(Bloomberg) -- Oil was little changed as traders weighed increasing military activity in the Middle East against diplomatic efforts to alleviate the conflict.

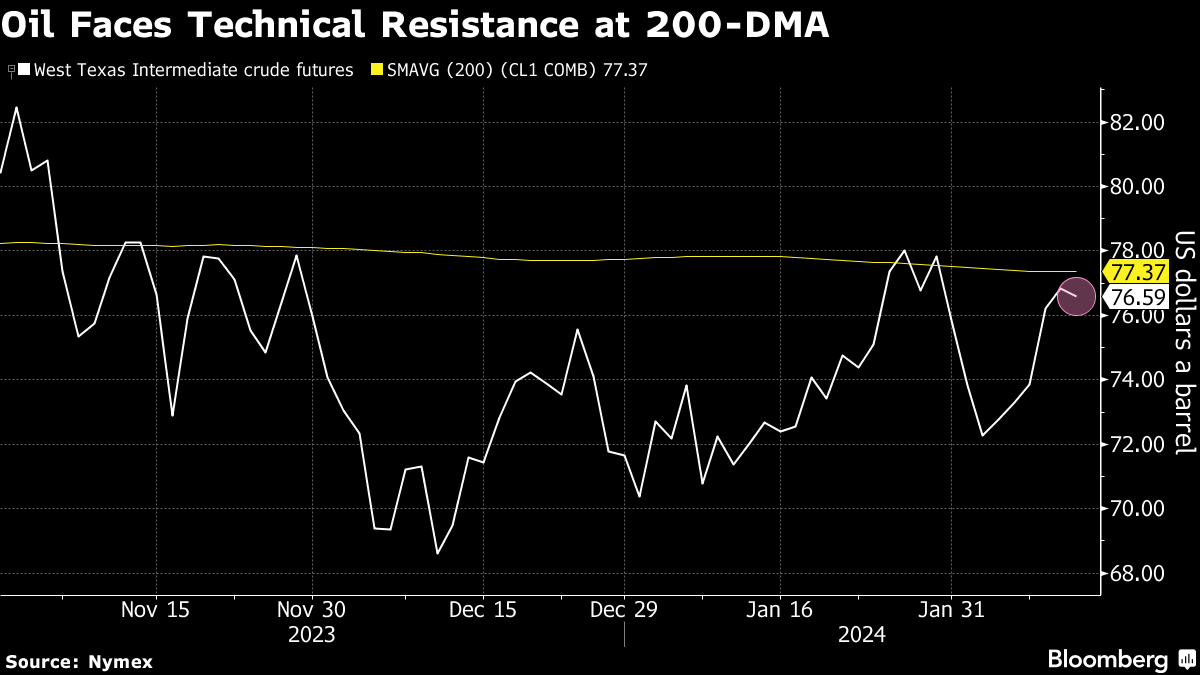

West Texas Intermediate settled near $77 a barrel as Israel's military conducted strikes in Gaza in the southern city of Rafah, where more than 1 million people have sought refuge. Adding to the turmoil, Yemen's Houthis said they attacked another ship in the Red Sea, underscoring the continued menace to vessels in the region.

Also supporting crude was declining crude production from Iraq, the second-largest producer in the OPEC+ alliance. The better-than-expected compliance by OPEC to supply cuts contributed to Morgan Stanley raising its price forecast for Brent to $82.50 a barrel in the first quarter, up from $80.

Keeping a lid on prices were signs of progress toward a diplomatic solution to the war. Iran foreign minister Hossein Amirabdollahian over the weekend discussed the potential release of Israeli hostages captured by Hamas during a meeting with the heads of Palestinian resistance groups.

Oil has traded within a band of about $10 this year as risks from the conflict in the Middle East have been partially offset by ample global supplies and a shaky demand outlook — especially in China, the second-biggest consumer.

Demand forecasts for China have additional downside risks, Goldman Sachs Group Inc. analysts said in a note, citing a surge in electric-vehicle sales and conversations with local consumers.

Traders this week will be looking to monthly reports from both OPEC and the International Energy Agency for further indications of supply and demand.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.