Trump, Tariffs And Turmoil: How Wall Street Navigated Market Swings In 2025

Here are some recollections from money managers and strategists about how they navigated the most pivotal market moments of 2025.

Jed Ellerbroek barely slept.

It was the evening of Wednesday, April 2, and President Donald Trump had just appeared in the White House Rose Garden, brandishing a large placard with the punitive tariff rates he was slapping on countries around the world. On Wall Street, it quickly sunk in that Trump was serious about shattering a global trading system that he said was wired against the US.

Over dinner with his family and throughout the night — as Asian markets tumbled, initiating a meltdown that would continue around the globe — Ellerbroek, a portfolio manager at Argent Capital Management, tried to game out what would happen next.

US President Donald Trump holds a reciprocal tariffs poster during an announcement in the Rose Garden of the White House on April 2.

When he and his team hunkered down the next morning at their office in St. Louis, they sought to work through the implications for their stock holdings. As the selloff raged that day, Amazon.com Inc. — their largest position — tumbled nearly 10%.

Like investors from Tokyo to New York, Ellerbroek was getting a frantic crash course in navigating what would be an unusually volatile year. The S&P 500 Index careened to the cusp of a bear market. Then sentiment reversed almost as quickly, unleashing one of the swiftest stock recoveries in decades and sending the benchmark back to new record highs. The overall lesson was that not panicking — or taking the leap to buy the dips — paid off.

The twists and turns of the US economy and the artificial-intelligence boom both played a role. But much of it could be traced to the White House.

“Volatility is a feature, not a bug,” Irene Tunkel, chief US equity strategist at BCA Research, said of the Trump administration’s effect on markets. “This year rewarded people who were very nimble, very humble and were very willing to incorporate new information.”

Also, she said: “You had to be brave.”

Here are some recollections from money managers and strategists about how they navigated the most pivotal market moments of 2025:

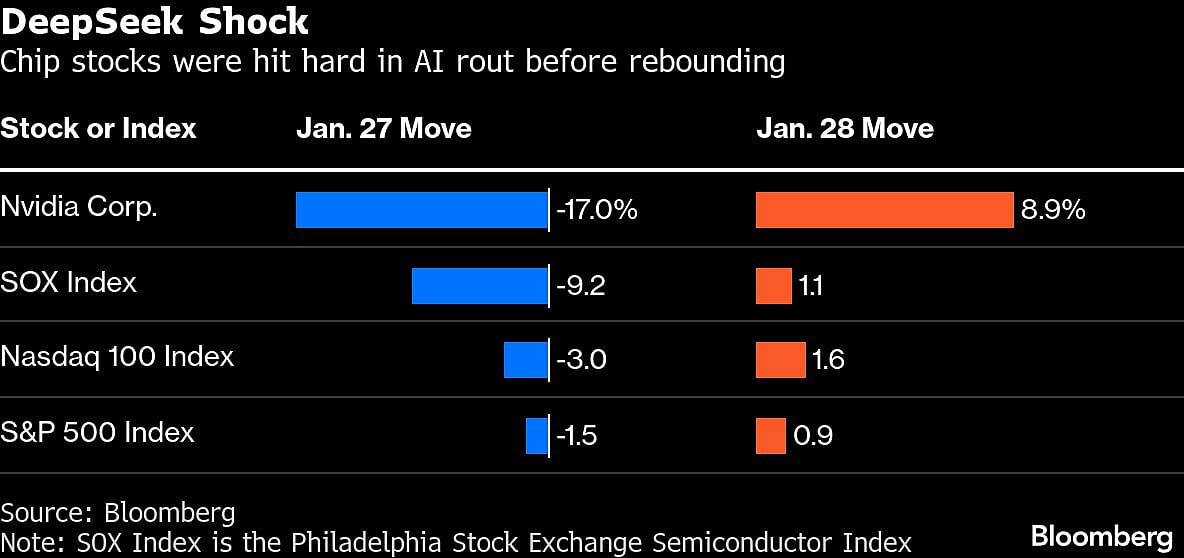

Jan. 27: DeepSeek

Venture capitalist Marc Andreessen on Jan. 26 called it “AI’s Sputnik moment.” The rollout of a powerful, seemingly low-cost AI program by DeepSeek, a Chinese upstart, appeared to threaten the foundations of the recent US tech boom. When US markets opened the next day — a Monday — Nvidia Corp. shares plunged 17%, erasing nearly $600 billion from its value in the largest wipeout in market history. Semiconductor stocks had the worst day since March 2020.

Nancy Tengler, the head of Laffer Tengler Investments Inc., said her heart raced as she scrolled her phone, trying to catch up with the news while in the car on her way to CNBC for a television interview. As the details became clear, she said her reaction was, “This is an opportunity.”

Like some others, she was skeptical of DeepSeek, thinking it had low-balled its cost estimates. She struck a bullish tone toward tech stocks in her TV appearance. Her firm snapped up shares of Nvidia and other AI favorites.

It turned out to be a good call. DeepSeek didn’t sound the death-knell of the American approach to AI or stanch the flood of big-tech spending to develop the technology. The Nasdaq 100 Index was back at a record high within a month and went on to a 21% gain in 2025. Nvidia is up 40% this year.

ALSO READ

US Stock Market Today: S&P 500, Nasdaq Trade Little Changed As Year-End Cheer Eludes Wall Street

April 2: ‘Liberation Day’

Garrett Melson’s first reaction was shock. Then in the coming hours, as markets tumbled and social-media users tried to piece together what exactly Trump had just done, the fleeting relief of gallows humor: Trump’s trade war, as was soon caught, had gone so far as to penalize uninhabited islands near Antarctica that are populated by penguins.

“Watching a sea of red on your screen, sometimes you have to laugh a little bit,” said Melson, a portfolio strategist at Natixis Investment Managers Solutions.

It was the biggest two-day jolt to global markets since March 2020, when the pandemic started shutting down the US. It set off days of panicked selling when China retaliated, recession fears flared, and Treasuries slid — breaking from their typical haven role — as Trump’s willingness to challenge the global economic order cast doubt on the safety of US government debt.

In the days after the president’s announcement, Melson worked with his colleagues late into the evening and during the weekend running analyses, staring at charts and cranking out commentary for clients. In one portfolio model, the team increased its allocation to US stocks and corporate bonds.

At Argent, Ellerbroek sent an email to the investment team on April 4. “This is a scary moment,” he wrote. “If you made me pick whether we are closer to the start or finish of this episode, I’d probably say start.” Ellerbroek stuck to his positions, deciding against snapping up beaten-down stocks because there was simply too much uncertainty.

A monitor displays stock market information at the New York Stock Exchange, on April 4.

Neil Sutherland, a fixed-income investor at Schroder Investment Management, and his colleagues started a project to track the fallout. They updated the average US tariff rate on affected countries as Trump kept rolling out new salvos, modeling the asset-price implications and relaying their findings to anxious clients. Eventually, they gave up.

“It just honestly became meaningless because it would change in the space of five minutes,” Sutherland said. “We just had to come to realize that it’s a moving target.”

April 9: The Tariff Pause

Tunkel, the BCA stock strategist, had taken the day off to hunt for a house in Boca Raton, Florida. It had been a relatively quiet day for stocks, with the S&P 500 drifting sideways. But she stayed tuned to the radio during the three-hour drive from her home in Venice, on the Gulf Coast.

Then, when she stopped for lunch and tuned out, the fear that descended on Wall Street days earlier quickly gave way to euphoria. At 1:18 p.m., after the bond-market selloff raised fears in Washington by pushing interest rates higher, Trump announced he was pausing many of his tariffs for 90 days. The S&P 500 surged 7% in less than 10 minutes and went on to a 9.5% gain — its biggest one-day jump since October 2008.

“This magnitude of the moves in response to the piece of news — I think this is something that is historical,” Tunkel said. “We’ll always remember those moments.”

Jay Woods, the chief market strategist at Freedom Capital Markets, saw the moment firsthand from his perch at the New York Stock Exchange. After the initial roar faded, he prepared to welcome a group of visitors. He was teaching a class in technical analysis at Fordham University. By chance, he had scheduled a field trip for his students to visit.

By the time they arrived, the Big Board was a sea of green — nearly everything up, with the so-called fear gauge, the VIX, one of the few exceptions. Alerts rang out constantly from brokers’ desks, including some with the ring of a cash register’s chime.

The day set up a dynamic that would occur repeatedly over the next several months and came to be known as the TACO trade, short for Trump Always Chickens Out. Traders started to discount his worst tariff threats, wagering they were only a negotiating tactic. Selloffs, therefore, were buying opportunities.

Chase Games, one of Woods’ students, was sucked in by the excitement. Visiting the exchange was “obviously a huge dream of mine,” said Games. “I lucked out.” In October, he started working as an intern at Woods’ firm, Freedom Capital.

June 21: Bombing of Iran

It was a Saturday evening in New Jersey, and Siebert Financial’s Mark Malek was celebrating his recent birthday when he learned the US had bombed Iran’s nuclear sites, a move that traders feared could dangerously escalate the conflicts in the Middle East.

“If this is true, my phone is going to ring,” Malek told his family at the French restaurant in Asbury Park. Soon enough it did.

For all the risks, Malek wagered — counterintuitively — that stocks would rise. The S&P 500 had already pulled back recently as traders started fretting about a widening conflict between Israel and Iran. But he thought the US wouldn’t escalate the conflict from there and the market’s reaction would ultimately be relief.

Sure enough, the S&P 500 advanced roughly 1% on Monday — and then again on Tuesday — as Trump moved toward a ceasefire. It went on to end the week at another record high.

ALSO READ

Tariff-Hit 2025, But India's Exports Chart Steady Course, Momentum Likely To Extend Into 2026

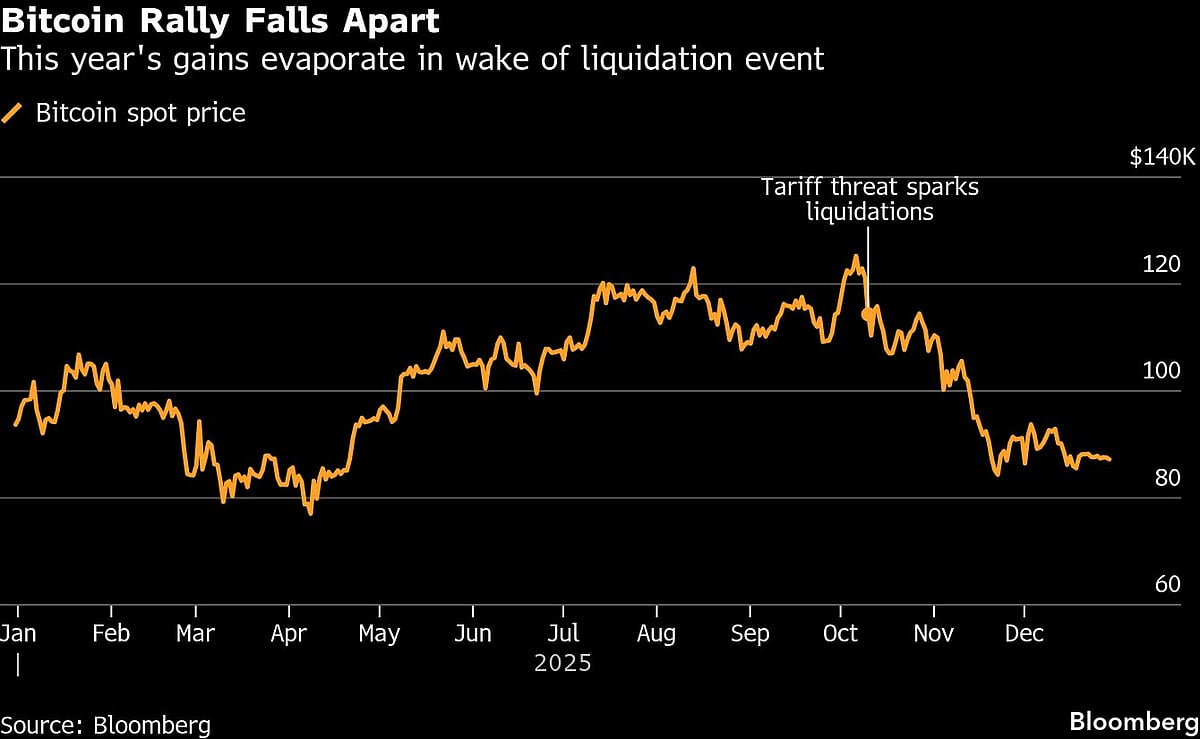

Oct. 10: Crypto Dives

“What is going on?” Jeff Dorman thought as crypto markets nosedived. Trump had threatened an additional 100% tariff on China and traders were dumping risk assets. And Bitcoin, which had recently pushed over $125,000, was sliding as leveraged bets were unwound.

Messages on Slack piled up at Arca, a crypto asset manager where Dorman is chief investment officer. He was at home, but soon he and his team were on a Zoom call. They made a plan to cover short positions by snapping up assets that had tumbled.

In their early days investing together, it would have taken them all night. After years of experience, they’d learned to draw up a plan and leave the execution to their traders. The CIO took stock of the situation, went to bed and “slept like a baby."

Dorman remains bullish on segments of the crypto sector. Still, the moment, for now, has deflated the euphoria for crypto that swept through markets for much of the year as Trump championed the industry.

It also has bucked the buy-the-dip formula that’s paid off elsewhere in 2025. Bitcoin is heading to its first annual drop since the 2022 crash, and other popular cryptocurrencies have tumbled over the past two months. That has hammered crypto-linked shares like the stockpiler Strategy Inc. and the Trump-family-affiliated American Bitcoin Corp.

Nov. 21: Year-End ‘Sigh of Relief’

It had looked like the retreat from risk was poised to drag down the broader stock market, too, as worries about frothy AI valuations and the Federal Reserve’s rate-cut path weighed on the S&P 500.

The worries didn’t last. On Nov. 21, stocks started bouncing back on anticipation that the cooling labor market would prod the Fed to continue easing monetary policy, as it did when it met on Dec. 10.

Meanwhile, the economy has kept on defying recession fears despite Trump’s trade war, federal-employee job cuts and a Congressional standoff that caused a record-long government shutdown. The AI boom, for all the bubble talk, hasn’t turned to bust. And whomever Trump picks to replace Fed Chair Jerome Powell next year is seen as likely to back Trump’s push for even faster rate cuts.

That has sowed a late-year sense of optimism heading into 2026. After this year’s gains stung anybody who stuck to bearish calls, Wall Street strategists are anticipating that the S&P 500 will rise for a fourth straight year. If they’re right, that would be the longest winning streak in nearly two decades.

“Overall,” Freedom Capital’s Woods said, “there’s a sigh of relief that we’ve gotten through some of the biggest waves that were thrown at this market.”