Federal Open Market Committee lowered the benchmark interest rate by a quarter-point to a target range of 3.5%-3.75%.

Nine of the 12 FOMC members voted to cut rates by 25 basis points. Two voted to keep the rate unchanged and one called for 50 bps cut.

The Fed's Dot plot of rate projections shows the median official expected to lower rates by a quarter-point in 2026 and another quarter-point in 2027, the same as they projected in September.

Median inflation rate projected at 2.4% by end of 2026, down slightly from 2.6% forecast in September.

Median US GDP growth of 2.3% in 2026, compared with 1.8% previously.

Powell said the inflationary impact of Trump tariffs is expected to ease in the second half of 2026, with the first quarter likely marking the peak effect.

The Fed is now "within a range of plausible estimates of neutral, and leave us well-positioned to determine the extent and timing of additional adjustments" to rates, Powell said, indicating that FOMC may hit pause on further cuts in the next meeting during January 27-28.

"In the near term, risks to inflation are tilted to the upside and risks to employment, to the downside. A challenging situation," Powell said.

"I don't think that a rate hike is anybody's base case at this point," Powell said, shunning any hawkish cues.

The live blog has ended. Thanks for joining!

Federal Reserve Chair Jerome Powell has ended the final press conference of 2025, after the FOMC slashed interest rate for the third time this year.

"I want to turnover my job to someone with an economy in good shape. I want inflation under control and strong labour market. All my efforts are to get to that place," Fed Chair Jerome Powell said, in response to a succession at the top job mid-2026.

S&P 500 up 0.8%

Dow Jones up 1.2%

Nasdaq up 0.6%

Federal Reserve Chair Jerome Powell said the inflationary impact of Trump tariffs is expected to ease in the second half of 2026, with the first quarter likely marking the peak effect.

Excluding tariffs, Powell noted that inflation is currently in “the low 2s” and emphasised that tariff-related price increases should remain a one-time adjustment.

Median Fed official sees inflation rate at 2.4% by end of 2026, down slightly from 2.6% forecast in September.

"I don't think that a rate hike is anybody's base case at this point. And I'm not hearing that. What you see is some people feel we should stop here and that we're at the right place and just wait. Some people feel like we should cut once or more this year or next year," said Jerome Powell.

"Spending on data centers and related to AI has been holding up business investment. So overall, the baseline expectation for next year is at least at the Fed, and I think with outside forecasters too, is a pick-up in growth from today's relatively low level of level of 1.7%," said Jerome Powell.

"AI spending will continue. The consumer continues to spend. So it looks like the baseline would be solid growth next year," he said.

The US growth, according to experts, have been holding up due to massive spending on AI that has eclipsed the strains in other sectors.

Jerome Powell said there will be a “great deal of data” between now and the January meeting. The data, he adds, will factor into their thinking.

US macro data for October and November has been delayed due to a recent government shutdown.

"In the near term, risks to inflation are tilted to the upside and risks to employment, to the downside. A challenging situation," Fed Chair Jerome Powell said.

The Fed is now "within a range of plausible estimates of neutral, and leave us well-positioned to determine the extent and timing of additional adjustments" to rates, Powell said, hinting that FOMC may hit pause on further cuts in the next meeting during January 27-28.

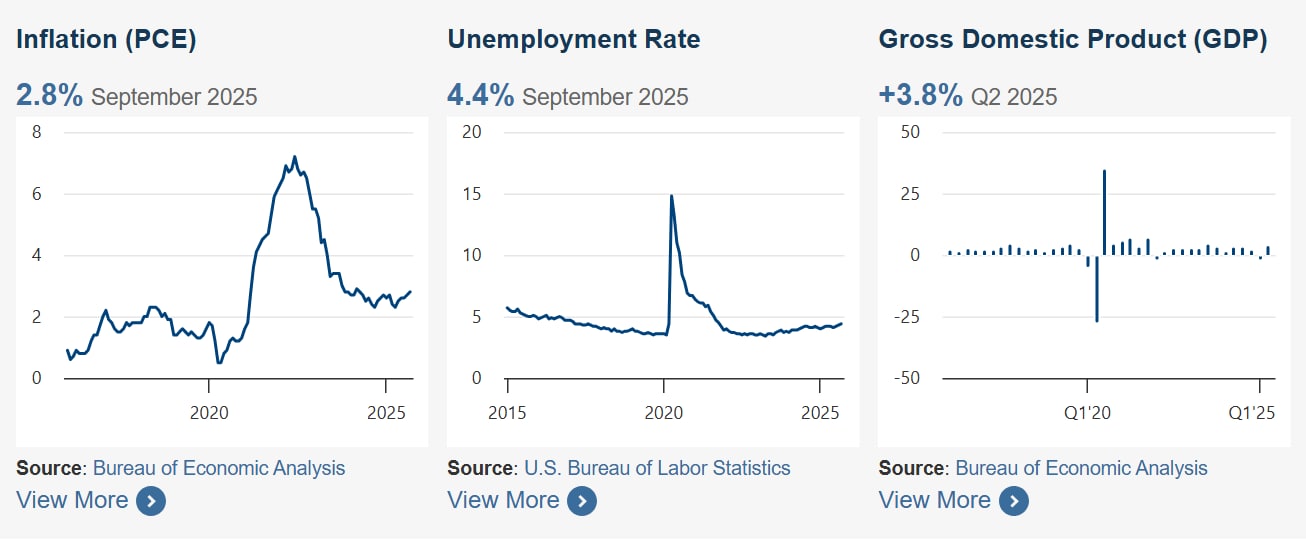

Jerome Powell said US inflation has eased but remains “somewhat elevated” compared to the Fed’s 2% longer-run goal. He noted that “very little” data on inflation has been released since policymakers last met in October. He referenced the 43-day US government shutdown, which prevented data collection and delayed reports.

""Inflation has eased significantly from its highs in mid-2022, but remains somewhat elevated relative to our 2% longer run goal," Powell said.

The Fed chair repeats that some of the slowdown in hiring is due to slower labour force growth but says lower demand is also playing a role. He emphasized the risk of lower demand a lot after the previous rate cut as well.

"Consumer spending appears to have remained solid, and business-fixed investment has continued to expand,” but housing remains “weak,” Powell said.

Fed Chair Jerome Powell said that available data show that the outlook for employment and inflation have not changed much since the last meeting. He nods to the disruption of data due to the federal shutdown.

"Although important federal government data for the past couple of months have yet to be released, available public and private sector data suggests that the outlook for employment and inflation has not changed as much since our meeting in October."

Spot gold price is down 0.25% at $4197

Spot silver price is down 0.5% at $60.30

The US dollar index is down 0.4% at 98.84. The euro surged the most, followed by the yen and pound.

The US 10-year Treasury bond yield is down 2 basis points at 4.169%, after reaching the highest since the first week of September earlier in the session.

The yield on policy-sensitive two-year notes is down five basis points to 3.56%.

After the Fed's FOMC delivered its third and final rate cut of 2025, here's how Wall Street is reacting:

S&P 500 up 0.3%

Dow Jones up 0.7%

Nasdaq 100 flat

Median Fed official sees inflation rate at 2.4% by end of 2026, down slightly from 2.6% forecast in September.

US GDP growth is seen at 2.3%, compared with 1.8% previously.

The Fed's 'Dot plot' of rate projections shows the median official expected to lower rates by a quarter-point in 2026 and another quarter-point in 2027, the same as they projected in September.

"Available indicators suggest that economic activity has been expanding at a moderate pace. Job gains have slowed this year, and the unemployment rate has edged up through September. More recent indicators are consistent with these developments. Inflation has moved up since earlier in the year and remains somewhat elevated. Uncertainty about the economic outlook remains elevated," the Fed said.

Nine of the 12 FOMC members voted to cut rates by 25 basis points. Two voted to keep the rate unchanged and one called for 50 bps cut.

The US Federal Reserve's FOMC decided to cut interest rate by 25 bps to 3.5%-3.75% target range.

(Source: Fed)

Kevin Hassett, the director of the National Economic Council, said futures markets expect the Federal Reserve to deliver a 25-basis-point rate cut, calling it “a small step in the right direction.” He noted that the Fed will likely need to ease further and reiterated that there is plenty of room to reduce interest rates.

Hassett added that Chair Jerome Powell had engaged in extensive negotiations to reach the 25-basis-point move, but suggested the cut could go as deep as 50 basis points or more. With strong supporting data, Hassett said, a 50-basis-point reduction could be secured.

Federal Reserve Chair Jerome Powell’s term ends in May, with President Donald Trump expected to announce a successor early in the new year. The shortlist reportedly includes top economic adviser Kevin Hassett among other candidates. Once nominated, the process will move to the Senate Banking Committee for a confirmation hearing, followed by a full Senate vote. The new chair is likely to take office in time to preside over the Fed’s June policy meeting.

US consumer spending increased moderately in September after three straight months of solid gains. It suggests a loss of momentum in the economy as a lackluster labor market and rising cost of living curbed demand.

Data on Tuesday showed US job openings increased marginally in October after surging in September.

Core US prices increased 2.8% annually through September, the latest Personal Consumption Expenditures report showed on Friday.

(Source: News reports)

White House economic adviser Kevin Hassett, the frontrunner to be the Federal Reserve's next chair, told a media event there was "plenty of room" to cut interest rates further, though he added that if inflation rises the calculation may change.

Brokerages including Nomura, JPMorgan, Morgan Stanley, Standard Chartered, and Goldman Sachs expect a 25-basis-point reduction to a range of 3.5%-3.75%.

Traders are pricing in an 87.4% chance of an interest rate cut in December, according to CME Group's FedWatch Tool.

The US dollar weakened on Wednesday, reversing two days of gains, as investors pared positions ahead of an anticipated third consecutive interest rate cut of 25 basis points by the Federal Reserve.

By late morning, the dollar slipped 0.3% against the yen to 156.45, while the dollar index eased 0.2% to 99.067. The euro edged up 0.1% to $1.1643, supported by expectations that euro zone rates will remain steady, with investors focusing on the widening gap between US and European bond yields.

(Source: Reuters)

Bond traders are betting on a shallower path of Federal Reserve interest-rate cuts in the year ahead, part of a global move to wager that major central banks will slow or halt their monetary easing.

Beyond Wednesday’s expected quarter-point cut from the current 3.75%-4% range, traders now anticipate a half-point of total reductions by the US central bank in 2026, futures and options trading shows.

Meanwhile in cash Treasuries, bullish momentum has also faded. The benchmark 10-year yield traded at the highest since September on Wednesday at 4.21%.

(Source: Bloomberg)

The markets see over 80% probability of the US Fed cutting interest rate amid cooling employment and mixed inflation data. This decision could ignite a year-end Santa Rally—a seasonal uptick in stocks during late December and early January, historically positive 79% of the time with average S&P 500 gains of 1.3%—by signaling dovish policy and boosting risk assets, as per reports.

Markets will also scrutinize Chair Jerome Powell’s post-meeting remarks for clues on the 2026 rates path.The fireworks will come from the vote split, the dot plot, updated economic forecasts, and of course, Fed Chair Jerome Powell’s press conference.

Gold prices slipped 0.4% to $4,192.29 an ounce in muted trading as traders await clues from policymakers on next year’s interest-rate path at their final meeting of 2025. Silver retreated from a record high above $60 an ounce.

The Federal Reserve is expected to deliver a quarter-point rate reduction at the conclusion of its policy meeting Wednesday. Such bets have supported gold prices as the precious metal typically performs well in a lower-rate environment.

(Source: Bloomberg)

The US Federal Reserve's monetary policy is among the most important factors in global capital markets. Borrowing costs in the world's largest economy, set by the central bank on a bimonthly basis, have a large bearing on the movement of money (read dollars) in the global financial system.

The Federal Open Market Committee (FOMC), headed by the Fed Chairman, decides on the interest rate. When rates are cut, money typically moves out of safe dollar assets like US Treasury bonds into riskier, high-return bets in emerging markets, including India.

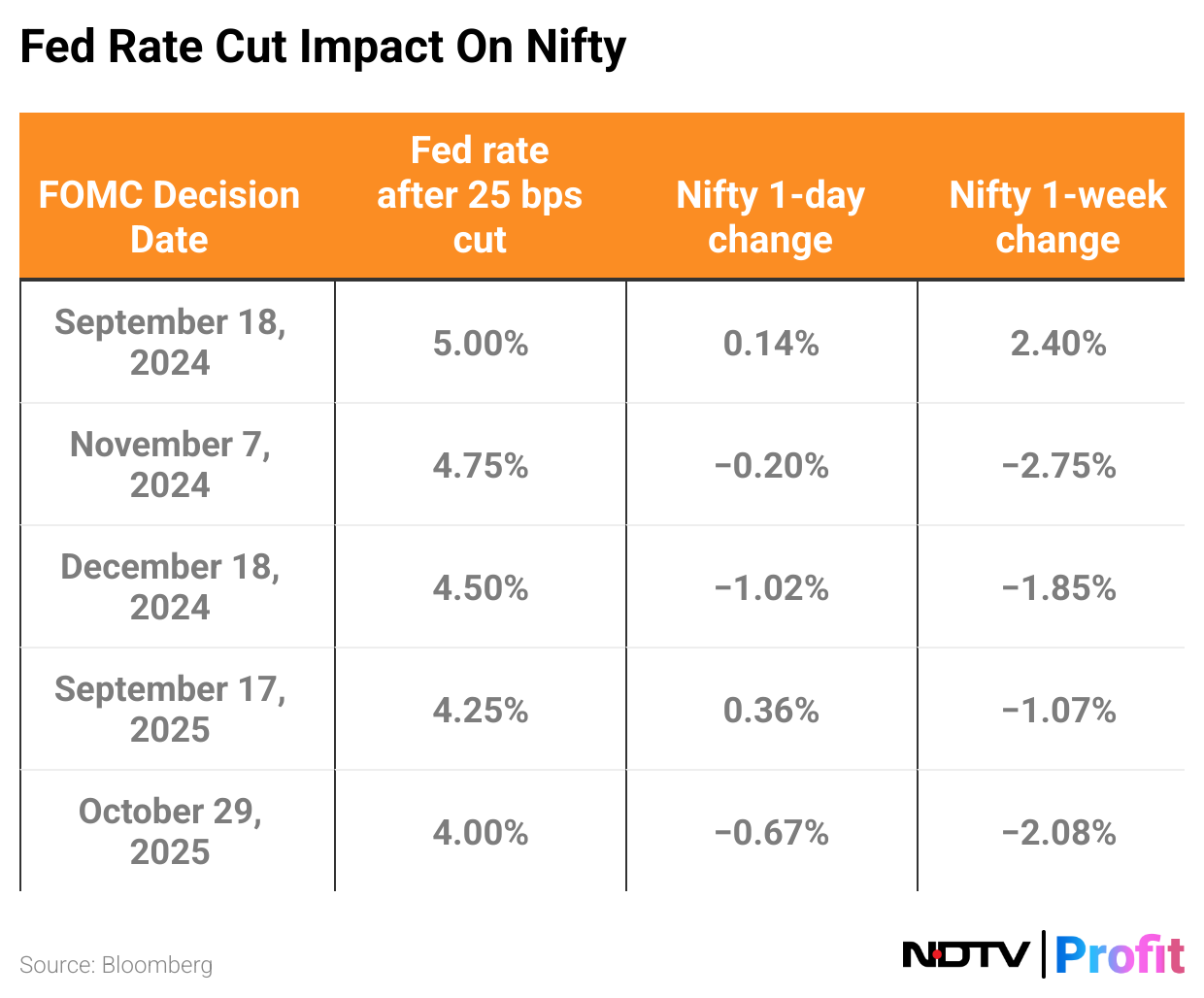

The FOMC is widely expected to deliver its third straight interest rate cut later on Wednesday. The last five instances of US Fed rate cuts show that India's benchmark Nifty 50 index declined three times on the immediate next day, and lost in four of five instances within a week.

To be sure, Indian markets during this period were also influenced by other global as well as domestic factors.

The US Federal Reserve's monetary policy is among the most important factors in global capital markets. Borrowing costs in the world's largest economy, set by the central bank on a bimonthly basis, have a large bearing on the movement of money (read dollars) in the global financial system.

The Federal Open Market Committee (FOMC), headed by the Fed Chairman, decides on the interest rate. When rates are cut, money typically moves out of safe dollar assets like US Treasury bonds into riskier, high-return bets in emerging markets, including India.

The FOMC is widely expected to deliver its third straight interest rate cut later on Wednesday. The last five instances of US Fed rate cuts show that India's benchmark Nifty 50 index declined three times on the immediate next day, and lost in four of five instances within a week.

To be sure, Indian markets during this period were also influenced by other global as well as domestic factors.

Read full story below:

Ahead of the US Fed's policy verdict, Ross Maxwell, Global Strategy Operations Lead, VT Markets said in interview with NDTV Profit's Nikita Prasad that the upcoming decision is 'harder to predict' than ever before.

The expert believes that the verdict is a 'tricky call' as the 'conflicting' economic data is not enough to guarantee a rate cut. Wall Street has already priced in a rate cut, which makes markets sensitive to any 'policy misstep'. Maxwell also eyes that easing the policy stance may be positive for Indian markets, depending upon other supportive indicators.

Read full story below:

Here's how the US Federal Reserve set the benchmark rates in the last four years.

The Fed began aggressively raising rates from May 2022 to fight rapidly surging inflation after the Covid and Ukraine War shocks to the economy.

Simce September 2024, the FOMC has reduced rates five times to spur economic growth.

The FOMC meeting is scheduled for Dec 9-10. The policy statement will be announced at 2 p.m. ET on December 10 (12:30 a.m. IST on December 11) at a press conference by US Fed Chair Jerome Powell.

The press conference, which follows the meeting, will be streamed live on the Federal Reserve's social media platforms, such as X and YouTube.

NDTV Profit will also stream the FOMC press conference on its YouTube channel and social media platforms.

The US dollar index is down 0.14% at 99.08 ahead of the Fed FOMC rate decision. The greenback is down against the pound (-0.2%), euro (-0.1%) and yen (-0.2%).

The US 10-year government bond yield was flat at 4.19%, hovering close to the highest level since the first week of September.

US stocks are little changed Wednesday ahead of the Federal Reserve’s interest rate decision. The S&P 500 opened 0.1% lower, while the tech-heavy Nasdaq slipped 0.2%. The Dow Jones Industrial Average traded along the flatline.

Eight out of the 11 sectoral indices on the S&P 500 were trading higher, led by industrials, consumer discretionary and healthcare. Information technology stocks were down.

The US Federal Reserve’s Federal Open Market Committee (FOMC) will announce the monetary policy decision later today, the outcome of which could potentially influence market trends in 2026.

The FOMC is expected to consider a rate cut, currently ranging between 3.75% and 4%. The Fed has previously eased rates by 0.25% at two successive meetings to prevent a softening job market from worsening into a sharp unemployment spike.

The probability of a rate cut has risen in recent weeks, driven by signs of weakening in the job market alongside surveys showing the public’s gloomy outlook on employment, as per reports.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.