Good Bye And Good Day

That's all for today folks. Infosys is all set to announce their Q3 results. You can check the live updates here.

For the Mumbaikars, please don't forget to vote. See you on Friday. Have a good day.

Nifty, Sensex Live Today: HDFC Bank, ICICI Bank Lead Decline

Axis Bank, Tata Steel, NTPC, RIL and Eternal emerged as the top gainers for the day.

On the other hand, HDFC Bank, ICICI Bank, TCS, Maruti Suzuki and Asian Paints were the worst performers of the Nifty 50 index.

Nifty, Sensex Live Today: IT, Realty Lead Decline

Broader indices on the other hand ended in the positive. Nifty Midcap 150 ended 0.21% higher and Nifty Smallcap 250 closed 0.48% higher.

Eight sectoral indices fell with Nifty IT and Nifty Realty leading the decline, Nifty Metal and Nifty PSU Bank were among the laggards.

The market breadth was skewed in the favour of sellers, as 2,145 stocks declined, 2016 advanced and 184 remained unchanged on the BSE.

Nifty Metal & PSU Banks gain over 2% for the day

Nifty Metal emerges as the top gaining sector for the day

Nifty PSU bank gain for the 4-day in a row

Nifty Realty falls for the 7-day in a row

Nifty Auto falls for the 6-day in a row

Nifty Auto falls for the 5-day in a row

Nifty Metal and Nifty Bank gain for the 3-day in a row

Stock Market At Closing

Indian equities end volatile session in red, extending the fall for the second day. Nifty had fallen near the 25,700 levels but closed near 25,700.

Intraday, both Nifty and Sensex fell nearly 0.50%.

Nifty ends 66.70 points or 0.26% lower at 25,665.60.

Sensex ends 244.98 points or 0.29% lower at 83,382.71.

MRPL Shares In Focus As Profit More Than Doubles

MRPL Q3 Highlights (Consolidated, QoQ)

Revenue up 9% at Rs 24,711 crore versus Rs 22,649 crore.

Ebitda up 87% at Rs 2,785 crore versus Rs 1,489 crore.

Ebitda margin at 11.3% versus 6.6%.

Net profit at Rs 1,445 crore versus Rs 639 crore.

Eternal Share Price Update: Large Trade In Stock

Over 1.42 million shares of Eternal were traded via a block deal on Wednesday. The share of Eternal rose as much as 1.56% to Rs 299.15 apiece.

Nifty 50 Live Today: Support At 25,600

Nifty 50 takes support around 25600 for second consecutive session

Q3 Results LIVE: HDFC AMC Profit Rises 7%

Profit rises 7% to Rs 769 crore versus Rs 718 crore.

Total Income up 9.9% at Rs 1,234 crore versus Rs 1,124 crore.

Dynamatic Technologies Shares In Focus

Dynamatic Technologies shares had secured major Airbus contract in February 2024 to manufacture and assemble A220 doors.

MD and CEO Udayant Malhoutra gives us a look into the Bengaluru facility.

Nifty, Sensex Live Today: Why Are Markets Volatile?

Sensex expiry at play-volumes remains low

Options data suggest narrow range

Markets shut tomorrow on account of BMC elections

Light trade positions

Pre-budget themes seeing buying like Railways

SC ruling on Trump's Tariffs tonight

European markets open positive

Infosys Q3 earnings post market hours

Reliance Industries Q3 Preview: Weak Oil & Gas, Strong O2C To Keep Earnings Stable

Reliance Industries Ltd is expected to report a largely stable set of consolidated numbers for Q3FY26 on a quarter-on-quarter basis, with modest growth across revenue, operating profit and net earnings. Analysts do not expect any major surprises in the quarter, with performance driven by steady execution in core segments and selective tailwinds in oil-to-chemicals and retail.

The oil-to-telecom conglomerate's October-December quarter revenue is expected to rise 1% on a sequential basis. Ebitda is expected to increase 4.6% to Rs 47,997 crore compared with Rs 45,885 crore in the previous quarter, supported by better operating performance in key businesses. Operating margin is projected to improve to 18.7% from 18%. While net profit is projected to grow 6% sequentially to Rs 19,271 crore from Rs 18,165 crore.

RIL is scheduled to announce the Q2 results on Friday, Jan. 16.

Reliance Industries Q3 Preview: Weak Oil & Gas, Strong O2C To Keep Earnings StableKotak Mahindra Bank Shares Decline After Stocks Trade Ex-Split

Shares of Kotak Mahindra Bank Ltd. dropped on Wednesday as it marked the last session for investors to buy shares to qualify for the stock split.

The shares fell by 1.81% with the stock trading at Rs 425.70.

Q3 Results LIVE: Indian Overseas Bank NII Up 18%

Indian Overseas Bank Q3 Highlights (YoY)

NII up 18% at Rs 3,299 crore versus Rs 2,789 crore

Net profit up 56% at Rs 1,365 crore versus Rs 874 crore

Gross NPA at 1.54% versus 1.83%

Net Gross NPA at 0.24% versus 0.28%

Q3 Results LIVE: Union Bank Of India Profit Up 9%

Union Bank of India Q3 Highlights (YoY)

NII up 1% at Rs 9,328 crore versus Rs 9,240 crore

Net profit up 9% at Rs 5,017 crore versus Rs 4,604 crore

Gross NPA at 3.06% versus 3.29%

Net Gross NPA at 0.51% versus 0.55%

Groww Q3 Result Live: Shares Fall Over 3%

Groww shares see sharp decline after it announced its third quarter results. The scrip fell as much as 3.02% to Rs 157.77 apiece on Wednesday, lowest level since Jan. 12. It pared gains to trade 2.94% lower at Rs 157.90 apiece, as of 12:53 p.m. This compares to a 0.05% advance in the NSE Nifty 50 Index.

It has risen 22.83% in the last 12 months and 1.36% year-to-date. Total traded volume so far in the day stood at 47.69 times its 30-day average. The relative strength index was at 67.20.

Groww Q3 Result Live: Profit Dips 28%

Billionbrains Garage Ventures (Consolidated, QoQ)

Revenue up 19.44% at Rs 1216 crore versus Rs 1018 crore.

Ebitda up 19.37% at Rs 720.8 crore versus Rs 603.8 crore.

Ebitda margin down 3 bps at 59.27% versus 59.31%.

Net profit up 16.13% at Rs 547 crore versus Rs 471 crore

State Street To Own Up To 4.99% In Groww AMC

To Sell Stake Worth `580 Cr In Groww AMC

Source: Exchange Filing

Get more Earnings update here.

Move Over Tata, JSW: This Underdog SME Silently Powering India's Steel Boom | SME Radar

A young company in the small industrial town of Purulia in West Bengal is quietly catching the eye of smart investors across the country. The company is slowly cementing its place as an extremely critical cog in India's plan to reach 300 million tonnes of steel capacity by 2030.

The company is Monolithisch India Ltd, an NSE SME-listed company that specialises in a niche but indispensable product — pre-mixed ramming mass. Now mind you, it is no Tata or JSW, but the company’s journey is writing a story of growth that many businesses would kill to have. It has mastered the art of industrial efficiency.

Read more here.

WPI Inflation Rises To 0.83% In December; Food Inflation Increases From November At 0%

Wholesale price inflation rose to 0.83% in December, government data showed on Wednesday. The rise was driven by a surge in prices of food articles like pulses and vegetables, as well as lower primary articles' prices.

Food inflation rose to a flatline as compared to a fall of 2.60% in November, whereas prices for manufactured products rose at 1.82% vs 1.33% in November.

Ajmera Realty Shares In Focus After Q3 Business Update

Achieves highest sales of Rs 1,431 crore in nine months of fiscal 2026.

Strong velocity poised to outperform guidance

Q3 sales area rises 59% at 2.63 lakh Sq Ft (YoY).

Q3 Sales value surges 123% At Rs 603 crore (YoY).

Q3 Collections rises 99% At Rs 333 crore (YoY).

Source: Exchange Filing

Pondy Oxides and Chemicals In Focus

Stock Price Movement

1 month: 13%

6 Months: 52%

1 year: 92%

Key Triggers

Product Mix and Value-Added Products (VAP)

Lead Segment:

VAP share in lead at 71% vs 50% YoY

Management targets more than 60% VAP share long-term; achieved 70%+ in Q1.

Copper Value-Added Strategy (Key Growth Lever)

Construction of copper value-added facility has started.

First product rollout expected in H1 FY27.

Target capacity by FY27 end is 24,000 tons.

Total copper capex through FY27 estimated at ₹100–110 cr.

Revenue potential from copper capex estimated at ₹900–1,000 cr over time.

Sensex, Nifty Today: Stock Market Watch 12 PM

Indian equities were trading higher on Tuesday recovering from day's low.

Intraday, both Nifty and Sensex fell nearly 0.40% but recovered and rose up to 0.25%.

Nifty rose 0.21% at 25,785.50 as of 12 p.m.

Sensex was up 0.16% to 83,765.30.

Broader indices were trading higher. Nifty Midcap 150 rose 0.33%; Nifty Smallcap 250 was trading 0.63% higher.

Most sectoral indices rose, led by Nifty Metal and Nifty Energy. Nifty Realty and Nifty IT were in the red.

Nifty Bank rose 0.13%, Nifty IT was down 0.56%.

Axis Bank, RIL, Tata Steel, NTPC and UltraTech were top Nifty gainers.

HDFC Bank, TCS, ICICI Bank, HUL and Asian Paints were top Nifty losers.

Hindustan Zinc Shares In Focus

Over a year stock is 149%

Stoch has gained 48% over last month & trading close to 52-wk high levels

What led to the rally?

Surging copper prices

Aggressive expansion targets

Capacity to expand from 4 MT to 12.2MT by FY30-31

Quality Power In Focus

Sukrut Electric Transfers 50% Stake For Rs 5.24 Cr In Favour Of Co

Clarification on India plans to scrap 5 year old curbs on Chinese firms

Consistently Competed With Chinese Manufacturers

Revenue Is Largely Dollar-Denominated

Do Not Foresee Impact On Growth Strategy, Revenue

No Negative Guidance Anticipated In Medium Term

Indian Mfg Base Serves Domestic & Export Markets

Clarifies On Likely China Bids For Govt Contracts

Stock Market Live Updates: Nifty, Sensex Recover From Day's Low

Nifty and Sensex rebound from day's low to trade in green. The index fell as much as 0.37% on Wednesday but pared losses to trade 0.17% higher at 25,775.80 as of 11:35 a.m. Similarly, Sensex that had fallen 0.41% recovered to trade 0.14% higher at 83,747.06.

Gold Price Live Today: Commodity Futures Hit Record High

MCX February gold contract has hit a new record high of Rs 143,096 per 10 gm. This is shortly after silver prices rose above $90 an ounce for the first time ever.

Amid persistent geopolitical uncertainty driving safe-haven demand, gold futures on the Multi Commodity Exchange (MCX) saw sharp swings. The February 5 contract opened lower by Rs 1,740 at Rs 1,40,501 per 10 grams compared to the previous close of Rs 1,42,241.

MCX February Gold Contract Hits New Record High Of Rs 143,096 Per 10 GmBajaj Auto To Layoff KTM Employees Amidst Business Restructuring

Bajaj Auto on Wednesday said it will layoff 500 employees from KTM AG in salaries and middle management. Employee reduction is a part of realignement the company said in an exchange filing. Headcount as of Dec. 31, 2025 stood at 3,794 employees.

"Positions cut difficult, but necessary to lower costs ," the CEO added.

Infosys Q3 Results Preview: Margin Seen Firm Even As Growth Remains Seasonally Soft

Infosys Ltd. is expected to report muted sequential growth in the December quarter, with margins seen holding firm even as seasonality and furloughs weigh on revenue momentum. The Bengaluru-based software developer will report its third-quarter results on Jan. 14.

Bloomberg estimates show revenue and operating profit rising about 2% quarter-on-quarter, while net profit is seen little changed. EBIT margin is expected to inch up to 21.14% from 21.02% in the previous quarter.

Infosys Q3 Results Preview: Margin Seen Firm Even As Growth Remains Seasonally SoftMetal Stocks In Focus: Vedanta, Hindustan Zinc Lead Gains

Vedanta, Hindustan Zinc and NACL Industries lead gains as metal stocks come into focus after Silver and Copper hit record high.

F&O Live: Long Buildup In Vedanta, Hindustan Zinc

BSE F&O

Long Buildup

Vedanta

Hindustan Zinc

Short Covering

IndusInd Bank

Vodafone Idea

Long Unwinding

Zydus Lifesciences

Premier Energies

Short Buildup

Kalyan Jewellers India

Tata Elxsi

Groww Q3 Results Live: Shares Fall Nearly 2%

The shares of Billionbrains Garage fell nearly 2% ahead of its quarterly result on Wednesday. The scrip fell as much as 1.89% to Rs 159.61 apiece on Wednesday, lowest level since Jan. 12. It pared gains to trade 0.85% lower at Rs 161.30 apiece, as of 10:38 a.m. This compares to a 0.23% decline in the NSE Nifty 50 Index.

It has risen 3.28% year-to-date. Total traded volume so far in the day stood at 47.69 times its 30-day average. The relative strength index was at 67.20.

Polycab Share Price In Focus Today

Shares of Polycab India Ltd. saw a dip after the counter witnessed a significant block trade of $135 million on the National Stock Exchange, signaling strong institutional activity in the cable manufacturer’s shares. The scrip fell as much as 3% to Rs 7,328 apiece, proceeding to pare losses to trade 1.98% lower at Rs 7,405 apiece, as of 09:50 a.m. This compares to a 0.15% decline in the NSE Nifty 50 Index.

It has risen 14.42% in the last 12 months. Total traded volume so far in the day stood at 3.6 times its 30-day average. The relative strength index was at 52.53.

Polycab Share Price Extends Decline For Fifth Session Amid Large DealBank Of Maharashtra Shares In Focus: Stock Hits 17-Month High

Bank of Maharashtra shares rose to hit 17-month high on Wednesday after it announced its third quarter results. The scrip rose as much as 4.14% to Rs 67.74 apiece on Wednesday, highest level since July 31, 2024. It pared gains to trade 0.61% lower at Rs 64.65 apiece, as of 10:10 a.m. This compares to a 0.11% decline in the NSE Nifty 50 Index.

It has risen 22.83% in the last 12 months and 4.40% year-to-date. Total traded volume so far in the day stood at 24.77 times its 30-day average. The relative strength index was at 57.25.

Coal India Share Price In Focus

The shares of Coal India hit two-month high on Wednesday after Bharat Coking Coal’s IPO drew record-breaking demand. The scrip rose as much as 3.05% to Rs 442 apiece on Wednesday, highest level since Nov. 4. It pared gains to trade 2.58% higher at Rs 439.95 apiece, as of 10:06 a.m. This compares to a 0.08% decline in the NSE Nifty 50 Index.

It has risen 19.16% in the last 12 months and 10.28% year-to-date. Total traded volume so far in the day stood at 7.12 times its 30-day average. The relative strength index was at 76.17, indicating it was overbought.

L&T Shares In Focus Today After Order Win

L&T gets order in the range of Rs 2,500-5,000 crore from Torrent Energy for Pumped storage. Gets order for 3,000 MW project in Maharashtra.

Source: Exchange filing

Tata Elxsi Shares In Focus

The shares of Tata Elxsi were in focus after their third quarter results. The scrip fell as much as 3.31% to Rs 5,601 apiece on Wednesday, lowest level since Jan. 12. It pared losses to trade 2.16% lower at Rs 1,670 apiece, as of 9:34 a.m. This compares to a 0.02% advance in the NSE Nifty 50 Index.

It has fallen 6.85% in the last 12 months. Total traded volume so far in the day stood at 0.55 times its 30-day average. The relative strength index was at 70.56

Nifty, Sensex Live Updates: Realty, IT Among Losers

On NSE, 10 of the 15 sectors were in the red. Nifty Realty and Nifty IT lead the decline, while Nifty Metal and Nifty Energy lead gains.

Broader markets were trading mixed, with the NSE Midcap 150 trading 0.008% lower and NSE Smallcap was trading 0.20% higher.

Nifty 50 Live Today: TCS, Asian Paints Drag

TCS, Asian Paints, Eicher Motors, Wipro and Bharti Airtel weighed on the Nifty 50 index.

ICICI Bank, Coal India, ONGC, HDFC Bank and NTPC added to the Nifty 50 index.

Stock Market Live Update: Nifty, Sensex Decline In Pre-Open

At pre-open, the NSE Nifty 50 was trading 83.75 points or 0.33% lower at 25,648.55. The BSE Sensex was down 61.30 points at 83,370.06.

Bharat Coking Coal IPO Creates History With 90 Lakh Applications

Bharat Coking Coal’s IPO drew record-breaking demand

BCCL is the first main board IPO of 2026

BCCL IPO garnered an overwhelming response from investors

Second-most subscribed PSU IPO in Indian history

BCCL IPO Surges to ₹1.17 Lakh Crore Bids, 147x Oversubscribed

Ranks third-most bid-for PSU IPO by total capital committed

Record demand from qualified institutional buyers and HNIs fueled the issue

Witnessed one of the highest subscription levels seen in recent public offerings

Issue received over 90 lakh applications

Waaree Energies brought its IPO in late 2024, is the close second with 82.65 lakh applications

Kotak Isn't Hitting The Brakes On TVS Motor; GST Cuts, EVs, Exports Add Fuel To The Tank — Details Inside

Kotak Institutional Equities has retained its 'Add' rating on TVS Motor, citing multiple demand and execution levers that are expected to sustain the company’s growth momentum over the medium term. The brokerage has revised its fair value to Rs 3,950, rolling forward its valuation to March 2028.

Kotak expects TVS Motor to continue outperforming the broader two-wheeler industry, driven by a combination of domestic recovery, electric vehicle (EV) leadership, network expansion and strong export momentum. Reflecting higher volume assumptions, Kotak has raised its FY2026–28 EBITDA estimates by 4–6%.

Kotak Isn't Hitting The Brakes On TVS Motor; GST Cuts, EVs, Exports Add Fuel To The Tank — Details InsideSpot Silver Above $90

Spot silver breaks over the $90 level, marking a fresh high.Silver Prices Rise Above $90/Oz For The First Time

Removal Of 10-Minute Delivery Positive For Swiggy, Eternal, Says Elara Capital — Here's Why

The brokerage firm believes the removal of the 10-minute benchmark from quick-commerce apps is net neutral to positive for Swiggy and Eternal.

Elara Capital believes metro demand for quick-commerce has already been entrenched, thus ruling out any significant impact of the move.

Perhaps more importantly, the firm notes that the ten-minute delivery threshold was largely optics-driven rather than a fundamental business guarantee.

Read the whole story here.

Silver Price Today: Hits Record At $89.16 Per Ounce

Silver hit a record high and gold rose as weaker-than-expected US inflation data supported the case for more interest rate cuts, while the geopolitical situation remained tense.

The white metal advanced as much as 2.5% to touch $89.1644 an ounce, while gold traded neared an all-time peak.

(Source: Bloomberg)

Oil India And ONGC In Focus

Brent crude has been gaining for 4 consecutive sessions.

From low of $60/bbl, prices moved up to $65/bbl.

But, price still 20% lower compared to 52-week high and 12% lower compared to last 6-month high prices

Why Price Uptrend?

Geo-political issues on Iran.

Recently, Trump cancelled meetings with Iran officials.

With the Iranian uprising and 25% tariff threat, the outcome remains unknown.

Iran currently accounts for 3.5% of the global crude oil production.

Iranian oil exports are currently under US embargo.

Note: India has stopped importing Iranian oil since 2020.

Nifty Today: What F&O Cues Indicate

Nifty January futures down by 0.37% to 25,780 at a premium of 48 points.

Nifty January futures open interest up by 1.27%.

Nifty Options on Jan 20: Maximum Call open interest at 26,000 and Maximum Put open interest at 24,500.

Securities in ban period: SAIL, Samman Capital

Dollar Check

The US Dollar index is up 0.08% at 99.015.

Euro was down 0.03% at 1.1639.

Pound was up 0.01% at 1.3424.

Yen was up 0.16% at 159.33.

Stock Market News Live: Global Check

Asian shares saw a modest gain in early trading, while Japanese stocks continued their winning streak, fueled by a weaker yen. The Nikkei 225 Stock Average rose 0.9% as the Japanese currency slipped past 159 per dollar, reaching its weakest level since July 2024, reports Bloomberg.

This surge comes amid reports of a potential snap election in Japan. Meanwhile, South Korean shares edged up, extending their winning streak to every trading day of 2026.

Stock Market Live Updates: GIFT Nifty Hints At Lower Opening

Good morning readers.

The GIFT Nifty was trading near 25,700 early on Wednesday. The futures contract based on the benchmark Nifty 50 fell 0.06% at 25,761 as of 6:45 a.m. indicating a negative start for the Indian markets. This comes as Asian shares post small gains.

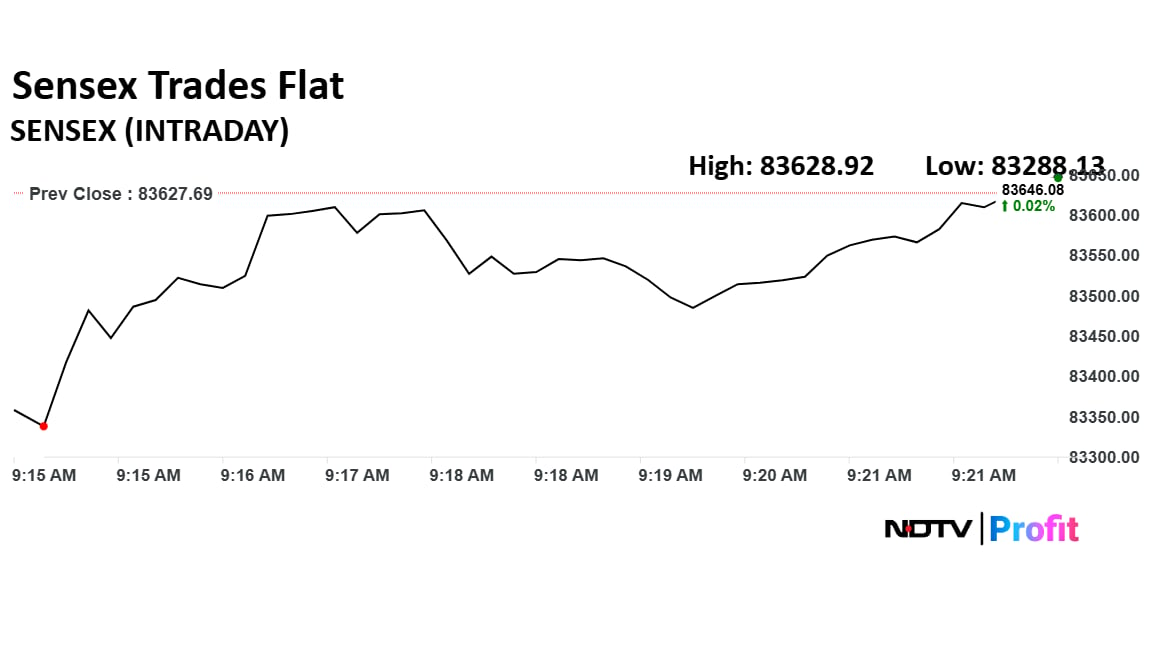

In the previous session on Tuesday, the benchmark ended in red after it pared its opening gains. The NSE Nifty 50 ended 57.95 points or 0.22% lower at 25,732.30, while the BSE Sensex closed 250.48 points or 0.30% lower at 83,627.69.