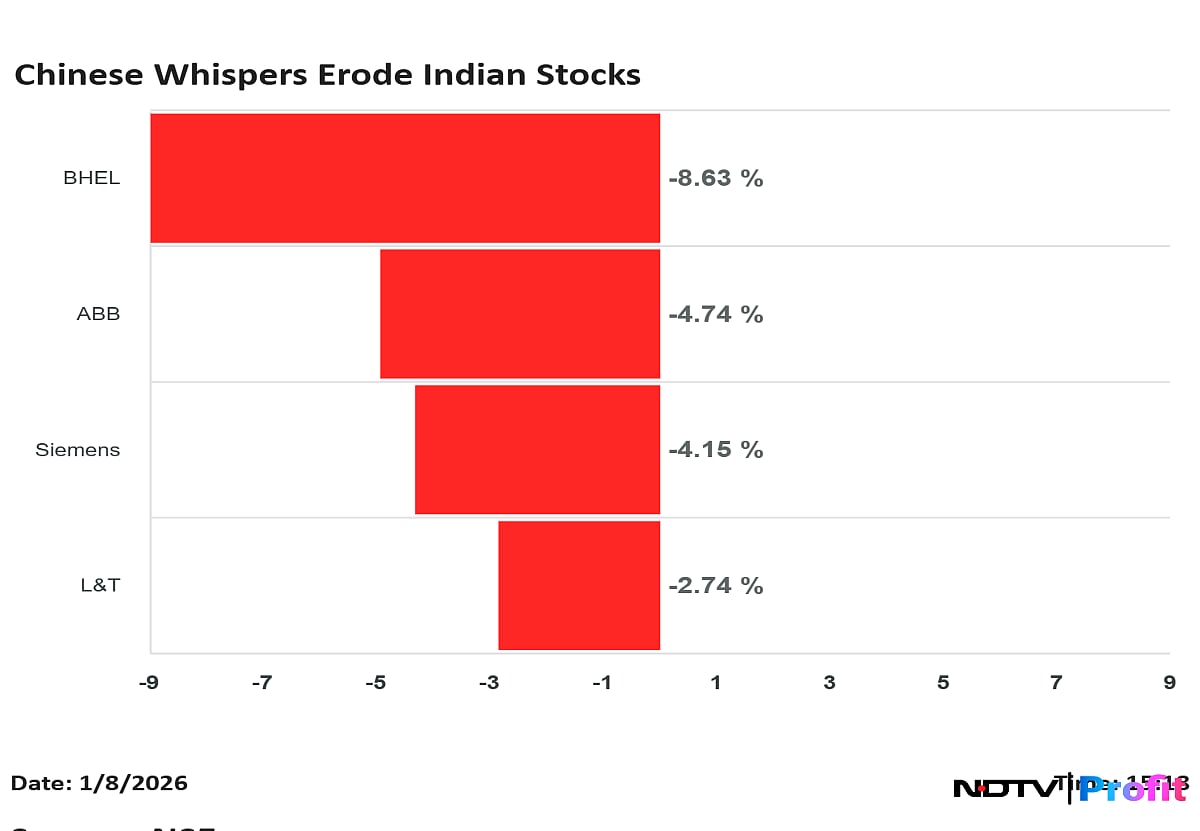

L&T, Siemens, BHEL, ABB India Stocks Slide On Fears Of Chinese Undercutting In Govt Tenders

The move could potentially impact these four companies whose topline and orderbook consist of large government orders.

Shares on Indian engineering contract companies Larsen & Toubro Ltd., Bharat Heavy Electricals Ltd., ABB India Ltd. and Siemens Ltd. tanked on Thursday after Reuters reported the government is considering scrapping curbs that restrict Chinese firms from bidding for government contracts.

India is planning to curb the five-year-old restriction in an attempt to normalise commercial ties with Chinese, especially against the backdrop of an easing of diplomatic and border tensions.

The move could potentially impact these four companies whose topline and orderbook consist of large government orders, as it would mean they will have to directly compete with deep-pocketed Chinese firms.

The restrictions, which were put in place in 2020 after deadly border clashes between the troops, required Chinese bidders to register with a government committee and obtain political and security clearance.

The policy had effectively given Indian firms the luxury to compete for government contracts without having to worry about competition from Chinese firms. During this time, government capital expenditure steadily kept rising.

The news report said the final decision will have to come from Prime Minister Narendra Modi's office.

Intraday, BHEL share price tanked nearly 14%, ABB India dropped nearly 6%, while Siemens and L&T shed 4.6% and 4%, respectively.

In a recent note, analysts at brokerage firm Motilal Oswal said maintains a positive stance on select names in capital goods and defence space.

"With a strong order backlog, improving execution, and government push on infrastructure and defense, the capital goods sector is well-positioned for sustained growth. Investors are advised to monitor commodity price trends and private sector ordering, which is gradually picking up in metals, mining, and thermal power," the firm said.

India is expected to continue spending lakhs of crores in public infrastructure in the coming decade. Some estimates suggest the world's fifth largest economy needs $1 trillion in infrastructure investment to hit its economic objectives.