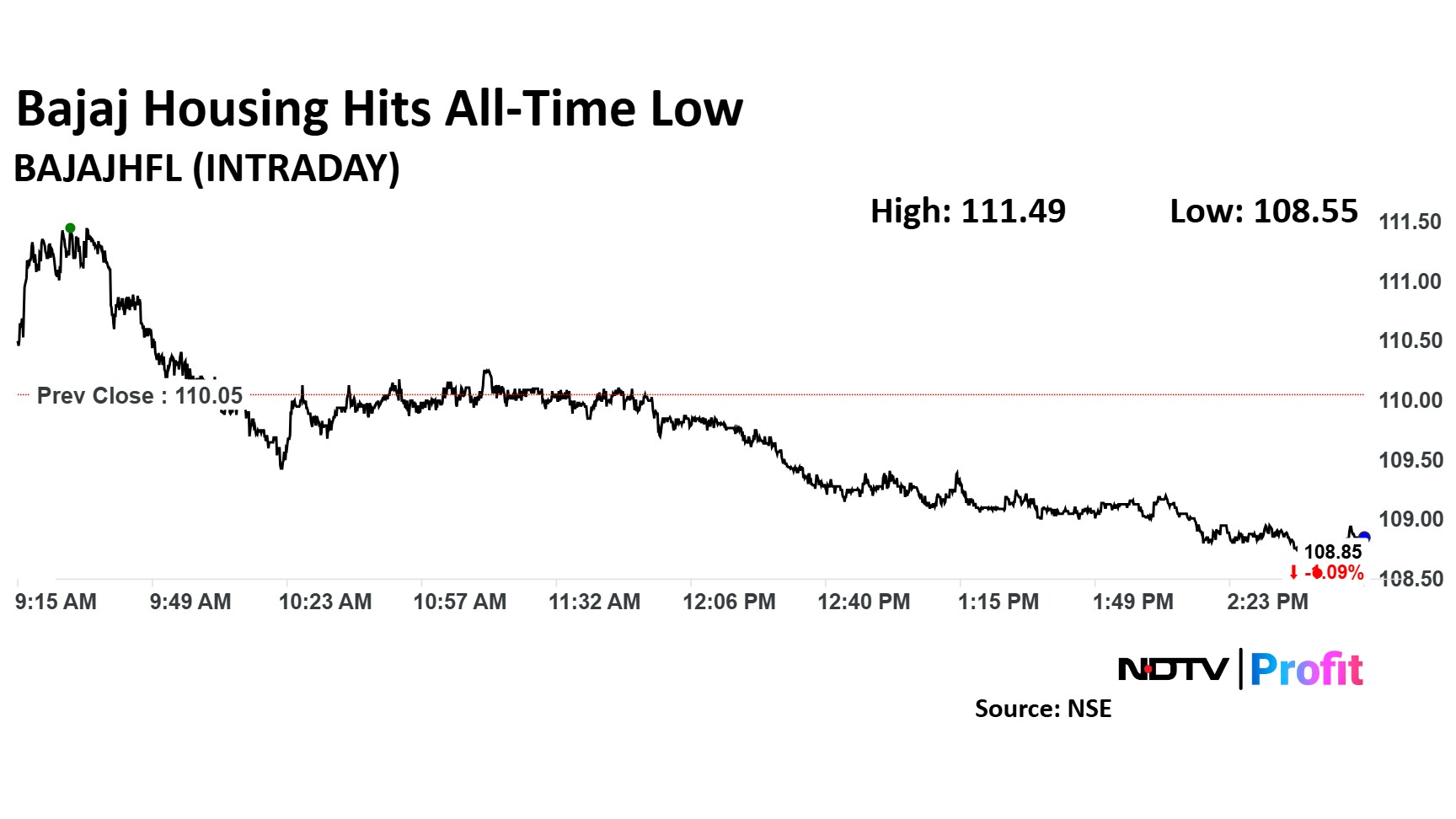

The stock has fallen 4.7% in its four-session fall.

The scrip fell as much as 1.3% during the day to Rs 108.55 apiece, the lowest level, on the NSE. It was trading 1% lower at Rs 109 apiece, as of 3:02 p.m. This compares to a 0.5% decline in the NSE Nifty 50 Index.

It has fallen 34% since listing. The relative strength index was at 27, indicating the stock may be oversold.

Out of the nine analysts tracking the company, three maintain a 'buy' rating, one recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average of 12-month consensus price target implies a potential upside of 2.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.