Angel One Share Price Slips After Board To Mull Stock Split And Interim Dividend On Jan 15

This will be the first time Angel One will announce a split of its equity shares.

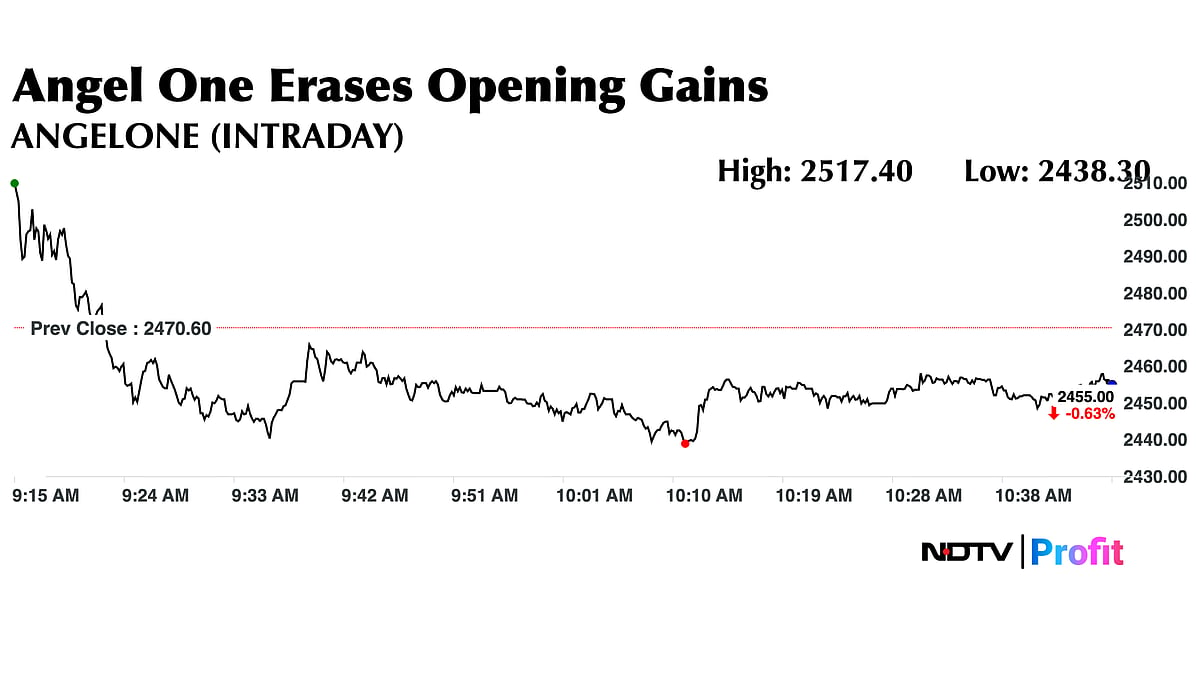

Shares of Angel One Ltd. pared opening gains to slip into the red in early trade on Thursday after the company announced that its board will meet on Jan.15, 2026, to consider a stock split as well as a dividend payout for shareholders.

The brokerage said the board will evaluate a subdivision or split of the existing equity shares, which currently have a face value of Rs 10 each.

The proposed stock split will require approval from shareholders along with other necessary regulatory clearances, the company said in an exchange filing.

This will be the first time the company has announced a split of its equity shares.

A stock split is generally carried out to increase the number of outstanding shares and improve trading liquidity by making the stock more affordable for investors.

Separately, the board will also consider declaring the company’s first interim dividend for the financial year 2025–26.

Angel One has set January 21, 2026, as the record date for the interim dividend. The company has rewarded shareholders with dividends earlier as well.

In its November business update, Angel One reported gross client additions of 0.5 million (5 lakh), down 11.1% from the previous month and 16.6% from November last year. Its overall client base rose 1.5% month-on-month and 21.9% year-on-year to 35.08 million in November.

Order volumes fell to 117.3 million, a decline of 12.3% month-on-month and 10.4% year-on-year. Average daily orders also decreased to 6.17 million, down 7.7% from October and 15.1% from November last year.

Angel One Share Price Today

The scrip rose as much as 1.89% to Rs 2,517.40 apiece, paring gains to trade 1.07% lower at Rs 1,008.30 apiece, as of 10:50 a.m. This compares to a 0.43% decline in the NSE Nifty 50 Index.

Share price has fallen 7.55%% in the last 12 months. Total traded volume so far in the day stood at 1.09 times its 30-day average. The relative strength index was at 46.89.

Out of 11 analysts tracking the company, eight maintain a 'buy' rating, two recommend a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 14.9%.