The race to create super apps, or mobile applications which offer a host of services under one umbrella, is heating up. From payment-focused firms, to tech giants and large industrial houses—each wants to become the "one and only" app for customers.

A Covid-induced preference for digital services has only accelerated the attempt to gain the undivided attention of customers.

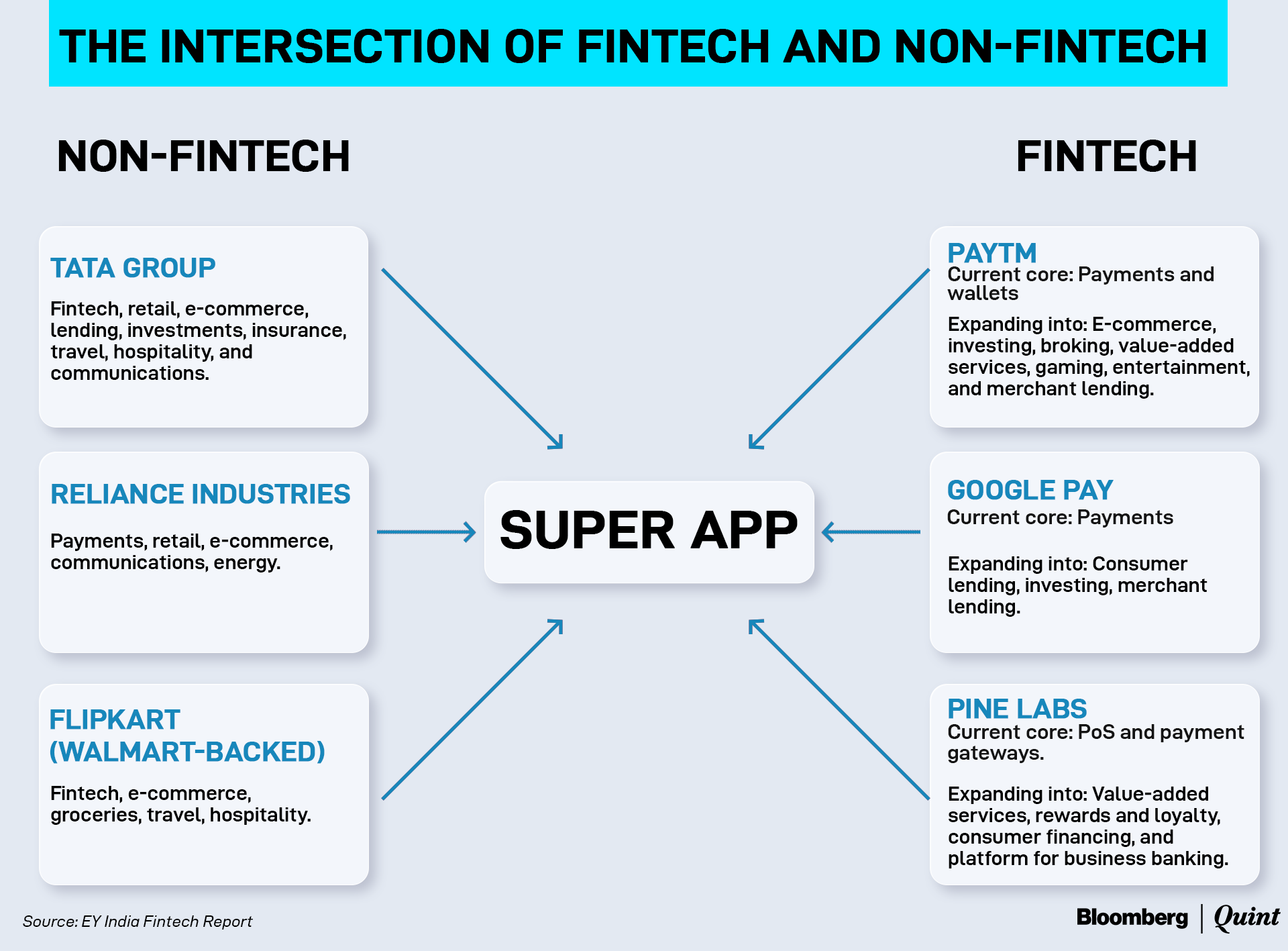

Those currently in the lead include the dominant payment firms like Paytm, PhonePe, MobiKwik and Google Pay, according to EY's India Fintech Report released on Sept. 29. Others like Pine Labs and Razorpay are also expanding offerings. Relatively younger firms such as ZestMoney and Simpl, which started with offering only open banking or digital banking platforms, are not being left behind either, with expansion beginning with the lucrative buy-now-pay-later market.

"Fintech startups are casting a wider net through new product lines and expansion to new geographies, which translates into the re-bundling of financial services," said EY in its report. "Collaboration with other Fintech and financial services players or using API offerings are other ways to quickly test and build new offerings."

Re-bundling Of Financial Services

As fintech firms expand offering beyond core areas, financial services are getting re-bundled.

For instance, Paytm, which started as an online wallet, is now present across at least seven segments. These include investing, equity broking, insurance and merchant lending, apart from ecommerce and travel.

PhonePe, one of the largest in UPI-based payments, has a presence in e-commerce, investing, and insurance.

Google Pay, also dominant in UPI-payments, has a spread across consumer lending, merchant lending and investing.

The re-bundling phenomenon is driven by investors' push for profitability or lucrative exits, said EY. Access to supporting infrastructure technologies, and the opportunity to monetise the data and user base by cross-selling other financial products and services, are other factors playing a part, the report added.

"In a digital ecosystem, customer acquisition and control is everything, said Shilpa Mankar Ahluwalia, partner and head-fintech at Shardul Amarchand Mangaldas & Co. A payment app that becomes the first point of “digital” contact for a customer can then offer multiple financial products over the same digital distribution channel, Ahluwalia added.

This is precisely the model that has fuelled a large part of the fintech growth in India. The move to superapps takes this model to the next level.Shilpa Mankar Ahluwalia, Head - Fintech, Shardul Amarchand Mangaldas & Co

Non-Financial Super Apps

Financial technology firms moving towards super apps have competition from banks and even non-banks.

Industrial houses like the Tata Group and Reliance Industries Ltd., and e-commerce heavyweights like Flipkart are all building out their own apps.

While Reliance-owned telecom operator Jio opted to launch multiple apps under the Jio banner, Tata Group plans to create a super app where all its services will be available under one brand.

Flipkart, too, has built up a wide array of service offerings on its app.

Trends in India are similar to those seen globally.

According to the EY report, most global super app examples have come from non-financial services companies, with consumer tech and e-commerce players embedding diversified financial product and service offerings to become a super app.

Indian conglomerates are leveraging a similar strategy by consolidating all their businesses under one umbrella and payments might follow, said Vivek Ramji Iyer, partner and national leader, financial services risk advisory, Grant Thornton Bharat LLP.

"Reliance / Tata / Flipkart have a focus on e-commerce and payments will be a natural extension to it," Iyer said. "The timing is dependent on how confident they feel about the stickiness of their customer base."

So who's better placed to win the super app sweepstakes?

Super apps from non-financial firms and financial firms will likely co-exist rather than one having the upper hand compared to the other, said Iyer.

"Fintechs aim to collaborate with non-fintechs for balance sheet support and trust with the market. Plus, a lot of historical client data sits with the non-fintech players and partnering with them offers the ability to leverage that with the right technology," Iyer said. "They will coexist is my view, as they both have their strengths."

New Approach To Regulation

The rise of super apps—from financial and non-financial firms—may pose a regulatory challenge. While the Reserve Bank of India has typically followed an "activity-based" regulatory approach, Deputy Governor T Rabi Sankar, recently spoke of the need for an "entity-based approach."

As fintech is transforming the financial landscape, the nature of regulation has to adjust. The sheer diversity in the functions performed by fintech firms necessitates a widening of the regulatory perimeter, he said.

Considering the rise of big tech, he suggests moving to the type of entity being regulated. This, as activity-based directives would be less effective than entity-based rules due to the presence of big tech companies, in particular.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.