Bank Of Maharashtra Shares Pare Gains After Hitting 17-Month High After Q3 Results

Bank of Maharashtra approved an interim dividend of 10% on the equity shares of the bank i.e., Rs 1 per share.

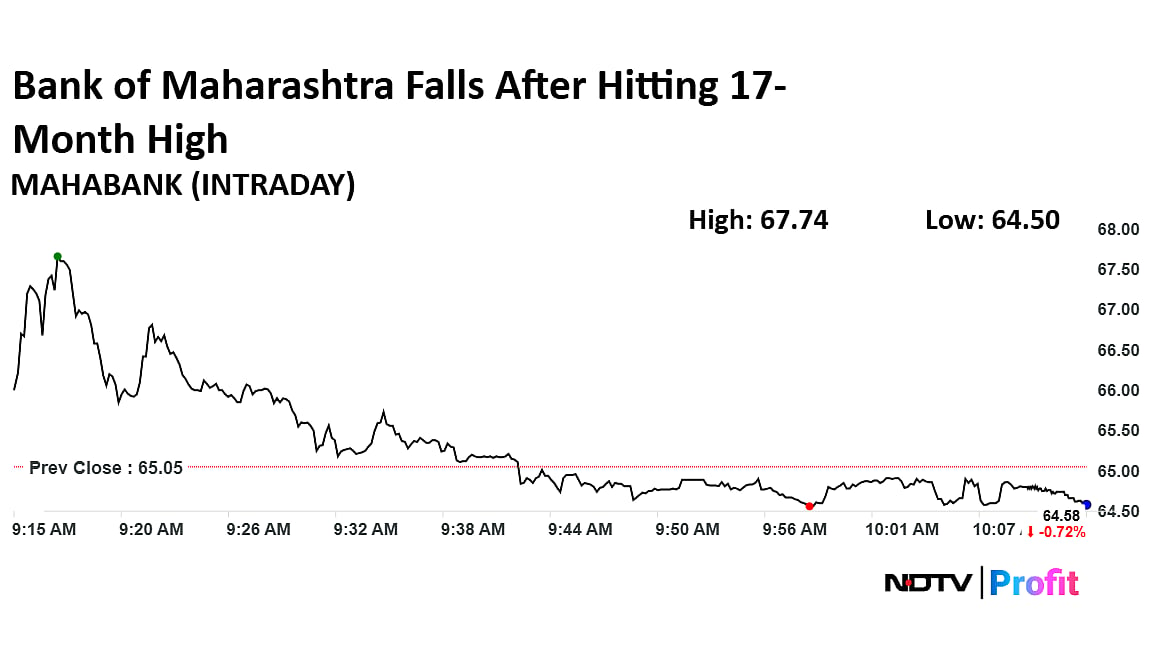

The shares of Bank of Maharashtra rose on Wednesday to hit 17-month high after it announced its third quarter results. However, it pared the gains to trade lower.

The state-owned bank posted 26.5% rise in net profit to Rs 1,779 crore for the third quarter ended December 2025 with rising interest income.

The Pune-based lender had posted a net profit of Rs 1,406 crore in the October-December period a year ago.

Total income increased to Rs 8,277 crore during the quarter under review from Rs 7,112 crore in the same period previous year, BoM said in a regulatory filing.

The bank earned an interest income of Rs 7,344 crore during the quarter compared to Rs 6,325 crore a year ago.

Net Interest Income (NII) grew 16% to Rs 3,422 crore in Q3FY26 as against Rs 2,943 crore in Q3FY25.

The board has approved an interim dividend of 10% on the equity shares of the bank i.e., Rs 1 per share having face value of Rs 10 each for financial year 2025-26, BoM Managing Director and CEO Nidhu Saxena said during a media interaction.

The bank was able to reduce gross Non-Performing Assets (NPAs) to 1.60 per cent of gross loans by the end of December 2025 from 1.80% in the year-ago period.

Similarly, net NPAs or bad loans came down to 0.15% from 0.2% at the end of the third quarter of the previous fiscal.

As a result, the bank's provision and contingencies declined to Rs 728 crore as against Rs 841 crore in the same period a year ago.

However, the Capital Adequacy Ratio of the bank witnessed moderation at 17.06% as compared to 18.71% at the end of the third quarter of previous year.

At the same time, Net Interest Margin (NIM) of the bank too declined to 3.88% from 3.98% at the end of December 2024.

Bank Of Maharashtra Share Price Today

The scrip rose as much as 4.14% to Rs 67.74 apiece on Wednesday, highest level since July 31, 2024. It pared gains to trade 0.61% lower at Rs 64.65 apiece, as of 10:10 a.m. This compares to a 0.11% decline in the NSE Nifty 50 Index.

It has risen 22.83% in the last 12 months and 4.40% year-to-date. Total traded volume so far in the day stood at 24.77 times its 30-day average. The relative strength index was at 57.25.

All three analysts tracking the company maintain a 'buy' rating according to Bloomberg data. The average 12-month consensus price target stands at Rs 77.33 indicating an upside of 19.7%.

(With Inputs From PTI)