Mergers and acquisitions are a critical component of the corporate landscape, enabling companies to fuel growth, enter new markets, and access advanced technologies. While many developed economies faced slowdowns, Indian companies showed strong performance in the 2024-25 financial year, and this positive momentum is clearly reflected in India's M&A market.

After a year of decline, M&A activity in India rebounded with an 18.2% increase, reaching $96.9 billion so far in 2024, according to Bloomberg. This figure includes pending, completed, and proposed deals. In contrast, M&A transactions in India dropped by 63.8% in 2023, totalling $81.9 billion.

Several high-potential companies across sectors such as cement, communications, healthcare, and real estate have been actively involved in M&A transactions this year.

Notable deals include the merger between Reliance Media and Disney, the consolidation of Air India and Vistara, and the merger of Gujarat State Petroleum Corp., Gujarat State Petronet, and GSPC Energy Ltd. with Gujarat Gas.

Top mergers and acquisitions in India in 2024

Reliance Media and Disney India Merger

Billionaire Mukesh Ambani-led Reliance Industries Ltd.'s Rs 70,000 crore merger with the India business of global media house Walt Disney is one of the most notable media mergers this year. This move will allow Reliance to consolidate its media assets and expand its reach, blending Disney's premium content with Reliance's distribution channels.

The companies came together to form a joint venture on Nov. 14. The joint venture will be led by Nita Ambani, taking charge as its chairperson. In this, 16.34% is owned by RIL, 46.82% by its step-down unit Viacom18, and the rest 36.84% by Disney.

Air India And Vistara Merger

Tata Group's vision for Air India took a significant step forward with the 2024 merger of Air India and Vistara. However, the Tata Group had acquired the struggling Air India from the government in January 2022.

This marked a major consolidation in the Indian aviation space, as the integrated entity will operate over 5,600 weekly flights and connect more than 90 destinations. The merger came after Tata Group's low-cost airline, Air India Express, merged with AIX Connect, formerly known as Air Asia India, in October 2024.

As part of the merger, Singapore Airlines will hold a 25.1% stake in the enlarged Air India. Singapore Airlines' contribution includes its 49% stake in Vistara and a cash infusion of Rs 2,058.5 crore. Additionally, Singapore Airlines will assume responsibility for its share of any pre-merger funding from Tata Group, along with costs up to Rs 5,020 crore, to maintain its stake.

(Photo Source: N Chandrasekaran/ LinkedIn)

Gujarat State Petronet To Restructure Into Gujarat Gas And GSPL

In September, Gujarat State Petronet Ltd. unveiled a restructuring plan to simplify its corporate structure. The plan involves merging Gujarat State Petroleum Corp., Gujarat State Petronet, and GSPC Energy Ltd. with Gujarat Gas while spinning off the gas transmission business into GSPL Transmission Ltd. The move aims to improve synergies, growth, efficiency, and resource utilisation.

The restructuring is subject to approval from the Ministry of Corporate Affairs, the NSE, BSE, and shareholders.

Under the plan, Gujarat State Petroleum Corp. shareholders will receive 10 shares of Gujarat Gas for every 305 shares held, while Gujarat State Petronet shareholders will get 10 shares of Gujarat Gas for every 13 shares held. Following the demerger, GSPL Transmission's shares will be listed on the BSE and NSE, with Gujarat Gas shareholders receiving one GSPL Transmission share for every three Gujarat Gas shares.

Ambuja Cements Rs 10,422 Crore Acquisition Of Penna Cement Industries

Ambuja Cements Ltd. completed the Rs 10,422 crore acquisition of Hyderabad-based Penna Cement Industries Ltd., making it a wholly owned subsidiary effective Aug. 16. The merger is expected to significantly bolster the company's footprint in southern India.

It will also lead to an additional capacity of 14 million tonnes per annum and mark another step in Adani Cement's aim of a 140 MTPA capacity by 2028.

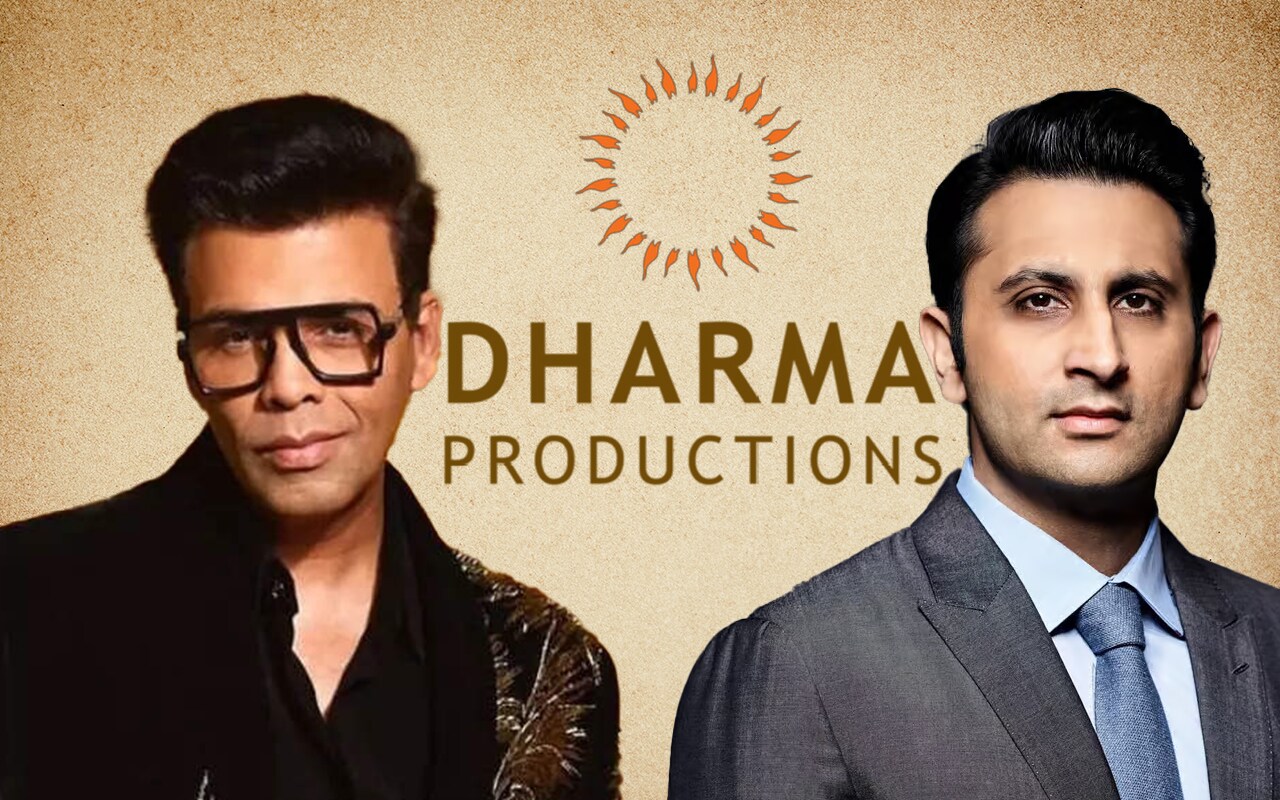

Adar Poonawalla-Led Serene Productions Acquires 50% Stake In Dharma Productions

Vaccine maker Serum Institute of India CEO Adar Poonawalla-led Serene Productions in October had announced a binding agreement to invest Rs 1,000 crore into Karan Johar's Dharma Productions and Dharmatic Entertainment. In this deal, Kaan Johar will retain the remaining 50% ownership and continue to remain executive chairman while Apoorva Mehta, in his role as the chief executive officer,.

Karan Johar will retain the remaining 50% ownership as Serene Productions will acquire a 50% stake in Dharma Productions. (Image Source: NDTV Profit)

Bharti Global Acquires 24.5% Stake In BT Group

Bharti Global, the international investment arm of Bharti Enterprises, on Nov. 18 acquired 24.5% of the issued share capital of BT Group plc, a British telecom group, for $4.08 billion (Rs 34,623 crore). The acquisition will make Bharti the largest shareholder in BT Group with a 24.5% stake.

The funding for this acquisition is being managed by Bharti Global, which has assets and investments across various sectors. Chairperson Sunil Bharti Mittal had also clarified that this move does not involve Bharti Airtel, which operates in India.

ACC Completes Acquisition Of Asian Concrete & Cements

Adani Group firm ACC, a subsidiary of Ambuja Cements, in January said it has acquired the remaining 55% stake in Asian Concretes and Cements from its existing promoter at an enterprise value of Rs 775 crore, making it a fully owned subsidiary.

Earlier ACC held a 45% stake in the firm, and with this acquisition, ACC's cement capacity has increased to 38.55 MTPA.

Mankind Pharma Completes Rs 13,768 Crore-Acquisition Of Bharat Serums

Mankind Pharma in October completed the transaction to acquire Bharat Serums and Vaccines Ltd. for a consideration of Rs 13,768 crore. This strategic move marks a significant leap for the company, positioning it as a market leader in the Indian women's health and fertility drug market alongside access to other high entry barrier products in the critical care segment with established complex R&D tech platforms.

Mergers And Acquisitions In 2025

Among the big names that will complete mergers and acquisitions in the upcoming year is UltraTech Cement Ltd., which is going to acquire India Cements Ltd. The Aditya Birla group's flagship company in July had announced it would acquire a 32.72% stake in India Cements from its promoters and their associates for Rs 3,954 crore to expand its footprint in the Southern cement market, particularly in Tamil Nadu.

However, earlier this month the company received communication from the Competition Commission of India regarding the proposed acquisition. The company in response said that it will respond to the CCI regarding the same, and it is confident of the merits of its case.

Aster DM Healthcare Ltd. and Blackstone- and TPG-backed Quality Care India Ltd. announced in November that it will merge through a share swap agreement. Aster expects the merger transaction to close by the third quarter of fiscal 2026.

In conclusion, 2024 has been a year of strategic consolidation and expansion in the M&A segment. While M&A deals had seen a slight dip, the outlook for 2025 appears even more promising as companies continue to capitalise on India's growing economic landscape.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Ltd., an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.