Financial services company Angel One Ltd.'s share price took a beating in early trading hours on Thursday, post the company's announcement of their final quarter performance.

The firm reported a net decline in both top line and bottom line, with the profit nearly halved, missing Bloomberg estimates, while revenue estimates were in line with the result.

Additionally, the company's board has approved the final dividend of Rs 26 per share for the financial year 2025.

Brokerage firm Investec remained bullish on the company in the medium term perspective. It maintained a 'buy' call on Angel One, with a price target of Rs 2,700, indicating 14.7% return potential.

The headwinds faced by the company, partially due to one-off instances as well as weak market sentiment, will continue to impact its earnings in fiscal 2026 as well, according to the brokerage.

It observed traction in some of the asset management company's new initiatives. However, they account for only 3% of net revenue, Investec said.

Angel One Q4 FY25 Highlights (Consolidated, YoY)

Revenue down 22.3% to Rs 1,056 crore versus Rs 1,358.5 crore.

Net profit down 49% to Rs 174.5 crore versus Rs 340 crore.

Broking revenue down 29%.

Net interest income grew 34%.

Other operating income down 53%.

Ebitda margin contracted to 32% from 45%.

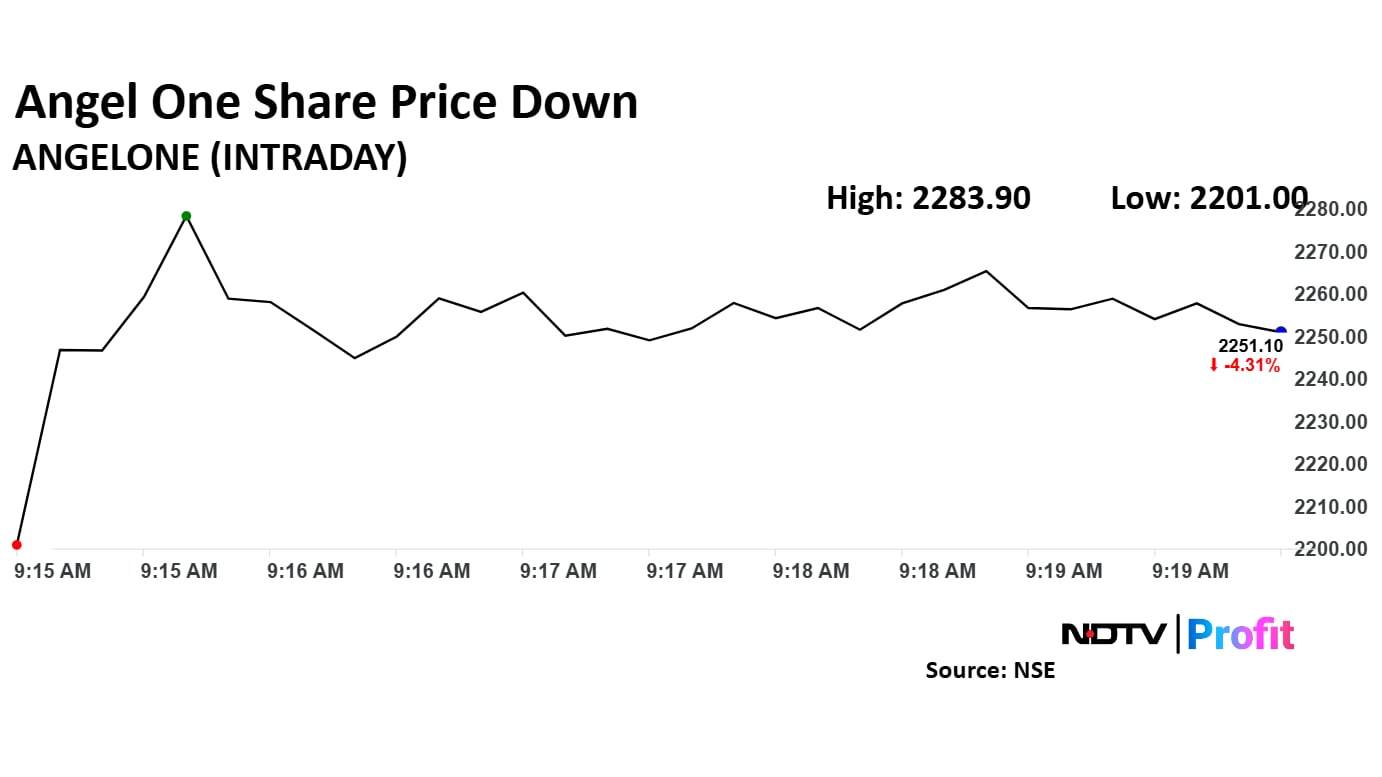

Angel One Share Price Today

The scrip fell as much as 6.44% to Rs 2,201 apiece. It pared losses to trade 4.08% lower at Rs 2,256.50 apiece, as of 09:20 a.m. This compares to a 0.36% decline in the NSE Nifty 50.

Share price of the company has fallen 19.75% on a year-to-date basis, and 17.51% in the last 12 months. Total traded volume so far in the day stood at 0.39 times its 30-day average. The relative strength index was at 49.26.

Out of 10 analysts tracking the company, seven maintain a 'buy' rating, two recommend a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target of Rs 2,750 implies an upside of 16.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.