Correction To Comeback: Nifty At Inflection Point — Will Indian Equities Rebound In 2026?

Analysts believe the weakness is set to reverse in 2026 supported by India's solid macroeconomic fundamentals, improved corporate earnings growth and a final seal to the US-India trade deal.

They say once you hit rock bottom, the only way is 'up'. For India's stock market analysts, this proverbial phrase defines the 'broadly constructive' outlook of domestic equity indices as it welcomes the new year, 2026.

To be clear, the defining feature of 2025 or the supposed 'rock bottom' for India's financial markets has been its sharp underperformance compared to most developed and emerging markets amid stretched valuations.

However, most analysts believe this weakness is set to reverse in 2026 supported by India's solid macroeconomic fundamentals, improved corporate earnings growth and a final seal to the US-India trade deal.

After Sensex and Nifty's tumultuous journey in 2025, which was wrought with challenges from Trump tariffs to FPI exodus, the Indian stock market is now at crossroads, to welcome 2026, and trace its annual path, starting from correction, consolidation, to finally, making a comeback.

Why was 2025 painful for Indian equities?

2025 proved to be a year of consolidation and recalibration for Indian equities, marked by intermittent volatility and global headwinds. Nifty entered the year in correction mode after hitting back-to-back record highs in 2024, with the correction extending until early April 2025 amid US tariffs.

Throughout the year, the market movement was largely influenced by the global trade dynamics, persistent foreign capital outflows, rupee's volatility against the US dollar, and the evolving geopolitical developments.

Despite a relatively stable domestic macroeconomic backdrop, moderation in earnings growth across select sectors—especially in small-cap stocks—kept markets range-bound. Towards the end of 2025, Nifty recovered most of its losses and clinched a new record high, hitting 26,325 on Dec. 1, 2025.

"2025 wasn’t an easy year for Indian markets. Performance lagged, global peers raced ahead, and investors were reminded that even strong stories go through uncomfortable phases," said Pranav Haridasan, CEO, Axis Securities. ''But, it was also a year when growth held, inflation eased, external balances managed, and domestic savings had faith with market."

"Below the headline numbers, the market structure actually got stronger. Primary markets stayed active, the listed universe widened, domestic institutions held steady, retail participation didn’t fade, and technology-driven investing became more mainstream. In ways, the market became broader, deeper, and a little more mature," added Haridasan.

Image: InCred Equities

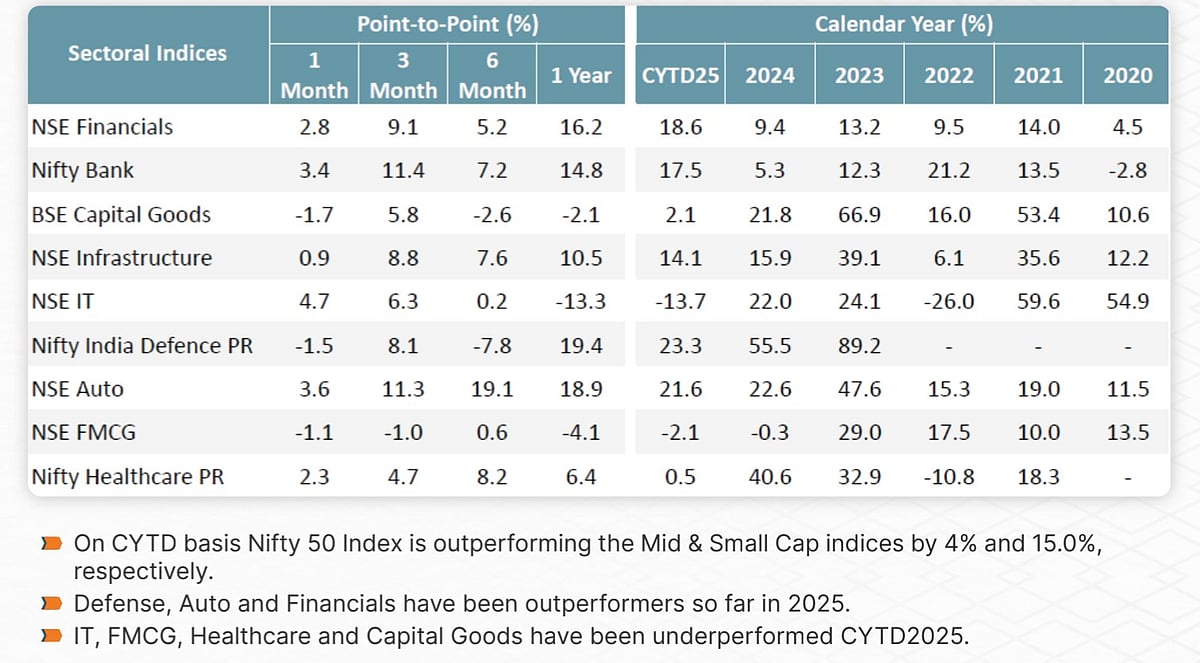

Domestic and global factors that shaped market performance in 2025:

RBI Monetary Policy Easing: The central bank implemented four repo rate cuts for easing, amounting to a cumulative 125 basis points, bringing the monetary policy interest rate down to 5.25%.

RBI's Liquidity Boost: A 100 basis point reduction in the cash reserve ratio was implemented in four tranches, releasing Rs 2.5 lakh crore of primary liquidity. It also conducted multiple open market operations.

India's GDP, Inflation: India’s economic fundamentals remained strong, with GDP growth of 8.2% in Q2 FY26 driven by consumption, while the latest CPI inflation was below RBI's 2% target.

Corporate Earnings: Nifty 50 reported single-digit growth, with profit rising 2% YoY in Q2 FY26, marking the sixth consecutive quarter of muted earnings growth. It reflected valuation-led consolidation rather than earnings-led expansion.

FII Outflows: FIIs were net sellers of Indian equities throughout most of the year, with cumulative outflows of around Rs 2.31 lakh crore as of Dec. 20, 2025, including the annual primary market investments.

What does 2026 have in store for Indian equities?

The outlook for 2026 appears constructive, with steady market growth expected on the back of an earnings recovery, improving liquidity and a gradual revival in private sector investment. Union Budget 2026 is likely to be a key catalyst, particularly for consumption and investment-led sectors.

According to Nitin Rao, CEO, InCred Wealth, the market story evolves from cautious to cautiously positive. 2026 may see a transition from valuation-driven investment returns to earnings growth-driven investment returns. Instead of a breakout, equities are showing directional improvement.

As we move into 2026, most domestic brokerages believe improving earnings visibility, supportive policy measures and the potential turnaround in FII flows create a favourable backdrop for Indian equities.

"These are favourable factors but not sufficient to trigger a rally soon. A strong rebound in the market needs a trigger like US-India trade deal with favourable thrills for India. There is no clarity on when this will happen," said Dr VK Vijayakumar, Chief Investment Strategist, Geojit Investments Ltd.

"Therefore, a consolidation phase is likely in the near-term, and investors can utilise this consolidation phase to slowly accumulate high quality stocks giving priority to largecaps," added Dr. VK Vijayakumar. Pranav Haridasan of Axis Securities also sounds caution. ''The outlook is constructive, but with both feet on the ground,'' he claimed.

''India’s growth engine, policy continuity, capex momentum and earnings visibility provide comfort. However, geopolitics, slower global growth, potential unwinds in crowded trades such as AI, and shifting global yield dynamics including Japan's, mean volatility will be a part of the journey," said Haridasan.

Top themes for 2026: What should you bet on?

According to Ajay Menon, MD & CEO, Motilal Oswal Financial Services, key opportunities may emerge financials, supported by healthy credit growth, improving return ratios and strong balance sheets. Consumption-oriented sectors such as automobiles should benefit from improving demand.

The market expert also said that industrials and capital goods are well positioned on infrastructure spending and localisation initiatives. Healthcare offers defensive growth opportunity, and digital and e-commerce themes provide long-term compounding potential.

2026 offers a favourable backdrop for disciplined investors focused on fundamentally strong businesses aligned with India’s long-term growth story, according to Menon. "On balance, 2026 appears to be a year where progress rather than dramatics will be the key to investment success; where patience, balance, and asset allocation will form the pillars on which investment decisions would rest." said Nitin Rao of InCred Equities.

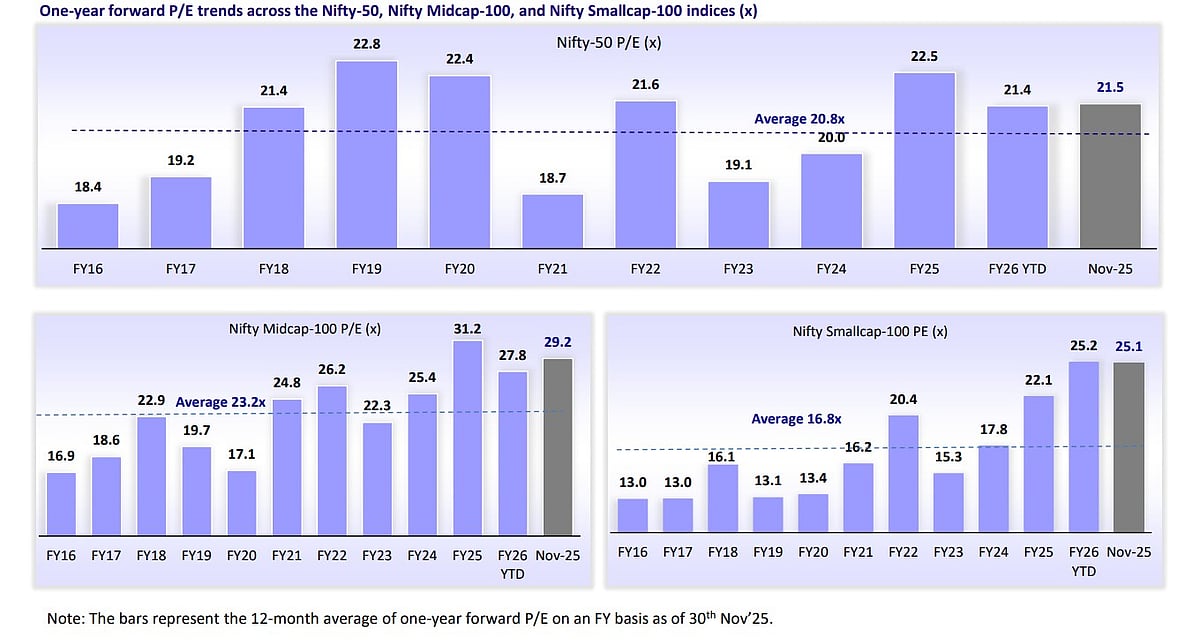

Chart: Motilal Oswal Financial Services

From a valuation standpoint, Nifty's one-year forward P/E stands at 21.5x, around 4% above its long-period average of 20.8x, according to Motilal Oswal. Valuations in the broader market remain elevated.

Nifty Midcap-100 and Nifty Smallcap-100 are trading at P/E multiples of 28.3x and 25.9x, representing premiums of ~26% and ~50% over their respective long-term averages. ''This suggests that large-cap valuations are relatively more reasonable after the recent consolidation,'' it said.

The midcap and small-cap stocks warrant a more selective approach, with a focus on companies that have strong balance sheets, sustainable cash flows and clear earnings visibility, according to the domestic brokerage.