LG Electronics Shares Trade At Lowest Level Since Listing — Here's Why

Around 15.2 million shares, or nearly 2% of the company's outstanding equity, have been freed up for trading following the expiry of the lock in.

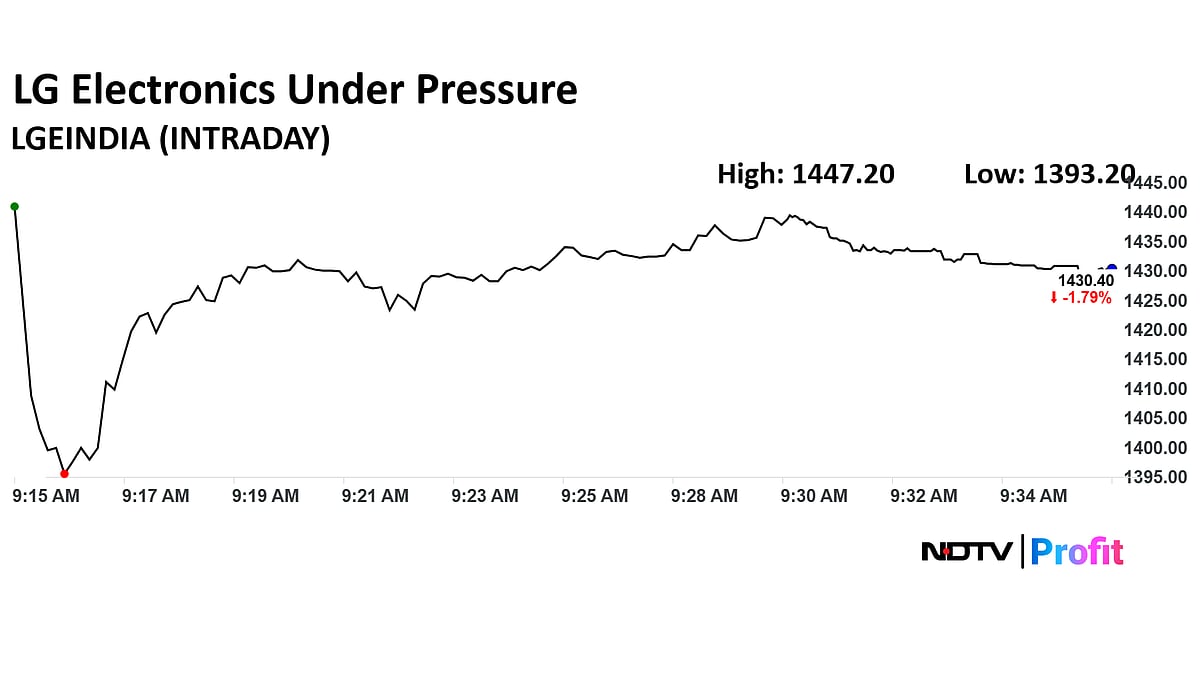

Shares of LG Electronics India Ltd. are trading more than 1% lower in Friday's trading session as the company's three-month shareholder lock in ends today.

The stock is currently trading 1.68% lower at Rs 1432. It also hit the lowest level that the share has dipped since listing.

According to Nuvama Alternative and Quantitative Research, around 15.2 million shares, or nearly 2% of the company's outstanding equity, have been freed up for trading following the expiry of the lock in.

Of the 18 analysts tracked by Bloomberg who have coverage on this stock, 16 have a 'buy' rating, and only two have a 'sell' call on it.

The end of the shareholder lock-in period does not mean all those shares will be sold immediately; it only makes them eligible for trading.

LG Electronics also recently received its lowest price target since its market debut. On December 24, Avendus Spark began coverage of the stock with a 'Reduce' recommendation and set a target price of Rs 1,536 per share.

In its report, the brokerage noted that although competition has intensified and customer bargaining power has declined, LG Electronics’ wide distribution network remains a significant strength and a key competitive advantage.

The brokerage noted that LG’s revenue CAGR over the past five years has lagged industry growth in key segments. Refrigerator and washing machine revenues grew at 5% and 10%, respectively, compared with industry growth of 7% and 11% over the same period. Increasing fixed costs linked to the upcoming manufacturing facility further limit the scope for margin expansion in the medium term.

Since listing, the stock has gained approximately 28% from its issue price of Rs 1,140 but has fallen nearly 17% from its peak of Rs 1,749.