Meesho Trades Near Listing Price As Shares Stuck In Lower Circuit For Second Session

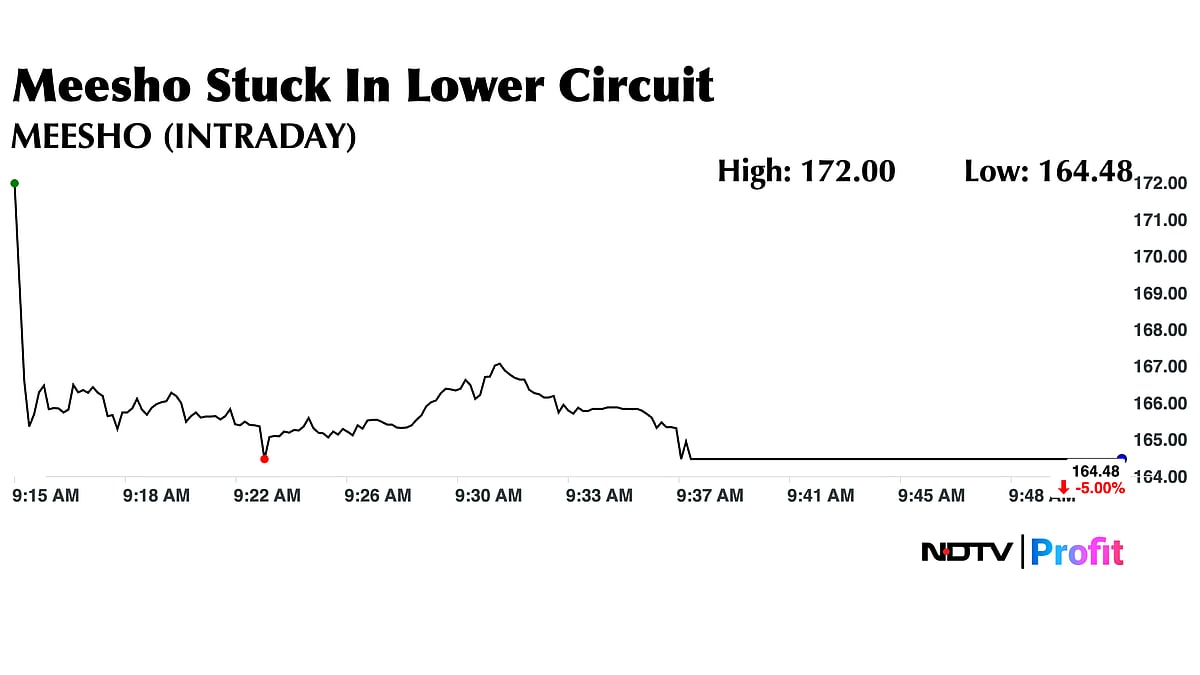

The e-commerce company’s stock remains stuck in the 5% lower circuit for the second straight day, currently trading at Rs 164.48 apiece.

Shares of Meesho Ltd. continued to decline as the one-month shareholder lock-in period expired on Wednesday, and senior executive Megha Agarwal quit the company after a seven-year stint .

The e-commerce company’s stock remains stuck in the 5% lower circuit for the second straight day, currently trading at Rs 165.22 apiece, close to its listing price of Rs 162. Of the two analysts tracked by Bloomberg who cover the stock, both have a ‘buy’ rating, implying an upside potential of 21.3%.

The expiry of the lock-in does not imply that all such shares will be sold immediately; it only makes them eligible for trading.

Even with recent volatility, Meesho’s stock is still trading comfortably above its IPO price. The shares are up nearly 48% from the issue price of Rs 111, despite a correction of around 35% from the post-listing high of Rs 254.

SoftBank-backed Meesho made a strong market debut on December 10, listing at a premium and closing its first day of trade 53% above the IPO price.

The three-day IPO, worth over Rs 5,000 crore, saw robust participation from all investor classes. It was subscribed 79 times overall, with the retail category receiving bids more than 19 times the allotted portion and the qualified institutional buyers’ segment subscribed about 120 times.

The sharp rally in mid-December last year was driven largely by strong initial demand and short-covering. As that momentum tapered off, profit-taking set in, leading to a natural correction. With sentiment turning swiftly, the stock experienced steep downward pressure.

Although Meesho continues to deliver strong revenue growth and operates a distinctive social-commerce model, the path to sustainable profitability remains unclear. Investors are increasingly cautious on earnings visibility, particularly as markets now place greater emphasis on profitability rather than growth alone.