Tata Elxsi Shares Tumble Despite Q3 Result Upbeat — Here's Why

The pressure in Tata Elxsi shares came even after a third-quarter earnings that saw the company register strong set of numbers while margins also expanded.

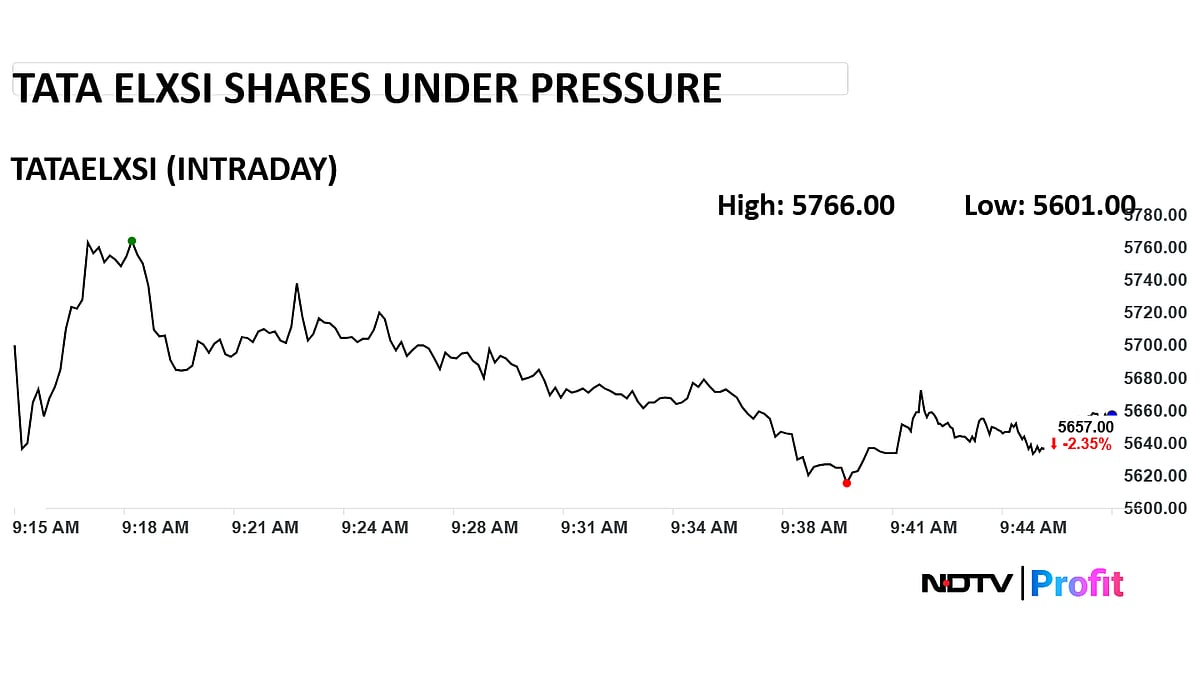

Shares of Tata Elsxi are facing pressure in trade on Wednesday after the company reported its third-quarter earnings report for the financial year ending March 2026.

The stock is trading at Rs 5,649, accounting for cuts of around 2.5%. This compares to Tuesday's closing price of Rs 5,793.

The pressure in Tata Elxsi shares came even after a third-quarter earnings that saw the company register strong set of numbers while margins also expanded.

Barring the quarterly results exceeding expectations, valuations have been expensive. Currently, the stock is trading 52 times price of earnings multiple compared to the Nifty 50's average price-to-earnings multiple of 22 times.

The margin expansion was led by the software segment, rising 318 basis points, while growth was led by the transportation business. Among regions, growth was led by Europe and the United States.

Photo: NDTV Profit

Tata Elxsi Q3 Results Key Highlights (Consolidated, QoQ)

Net profit down 29.7% at Rs 109 crore versus Rs 155 crore

Revenue up 3.9% to Rs 953 crore versus Rs 918 crore

EBIT up 17.4% to Rs 199 crore versus Rs 170 crore

EBIT margin At 20.9% versus 18.5%

While the transportation revenue grew by 7.7% sequentially other segments such as Media and Communications and Healthcare registered a 0.3% and 3.6% decline in revenue on a quarter-on-quarter basis.

"Media and Communications, and the Healthcare and Life Sciences verticals were impacted by seasonal furloughs and some key deal awards that were delayed at the end of the quarter, I am confident of recovery and growth in both these verticals starting Q4 of the current financial year", CEO Manoj Raghavan highlighted.

Shares of Tata Elxsi currently trade with a relative strength index of 70, which suggests the stock could be in an overbought territory.

Out of 51 analysts tracking the company, two maintain a 'buy' rating, four recommend a 'hold,' and 12 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target of Rs 5,051.06 implies a downside of 10.9%.