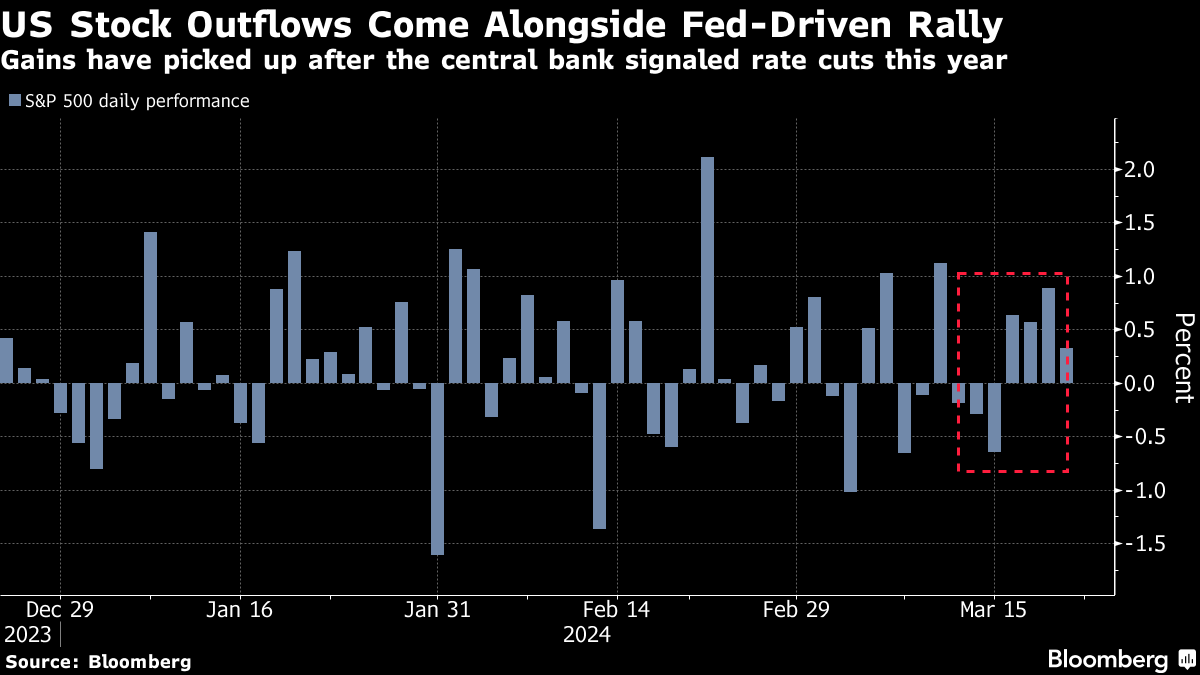

(Bloomberg) -- US stocks saw hefty outflows in the runup to the Federal Reserve's policy meeting that took the S&P 500 Index to fresh all-time highs.

US equity funds suffered redemptions of about $22 billion in the week through Wednesday — the biggest since December 2022, according to a note from Bank of America Corp., citing EPFR Global data. That's alongside a 1.2% advance in the S&P 500 over that period, with the rally building steam following signals that the Fed was on course for three rate cuts this year.

The trend was also a sharp turnaround from the previous week, when US stocks had attracted record inflows. The S&P 500 has now notched an all-time peak 20 times this year, and market strategists including Manish Kabra at Societe Generale SA said the rally had scope to run further amid an upbeat corporate earnings outlook.

Bank of America strategist Michael Hartnett, on the other hand, has warned that the gains are indicative of a bubble. The strategist had remained bearish on stocks last year despite a sharp rally in the S&P 500.

Among other highlights from the note, cash funds posted outflows of over $61 billion, the most since October. Global bond funds registered inflows of $5.4 billion.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.