Citi has initiated a 'buy' rating on Akums Drugs and Pharmaceuticals Ltd., citing consistent financial performance and market share gains. The brokerage has a target price of Rs 700.

"The target multiple is at a 25% discount to domestic formulation peers, which we justify given Akums' lower pricing power, higher sensitivity to API prices; and lower margins or returns," the brokerage further said.

Citi noted that Akums is its preferred mid-cap pick in the sector.

"The company has an edge over competition in terms of scale, manufacturing capabilities, and has potential to scale up internationally," it added.

"We expect CDMO growth to pick up in 1HFY26E once the impact of these factors comes in the base, which we envisage will help currently suppressed valuations to bounce back," the brokerage said.

Citi highlighted that as API prices seem to have bottomed out after sustained weakness in 2024; this, coupled with commercialisation of new facilities in Haridwar and Baddi, and business development activities anchor its forecast of 9%/12% growth in the domestic CDMO business in FY26/27E vs. 4% year-on-year decline in FY25E.

Akums has already received Euro 100 million upfront from a global pharma company. This six-year contract is expected to not only add 5-7% incremental growth in FY28E, but it also demonstrates the company's capability to make inroads in international and regulated market CDMO opportunities.

"Given that listed names in this space are few and very small, we benchmark Akums to listed domestic formulation peers and assign 15x Sept'26E Ebitda (CDMO + Formulation business) to arrive at TP of Rs 700 per share," Citi said.

As per Citi, the downside risks include further correction in API prices delaying growth recovery.

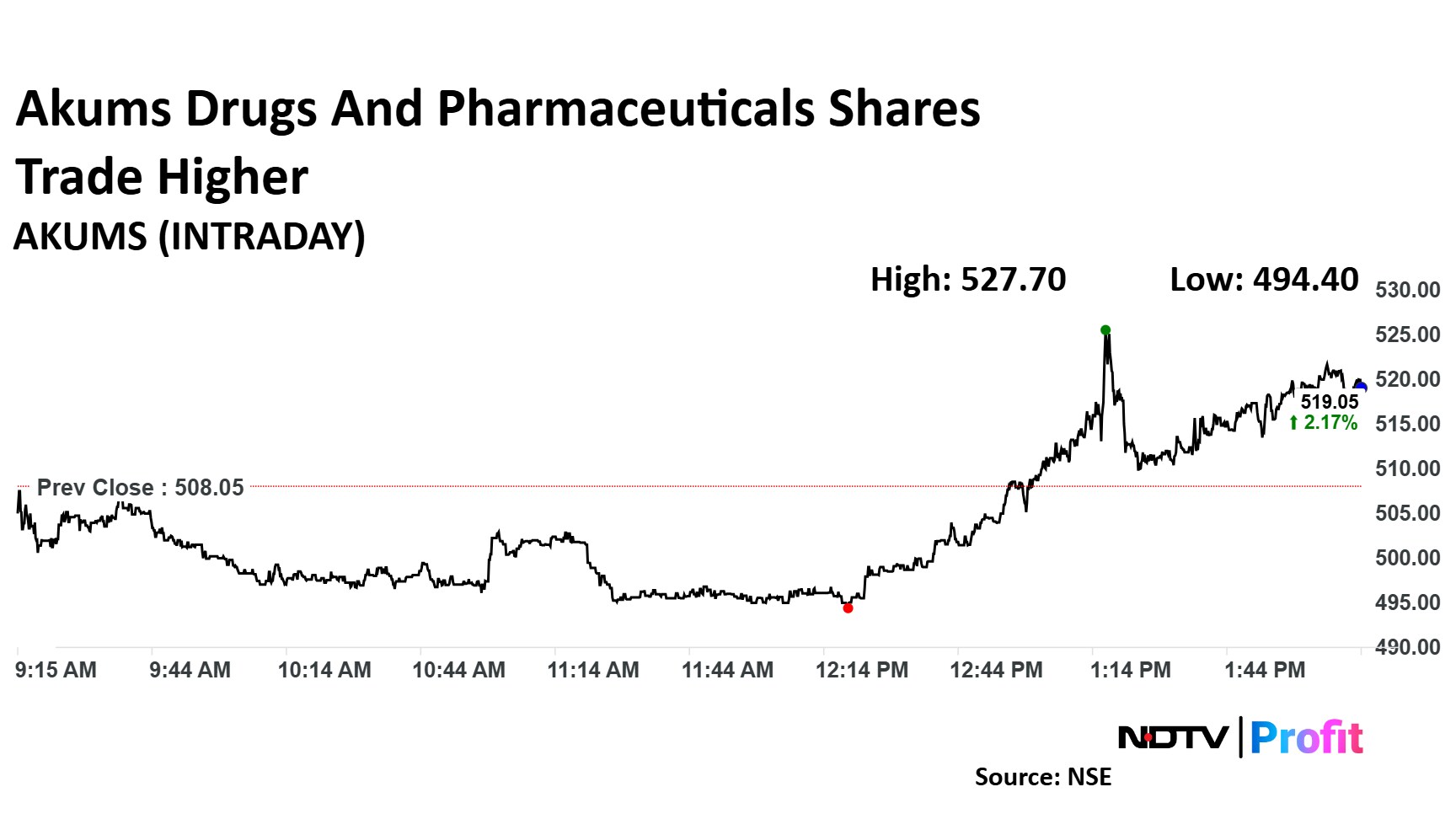

Shares of Akums Drugs and Pharmaceuticals Ltd. rose as much as 3.87% to Rs 527.70 apiece. They pared gains to trade 2.29% higher at Rs 519.70 apiece, as of 2:16 p.m. This compares to a 0.27% decline in the NSE Nifty 50.

The stock has fallen 35.06% in the last 12 months. The relative strength index was at 65.44.

Three analysts tracking the company have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 44.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.