(Bloomberg) -- UK inflation rose to a fresh four-decade high in May after broad increases in the cost of everything from fuel and electricity to food and beverages.

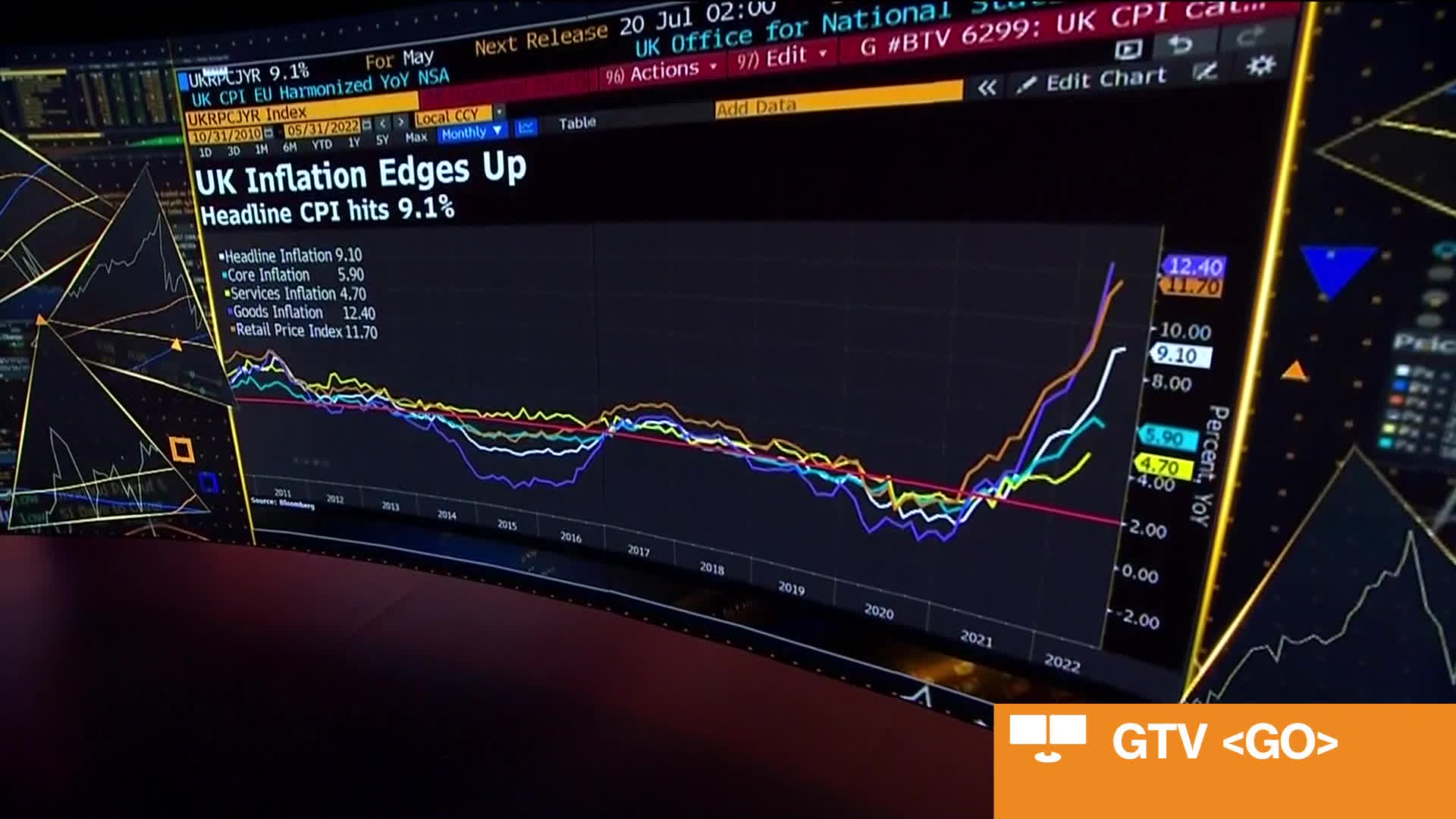

The rate accelerated to 9.1%, from 9% a month earlier, the Office for National Statistics said Wednesday.

Retail prices climbed more than expected to 11.7%, and there were also more signs of inflationary pressures building at the wholesale level, with raw material costs increasing the most on record.

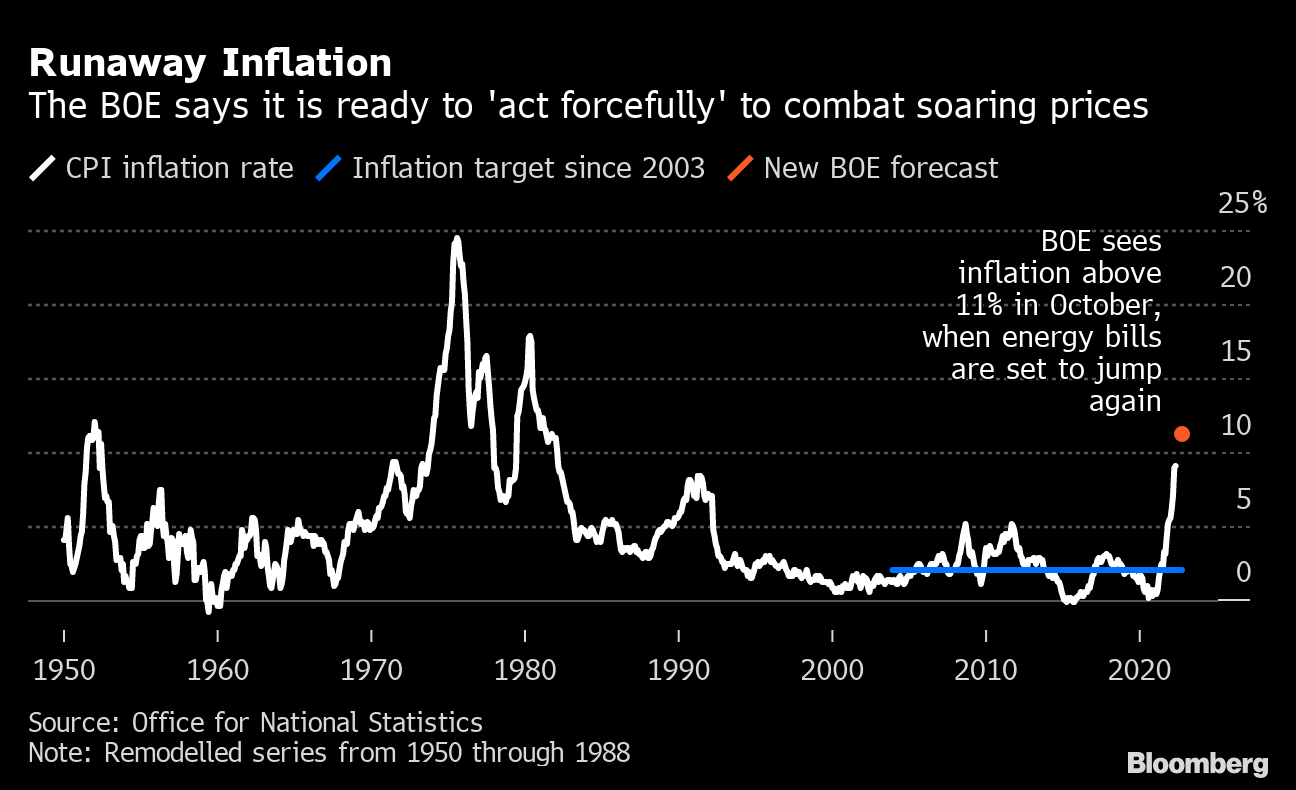

While the jump was smaller than seen in recent months, the figures still underline the scale of the inflation crisis facing the UK. Matters will get worse later this year when another energy price hike kicks in, with the Bank of England forecasting price gains will surge above 11% in October.

What Bloomberg Economics Says ...

“The BOE opened the door to moving in bigger steps than 25 basis points by saying signs of more persistent inflationary pressure would be met by ‘forceful action.' Today's release will do nothing to allay those fears. We expect inflation to pick up in the months ahead as rising food and fuel prices lift the annual rate. The peak isn't likely to arrive until October, when Ofgem, the UK's energy regulator, raises the price cap on energy bills again.”

--Dan Hanson, Bloomberg Economics. Click for the REACT.

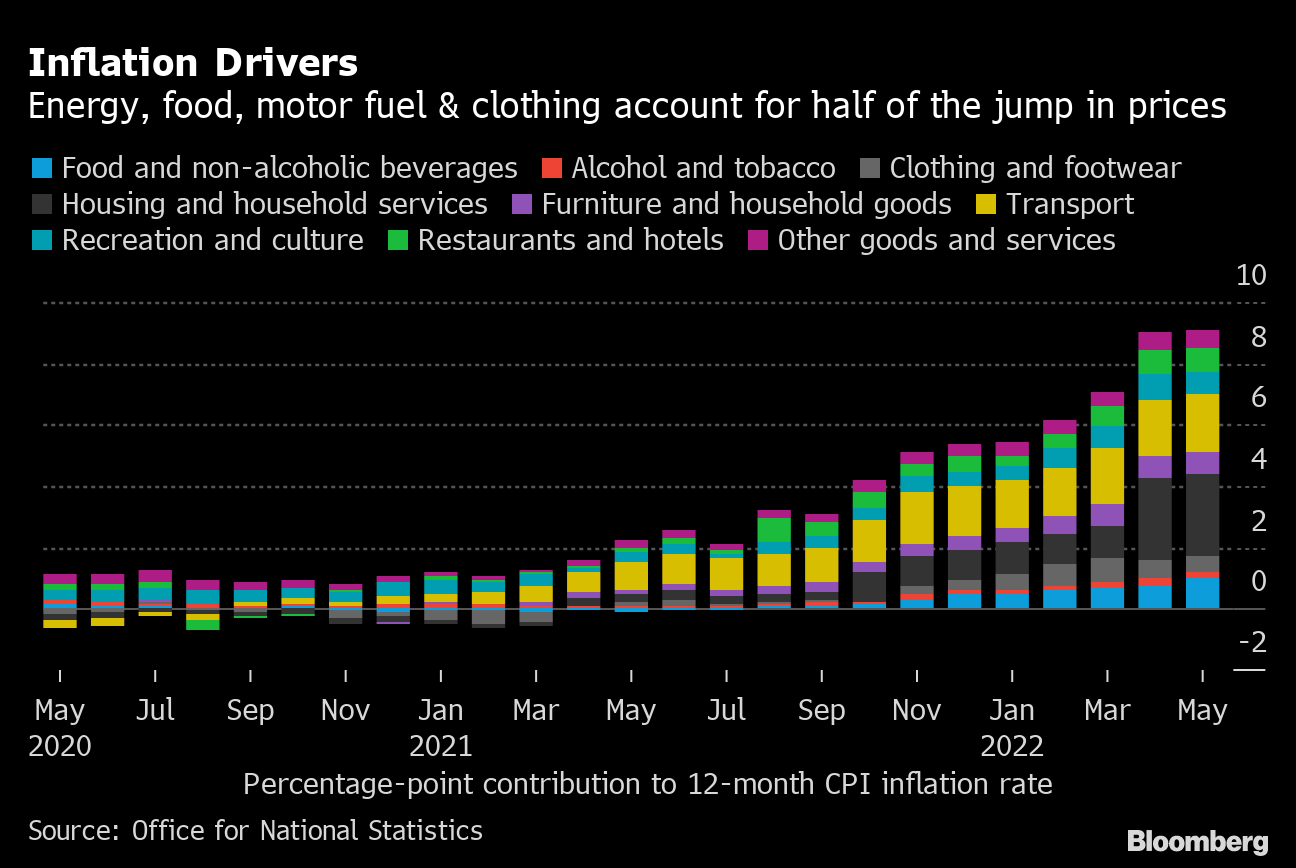

The increase was driven by rising prices for food and non-alcoholic beverages, which formed a stark contrast to declines a year ago. Rising electricity and gas and other fuel prices, motor fuels and second-hand cars were also big contributors to the headline figure.

The cost of goods leaving factories rose 15.7% from a year ago, a full percentage point stronger than expected and the most since 1977.

Raw materials prices jumped 22.1%, also more than expected and the most since records started in 1985.

The runaway inflation rate is setting the backdrop for a tumultuous summer for the central bank and Prime Minister Boris Johnson's government. About 60% of adults report spending less on non-essential items in response to rising costs.

“I know that people are worried about the rising cost of living, which is why we have taken targeted action to help families,” said Chancellor of the Exchequer Rishi Sunak. “We are using all the tools at our disposal to bring inflation down and combat rising prices.”

Sunak said that “fiscal policy which doesn't add to inflationary pressures” will be part of the solution, a signal that the government will keep a tight rein on pay settlements with public-sector workers.

The economy is on course to shrink for the first time since the pandemic, consumers are seeing their incomes squeezed at the sharpest pace in two decades, and a series of rail strikes are bringing the nation to a standstill this week.

While Johnson has introduced a package of measures to help offset some of the jump in energy bills, it says increasing pay to match inflation is not an option. Johnson told his cabinet Tuesday that his government seeks to enforce pay restraint on public sector workers or else push prices even higher.

Meanwhile the BOE, which says it can do nothing to stop the spike in prices this year, is adding to the short-term pain of some households by hiking rates at an unprecedented pace.

Policy makers have already announced five straight hikes, and markets are betting rates will more than double to hit 3% by the end of the year.

Chief Economist Huw Pill said policy makers would sacrifice growth in order to bring down inflation in the UK, saying there's a risk of prices developing a “self-sustaining momentum.”

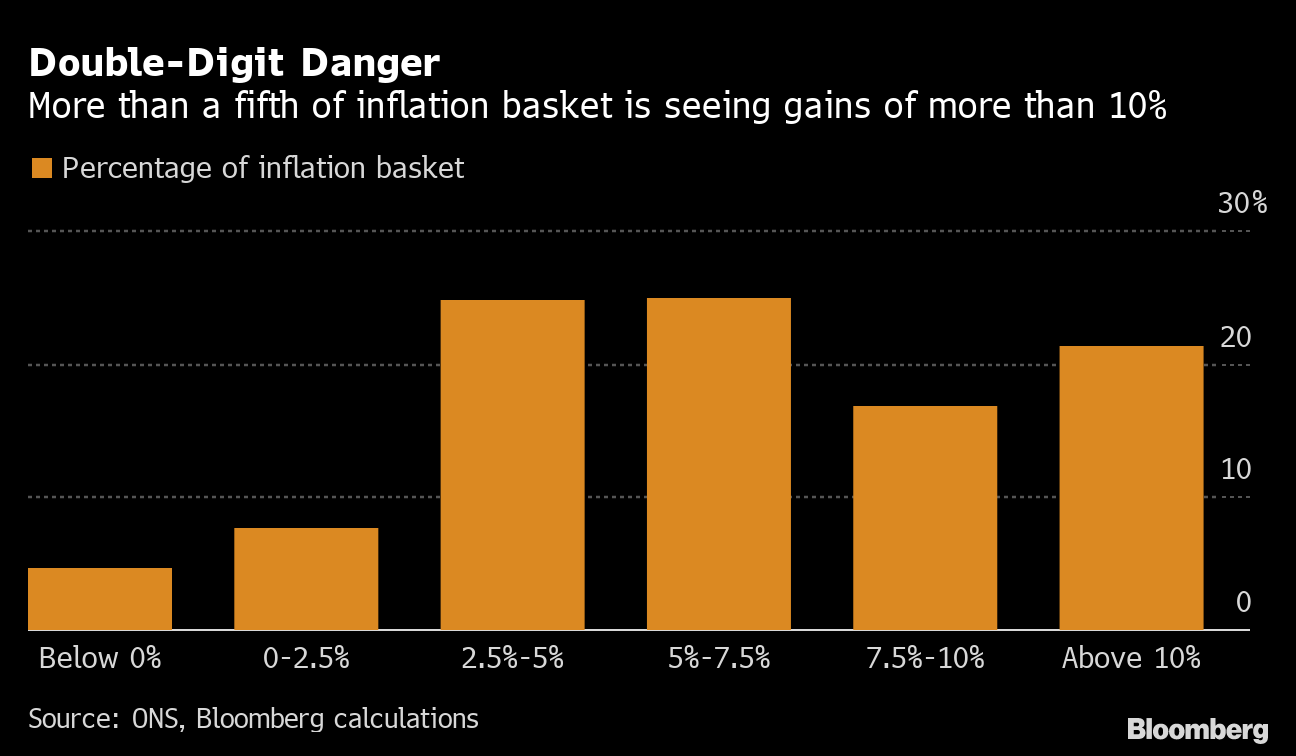

“No signs yet of inflation receding” says Yael Selfin, chief economist at KPMG UK. “Inflation continues to rise, primarily driven by external factors, with price rises spread widely across the economy.”

Read more:

- UK Wholesale Prices Jump Most Since 1977 With Inflation Surge

- Brexit's Legacy Is Hotter UK Inflation Risk for Years to Come

- Brexit Has Made UK Less Open and Competitive, Study Finds

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.