For a young earner who has just started his career, achieving the first million or Rs 10 lakh (Rs 1 million) may not be an easy task until and unless one has graduated from one of the leading management or engineering colleges and is hired at a hefty package.

Although, the task is tough it is not unachievable.

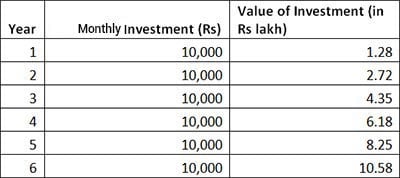

If you are 24 and want to accumulate Rs 10 lakh in your account by the time you reach 30, you will be required to invest Rs 10,000 per month in an asset class which gives you Rs 12 per cent, to achieve the goal.

The following table shows your yearly accumulation. To achieve a rate of return of 12 per cent, you will have to invest fully or majority of your investments into equity as it has the potential to deliver higher return over the long term. It will be difficult to achieve the targeted amount at lower rate of return.

1) Save before you spend: Basically, automate withdrawals from your salary account. Use the electronic clearing service (ECS) provided by your bank so that the amount of monthly investment is deducted from your salary as soon as it is credited to your account.

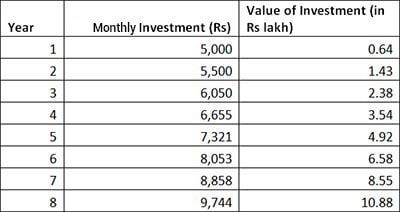

2) Increase your investments with increase in income: It is ok to start investing at a lower amount but as your salary increases you should increase the amount of investment. You should invest at least 25-30 per cent of your salary.

3) Hone up your skills: To increase your salary, you should keep updating your skills regularly. So invest in yourself to be able to move ahead in your career easily.

4) Invest in equities: As you are young, you have time in hand. So you can invest in relatively risky asset class such as equity as they have the potential of delivering inflation-beating-double digit returns over long-term. Debt should be restricted to 20 per cent of your portfolio.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.