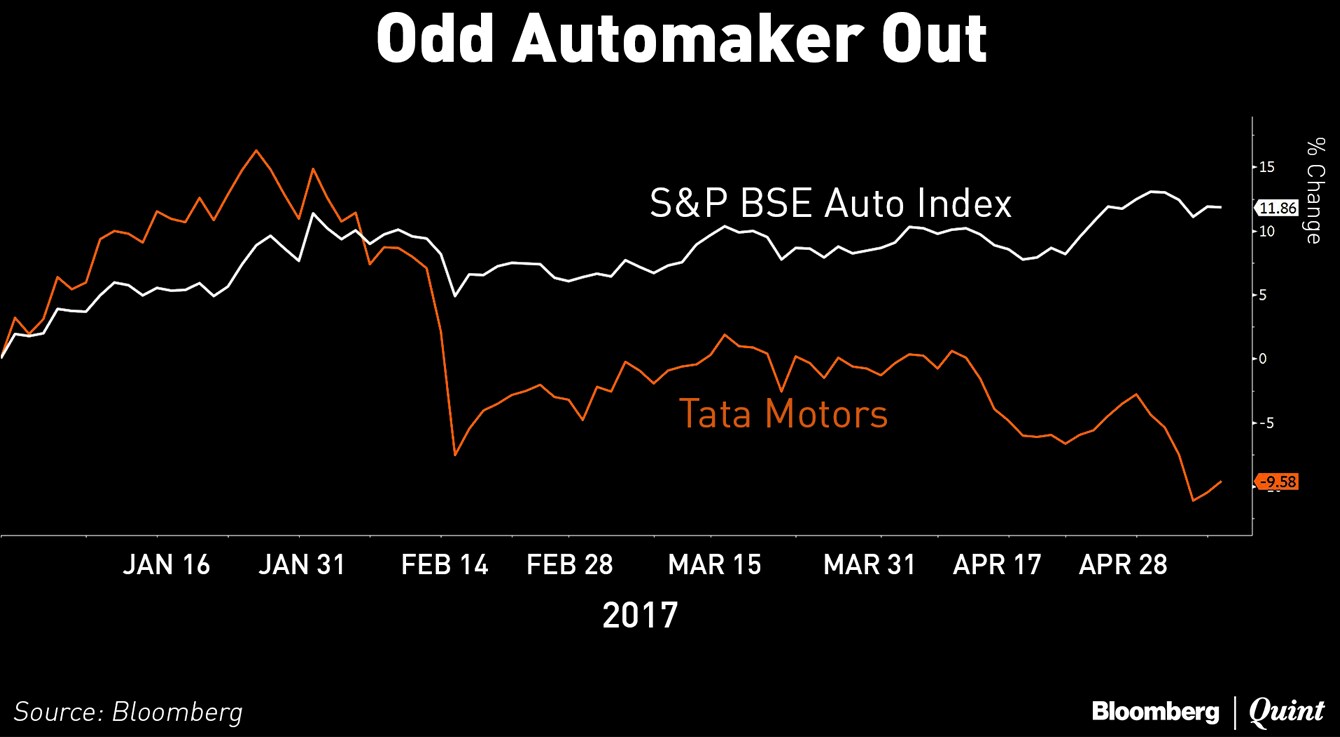

Homegrown auto major Tata Motors Ltd. is off to a rough start in 2017. The stock has fallen over 9 percent, compared to the 13 percent gain for the S&P BSE Auto index.

In fact, Tata Motors is the only stock on the 13-member index which has given a negative return year-to-date.

A lower-than-anticipated margin forecast for its subsidiary Jaguar Land Rover, is among the reasons for the stock's underperformance. The company forecast around 14 percent earnings before interest, taxes, depreciation, and amortization margin -- which is around 2 percentage points lower than estimates, according to ICICI Securities Ltd. A stronger currency, higher advertising spends, and lower profitability estimates for China are also dragging the stock lower.

Also Read: Tata Motors Expects 15% Growth In Commercial Vehicles Exports

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.