Good Bye, Good Day!!

That's all for today folks. However, some parting thoughts:

After delivering outsized returns in 2025, gold and silver are no longer fringe portfolio hedges — they are increasingly being discussed as core holdings. The sharp rally has left investors asking whether 2026 will bring consolidation, correction, or another leg higher.

Well, here is your answer.

Nifty, Sensex Live Today: Reliance Industries, L&T Drag

ICICI Bank, Eternal, Bajaj Finance, SBI Life and Infosys emerged as the top gainers for the day.

On the other hand, Reliance Industries, L&T, TCS and Bharti Airtel were the worst performers of the Nifty 50 index.

Nifty, Sensex Live Today: Nifty Metal Falls Most

Broader indices also ended in the negative. Nifty Midcap 150 ended 1.88% higher and Nifty Smallcap 250 closed 1.94% lower.

All sectoral indices fell with Nifty Metal and Nifty Energy leading the decline.

The market breadth was skewed in the favour of sellers, as 3,153 stocks declined, 1,045 advanced and 175 remained unchanged on the BSE.

L&T, Siemens, BHEL, ABB India Stocks Slide On Fears Of Chinese Undercutting In Govt Tenders

Shares on Indian engineering contract companies Larsen & Toubro Ltd., Bharat Heavy Electricals Ltd., ABB India Ltd. and Siemens Ltd. tanked on Thursday after Reuters reported the government is considering scrapping curbs that restrict Chinese firms from bidding for government contracts.

India is planning to curb the five-year-old restriction in an attempt to normalise commercial ties with Chinese, especially against the backdrop of an easing of diplomatic and border tensions.

L&T, Siemens, BHEL, ABB India Stocks Slide On Fears Of Chinese Undercutting In Govt TendersBHEL Share Price Update: Large Trade In Stock

Over 2.4 million shares of BHEL were traded via a block deal on Thursday. The share of BHEL fell as much as 13.85% to Rs 261.50 apiece. The shares hit over two-month low.

BHEL Shares Fall 10% — Here's Why Investors Are Selling The PSU Stock

Shares of Bharat Heavy Electricals Ltd. (BHEL) have nosedived late in Thursday's trade, despite having confirmed entry into the semi-high-speed rail market earlier in the day.

The stock is currently trading at Rs 273, accounting for a fall of 10% compared to Wednesday's closing price of Rs 303.55.

The sharp plunge in the BHEL stock comes in the wake of a Reuters report that suggests the Indian government is considering scrapping curbs that restrict Chinese firms from bidding for government contracts.

India is planning to curb the five-year-old restriction in an attempt to normalise commercial ties with Chinese, especially against the backdrop of an easing of diplomatic and border tensions.

BHEL Shares Fall 10% — Here's Why Investors Are Selling The PSU StockTransformers & Rectifiers Shares In Focus

The shares of Transformers & Rectifiers saw a sharp decline of over 8%. Here is why there was a steep decline:

Key Management Change:

Resignation of Mukul Srivastava as CEO

Appointment of Satyen J. Mamtora as Managing Director & CEO

Recent Updates:

World Bank removes co from list of debarred firms

Granted extension for submitting explanation in the sanctions case

New deadline for submission is Jan. 12, 2026

What happened earlier?

World Bank Debars TRIL from bidding on its financed Projects

For engaging in alleged corruption and fraud tied to Nigeria project

Pertains to order received in FY20 worth $24.74 mn in Nigeria

Accuses fraudulent practices during the bidding and execution stages

By failing to disclose commission payments to two agents

Accuses corrupt practices by making improper payments to public officials

Q3 Results Live: Transformers & Rectifiers Profit Rises 35%

Transformers & Rectifiers Q3 Results Highlights (Cons, YoY)

Revenue rises 31.7% to Rs 737 crore versus Rs 559 crore.

Ebitda up 47.4% at Rs 125 crore versus Rs 84.8 crore.

Margin at 20% versus 15.2%.

Net Profit rises 35% to Rs 73.9 crore versus Rs 54.7 crore.

Edelweiss Mutual Fund's Radhika Gupta Gives Advice For 2026

"It is important to realise that one's ability to predict is limited but ability to prepare high," she said.

India Inc Set For Robust Earnings Growth In 2026, Says Gautam Duggad

After a sluggish 2025, corporate earnings in India are poised for a rebound in this new year, with the trend likely to be driven by government reforms and tax cuts, according to a top strategist at Motilal Oswal Financial Services, Gautam Duggad.

Gautam Duggad, director and head of research for institutional equities at the firm, spoke to NDTV Profit, offering insights about the upcoming earnings season.

Read more

Silver's Golden Wings — Rally To Hold Through H1 And Correct In H2, Predicts HSBC

Silver’s historic rally is going steady, calming down from the historic highs it hit in 2025 — but its next act may be far less linear. According to a fresh outlook from HSBC Global Research, the metal is likely to remain buoyant through the first half of 2026 before facing a meaningful correction in the latter part of the year as supply responses kick in and demand cools.

HSBC expects silver prices to stay elevated in the near term, supported by lingering tightness in physical markets, strong investment flows and gold’s continued strength.

Stock Market Live: Meesho Trades Near Listing Price

Meesho trades near listing price of Rs 162

Stock down 35% from all-time high Rs 254.40

Meesho slips 9% in 2026 so far

Meesho back to square one after sharp fall

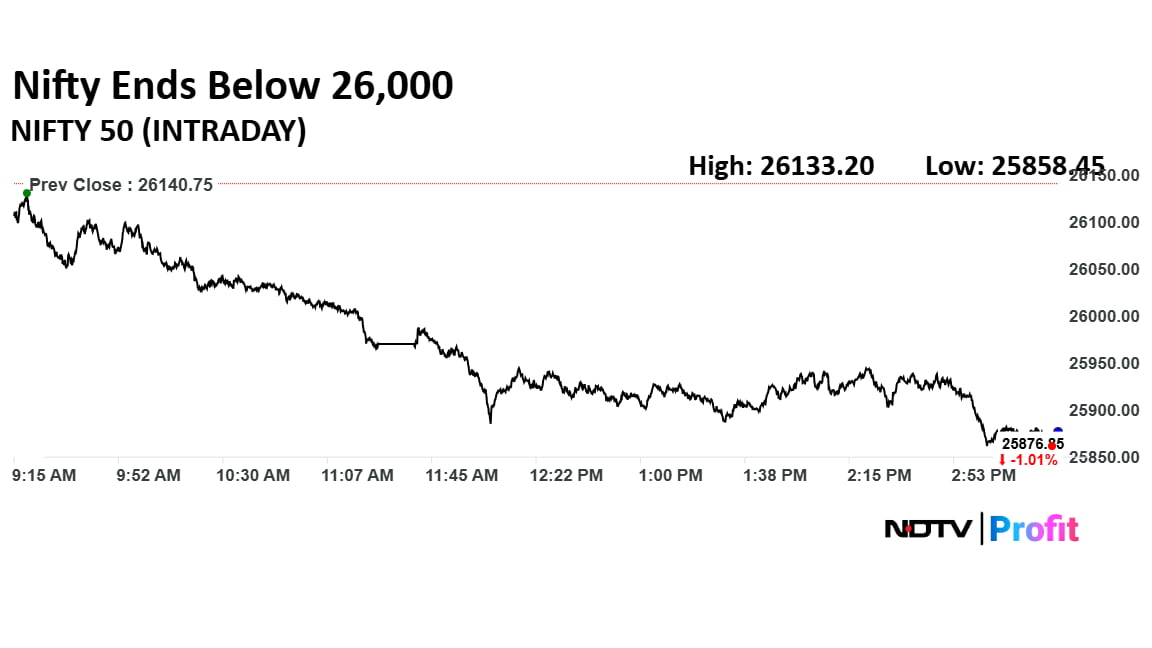

Nifty 50 Today: Over 200 Points Down

Nifty slips over 200 pts in trade

Weak momentum persists for fourth straight session

Nifty 50 hovers near strong 50-EMA support at 25,912

Index down 420 pts this week

Stock Market Live Update: Metals, Aluminium Down

Metal stocks came under sharp selling pressure on Thursday, with Hindustan Zinc plunging 6%, leading losses across the sector. The weakness spilled over into aluminium producers as well, with NALCO, Hindalco Industries and Vedanta sliding more than 3% each.

Angel One Share Price Slips

Shares of Angel One Ltd. pared opening gains to slip into the red in early trade on Thursday after the company announced that its board will meet on Jan.15, 2026, to consider a stock split as well as a dividend payout for shareholders.

In its November business update, Angel One reported gross client additions of 0.5 million (5 lakh), down 11.1% from the previous month and 16.6% from November last year. Its overall client base rose 1.5% month-on-month and 21.9% year-on-year to 35.08 million in November.

Order volumes fell to 117.3 million, a decline of 12.3% month-on-month and 10.4% year-on-year. Average daily orders also decreased to 6.17 million, down 7.7% from October and 15.1% from November last year.

Angel One Share Price Slips After Board To Mull Stock Split And Interim Dividend On Jan 15Nifty Live Today: BHEL Shares In Focus

Bharat Heavy Eletricals Ltd. (BHEL) has entered the semi-high speed rail market by beginning the supply of traction converters for the Vande Bharat sleeper train project, the company confirmed in an exchange filing on Thursday.

BHEL's statement comes at a time when the stock is trading with cuts of almost 3%, though the share priced has inched up slightly since the announcement. In the last month, the stock has given returns of almost 10%.

BHEL Shares In Focus As It Begins Supply Of Crucial Component In Vande Bharat Sleeper Trains — Details InsideNifty, Sensex Live Today: Three Reasons Why The Stock Market Is Down Today

From US tariff, FII selling to decline in metal stocks. Check out why the markets are falling today in this video.

Reliance Industries Share Price Live: Stock Falls Over 2%

The shares of Reliance Industries fell 2.11% to Rs 1,472.50 apiece on Thursday. It pared losses to trade 2.09% lower at Rs 1,473.10 apiece, as of 12:41 p.m. This compares to a 0.85% decline in the NSE Nifty 50 Index.

It has risen 16.40% in the last 12 months and fallen 6.18% year-to-date. Total traded volume so far in the day stood at 0.37 times its 30-day average. The relative strength index was at 54.71.

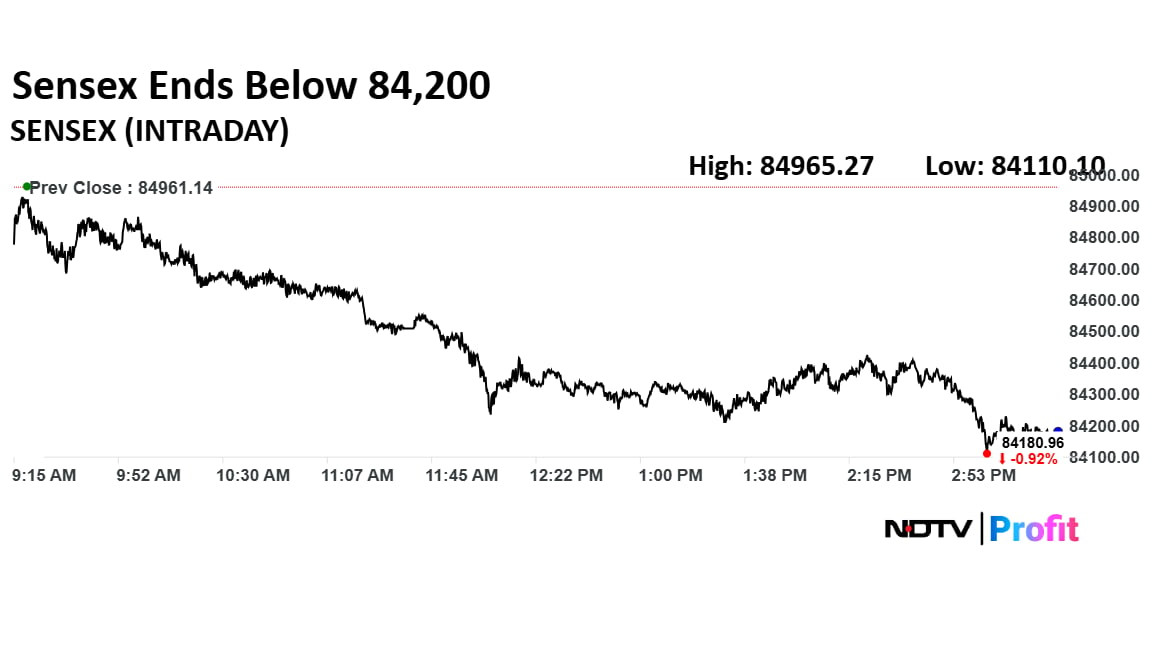

Nifty Falls Below 25,900, Sensex Falls Over 500 Points — Why Is The Indian Stock Market Falling? Explained

The Sensex and the Nifty 50 extended losses for the fourth consecutive session on Thursday taking cue from Asian markets that fell due to weak US economic data and rising geopolitical tensions.

Nifty fell below 25,900, while Sensex was down over 500 points. The broader segment of the market was also in the negative, with the Nifty Midcap 100 falling 1.50% and Smallcap 250 index down 1.45%.

Nifty 50 fell nearly 1% to 25,884.15 level, while Sensex was down 0.86% to 84,230.95.

Volatility index VIX rose over 8% on Thursday.

Read the reasons here.

Options Data

As the markets are declining the options data is suggesting a bearish sentiment. In addition, the FII positioning are coming back to the higher side and the shots are at 90% in comparison to 87% in the last trading session.

EPFO Wage Cap May Be Raised Beyond Rs 15,000 — What Does It Mean For You?

A long-pending proposal to raise the wage ceiling under the Employees Provident Fund Organisation is back in focus. The government is reconsidering an increase from the current Rs 15,000 a month to a range of Rs 25,000-Rs 30,000. If implemented, the move could significantly widen the social security net by bringing millions of additional workers under mandatory provident fund coverage.

The wage ceiling determines the salary threshold up to which employees, in establishments covered under EPFO, must contribute to the retirement fund. At the current cap it is not mandatory for employers and employees earning above Rs 15,000 to contribute to the social security organisation. Those earning above the cap can join voluntarily.

Sensex, Nifty Today: Stock Market Watch 12 PM

Indian equities were trading lower on Thursday, extending the decline for the fourth day.

Intraday, both Nifty and Sensex fell nearly 0.80%.

Nifty fell 0.79% at 25,934.75 as of 12 p.m.

Sensex was down 0.67% to 84,387.92.

Broader indices were trading lower. Nifty Midcap 150 fell 1.55%; Nifty Smallcap 250 was trading 1.45% lower.

All sectoral indices fell, led by Nifty Metal and Nifty oil and gas.

Nifty Bank fell 0.54%, Nifty IT was up 1.57%.

ICICI Bank, Eternal, BEL, HUL and SBILife were top Nifty gainers.

Reliance Industries, TCS, Bharti Airtel, Hindalco, M&M were top Nifty losers.

Google-Parent Alphabet Dethrones Apple To Become World's Second-Most Valuable Company

Alphabet’s stock rose more than 2% on Wednesday, Jan. 7, pushing the Google parent company’s market capitalization to $3.89 trillion, according to Dow Jones Market Data. The rise in market cap has led Alphabet to become the world's second-most valuable company, dethroning Apple.

Apple now commands a market cap of about $3.85 trillion after a fractional decline in its stock price in the session. AI-chip making titan Nvidia is still by far the biggest US company by market cap, worth more than $4.6 trillion.

Google-Parent Alphabet Dethrones Apple To Become World's Second-Most Valuable CompanySwiggy Share Price Update: Large Trade In Stock

Over 1.52 million shares of Swiggy were traded via a block deal on Thursday. The share of Swiggy rose as much as 2.17% to Rs 354.05 apiece.

Nifty 50 Live Today: Nifty Breaches 26,000

As the markets extended their decline Nifty 50 falls below the 26,000 level.

IDFC First Bank Share Price In Focus

The shares of IDFC Bank rose as much as 2% on Thursday after it rolled out another revision to its savings account interest rates, effective January 9, 2025, lowering the headline rate by 50 basis points and reshuffling balance slabs — changes that will directly impact depositors tracking returns on idle cash.

Nifty 50 Live Today: NMDC In Focus

Domestic iron ore price set to rise

NMDC is likely to increase iron ore prices by Rs 400/t in January

Global prices improving owing to restocking demand before Chinese Lunar holidays

At this price, NMDC prices are at 36% discount

Additionally, domestic steel prices increased by Rs 4,500/t to Rs 51,900/t

This provides opportunity to NMDC to increase prices

Every Rs 100/t change in iron ore price leads to 3% change in FY27E EBITDA

Source: Nuvama

Stock Market Live Update: Nifty, Sensex At Day's Low

As of 10:52 a.m. the markets were trading at the day's low with Nifty falling 0.45% and Sensex down over 300 points. Nifty Metal fell the most with Hindustan Zinc leading the decline. Reliance Industries shares were also among laggards with the shares trading over 1% lower.

Reliance Industries Share Price Live: Stock Falls Over 1%

The shares of Reliance Industries fell 1.48% to Rs 1,482 apiece on Thursday. It pared gains to trade 1.26% lower at Rs 1,485.30 apiece, as of 10:48 a.m. This compares to a 0.43% decline in the NSE Nifty 50 Index.

It has risen 17.30% in the last 12 months and fallen 5.49% year-to-date. Total traded volume so far in the day stood at 0.37 times its 30-day average. The relative strength index was at 54.71.

Dee Development Shares In Focus

The shares of Dee Development rose to hit over one-month high as its cumulative orders in the first nine months of this year rose to Rs 793 crore. The scrip rose as much as 13.11% to Rs 236 apiece on Thursday, highest level since Nov. 19. It pared gains to trade 10.91% lower at Rs 231.40 apiece, as of 10:40 a.m. This compares to a 0.43% decline in the NSE Nifty 50 Index.

It has fallen 23.84% in the last 12 months and risen 10.59% year-to-date. Total traded volume so far in the day stood at 17.8 times its 30-day average. The relative strength index was at 66.28.

Kaynes Tech May Cut Revenue Guidance In Q3, Says JPMorgan — Check Slashed Target Price

With the Q3FY26 earnings season just around the corner, JPMorgan has put out a comprehensive preview of the Electronics Manufacturing Service (EMS) space, in which it has given an update on Kaynes Technologies.

The brokerage firm has notably cut the target price on Kaynes Tech, predicting the company to reduce its FY26 guidance on account of delays in revenue from the KAVACH program.

Read more here

Eternal Share Price Update: Large Trade In Stock

Over 1.62 million shares of Eternal were traded via another block deal on Thursday. The share of Eternal rose as much as 2.3% to Rs 287.40 apiece.

Eternal Share Price Update: Large Trade In Stock

Over 5.79 million shares of Eternal were traded via a block deal on Thursday. The share of Eternal rose as much as 2.3% to Rs 287.40 apiece.

HDFC Bank Share Price Update: Large Trade In Stock

Over 8.07 million shares of HDFC Bank were traded via a block deal on Thursday. The share of ICICI Bank fell as much as 0.81% to Rs 941.40 apiece.

Vedanta, Hindustan Zinc To NALCO: Nifty Metal Index Falls

Metal stocks were under pressure on Thursday with the Nifty Metal index falling over 2% to 11,268.10. The decline was led by Hindustan Zinc, NALCO, Hindustan Copper and Vedanta.

LG Electronics Shares In Focus

LG Electronics shares were in focus on Thursday as the company's three-month shareholder lock in ends. The scrip fell as much as 4.3% to Rs 1,393.20 apiece on Thursday, lowest level since listing last year. It pared gains to trade 1.32% lower at Rs 1,437.20 apiece, as of 9:40 a.m. This compares to a 0.19% decline in the NSE Nifty 50 Index.

It has fallen 34.72% in the last 12 months and 5.98% year-to-date. Total traded volume so far in the day stood at 0.24 times its 30-day average. The relative strength index was at 66.05.

Meesho Shares In Focus

Meesho shares were in focus on Thursday after it extended decline for the third day. The scrip fell as much as 4.7% to Rs 465.30 apiece on Thursday, lowest level since Dec. 15. It pared gains to trade 3.09% lower at Rs 166.73 apiece, as of 9:31 a.m. This compares to a 0.30% decline in the NSE Nifty 50 Index.

It has fallen 7.33% year-to-date. Total traded volume so far in the day stood at 0.24 times its 30-day average. The relative strength index was at 44.17.

Nifty, Sensex Live Updates: Metal, Oil & Gas Fall Most

On NSE, 13 out of 15 sectors were in the red. Nifty Metal and Nifty Oil and Gas lead the decline, while Nifty Realty and Nifty Defence were the only sectors in the green.

However, broader markets were in the red, with the NSE Midcap 150 trading 0.25% lower and NSE Smallcap was trading 0.15% lower.

Nifty 50 Live Today: Reliance Industries, TCS Shares Drag

RIL, TCS, Kotak Mahindra Bank, Maruti Suzuki and M&M weighed on the Nifty 50 index.

ICICI Bank, BEL, Eternal, HCLTech and Titan added to the Nifty 50 index.

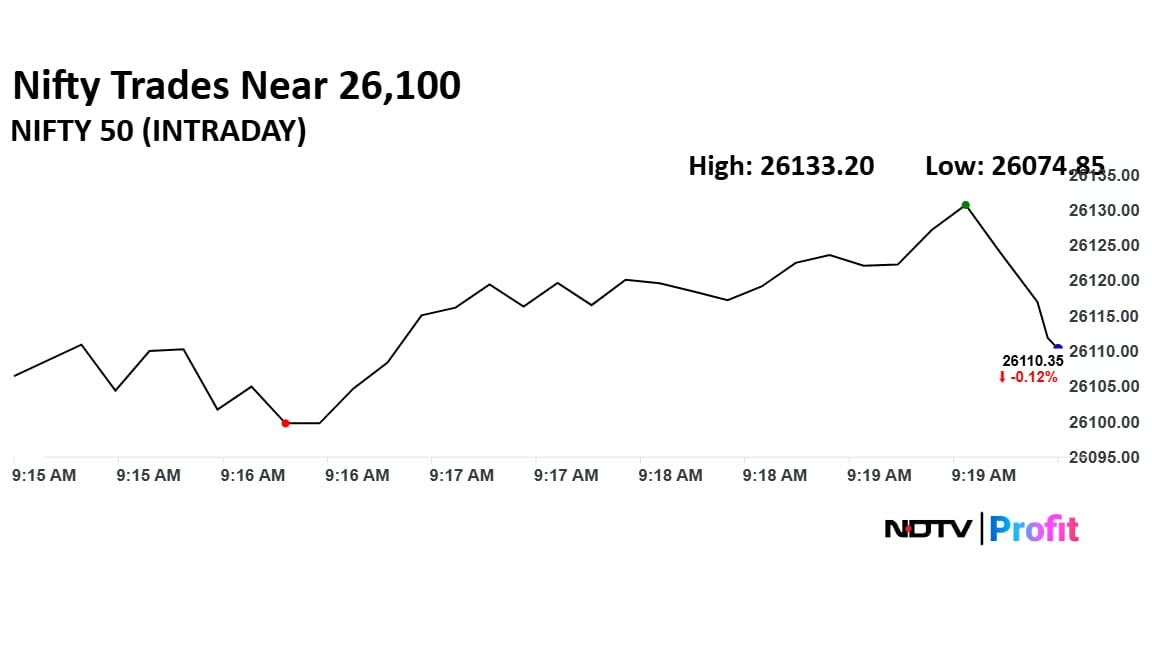

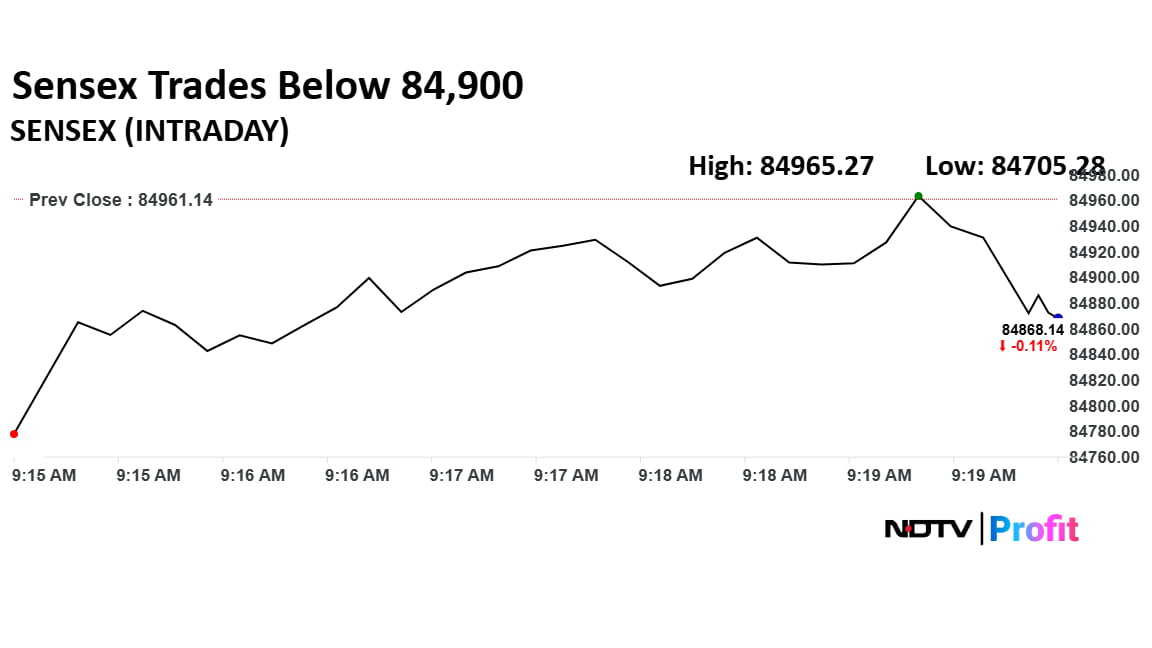

Stock Market Live Update: Nifty Near 26,100, Sensex Opens Nearly 200 Points Lower

The NSE Nifty 50 and BSE Sensex opened lower on Thursday extending decline for the fourth day. The Nifty 50 opened 0.13% lower at 26,106.50 and Sensex opened 0.22% down at 84,778.02. However, minutes after open the Nifty fell below 26,100 to recover and trade 0.05% lower, Sensex was also trading flat.

Stock Market Live Update: Nifty, Sensex Decline In Pre-Open

At pre-open, the NSE Nifty 50 was trading 34.25 points or 0.13% lower at 26,106.50. The BSE Sensex was down 183.41 points at 84,777.73.

HDFC Bank, ICICI Bank Remain BofA’s Top Picks As Growth Outlook Improves Despite Rate Cut Risks

HDFC Bank Ltd. and ICICI Bank Ltd. remain among the top picks of Bank of America (BofA) as the brokerage in its note on Thursday maintained a constructive view on the banking sector, supported by an improving growth outlook, even as concerns around further interest rate cuts remain an overhang.

Read what the brokerages have to say here.

Bharti Airtel, Indus Towers Shares In Focus

Shares of Bharti Airtel and Indus Towers will be in focus heading into trade on Thursday, in the wake of a recent report from Jefferies, which has pegged 2026 as the year of growth and re-rating in the telecom space.

In its latest note, Jefferies has also hiked target price on both Bharti Airtel and Indus Towers while putting emphasis on Jio's IPO, which could potentially drive up sector valuations.

The brokerage firm has retained buy calls on both Bharti Airtel and Vodafone Idea. The price target for Airtel has been raised from Rs 2,635 to Rs 2,760, while the Indus Towers target has been increased from Rs 425 to Rs 510.

Bharti Airtel, Indus Towers Shares In Focus As Jefferies Hikes Target Price; Pegs 2026 As Year Of TelecomEternal, Swiggy In Focus As Morgan Stanley Slashes Targets For India's Darling Internet Stocks

Morgan Stanley has cut price targets across a clutch of India’s listed internet and technology names like Delhivery, Eternal, Swiggy, and Make My Trip. The brokerage has cautioned that the earnings downgrade cycle is far from over amid slowing growth, rising competition and margin pressures. In a recent research note, the global brokerage said it expects further consensus estimate cuts across its coverage universe, even as valuations for select stocks begin to look reasonable.

The brokerage lowered its price target on Delhivery to Rs 445 from Rs 450, Swiggy to Rs 414 from Rs 455, and Eternal to Rs 417 from Rs 427. MakeMyTrip also saw a sharp cut, with the target lowered to $113 from $178.

Eternal, Swiggy In Focus As Morgan Stanley Slashes Targets For India's Darling Internet StocksStock Market News Live: Angel One Business Update

Client base in December up 1.8% MoM to 3.6 crore

Total orders in December up 10% MoM to 12.9 crore

Average daily orders in December up 5% MoM to 58.6 lakh

Gross client additions in December up 35% MoM to 7 lakh

Source: Exchange Filing

Trade Setup For Jan 8: Nifty Support Slips To 25,900

The crucial support level for Nifty 50 slipped below the psychological-mark of 26,000, analysts said after the benchmark index declined for a third consecutive day on Wednesday.

"Overall, we expect markets to remain in a consolidation phase with profit booking emerging at higher levels; while sector-specific movements continue, driven by third quarter business update announcements," said Siddhartha Khemka head of research, wealth management, Motilal Oswal Financial Services Ltd.

Silver Price Check

Silver – which fell 3.8% on Wednesday – is particularly vulnerable to a sharp selloff, given its recent volatility. Silver’s rally — it gained around 150% in 2025 — has been even more spectacular than gold’s. This week alone, it had advanced 7.4% by Wednesday’s close. Silver rose 0.7% to $78.72.

Gold Price Today: Commodity Steadies As Traders Brace For Index Rebalancing, US Data

Gold steadied, after slipping nearly 1% in the previous session, ahead of an annual rebalancing of commodity indexes and the release of key US economic data.

Gold edged down 0.1% to $4,452.63 an ounce as of 9:34 a.m. Singapore time.

Nifty Today: What F&O Cues Indicate

Nifty January futures down by 0.18% to 26235 at a premium of 95 points.

Nifty January futures open interest up by 0.07%.

Nifty Options on Jan 13: Maximum Call open interest at 26500 and Maximum Put open interest at 25500.

Securities in ban period: Sail and Sammaan Capital

Dollar Check

The US Dollar index is up 0.03% at 98.510.

Euro was down 0.01% at 1.1675.

Pound was down 0.04% at 1.3455.

Yen was up 0.10% at 156.91.

Stock Market News Live: Major Announcements From Trump-Overnight

On World

Signs order withdrawing US from 66 international organizations

Green light’s bipartisan Russia sanctions bill

On USA

Increases military budget from $1tn to $1.5tn for 2027

Won’t permit dividends, stock buybacks for defense companies

To ban large institutional investors from banning single family homes

On Venezuela

Discussed counter-narcotics policy with Colombian leader Gustavo Petro

Venezuela to purchase only US products with oil revenue

Stock Market News Live: What Happened Overnight?

US job openings slide to 14-month low; hiring weak in November

Job openings decrease 303,000 to 7.146 million in November

US seized Russian oil tankers

US Sec. State Marco Rubio will meet Denmark Government (On Denmark’s offer to discuss Greenland)

Stock Market News Live: Global Check

Asian equities slipped for a second straight session as the recent record-setting rally began to cool. Treasuries held onto gains after advancing in US trading, helped by mixed US economic data.

Shares opened weaker in Japan and South Korea. Both a global equity gauge and the S&P 500 logged their first declines of 2026 on Wednesday.

S&P 500 futures were little changed as of 9:32 a.m. Tokyo time

Hang Seng futures fell 0.5%

Japan’s Topix fell 0.4%

Australia’s S&P/ASX 200 rose 0.2%

Euro Stoxx 50 futures were little changed

Stock Market Live: GIFT Nifty Hints At Negative Opening

Good morning readers.

The GIFT Nifty was trading near 26,200 early on Thursday. The futures contract based on the benchmark Nifty 50 fell 0.17% at 26,182 as of 6:49 a.m. indicating a negative start for the Indian markets. This comes as the Asian markets extended decline for a second day as its record-breaking rally lost steam.

In the previous session on Wednesday, the benchmark ended lower for the third consecutive session. The NSE Nifty 50 ended 37.95 points or 0.14% lower at 26,140.75, while the BSE Sensex closed 102.20 points or 0.12% lower at 84,961.14.