Vedanta, Hindustan Zinc To NALCO: Here's Why Nifty Metal Shares Fell

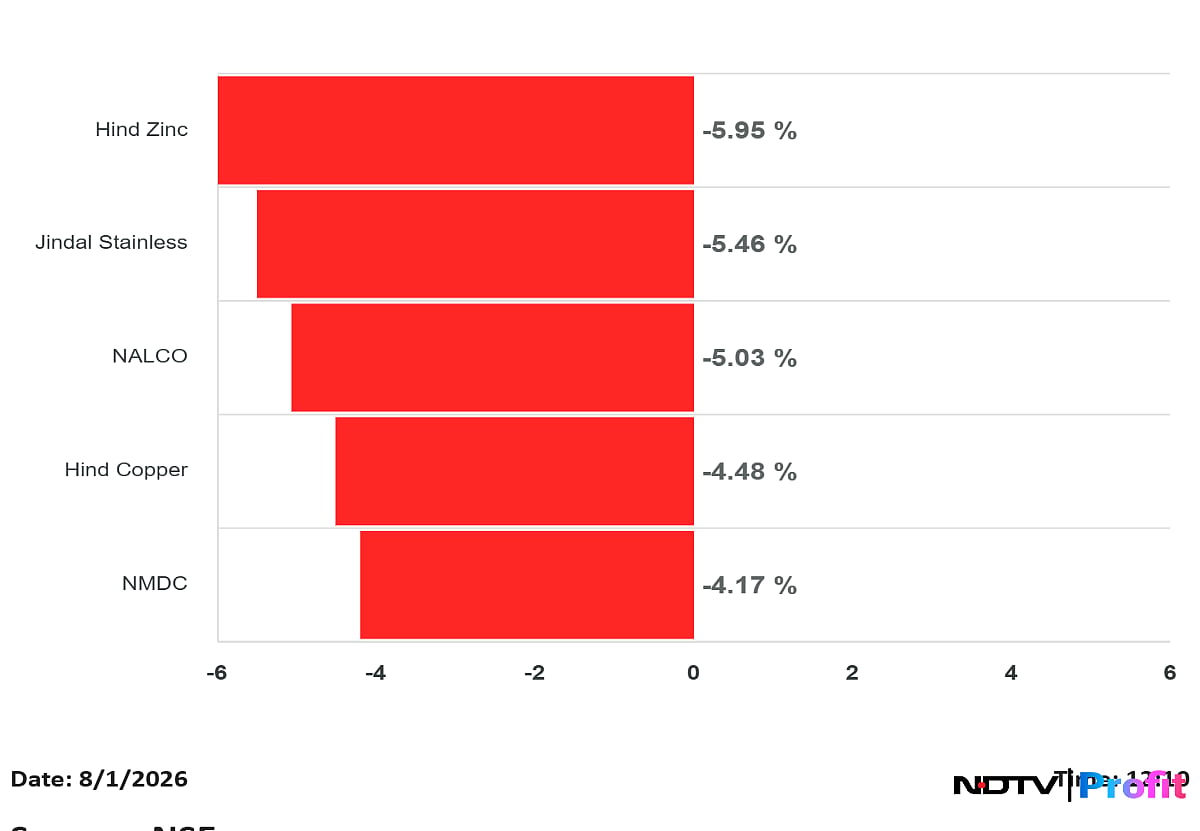

Hindustan Zinc emerged as the worst-performing metal stock, falling over 5% to trade at Rs 596.35, its lowest level since Dec. 19.

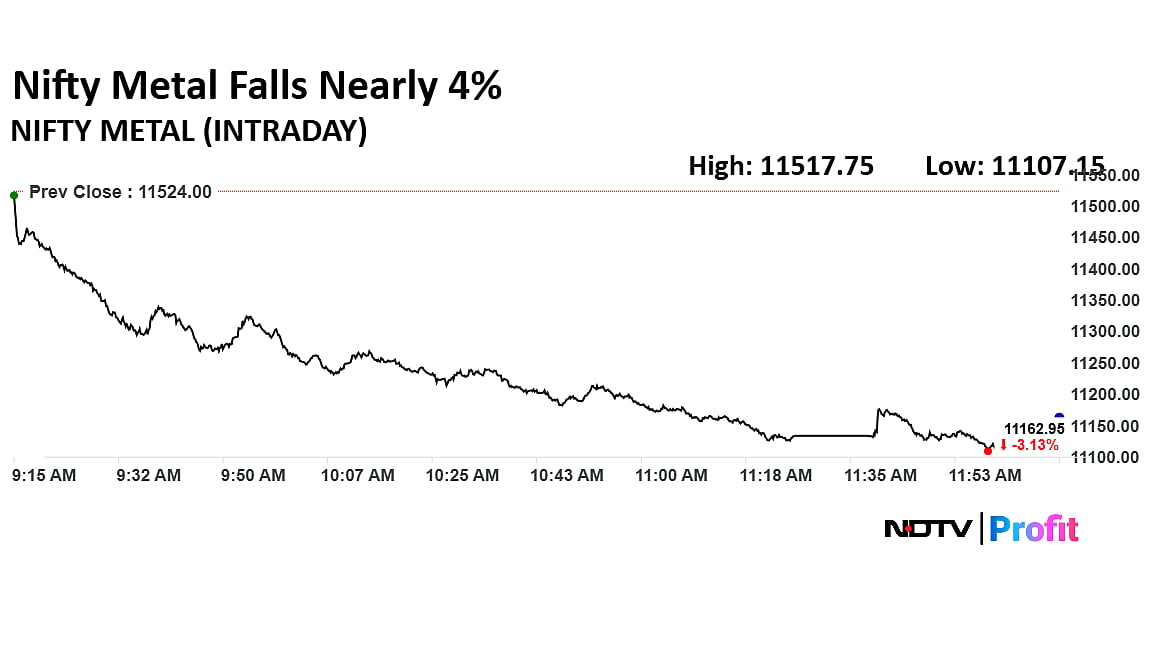

Metal stocks were under pressure on Thursday with the Nifty Metal index falling 3.35%, marking its steepest intraday fall since April 2025 and snapping a two-week gaining streak. The decline was led largely by non-ferrous metal stocks, which had been among the biggest beneficiaries of the recent commodity upswing.

Hindustan Zinc emerged as the worst-performing metal stock, falling over 6% to trade at Rs 588.35, its lowest level since Dec. 19.

National Aluminium Company Limited (NALCO) and Hindustan Copper fell 5.91% and 5.22%, respectively, while Vedanta shed 4.37%.

The decline comes as silver, copper and gold fall on the Multi Commodity Exchange of India. Silver futures, due for a March 5 expiry, were trading nearly 1% lower on Thursday at Rs 2,48,252. On Wednesday silver had snapped a four-day rally, dropping over 3% to Rs 2,51,72 per kilogram. However, MCX silver futures had hit a fresh record-high on Wednesday.

In overseas markets, silver pared its early-morning gains and is now trading slightly higher at $77.72 an ounce.

Similarly, Copper futures on the MCX were trading 0.56% lower at Rs 1,300.45, while spot copper was trading 0.15% higher at $586.90.

Futures for copper, nickel and zinc had declined more than 2% at the close of trading on the London Metal Exchange, trimming sharp gains seen over the past couple of weeks as a broad-based flood of investment in China’s domestic metals markets pushed prices up.

While Nickel settled 3.4% lower at $17,895 a ton on the LME as of 5:55 p.m. London time, Copper closed 2.6% lower at $12,899.50, as all other major metals declined on the exchange.

Aluminium was down 1.29% and Lead fell as much as 0.79% during the close. According to analysts at Kotak Securities the fall was on the back of profit booking following a strong rally that had pushed prices to record highs earlier in the week. "The move was due to firmer U.S. dollar and caution ahead of a heavy slate of U.S. economic data that could shape the policy outlook of the Fed," Kotak Securities added.

Looking ahead, the outlook across the metals space remains mixed rather than uniformly bearish. Non-ferrous players continue to enjoy structural tailwinds from the broader commodity upcycle, and earnings support from higher average metal prices remains intact despite short-term corrections. Ferrous metal companies, however, face a softer near-term outlook due to weak steel prices and margin pressure in Q3. Precious metals, despite recent volatility, remain relatively well positioned over the medium term, supported by rising geopolitical tensions and their role as safe-haven assets.