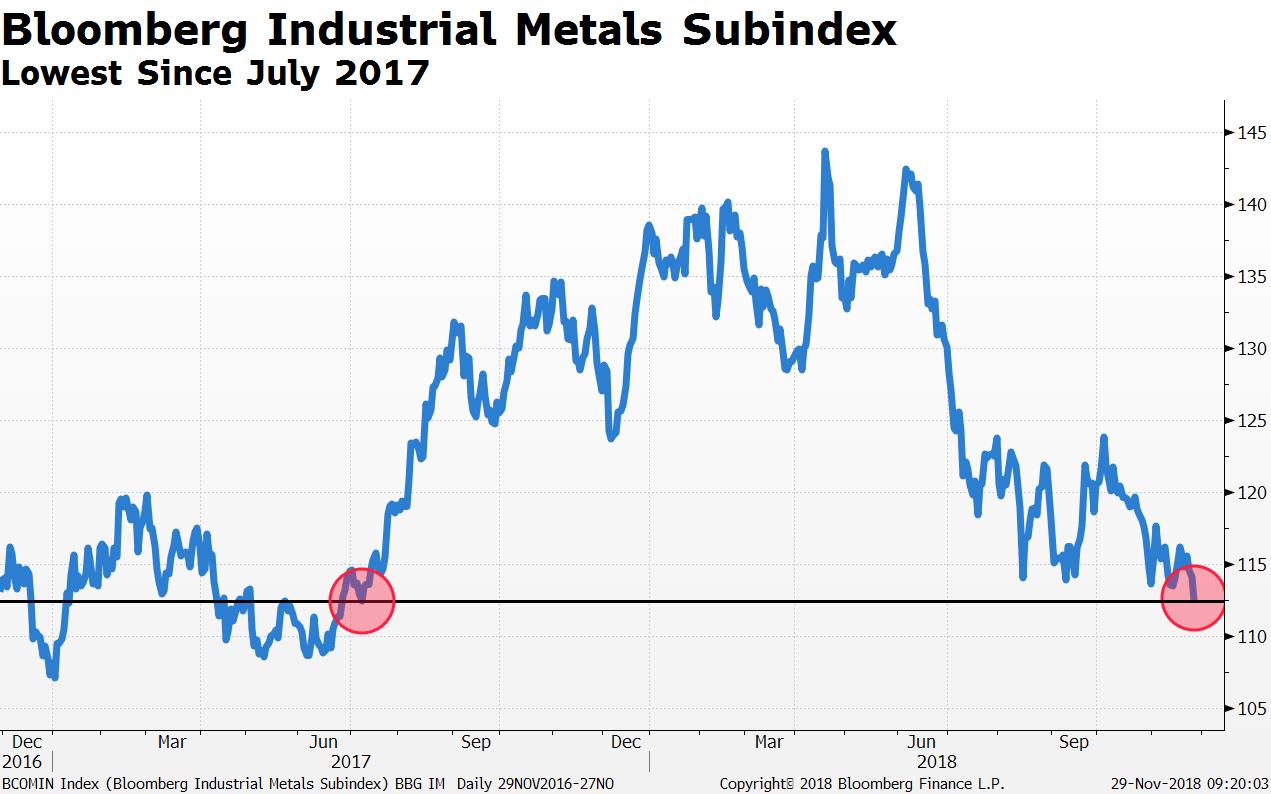

Industrial metal prices have tumbled to their lowest in 17 months as falling demand in China and trade war concerns have made commodities cheaper.

The Bloomberg Industrial Metals Sub-index tracking aluminium, copper, nickel and zinc has plunged close to 19 percent in 2018 to its worst level since July 2017. That tracks a fall in the base metals after they hit 52-week highs in the beginning of the year.

Copper futures, which have the highest weight in the index of 41.38 percent, is down nearly 18 percent and on track for a fourth straight quarter of decline. Zinc tops the list of losers with a 26 percent plunge on the London Metals Exchange.

A weakness in Chinese steel rebar price—down more than 18 percent from its peak in August—due to a slowdown in demand, coupled with rising trade war concerns, hurt commodity prices, Rakesh Arora, managing partner at Go India Advisors, told BloombergQuint earlier. This may not be the end of the cycle and prices could come under pressure against if the U.S. raises tariffs on Chinese imports.

Shares of Indian metal companies—Tata Steel Ltd., Hindalco Ltd. and Vedanta Ltd.—have fallen between 20 and 40 percent tracking the global weakness in commodities.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.